As investors head into a monster week for company earnings and economic news, many are wondering if the bull market has finally come to an end and whether it might be time to lock in some profits.

Bulls and bears alike are getting a wee bit jittery.

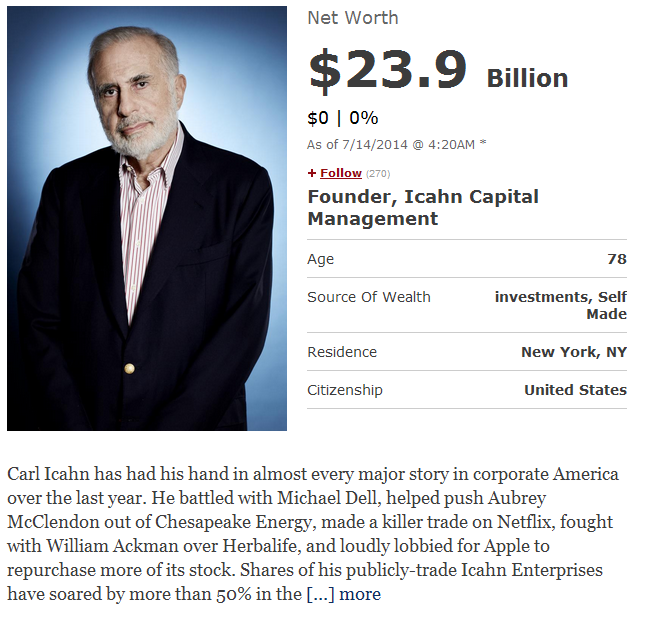

Even hard-charging Carl Icahn, no less, warned in the past few days that it might be time to stop drinking the Kool Aid.

“In my mind, it is time to be cautious about the U.S. stock markets,” Icahn told Reuters. “While we are having a great year, I am being very selective about the companies I purchase.”

The coming week is choc full or corporate news – earnings will be

announced by many of America’s biggest companies including Goldman

Sachs, JPMorgan Chase, Morgan Stanley, Google, General Electric, Intel,

Yahoo, Johnson & Johnson, BlackRock and eBay.

What’s more, Federal Reserve chair Janet Yellen will testify to two

congressional committees on the outlook for the US economy, with

investors listening for clues on interest rates now that Wall Street

knows the Fed’s controversial bond-buying stimulus program will probably

end after the central bank’s October meeting.

Wall Street may even get updates on the IPO of giant Chinese e-commerce company Alibaba.

Monday sees the leaders of the so-called BRICS nations – Brazil, Russia,

India, China and South Africa – meeting in Brazil to discuss

infrastructure developments and a special reserve fund.

Tuesday brings earnings from JPMorgan Chase, Goldman Sachs, Intel, Yahoo! and Johnson & Johnson among others.

JPMorgan Chase may be quizzed by investors about how the health of chief

executive and chairman Jamie Dimon – he is being treated for curable

throat cancer – will affect its operations.

And Yahoo! could be asked by investors what it might do with the

anticipated windfall from its massive stake in Chinese internet giant

Alibaba which is expected to have its IPO very soon.

Tuesday also brings Fed chair Janet Yellen to the US Congress to testify

before the Senate Banking Committee on the economy, followed by her

appearance before the House Financial Services Committee on Wednesday.

Tuesday also sees an update on US retail sales for June.

Wednesday brings news on June US industrial production, updates on the

economy of China, and also the closely watched “Beige Book” that gives

reports on economic conditions in the 12 regions of the Federal Reserve

system.

Companies reporting earnings on Wednesday include Bank of America, BlackRock, Yum! Brands and eBay.

Thursday brings news on US housing starts and building permits and

earnings from a slew of firms including Morgan Stanley, Blackstone, IBM

and UnitedHealth.

Friday sees an update on US consumer sentiment and leading indicators, as well as earnings from General Electric.

Stock markets have defied gravity for a long time. It takes a brave

investor to call the top of the market, given the resilience of US

equities, which have proved the doubters wrong for so long and may

continue to do so.

Last word, though, goes to Dr Doom himself — investor Marc Faber, editor

of the Gloom, Boom and Doom report, who declared a few days ago to

CNBC: “I think it’s a colossal bubble in all asset prices, and

eventually it will burst, and maybe it has begun to burst already.”

We shall see. Watch this space.