According to the American Petroleum Institute (API) on Tuesday evening, the increase in oil reserves in the US in the week of April 14-20 was +1.1 million barrels. At the same time, gasoline and distillate stocks fell by -2.7 and -1.9 million barrels, respectively.

Participants in the oil market reacted with sufficient restraint to the API data. More strong reaction of investors was to the new statements of the US president, which he made on Tuesday at a meeting with French President Emmanuel Macron. As Donald Trump said, "if they (Iran) resume the nuclear program, they will have such problems as never existed."

Macron arrived in the US, including to persuade Trump not to leave the nuclear agreement on Iran in 2015, and proposed the idea of a more extensive deal. During the talks, Trump said that this nuclear agreement on Iran "should not have existed" and called the deal "insane".

Later at the press conference Trump again used tough rhetoric against Tehran. "If Iran somehow threatens us, they will pay the price that few people paid", he threatened. According to Trump, thanks to the lifting of sanctions, Iran has received too much in exchange for an insufficient reduction of the nuclear program.

However, Macron wants to expand the deal of 2015, aimed at limiting Iran's nuclear activity, until 2025. Macron hopes that the US and other countries will agree to sign a new agreement aimed at resolving those problems that the original deal did not solve.

Iranian Foreign Minister Javad Zarif on Sunday in an interview for the CBS channel said that Iran "has prepared several options for action, including the resumption of the nuclear program and develop it very quickly" in the case of unilateral US actions aimed at seceding from the deal with Iran.

Nevertheless, after the meeting on Tuesday of French President Emmanuel Macron and Trump in the White House, prices fell. The US president expressed his interest in a possible new deal designed to limit Iran's nuclear program. According to economists, in this case it will be possible to avoid the introduction of new sanctions and leave oil production in Iran at the same level.

If before May 12, when US President Trump intends to take a decision on the Iranian agreement, there will be no unexpected statements on this issue from him, the oil market participants will again pay attention to the dynamics of the dollar, which is strengthened in the currency market, and the statistics on oil reserves and the level of production in the United States.

Today, the weekly report of the Energy Information Administration (EIA) of the US Energy Ministry, which will be published at 14:30 (GMT), may become the main driver on the oil market in the absence of new applications from the White House. According to the forecast of economists, the report of the US Energy Ministry will point to a drop in oil reserves in the US last week by -2.043 million barrels, and this is a positive factor for oil prices.

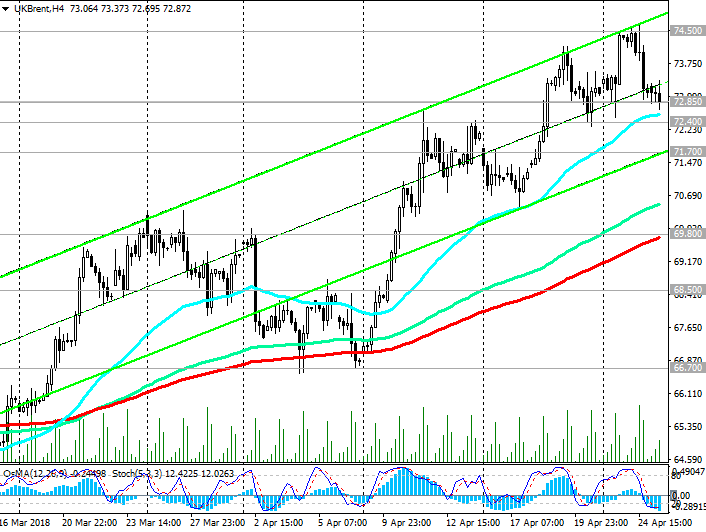

Reducing the reserves of oil and oil products will support the oil market, and Brent crude will again try to break into the zone above $ 75 per barrel.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

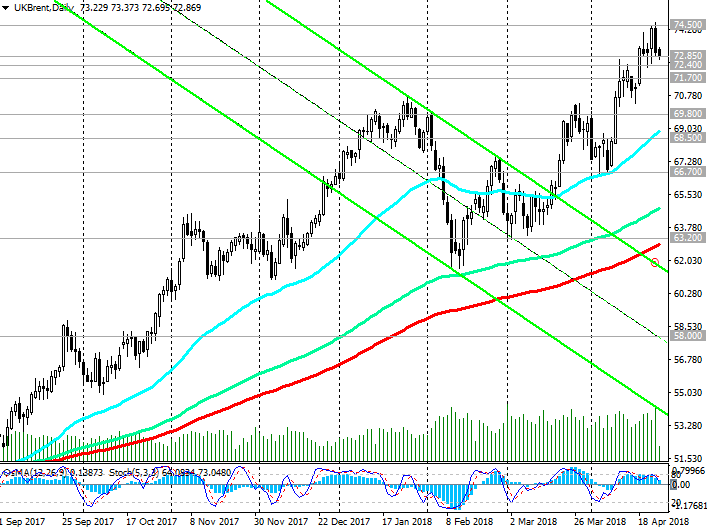

Support levels: 77.85, 72.40, 71.70, 70.00,

69.80, 68.50, 66.70, 63.20, 58.00

Resistance levels: 73.50, 74.50, 75.00, 76.00, 77.00

Trading Scenarios

Sell Stop 70.70. Stop-Loss 72.50. Take-Profit 70.00, 69.80, 68.50, 66.70, 63.20, 58.00

Buy Stop 73.50. Stop-Loss 72.30. Take-Profit 74.00, 75.00, 76.00, 77.00

Buy Limit 72.85, 72.40, 71.70. Stop Loss 70.85. Take-Profit 73.00, 73.50, 75.00

) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com