Trade USD/JPY Summer Relief - SocGen

From Societe General:

USD/JPY likely to bounce before next risk-off move. Summer could be quieter with delayed risks.

Financial markets experienced severe dislocations around the Brexit vote. The pulse of the price action is gradually normalising as the effects of the shockwave gradually dissipate. In our view, risk aversion is likely to step back further in the coming weeks, leaving investors time to digest the 'leave' vote. With a lack of new imminent risks and a new leader of the Conservative Party not in place until 9 September, near-term relief is likely. The possibility of the activation of Article 50 by the UK is potentially the next major source of risk aversion, but it should not be on the table in the coming weeks

Technical picture suggests near-term bounce

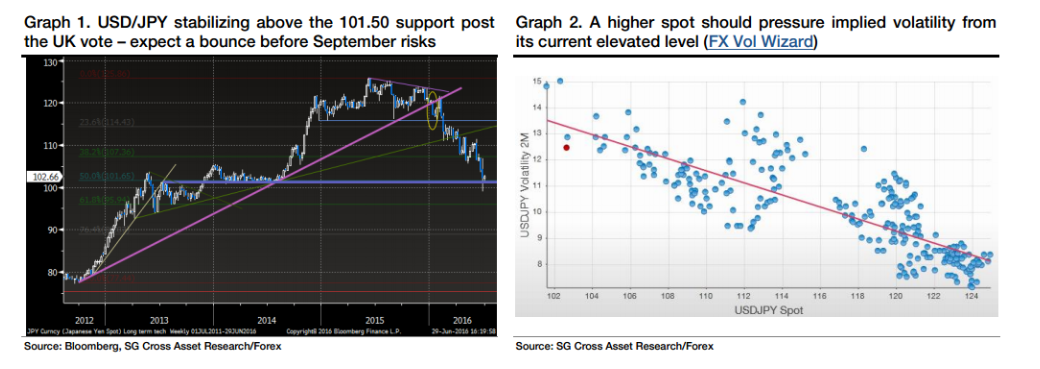

As the market was in full risk-off mode, the yen spiked and pressured USD/JPY to visit sub-100 levels at the apogee of post-Brexit fears. But it did not last, and the FX rate promptly bounced above the important 101.50 support. This level is very significant in the medium-term picture (and even more so since recent events), as USD/JPY consolidated just above it in 1H14 before starting its second bullish leg, and it also is the 50% Fibonacci level between the multi-year low and high at 75 and 126 (Graph 1). According to our technical analysts, 101/100 is likely to be an important level in the near term, and 105.60/106.60 will confirm if USD/JPY sees a meaningful recovery.This makes it attractive to trade an appreciation of about four big figures from there.