Join our fan page

- Views:

- 10440

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Author: Andrey N. Bolkonsky

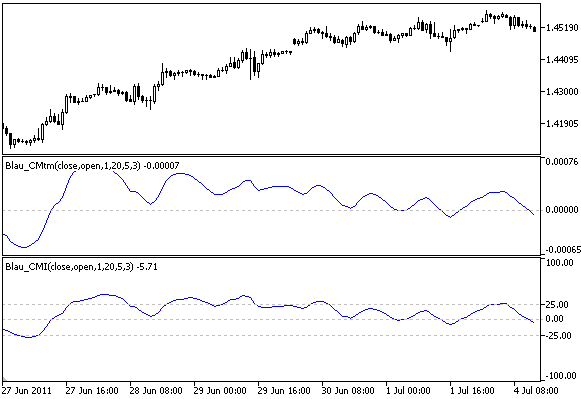

Candlestick Momentum Index (CMI, based on Candlestick Momentum Indicator) is described by William Blau in the book "Momentum, Direction, and Divergence: Applying the Latest Momentum Indicators for Technical Analysis".

- WilliamBlau.mqh must be placed in terminal_data_folder\MQL5\Include\

- Blau_CMI.mq5 must be placed in terminal_data_folder\MQL5\Indicators\

The values of Candlestick Momentum Indicator are normalized (by absolute values) and mapped into the [-100,+100] interval. Due to normalization, the positive values of CMI correspond the overbought states of the market, the negative values correspond to the oversold states of the market.

Candlestick Momentum Index

Calculation:

The Candlestick Momentum Index is calculated by formula:

100 * EMA(EMA(EMA( cmtm(price1,pric2,q) ,r),s),u) 100 * CMtm(price1,pric2,q,r,s,u)

CMI(price1,price2,q,r,s,u) = –––––––––––––––––––––––––––––––––––––––––––– = –––––––––––––––––––––––––––––––––––––––––

EMA(EMA(EMA( |cmtm(price1,pric2,q)| ,r),s),u) EMA(EMA(EMA( |cmtm(price1,pric2,q)| ,r),s),u)

if EMA(EMA(EMA(|cmtm(price1,pric2,q)|,r),s),u)=0, then CMI(price1,price2,q,r,s,u)=0

where:

- q - number of bars, used in calculation of Candlestick Momentum;

- price1 - close price;

- price2 - open price q bars ago;

- cmtm(price1,pric2,q)=price1-pric2[q-1] - Candlestick Momentum;

- |cmtm(price1,pric2,q)| - absolute value of Candlestick Momentum;

- CMtm(price,q,r,s,u) - Triple smoothed Candlestick Momentum;

- EMA(...,r) - 1st smoothing EMA(r), applied to:

- Candlestick Momentum;

- Absolute value of Candlestick Momentum;

- EMA(EMA(...,r),s) - 2nd smoothing - EMA(s), applied to result of the 1st smoothing;

- EMA(EMA(EMA(...,r),s),u) - 3rd smoothing - EMA(u), applied to result of the 2nd smoothing.

- q - number of bars, used in calculation of Candlestick Momentum (by default q=1);

- r - period of the 1st EMA, applied to Candlestick Momentum (by default r=20);

- s - period of the 2nd EMA, applied to result of the 1st smoothing (by default s=5);

- u - period of the 3rd EMA, applied to result of the 2nd smoothing (by default u=3);

- AppliedPrice1 - price type (by default AppliedPrice1=PRICE_CLOSE);

- AppliedPrice2 - price type (by default AppliedPrice2=PRICE_OPEN).

- q>0;

- r>0, s>0, u>0. If r, s or u are equal to 1, the smoothing is not used;

- Min rates =(q-1+r+s+u-3+1).

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/378

Candlestick Momentum Blau_CMtm

Candlestick Momentum Blau_CMtm

Candlestick Momentum Indicator by William Blau.

Ergodic MACD Oscillator Blau_Ergodic_MACD

Ergodic MACD Oscillator Blau_Ergodic_MACD

Ergodic MACD Oscillator by William Blau.

Candlestick Index Blau_CSI

Candlestick Index Blau_CSI

Candlestick Index (CSI) Indicator by William Blau.

Ergodic CMI-Oscillator Blau_Ergodic_CMI

Ergodic CMI-Oscillator Blau_Ergodic_CMI

Ergodic CMI-Oscillator by Willam Blau.