It is dangerous to make a leverage trade of currency pairs other than XBTUSD in BitMEX.

The recommended currency pair for using BTC Trend Trader is BTCUSD (XBTUSD). This article describes trading with XBTUSD.

In BitMEX, the volume of XBTUSD is very high, and you can trade at a price close to the average value of bitcoin prices on other exchanges. In Bitcoin trading, it is probably the most reliable exchange in the world.

As an aside, currency pairs other than XBTUSD may have a sharp price move due to the low volume. For this reason, trading of currency pairs other than XBTUSD may lose all margin when leveraged. For example, at 23:00 on February 13, 2020, the price of XRPUSD could drop to less than half in an instant and return to its original price in less than a minute. Be careful with leveraged trades other than XBTUSD.

Margin is Bitcoin.

The margin of BitMEX is bitcoin, not cash.

In other words, even if there is no position in “Your Position” column of BitMEX, at the time of depositing margin, it is effectively the same as having a long position of Bitcoin with leverage of 1 time.

Therefore, in order to offset fluctuations in the value of margin, it is good to have a short position of Bitcoin with leverage of 1 times.

Definition

Leverage “n times” is defined as "having a position with n times the amount of margin balance".

In other words, 1x leverage means having a position equal to the amount of the margin, and 6x leverage means having a position 6 times the margin.

For example, if the price of Bitcoin is $ 10,000, "entering a long position with a leverage 6x account with $ 10,000 margin" means "buying $ 60,000 bitcoin.”

The leverage displayed in “Your Position” column of BitMEX is defined as "nominal leverage". The leverage calculated by summarizing both the margin and the current position is defined as "real leverage".

Example

As an example, let's consider the case of an account for leverage 6x.

●When you do not have a position

If BTC Trend Trader does not have a position, keep a short position at Bitmex with a nominal leverage of 1x and set the real leverage to zero.

To make the explanation easier to understand, short positions are represented by minus and long positions are represented by plus.

If you have a + 1x long position as a margin and enter a "nominal leverage" -1x short position, you will have a "real leverage" of 0x, meaning you have virtually no position.

+ 1x (margin)-1x (nominal) = 0x (real)

●When entering a long position

If BTC Trend Trader enters a long position, enter a long position in Bitmex with "Nominal Leverage" 5x.

To make the explanation easier to understand, short positions are represented by minus and long positions are represented by plus.

If you have a + 1x long position as a margin and enter a "nominal leverage" + 5x long position, you will have a "real leverage" + 6x long position.

+ 1x (margin) + 5x (nominal) = + 6x (real)

● When entering a short position

If BTC Trend Trader enters a short position, enter a long position in Bitmex with "Nominal Leverage" 7x.

To make the explanation easier to understand, short positions are represented by minus and long positions are represented by plus.

If you have a + 1x long position as a margin and enter a "nominal leverage" -7x short position, you will have a "real leverage" -6x long position.

+ 1x (margin) -7x (nominal) = -6x (real)

Excel file for calculating quantity (position size)

Download and use the Excel file to calculate the order quantity.Specific method

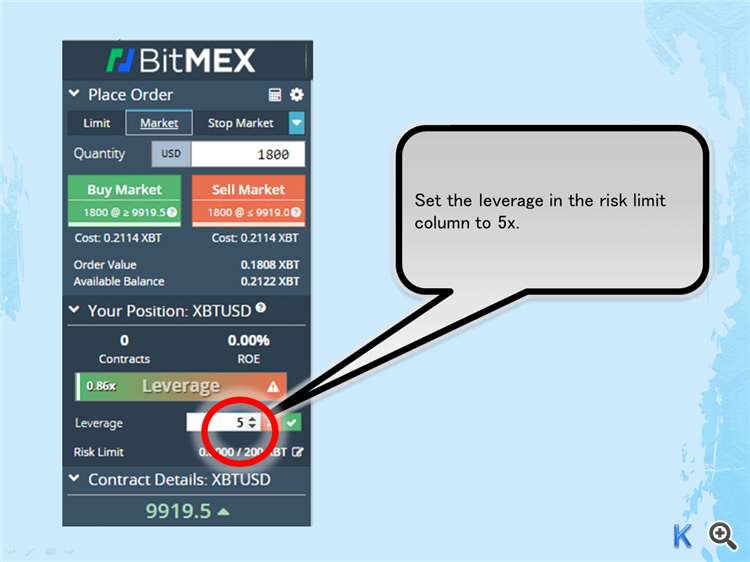

Be sure to set

the leverage in the risk limit column before placing an order, and return

the leverage in the risk limit column back to cross when the order is completed.The following explanation is based on the assumption that trading will take place at the market. The same method is used to calculate risk limits and quantities when buying and selling with limit prices.

To make the explanation easier to understand, short positions are represented by minus and long positions are represented by plus.

All photos related to BitMEX in this article are screenshots of BitMEX Testnet. Before using BitMEX, we recommend using BitMEX Testnet to confirm how to use it.

① When BTC Trend Trader has no position

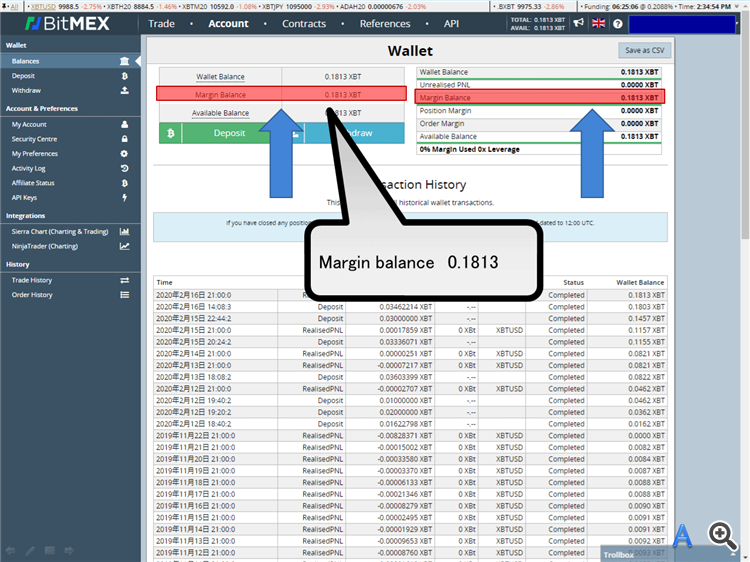

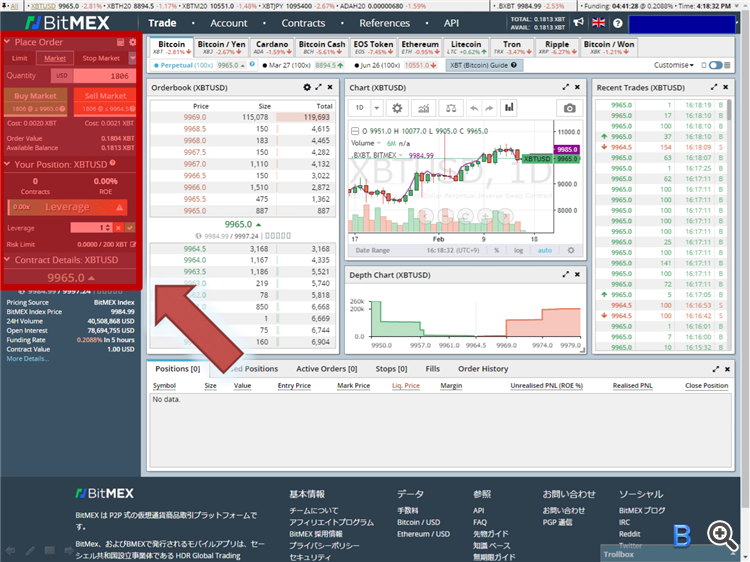

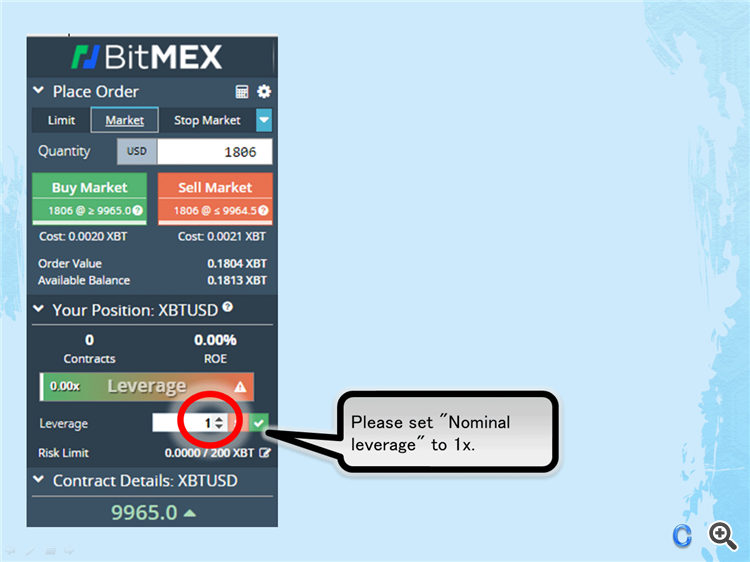

(1)After depositing at Bitmex, first enter the short position with "nominal leverage"-1x.

Set the leverage in the risk limit column to 5x. This is because if you enter the wrong quantity, you will not lose money due to unnecessary fees.

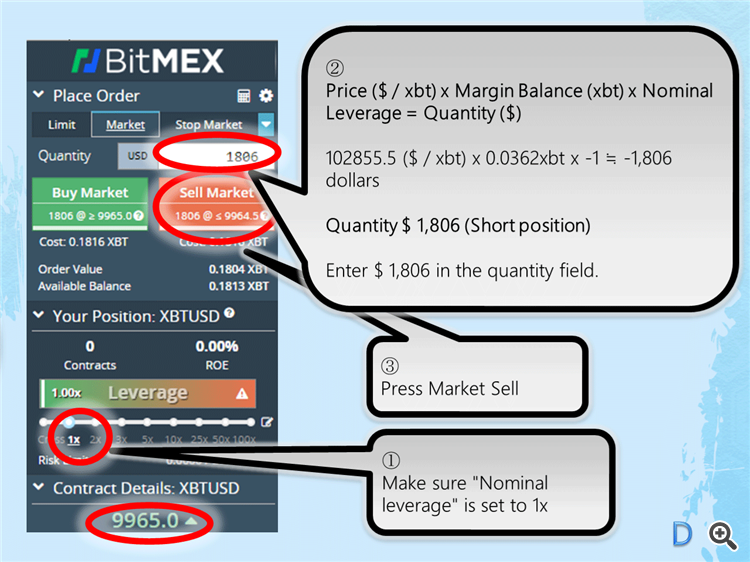

Calculate the quantity. The formula for calculating the quantity when the margin balance is 0.0362 xbt and the bitcoin price is $ 10285.5 is as follows.

Price ($ / xbt) x Margin Balance (xbt) x Nominal Leverage = Quantity ($)

102855.5 ($ / xbt) x 0.1813xbt x -1 ≒ -1,806 dollars

$ 1,806 (Short position)

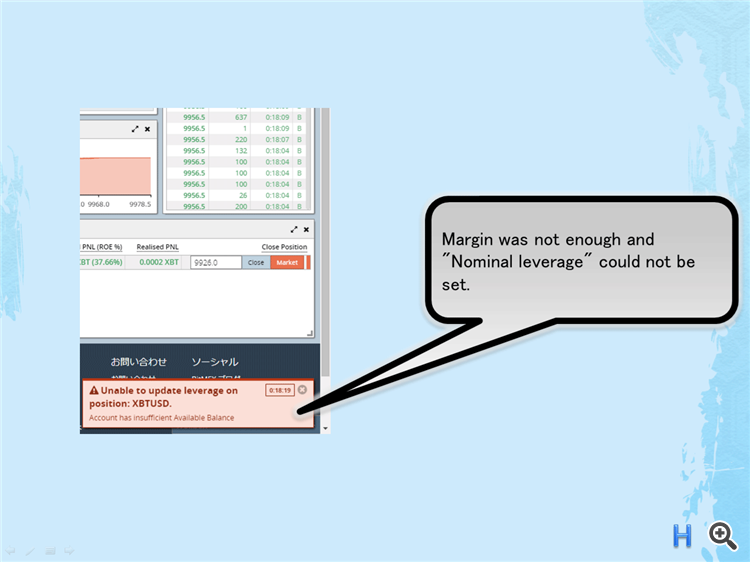

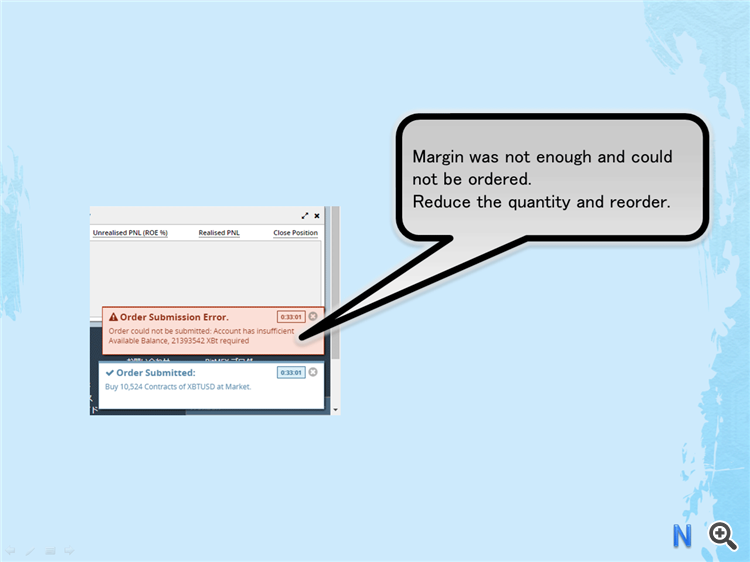

If you place an order in a quantity that exceeds the set leverage, you will get an error message.

Let's reduce the quantity and reorder.

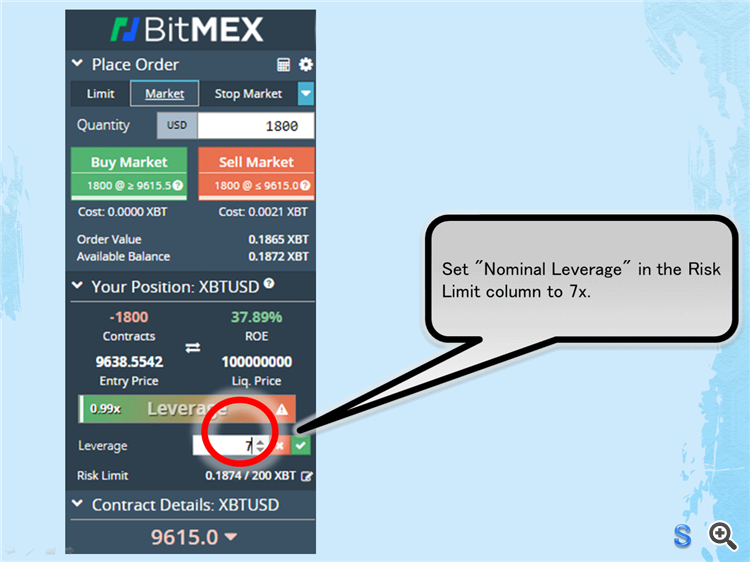

This time I will reorder for $ 1,800.

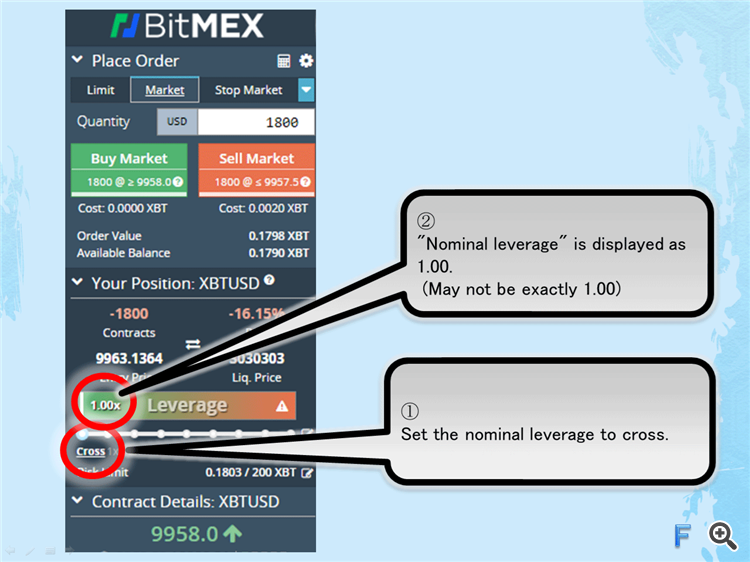

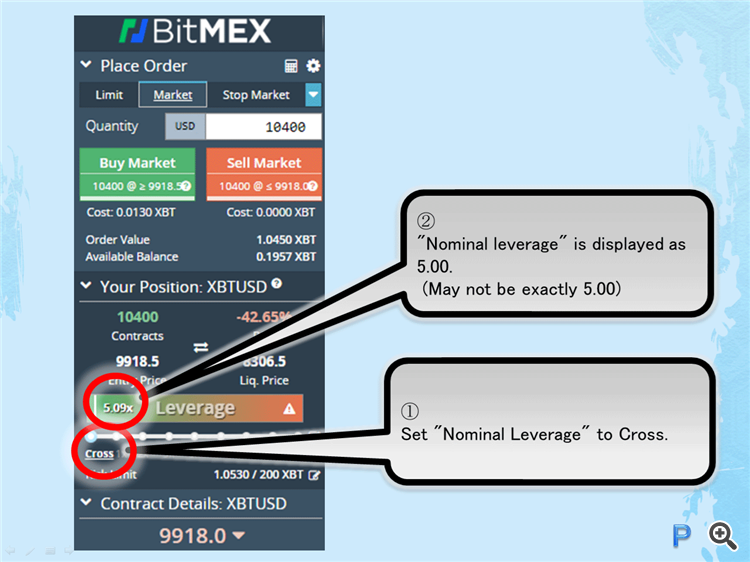

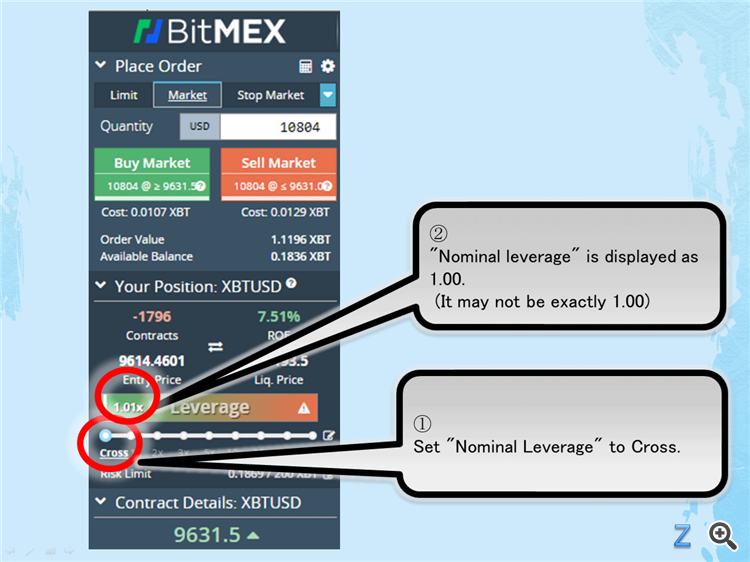

After that, set the leverage in the risk limit column back to cross. If you do not return the risk limit leverage back to cross, your position will be closed with only a small unrealized loss.

Make sure the leverage display is 1x or almost 1x.

After that, return the leverage in the risk limit column to cross.

Make sure the leverage display is 1x or almost 1x.

②When entering a long position with a leverage 6x account

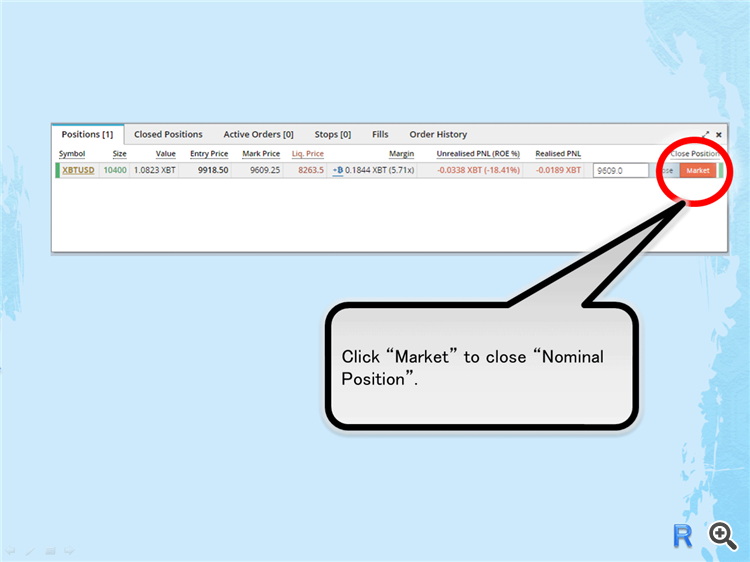

(1) Closing the short position (nominal leverage-1x)

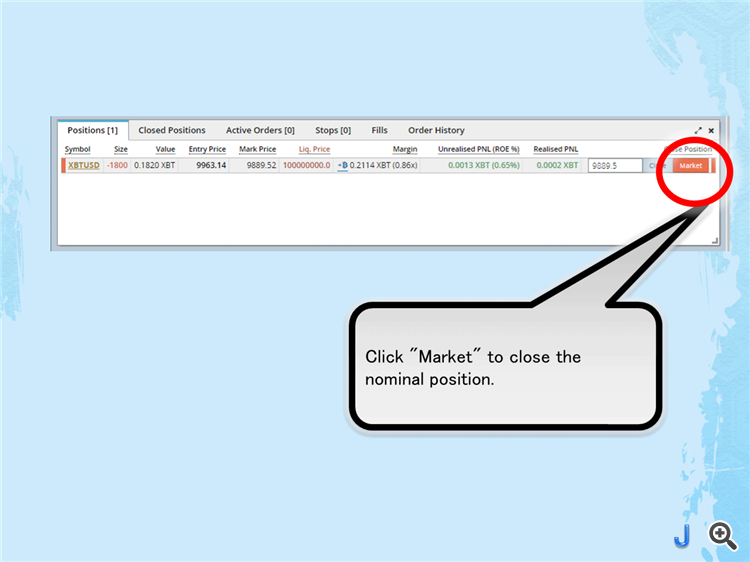

Close your short position (nominal leverage-1x).

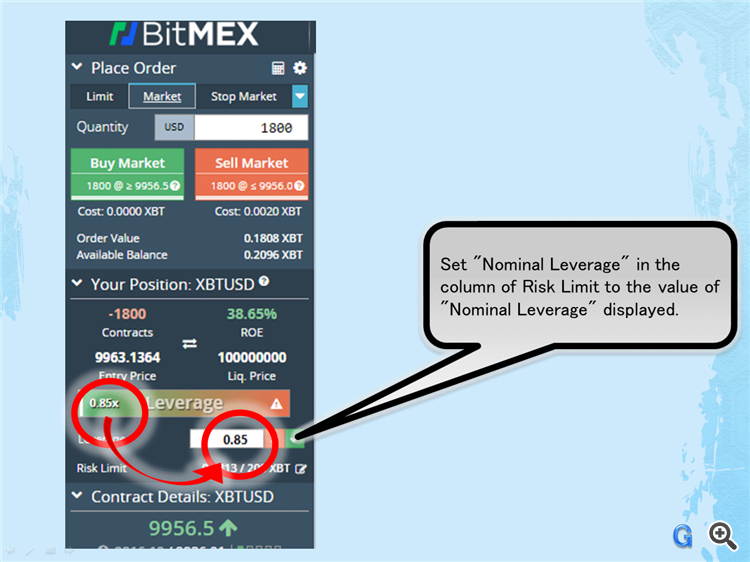

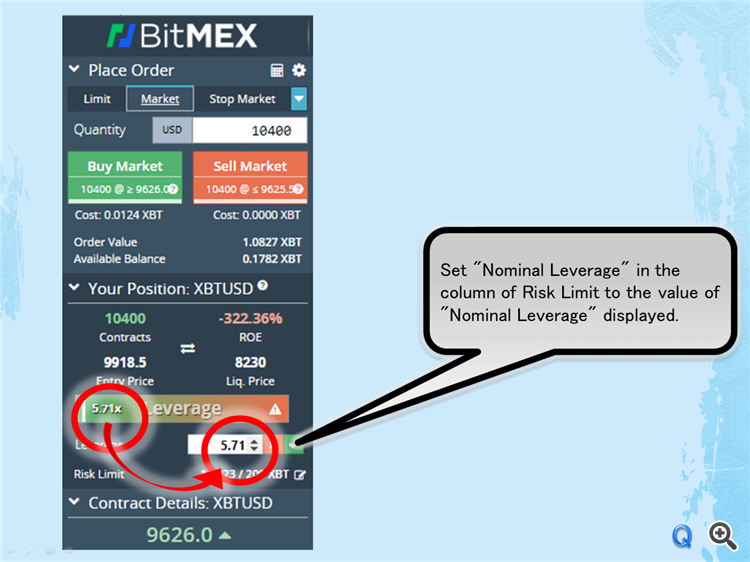

Set the leverage in the risk limit column to the displayed leverage value. In the unlikely event that you make a mistake, you will not lose money due to unnecessary fees.

Click "Marketing" under the word "Close position" in the "Position" frame.

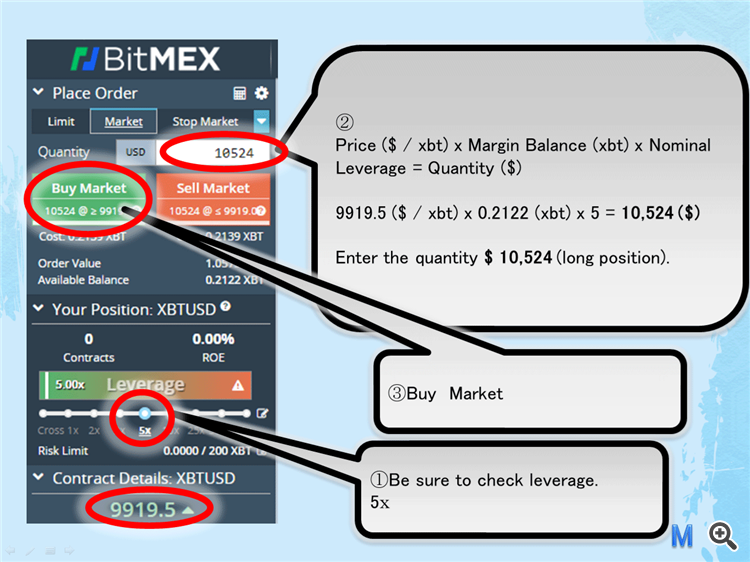

(2) Entry for long positions (nominal leverage + 5x)

To enter a long position with "real leverage" + 6x, enter a long position with "nominal leverage" + 5x.

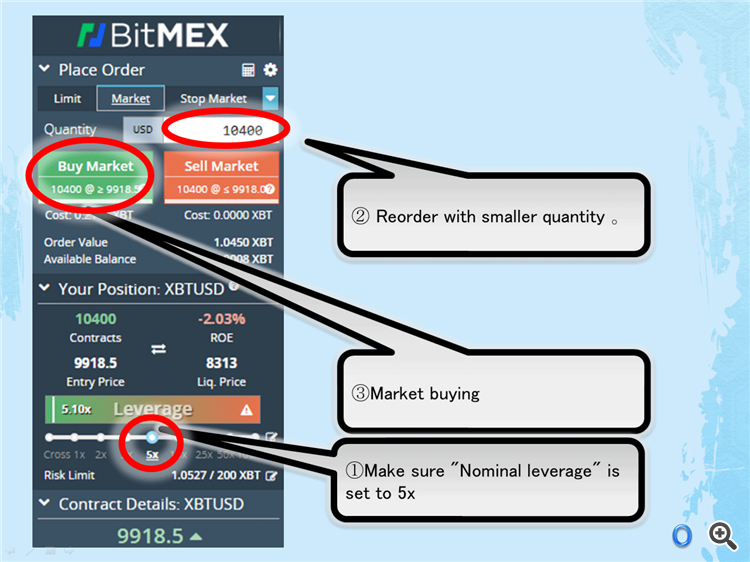

Set the leverage in the risk limit column to 5x. This is because if you enter the wrong quantity, you will not lose money due to unnecessary fees.

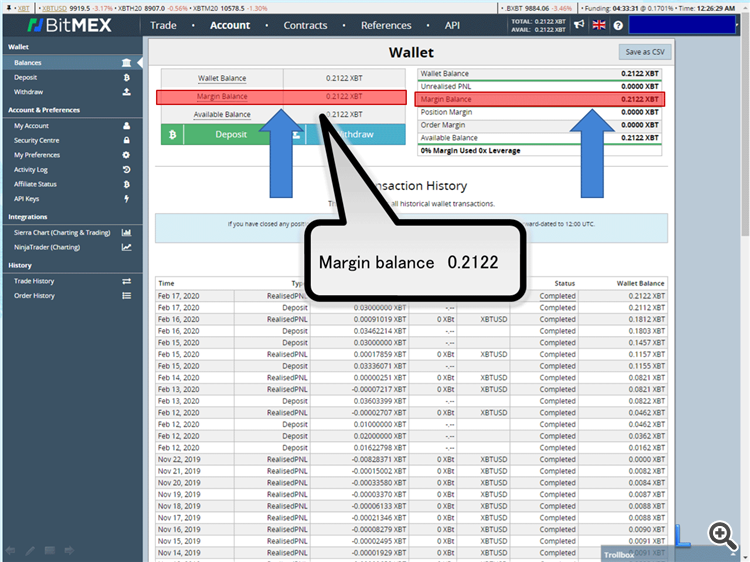

Calculate the quantity. The formula for calculating the quantity when the “margin balance” is 0.2122xbt and the bitcoin price is $ 9919.5 is as follows.

Price ($ / xbt) x Margin Balance (xbt) x Nominal Leverage = Quantity ($)

9919.5 ($ / xbt) x 0.2122 (xbt) x 5 = 10,524 ($)

Enter the quantity and buy the market.

If you get a margin shortage error message, reduce the quantity a bit.

Then set the leverage in the risk limit column back to "cross". If you do not return the risk limit leverage back to cross, your position will be closed with only a small unrealized loss.

③ When closing a long position with a leverage 6x account

(1) Close long position

Set the leverage in the risk limit column to 5x. This is because if you enter the wrong quantity, you will not lose money due to unnecessary fees.

Click "Marketing" under the word "Close position" in the "Position" frame.

(2) Entry to short position (nominal leverage-1x)

Same as ①.

④When entering a short position with a leverage 6x account

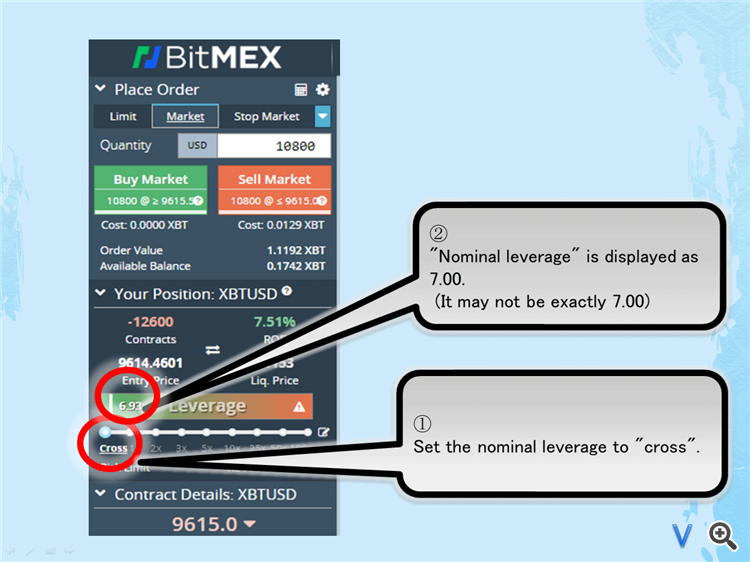

Since you should be entering the short position with "nominal leverage"-1x, increase the number of short positions so that the short position will be "nominal leverage"-7x.

(1) Entry to short position (nominal leverage-7 times)

Set the leverage in the risk limit column to 5x. This is because if you enter the wrong quantity, you will not lose money due to unnecessary fees.

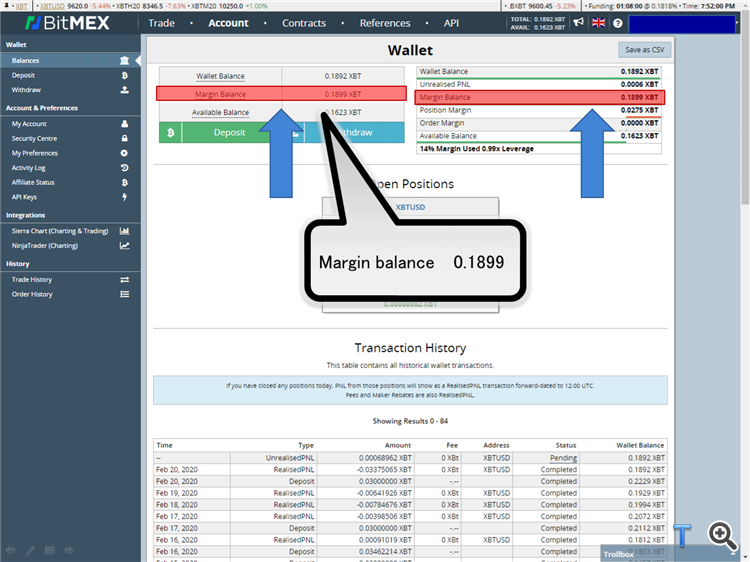

Calculate the quantity. The formula for calculating the quantity when the margin balance is 0.1915 xbt and the bitcoin price is $ 9653 is as follows.

First, since the current position quantity is $ -1,800 (short position), subtract 1800 from the quantity calculated for leverage 7x.

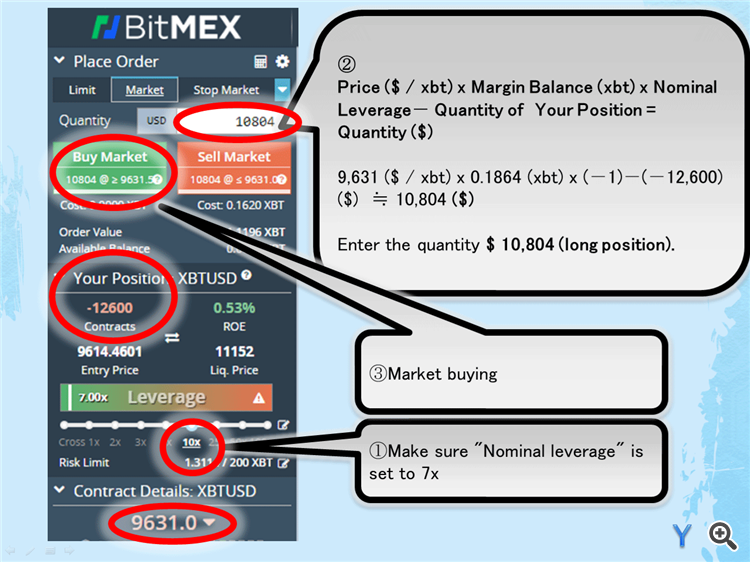

Price ($ / xbt) x Margin Balance (xbt) x Nominal Leverage-Quantity of Your Position = Quantity ($)

9,628 ($ / xbt) x 0.1899 (xbt) x (-7) -( -12,600) ≒-10,804 (dollar)

Enter the quantity and sell the market.

After that, return the leverage in the risk limit column to cross. If you do not return the risk limit leverage back to cross, your position will be closed with only a small unrealized loss.

⑤When closing a short position with a leverage 6x account

Here are two methods, (a) and (b), for closing short positions.

(a) After closing the short position until the "nominal leverage" becomes 0x, enter the short position with the nominal leverage -1x

(1) Short position close

Same as ①

(2) Entry in short position (nominal leverage-1x)

Same as ①.

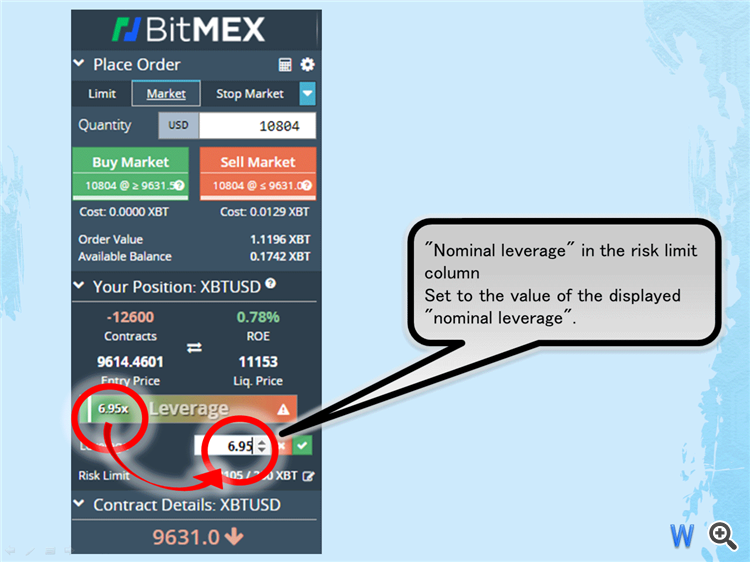

(b) Close a part of the short position to "Nominal leverage"-1x short position

(1) Close some positions so that the short position becomes "Nominal leverage" 1x.

Calculate the difference between the quantity of the short position you have and the quantity at which the short position is "nominal leverage"-1x, and make a market buy with the difference of the quantity.

Set the leverage in the risk limit column to 5x. This is because if you enter the wrong quantity, you will not lose money due to unnecessary fees.

Price ($ / xbt) x Margin Balance (xbt) x Nominal Leverage-Your Position = Quantity ($)

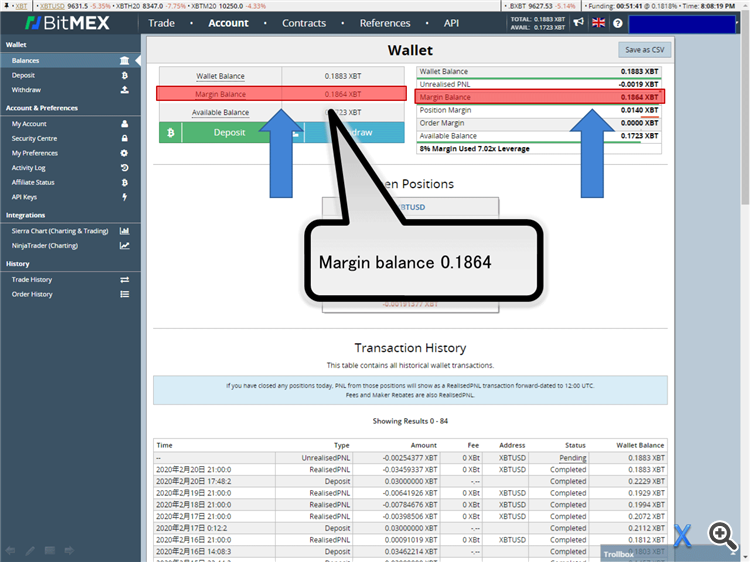

9,631 ($ / xbt) x 0.1864 (xbt) x (-1)-(-12,600) ($) ≒ 10,804 ($)

Enter the quantity and buy the market.

After that, return the leverage in the risk limit column to cross. If you do not return the risk limit leverage back to cross, your position will be closed with only a small unrealized loss.

About changing the display of leverage

The display of leverage in the current position column will decrease as unrealized gains occur. This is because margins increase when there is an unrealized gain. Conversely, the display of leverage goes up if there is an unrealized loss. This is because margin is "decreased" if there is an unrealized loss.

There is no need to increase or decrease the position size when the leverage display changes.