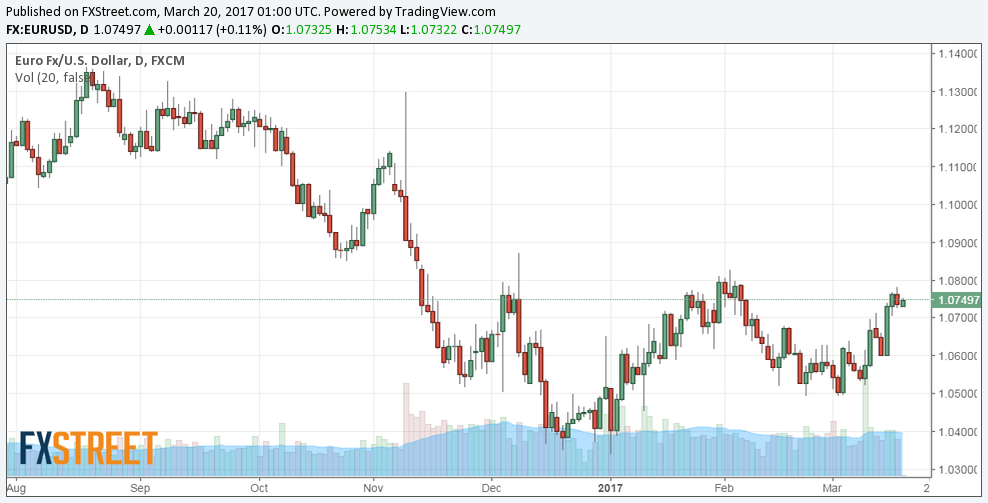

EUR/USD retreated from Friday’s five-week high of 1.0782 to 1.0727 only to find fresh bids in the Asian session and revisit the 1.0750 region.

EUR caught a bid wave last week after ECB’s Nowotny said the bank could hike deposit rate before the main refinancing rate. Moreover, the speculation that rates would go higher in Eurozone in response to higher inflation refuses to die down.

Focus on BUBA report

The data released last week showed German inflation rose at a fastest rate in 4 years. Meanwhile, Eurozone February inflation hit 2% for the first time in 4 years. The talk of a rate hike may gather pace further if the German Bundesbank points to higher inflation in the near future.

On the other hand, if the report blames transitory factors for higher inflation, the rate hike speculation may fizzle out, leading to a pullback in the EUR. Also worth keeping an eye on is the Franco-German yield spread.

EUR/USD Technical Levels

A break above 1.0790 (inverse head and shoulder neckline) would mark a major trend reversal and open doors for 1.1239 (breakout target as per the measured height method). On the way higher, the spot is likely to have an encounter with 200-DMA located at 1.09 and the psychological hurdle of 1.10.

On the downside, a breach of 1.0714 (Mar 13 low) could yield a pullback to 1.0648 (50-DMA) and 1.06 (zero levels).