Looking at bond yields which are on the rise, it seems that the market is weighing a December rate hike as a very likely possibility.

This week, the 10-year Treasury note yield has been at a four-month peak, trading above 2.3%. Since

yields rise as prices fall, the recent move signals that bond traders are

selling off current holdings bracing for lower-priced bonds after

a rate increase.

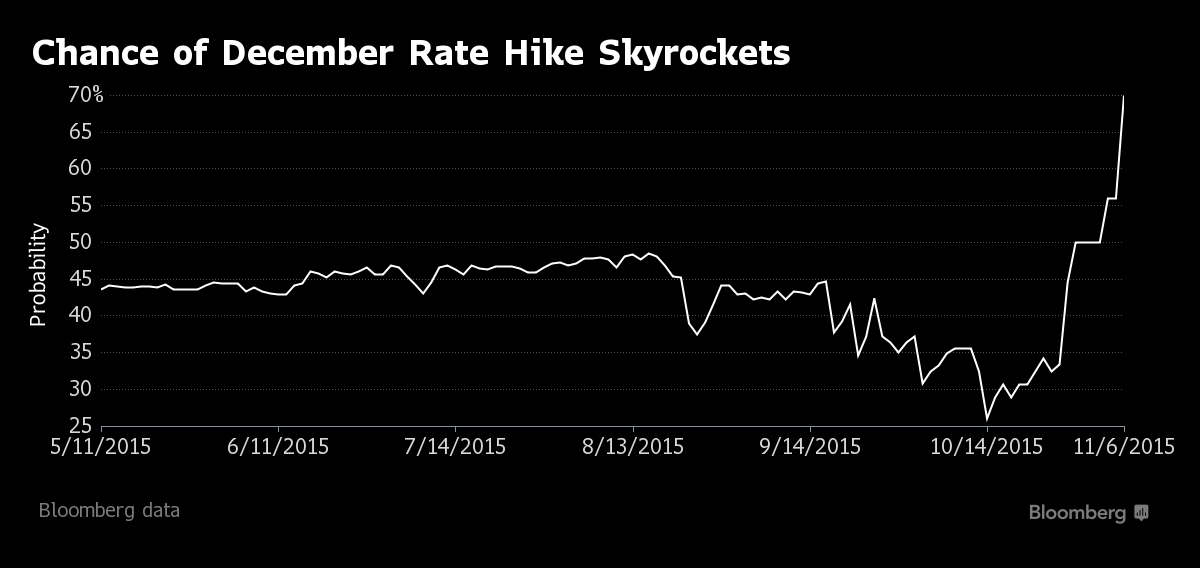

Market players now wildly expect a U.S. rate hike, elevating the odds above 60% after a robust jobs report on November 6. However, one trader remains quite skeptical that the Fed will raise its federal funds rate target in December.

"Lucy's going to pull the football out from under Charlie Brown again. How many times do we have to see this?" Larry McDonald, head of U.S. macro strategy at Societe Generale, said Wednesday.

He reminds us of the Fed's history of pushing back rate hike expectations in June and again in September as evidence that the same situation will play out.

A stronger U.S. dollar, a drop in

commodities prices and trouble in emerging markets are the key obstacles

for hiking, in his opinion.

McDonald believes that when the time comes to estimate monetary policy,

the same problems that hurt the market in August will come back.

"That's impacted the Fed's policy path, the path has been vetoed by economic risk outside the United States and that's probably going to play out again," he said. "That brings back credit risk, then we get a leg down in the market, then once again the Fed gets put in a box."

Meanwhile, Bloomberg news agency recently reported that futures traders now see a 70% chance that the Fed will raise its benchmark rate from near zero at its next meeting, up from a 56% possibility before Friday’s release of stronger-than-forecast U.S. labor data. The calculation assumes the effective fed funds rate averages 0.375 percent after the first hike, Bloomberg says.