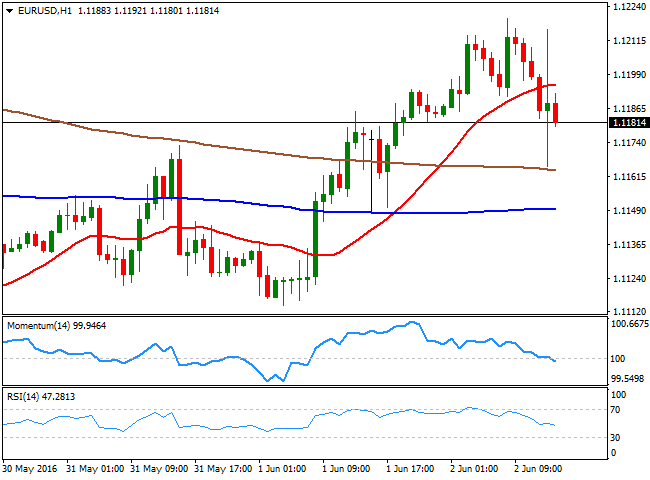

EUR/USD: Draghi Disappoints, EUR Still Mute

EUR/USD Current Price: 1.1181

The dollar got a short lived boost from Mario Draghi, as the ECB's head left the economic policy unchanged, as expected, whilst made the poorest upward revision ever for inflation, lifting expectations for this 2016 to 0.2% from previous 0.1%. Upcoming years´ inflation forecasts remained unchanged. Growth has also been revised higher, for this year, up to 1.6% from previous 1.4%. The EUR/USD pair retreated further from the high set at 1.1219 earlier today, and fell down to 1.1165, although it bounced back during the press conference.

In the US, the ADP private survey showed that the private sector

added 173K new jobs in May, slightly below market's expectations of

175K, while weekly unemployment claims came in at 267K for the week

ended May 27, slightly better than the 270K expected.

The EUR/USD pair 1 hour chart shows that the price is now below its 20 SMA, whilst the technical indicators head modestly lower below their mid-lines, indicating an increasing downward potential. In the 4 hours chart, the 20 SMA heads north below the current level, providing an immediate support in the 1.1160 region, whilst the technical indicators have retreated modestly within positive territory. A stronger decline below 1.1160 could see the pair down to 1.1120, although further declines are unlikely ahead of US employment data this Friday.

Support levels: 1.1160 1.1120 1.1090

Resistance levels: 1.1200 1.1235 1.1280

GBP/USD Current price: 1.4439

The GBP/USD pair recovered some ground early Thursday, advancing up to 1.4472 before retreating to current 1.4440 region, with no certain directional strength. There were no macroeconomic releases in the UK, with only Governor Mark Carney presenting a new five pound bill, and making comments over the risk of a Brexit, nothing actually new. The 1 hour chart shows that the technical indicators are retreating within positive territory, whilst the price is approaching its 20 SMA, indicating little buying interest at current levels. In the 4 hours chart, the technical indicators have barely bounced from oversold levels, but with no upward strength, whilst the 20 SMA maintains its strong bearish slope above the current level, maintaining the risk towards the downside.

Support levels: 1.4400 1.4360 1.4320

Resistance levels: 1.4470 1.4515 1.4550

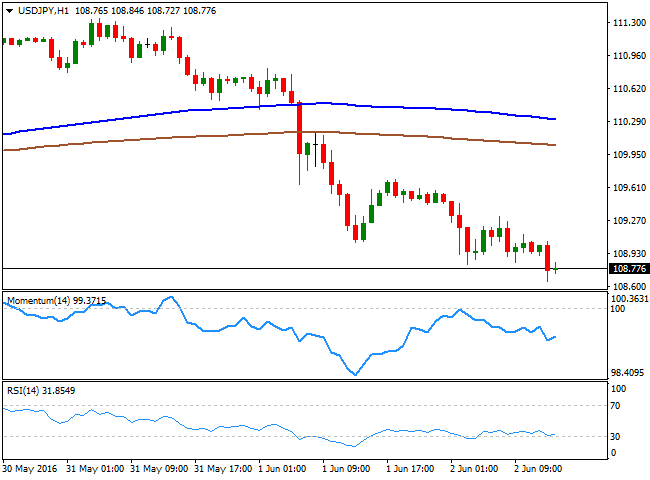

USD/JPY Current price: 108.77

Fresh lows on risk aversion. The USD/JPY pair continued declining this Thursday, down below the 109.00 mark ahead of the US opening and after ECB's economy policy decision. In the news, Moody's rating agency said that Japan's sales tax hike delay is credit negative, making fiscal goals more challenging, not really good news for Germany. Anyway the yen's advance is being backed by falling equities and the 1 hour chart shows that the price is well below its moving averages, whilst the technical indicators have lost downward strength but remain within bearish territory. In the 4 hours chart, the technical indicators maintain their sharp bearish slopes near oversold levels, whilst the price is currently being capped by the 200 SMA, now around 109.20, in line with further slides for today.

Support levels: 108.70 108.30 107.95

Resistance levels: 109.20 109.50 110.00