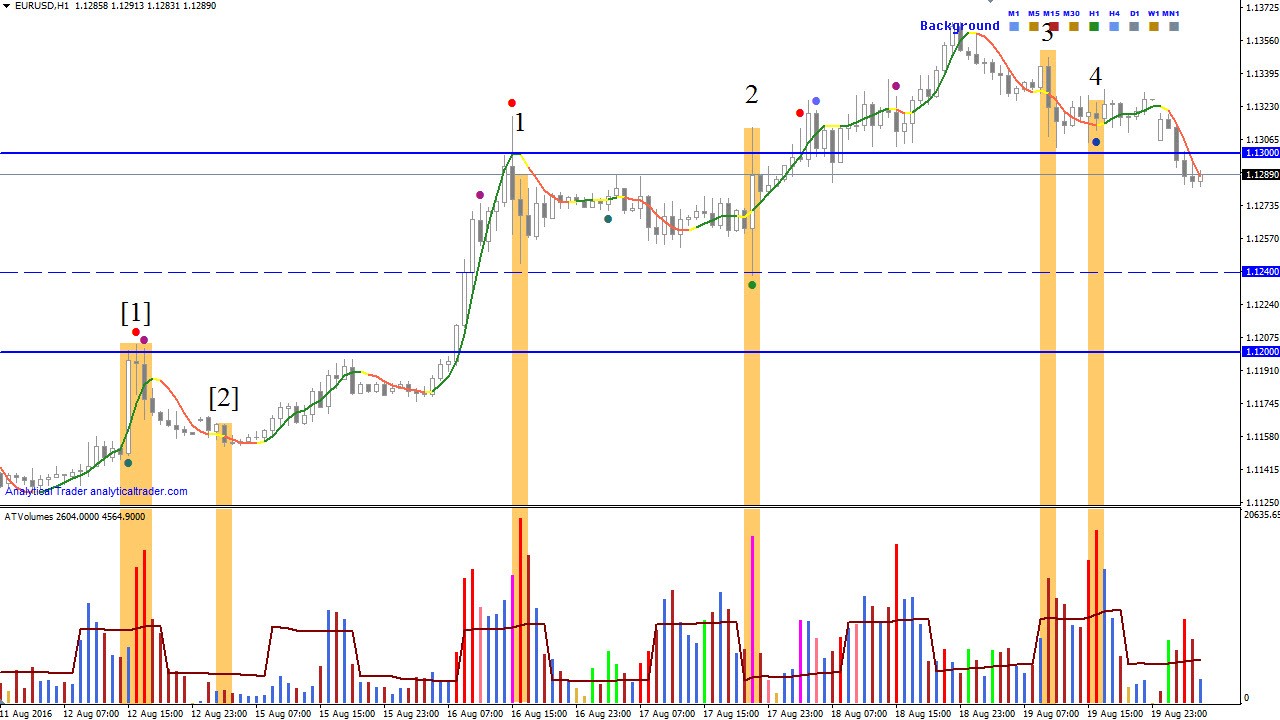

In last Monday’s analysis, the point [1] was regarded as the selling climax. However, the subsequent down-bars had reduced volumes and narrow spreads and further “No Supply” in point [2] showed the lack of interest on lower prices from the Smart Money.

In point 1 and 2 there were two strong “shakeout” with a high volume and wide spread. The result – price increases.

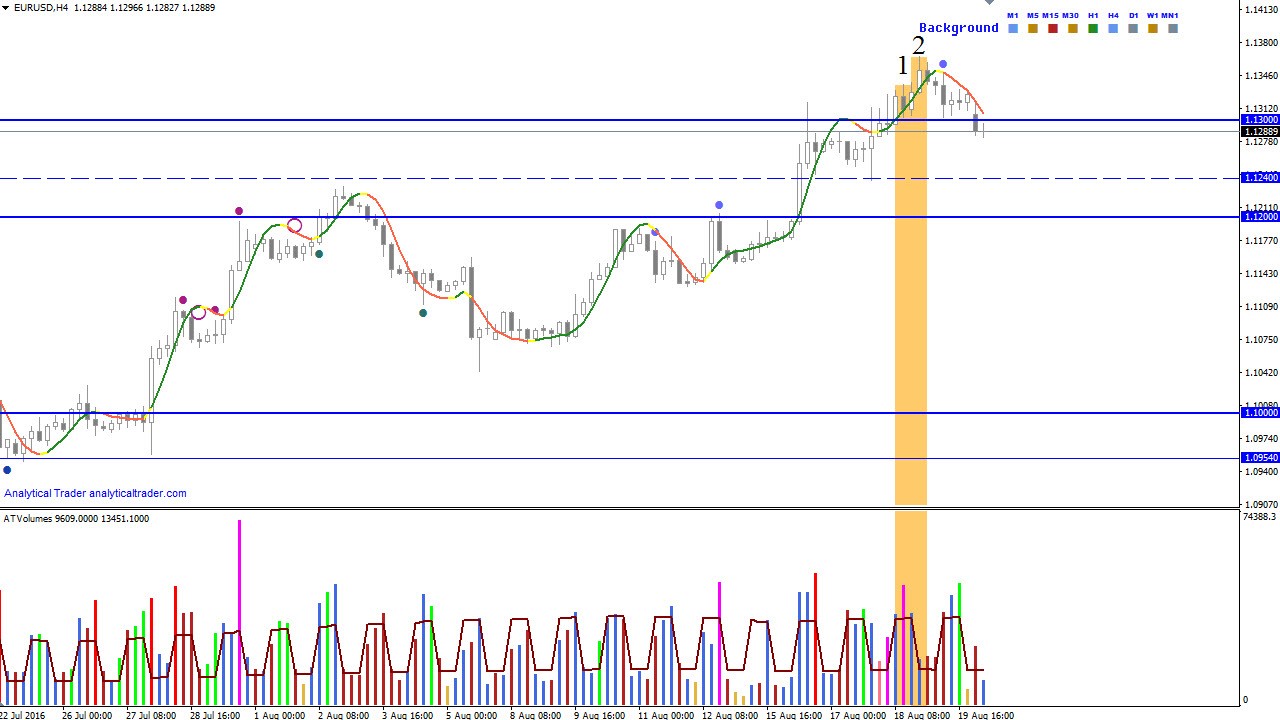

In point 3 and 4 there was a change in price/behavior. It became bearish (i.e. volume growth leads to price decreases). Also, on the H4 timeframe, the down bar with high volume in point 1, “No Demand” in point 2 and the further price decreases on the show the same weakness.

Suggested Strategies

Consider selling if the price breaks the level 1.124 and «No Demand» bar appears. On the other hand, if the price breaks-out the level 1.13 and «No Supply» bar appears, a long should be considered. The lower timeframe can be used to search for the «No Demand» and «No Supply».