Analytical Review of the Currency Pair USD/JPY

Technical data of the currency pair:

Previous closing: 111.95;

Daily range: 111.68-112.20;

Opening: 111.95;

52- week range: 110.65-125.86;

Annual revenue: -6.73%;

Change in % for the previous day: +0.63.

Analytical review:

- Last week the Yen has significantly grown increasing in price by over 250 points after the announcement that the US Fed is planning to raise key interest rate twice this year instead of previously planned increase of 4 times.

- During yesterday’s session the Yen has slightly corrected despite poor US statistics, which showed that according to National retail Association housing sales in the secondary market fell by 7% to 5.08 million houses.

- Since mid February stock markets of Japan shows positive dynamics. Index of Индекс Nikkei 225 rose by over 11.5% to 16725.

- “Commitments of Traders” demonstrates significant increase in long positions. Large speculators have opened up to 142534 contracts.

- Some important news will be released this week, including basic orders for durable goods in the USA (Thursday) and US GDP (Friday). This information can influence on dynamics and volatility in the market.

Summary:

- During yesterday’s session the Yen has corrected by 0.63%, after the rally of the last week. Ambiguous situation in the US economy, improvement of the market sentiments in Japanese financial markets contribute to the rise in the Yen. According to “COT” large speculators believe in strength of Japanese currency.

- In the near future the JPY will strengthen against the USD. We recommend to open short positions.

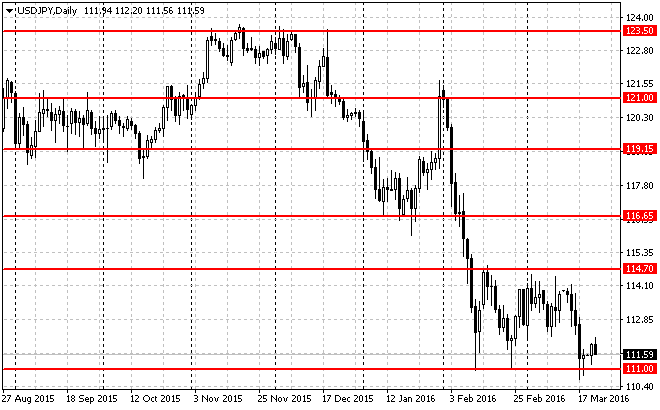

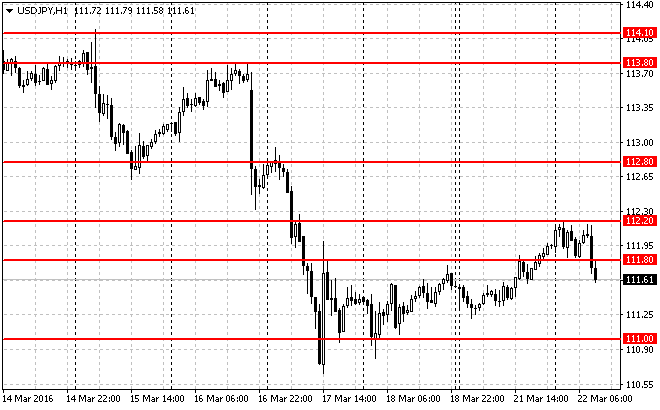

Trading tips for the currency pair USD/JPY

Long-term trading: The currency is traded in the range of 111.00-114.70. After breaking out and testing of support level of 111.00 and in case of the respective confirmation (such as pattern Price Action), we recommend to open short positions. Risk per trade is not more than 2% of the capital. Stop order can be placed slightly above the signal line. Take profit can be placed in parts at the levels of 110.20, 109.50 and 108.50 with the use of trailing stop.

Medium-term trading: the moment the currency has broken down the local support level of 111.80. In case of maintenance and testing of levels of 111.80-112.20 and respective confirmation (such as pattern Price Action), we recommend to open short positions. Risk per trade is not more than 3% of the capital. Stop order can be placed slightly above the signal line. Take profit can be placed in parts at the levels of 111.30, 110.70 and 110.20 with the use of trailing stop.

The material has been provided by LiteForex - Finance Services Company - www.liteforex.com