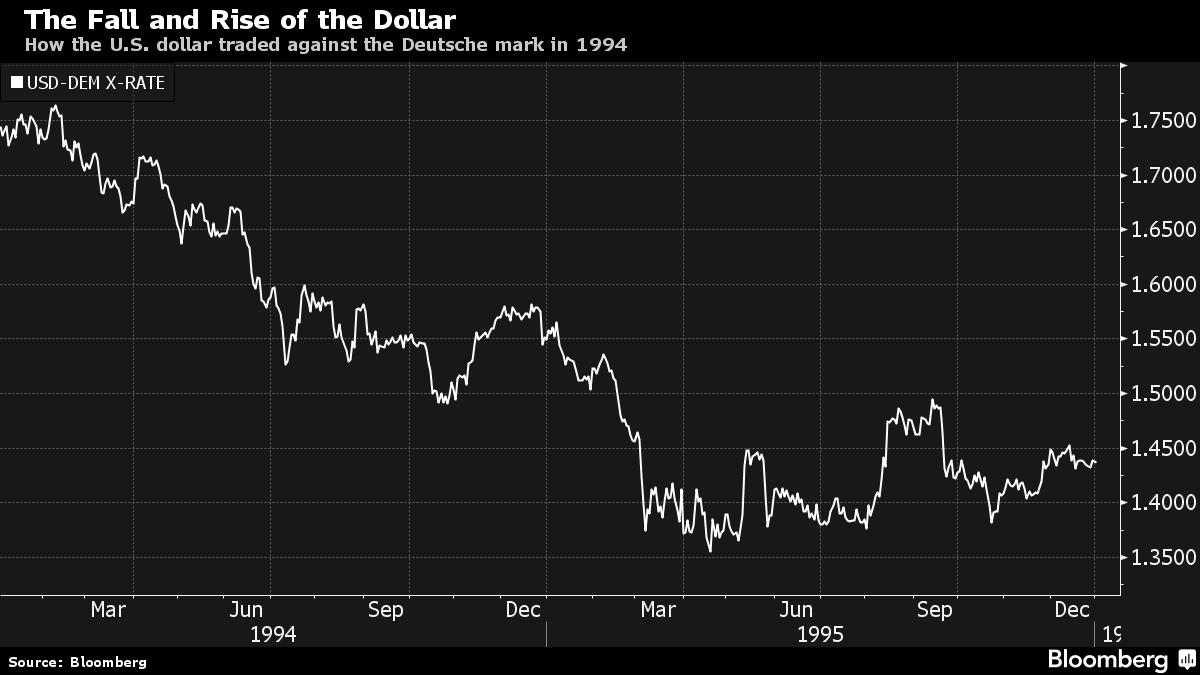

What will happen if Fed and Europe split again, as it was in 1994?

It was in May 1994 when the U.S. Federal Reserve last increased its borrowing costs when its European counterpart added a stimulus measure. What will happen if the same takes place in December? Some analysts predict euro-dollar parity.

Neither the euro nor the ECB existed, and Europe's benchmark interest rates were set by Germany's Bundesbank.

Mario Draghi was a top civil servant in Italy’s finance ministry, while Janet Yellen was teaching at the University of California Berkeley. Nelson Mandela was chosen in South Africa as the first black president and the tunnel linking the U.K. and France was being opened for the first time.

In May 1994 that-time Fed governor Alan Greenspan increased its benchmark to 4.25% from 3.75% to “maintain favorable trends in inflation and thereby sustain the economic expansion.”

At the same time, Hans Tietmeyer's Bundesbank trimmed its rate to 4.5% from 5% to bolster expansion in Europe’s largest economy. Both central banks possibly desired a stronger dollar after its decline had started to disturb financial markets.

A similar split will likely happen as investors forecast December will see the Fed increase its key rate from near zero and the ECB add fresh monetary stimulus, probably in the form of more asset-purchases or a lower deposit rate.

Meanwhile, Credit Suisse currency

strategists Shahab Jalinoos and Matthew Derrwrote in a report that looking for parallels between now and 1994 is not fair.

21 years ago, Germany’s rates were coming down from the highs of the post-unification boom and its bond yields stayed higher than those of the U.S. even with the policy split.

Yet, German and U.S. yields converged at the end of the day, as the Fed and Bundesbank kept on walking their separate paths. The rates on U.S. 10-year Treasuries added more than 200 basis points - what became known as an annus horribilis for bond traders. By the mid-1995, the dollar was climbing.

So what will happen this time?

Citigroup forecast a flatter

yield curve in the U.S. as rates on short-term Treasuries climb in

response to the Fed’s shift. European stocks will likely outperform U.S. ones and the dollar will get stronger, Citigroup said.

Credit Suisse also predicted the buck will rise and said it could even reach parity with the euro. However, a stronger currency could force the Fed or the ECB to hold off on easing because of a weaker euro, strategists at the bank said.

However, Anatole Kaletsky, chief economist and co-chairman of consultancy Gavekal Dragonomics, doubts the dollar will jump. He reminds that in 1994 the dollar continued to fall against the Deutsche mark until April 1995, when it kicked off a two-year surge.