About:

Turtles 3xATR EA on MT5: https://www.mql5.com/en/market/product/152767

Turtles 3xATR EA: A Trend-Following Expert Advisor for MetaTrader 5

Overview

Turtles 3xATR EA is an automated trading robot inspired by the classic Turtle Trading system so the buy or sell signals are given by breakouts. The ATR trail stop was used in many trading systems by the legendary Ed Seykota which often used 10ATR for stop loss and trail stop for long term trades. It focuses on capturing breakouts in trending markets while using volatility-based stops to manage risk. The EA trades one position at a time per symbol, entering on breakout signals and trailing stops to lock in profits. It emphasizes disciplined risk control, never risking more than a configurable percentage of your account per trade.The expert has implemented a robust reduction position size which is activated once the account balance decreases more than 10% by default. When the loss in the account balance is recovered the position size automatically is restored to the initial value (1% risk per trade from the account balance by default). It can be used to trade forex, crypto, metals, stocks, commodities.

Key Inputs (Customizable)

- EntryPeriod: 20 (bars) – Period for detecting breakouts.

- StopLossATRPeriod/TrailATRPeriod: 20 (bars) – ATR calculation period for stops.

- StopLossATRMultiplier/TrailATRMultiplier: 3.0 – Multiplier for initial and trailing stops (wider than original Turtles for less whipsaw).

- InitialRiskPercent: 1.0% – Max account risk per trade.

- Other options: Enable drawdown-based risk reduction, magic number for trade identification, etc.

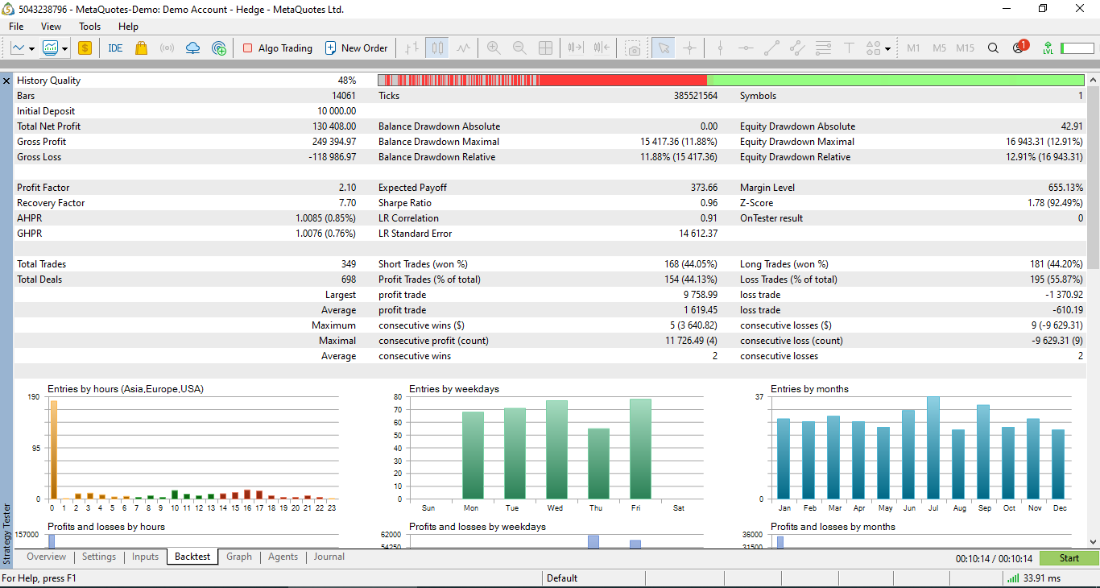

In the following backtest i used S1 = 40, SL = 3ATR, trail stop = 3ATR, 1% risk per trade, daily time frame. Period tested 1971 - 2025.

How It Works: Step-by-Step

1. Detecting New Bars and Levels

- The EA runs on every tick but only updates signals on new bar closes (e.g., end of D1 candle).

- It calculates:

- Entry High/Low: Highest high and lowest low over the past 20 bars (excluding current).

- ATR (Average True Range): Volatility measure over 20 bars, using Wilder's smoothing (RMA).

2. Entry Signals (Breakout Trading)

- Long (Buy): If the current Ask price breaks above the 20-bar high, open a buy position.

- Short (Sell): If the current Bid price breaks below the 20-bar low, open a sell position.

- Only one position open at a time—no pyramiding or multiple entries.

- Position size is auto-calculated to risk exactly 1.0% (or your setting) of account balance, based on the stop distance.

3. Initial Stop Loss

- Set immediately on entry:

- Long: Entry price minus (3 × ATR).

- Short: Entry price plus (3 × ATR).

- This gives the trade "breathing room" in volatile conditions, avoiding early exits.

4. Trailing Stop (Profit Locking)

- Updated only on new bar closes, using the previous bar's close as reference.

- Tracks a "Reference Extreme" (highest close for longs, lowest for shorts) that ratchets in the trade's favor.

- For Longs:

- Reference High = max(Previous Reference High, Previous Close).

- New Trail Stop = Reference High minus (3 × ATR).

- Move the stop up if the new level is higher than current (locks profits); never lower.

- Bonus: If volatility (ATR) drops even without new highs, the trail tightens to protect more gains.

- For Shorts: Mirror logic—Reference Low = min(Previous Reference Low, Previous Close); Trail Stop = Reference Low plus (3 × ATR). Move down if beneficial.

- Exits automatically if price hits the trail stop (via broker SL modification).

5. Exits

- Primary: Hit initial or trailing stop loss.

- No take-profit—lets winners run indefinitely in trends.

- (Note: Classic 10-bar reversal exits removed for this variant.)

6. Risk Management Features

- Position Sizing: Scales lots dynamically so stop distance risks a fixed % (e.g., 1.0%) of balance.

- Drawdown Protection: If enabled, reduces risk % after drawdowns (e.g., cuts by 20% per 10% loss threshold, up to 3 steps). Resets on new balance highs.

- Persistence: Saves risk state to file across restarts/reboots to avoid resets.

- Logs critical events (e.g., entries, trails) for monitoring.

Performance Notes

- Best in trending markets; may underperform in sideways chop (like original Turtles).

- Backtest on your broker's data—expect 20-40% drawdowns in tests, but strong long-term equity curves.

- Run on any timeframe (e.g., H1/D1), but as a trend follower i recommend using daily timeframe.

This EA keeps things simple: Break in, ride the trend, trail smartly, and cut losses quick.

Feel free to test different lengths for breakouts(40 - 100 days) and different ATR multiples for trail stop and stop loss (up to 10).