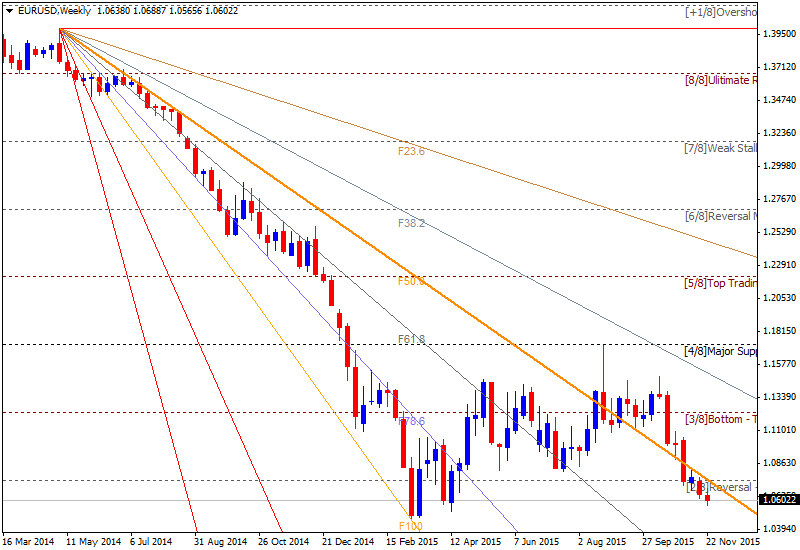

More aggressive ECB easing and EUR/USD trading range in the near-term

Investors are expecting for more aggressive ECB easing during the European Central Bank metting, and the ECB will

introduce two-tier system for deposit rate for

expectations for the larger deposit rate cut than 10 basis points. Bank of Tokyo Mitsubishi made this forecast together with Reuters report concerning this fundamental news events and made the conclusion that 'the EUR/USD will likely fall to new cyclical lows before year-end'.

- 'Expectations surrounding the ECB are running very high and this is driving European markets higher, weakening the euro and helping them do better than U.S. stocks,' said Marco Vailati, head of research and investment at Italy's Cassa Lombarda.

- 'Ultimately, I think the ECB will be aggressive and that divergence in policy with the United States must imply a weaker euro,' said Chris Scicluna, head of economic research at Daiwa Capital Markets in London.

According to this forecast - the price may break 1.04 support level by the end of the year but in general point of view - it will be ranging within 1.03-1.08 levels anyway.

Thus, we may see new low in the end of this week: the price may get new key support which is around 1.03 instead of 1.04 for exa,ple, and that is why the uncoming EBC meeting is the key points for the price movement for this year and the next Q1'2016.