Unexpectedly grown in October, retail sales have supported the British currency.

According to data published on Thursday, retail sales in the UK increased 0.3% in October (the forecast was + 0.1%). In September, as compared to August, sales decreased by 0.7%. It is noteworthy that the most significant increase in October was the sale of second-hand items. Whether the British are moving to a more economical regime due to the weakening of the pound against the background of rising inflation, whether the residents of the UK have grown interested in antiques in terms of its historical value, which, on the contrary, indicates an increase in their welfare. However, compared to October last year, retail sales for the first time since early 2013 decreased (by 0.3%).

This year, the growth of the UK economy slowed significantly, as consumer expenses are under pressure exerted by inflation accelerated as a result of the fall of the pound after voting for an exit from the EU.

Last week, the European Commission lowered its forecast for UK GDP growth this year, including, due to a weak increase in investment in the UK economy against the backdrop of Brexit.

The statistics presented on Tuesday showed that inflation in the UK in October, as in September, rose to 3.0%. At the same time, prices are growing faster than salaries, which mean that consumer spending will remain low-key. This is a negative factor for the pound and the country's economy, which focuses on domestic consumption.

The pound continues to remain under pressure, even though at the beginning of the month the Bank of England raised its interest rate due to a galloping inflation after the referendum on Brexit. Investors do not believe in the possibility of accelerating the growth of the British economy, as evidenced by the fall, the second week, in a row of the British stock index FTSE. And in the leaders of the fall are shares of British companies that build their business inside the country.

The Bank of England Governor Mark Carney has repeatedly said that the central bank will monitor how the economy reacts to the rate hike in November. It is likely that the Bank of England will not raise rates again in the near future, given the uncertainty associated with Brexit.

Meanwhile, the US dollar is restoring its positions today in the foreign exchange market. Macroeconomic indicators remain positive, and growth continues in the corporate sector of the US economy.

Today, the US House of Representatives must pass a vote on the tax bill. Investors will closely monitor the results of voting. Any delay or reduction in the scale of tax cuts can damage to the dollar.

Also today we are waiting for the publication of important macro statistics from the USA. Among the data - primary applications for unemployment (changes in the number of applications for the past week), indices of import / export prices for October, the volume of industrial production and use of production capacities for October. If the US strong macro statistics comes out, the dollar will continue to recover.

The publication of the data is scheduled for 13:30, 14:15 (GMT), and at 14:00, 14:10, 14:30, 17:30, speeches of the representatives of the Bank of England and the Federal Reserve will begin, which again may cause volatility in the pound trade and the dollar, if they touch upon the subject of monetary policy of the central banks of the United Kingdom and the United States.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

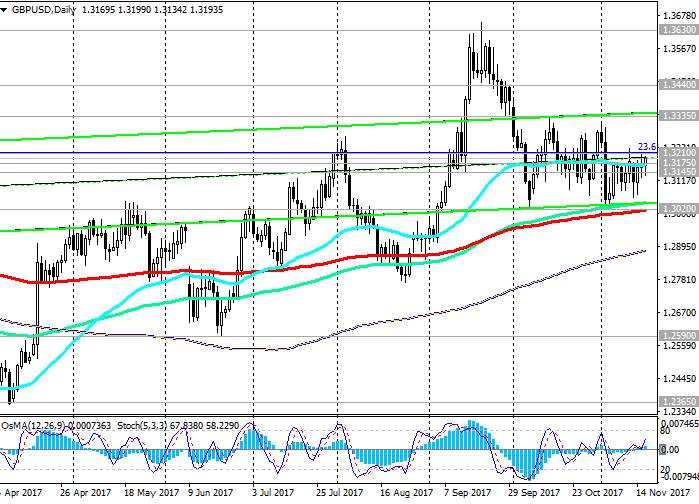

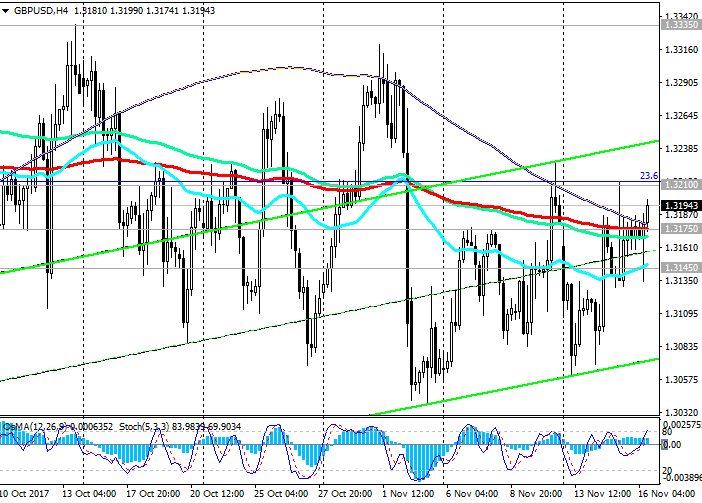

Support levels: 1.3175, 1.3145, 1.3100,

1.3065, 1.3020, 1.2975, 1.2590, 1.2365, 1.2110, 1.2000

Resistance levels: 1.3210, 1.3300, 1.3335, 1.3440, 1.3500, 1.3630, 1.3760, 1.3970, 1.4100

Trading Scenarios

Sell Stop 1.3140. Stop-Loss 1.3220. Take-Profit 1.3100, 1.3065, 1.3020, 1.2975, 1.2590, 1.2365, 1.2110, 1.2000

Buy Stop 1.3220. Stop-Loss 1.3140. Take-Profit 1.3300, 1.3335, 1.3440, 1.3500, 1.3630, 1.3760, 1.3970, 1.4100

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com