Join our fan page

- Views:

- 17061

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Author: Andrey N. Bolkonsky

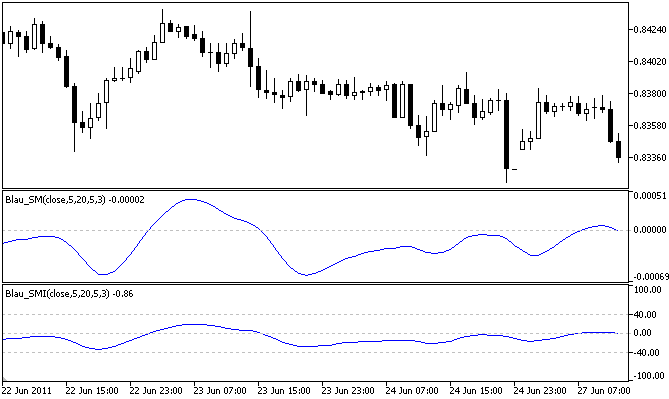

Stochastic Momentum Index (SMI) by William Blau is based on Stochastic Momentum Indicator (see Momentum, Direction, and Divergence: Applying the Latest Momentum Indicators for Technical Analysis).

Stochatic Momentum Index is normalized (to half of q-period price range) and mapped into the [–100,+100] interval. The values of SMI is interpreted as overbought (positive) and oversold (negative) states of the market.

- WilliamBlau.mqh must be placed in terminal_data_folder\MQL5\Include\

- Blau_SMI.mq5 must be placed in terminal_data_folder\MQL5\Indicators\

Calculation:

Stochastic Momentum Index is calculated by formula:

100*EMA(EMA(EMA( price-1/2*[LL(q)+HH(q)] ,r),s),u) 100 * SM(price,q,r,s,u)

SMI(price,q,r,s,u) = --------------------------------------------------------------- = -------------------------------------------------

EMA(EMA(EMA( 1/2*[HH(q)-LL(q)] ,r),s),u) EMA(EMA(EMA( 1/2*[HH(q)-LL(q)] ,r),s),u)

where:

- price - close price;

- LL(q) - minimal price (q bars);

- HH(q) - maximal price (q bars);

- sm(price,q)=price-1/2*[LL(q)+HH(q)] - q-period Stochastic Momentum;

- SM(price,q,r,s,u) - triple smoothed q-period Stochastic Momentum;

- HH(q)-LL(q) - q-period price range;

- 1/2*[LL(q)+HH(q)] - midpoint of q-period price range;

- 1/2*[HH(q)-LL(q)] - half of q-period price range;

- EMA(...,r) - 1st smoothing- exponentially smoothed moving average with period r, applied to:

- to the Stochastic Momentum;

- to the half of q-period price range;

- EMA(EMA(...,r),s) - 2nd smoothing - EMA of period s, applied to result of the 1st smoothing;

- EMA(EMA(EMA(...,r),s),u) - 3rd smoothing - EMA of period u, applied to result of the 2nd smoothing.

Input parameters:

- q - period, used for the calculation of Stochastic Momentum (by default q=5);

- r - period of the 1st EMA, applied to stochastic (by default r=20);

- s - period of the 2nd EMA, applied to result of the 1st smoothing (by default s=5);

- u - period of the 3rd EMA, applied to result of the 2nd smoothing (by default u=3);

- AppliedPrice - price type (by default AppliedPrice=PRICE_CLOSE).

Note:

- q>0;

- r>0, s>0, u>0. If r, s or u =1, smoothing is not used;

- Min. rates=(q-1+r+s+u-3+1).

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/371

Stochastic Momentum Blau_SM

Stochastic Momentum Blau_SM

Stochastic Momentum by William Blau.

Stochastic Oscillator Blau_TS_Stochastic

Stochastic Oscillator Blau_TS_Stochastic

Stochastic Oscillator by William Blau.

Stochastic Momentum Oscillator Blau_SM_Stochastic

Stochastic Momentum Oscillator Blau_SM_Stochastic

Stochastic Momentum Oscillator by William Blau.

Mean Deviation Index Blau_MDI

Mean Deviation Index Blau_MDI

Mean Deviation Index (MDI) by William Blau.