Which strategy is best for scalping? (mql5 scalping strategy)

Scalping is a highly dynamic trading strategy focused on making small, consistent profits through numerous rapid trades in volatile markets like Forex, stocks, and cryptocurrencies. Traders who excel in scalping understand the importance of market knowledge, risk management, and quick decision-making.

A crucial factor in achieving success is determining which strategy is best for scalping; this includes utilizing effective indicators, appropriate timeframes, and maintaining discipline in a fast-paced environment. By continuously evaluating and refining their approach, traders can enhance their performance and better navigate the challenges of scalping.

Ultimately, understanding which strategy is best for scalping empowers traders to unlock the potential of this exciting trading style, fostering consistent profitability and success in their trading endeavors.

easily invest in the gold Forex Signal Trading Market

First and foremost , what is scalping?

Scalping is a trading strategy that focuses on making small profits repeatedly over very short time frames. The 5-minute scalping strategy is designed for traders aiming for rapid exchanges in volatile markets such as Forex, stocks, and cryptocurrencies...

Is scalping really profitable?

Scalping can indeed be highly profitable for traders who possess the right skills and effective strategies. This trading technique involves making numerous trades throughout the day, capitalizing on small price movements to generate consistent profits. Here are several factors to consider when evaluating the profitability of scalping:

1. Market Knowledge: Successful scalpers have a deep understanding of market dynamics, including technical analysis, chart patterns, and economic indicators. This comprehension allows them to identify potentially lucrative short-term opportunities.

2. Risk Management: A robust risk management strategy is essential in scalping. Traders often set strict stop-loss orders to limit potential losses and use proper position sizing to manage their overall risk exposure.

3. Speed and Execution: Scalping requires fast execution of trades. A reliable and efficient trading platform is crucial, as even slight delays can affect profitability. Traders often use direct market access (DMA) to ensure swift order execution.

4. Discipline and Focus: Successful scalpers maintain a high level of discipline and concentration. Given the rapid pace of scalping, emotions can run high, and traders must stick to their strategies without being swayed by short-term fluctuations.

5. Transaction Costs: Since scalpers make many trades per day, transaction costs (such as brokerage fees and spreads) can significantly impact profits. It's essential to choose a broker with competitive pricing and low fees for frequent trading.

6. Market Conditions: Scalping strategies may perform differently in various market conditions. Volatile markets may present more opportunities, while low-volatility periods can make it challenging to achieve profit targets.

7. Technology and Tools: Advanced tools and software can enhance a scalper's effectiveness. Many traders use algorithms, charting software, and real-time data feeds to identify entry and exit points quickly. In conclusion, while scalping can be a profitable strategy, it requires a unique skill set, disciplined execution, and sound risk management. Traders must continuously refine their techniques and adapt to changing market conditions to succeed in this fast-paced trading style.

This article is about (mql5 scalping strategy) and determining (Which strategy is best for scalping) We also have another article related to this topic that you might find interesting.

MetaTrader5 (MT5) is indeed considered a good platform for scalping.It offers several advantages:

One-click trading: This feature allows for quick order placement, which is essential for scalping strategies that require rapid entries and exits.

Speed: MT5 is known for its fast execution times, which is crucial for scalpers who need to capitalize on small price movements.

Is MT5 good for scalping?

However, there is a notable challenge.For traders who open50-100 positions per day, manually setting stop-loss orders for each position can be cumbersome. This repetitive task can add significant stress and increase the risk of missing essential trade management steps.Overall, while MT5 is excellent for scalping due to its features, the manual process of setting stop-loss levels for multiple trades can be a drawback for traders operating at high frequencies.

To address this challenge, we have a product that simplifies the entire scalping process.With our innovative solution, setting stop-loss levels becomes much easier, enabling traders to focus on their strategies without the hassle of repetitive tasks.We highly recommend you check it out!

Which timeframe is best for scalping?

The best timeframes for scalping typically range from one minute to15 minutes, with most scalpers favoring the one- to three-minute intervals.Here’s a breakdown of why these timeframes are preferred:

-One to Three Minutes: These shorter timeframes allow scalpers to capture small price movements and react quickly to market changes. The high frequency of trades can lead to numerous opportunities throughout the day.

- Five Minutes: This timeframe is popular among scalpers who prefer a slightly longer perspective, allowing for a bit more analysis while still enabling quick trades. It provides enough data to recognize short-term trends.

Fifteen Minutes: While scalpers usually focus on shorter intervals, the15-minute timeframe can help identify stronger support and resistance levels and trends, serving as a good framework for executing trades.Choosing the best timeframe ultimately depends on individual trading style, strategies, and comfort with quick decision-making in fast-moving markets.

This article is about (mql5 scalping strategy) and determining (Which strategy is best for scalping) We have another article related to this topic that you may find intriguing.

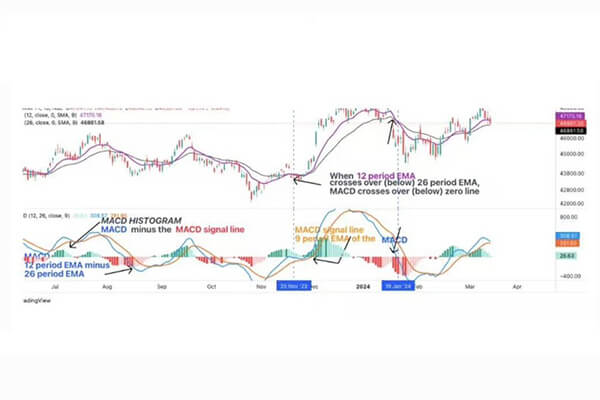

What are the MACD settings for 5 min scalping?

For 5-minute scalping using the MACD (Moving Average Convergence Divergence) indicator, the following settings are commonly recommended:

- Fast EMA:12

- Slow EMA:26

- Signal Line:9

These settings are standard for the MACD and can be beneficial for shorter time frames like

5 minutes, as they help capture quick price movements. You may also want to adjust these parameters based on your trading strategy and backtest to find the best fit for your specific conditions.

What is the best indicator for scalping 5 minutes?

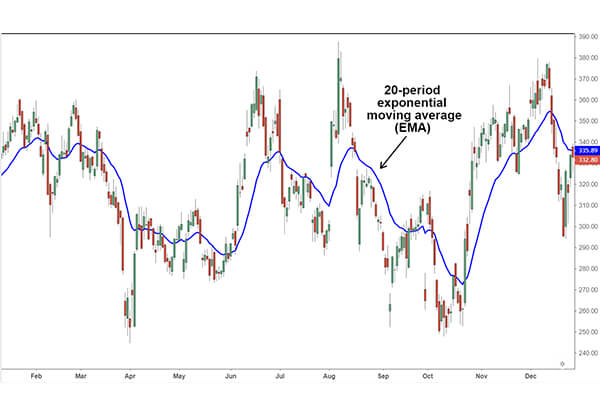

For a 3-5 minute scalping strategy, use a combination of the Exponential Moving Average (EMA) for trend direction (eg, 9 EMA and 21 EMA) and the Relative Strength Index (RSI) to spot overbought/oversold levels.

What is the best mt5 indicator for scalping?

The most efficient indicator for scalping in Forex is the Exponential Moving Average (EMA), particularly the 5 EMA and 20 EMA crossover technique. This tool assists in recognizing short-term trends rapidly, making it perfect for high-frequency trading.

The easiest scalping trading approach ? Which strategy is best for scalping

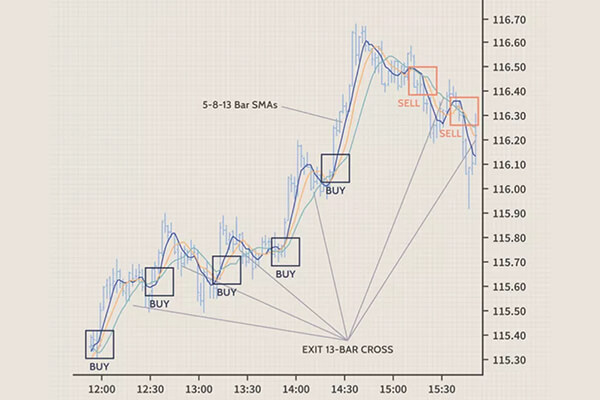

Utilize a combination of 5-8-13 Simple Moving Averages (SMA) on the two-minute chart to detect robust trends that can be acquired or sold short during counter swings, along with receiving alerts for upcoming trend shifts that are unavoidable in a typical trading day. This scalping trading approach is straightforward to master.

In conclusion, scalping is a trading strategy that enables traders to capitalize on small price movements within very short time frames. One of the factors contributing to successful trading is identifying the best MQL scalping strategy that suits individual trading styles. Success in this method relies on several key factors:

- Market Knowledge: A deep understanding of market dynamics that applies to the best MQL scalping strategy.

- Risk Management: Utilizing stop-loss orders and proper position sizing, which is essential for any best MQL scalping strategy.

- Speed and Execution: The need for a reliable trading platform that supports the best MQL scalping strategy.

- Discipline and Focus: Maintaining discipline in a fast-paced environment is critical for implementing the best MQL scalping strategy effectively.

- Transaction Costs: Choosing a broker with low fees can enhance the profitability of the best MQL scalping strategy.Overall, while scalping can be profitable, it requires skill, discipline, and the right tools. By selecting appropriate timeframes, indicators, and the best MQL scalping strategy, traders can enhance their performance.

Happy trading

may the pips be ever in your favor!