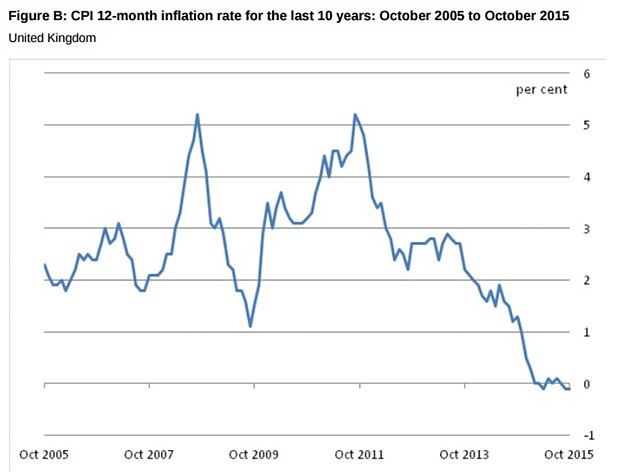

On Tuesday official data showed that consumer price inflation in the U.K. remained in negative territory

for the second straight month in October, which highlights worries over

deflationary pressures and a view that interest rates will

remain unchanged at record-lows in the near future.

GBP/USD was last down 0.03% at 1.5200, while EUR/GBP was lower 0.18%, at 0.7016.

In a report, the U.K. Office for National Statistics said the rate of consumer price inflation held unchanged at a seasonally adjusted -0.1% last month, matching expectations.

Month-over-month, consumer price inflation edged up 0.1% in October, in line with forecasts and following a decline of 0.1% in the preceding month.

Bank of England head Mark Carney will now have to write an open letter to Chancellor of the Exchequer George Osborne, since inflation is more than a percentage point below the central bank's target of 2.0%. Central bank policy-makers have said recently they expect inflation to stay near zero for much of this year, before advancing back to target during 2016 and 2017.

Core CPI, which excludes food, energy, alcohol, and tobacco costs climbed at a seasonally adjusted rate of 1.1% in October, above forecasts for a reading of 1.0% and up from 1.0% in September.

The retail price gauge increased 0.7% in October, below expectations for 0.9% and down from 0.8% a month earlier.

The numbers also showed that the house price index rose 6.1% in September, beating expectations of a gain of 5.4% and following a 5.5% rise in August.

Separately, the ONS said producer price inflation input in the U.K. rose last month.

U.K. PPI input rose to a seasonally adjusted 0.2%, from 0.5% in the preceding month whose figure was revised down from 0.6%. Experts had expected U.K. PPI input to rise 0.2% last month.

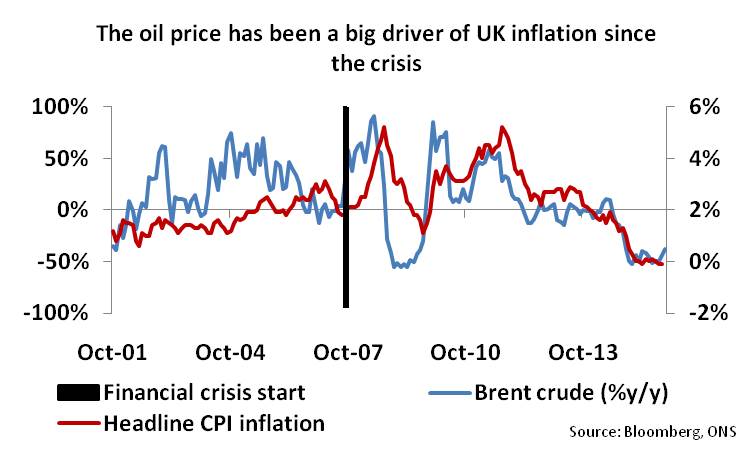

Meanwhile, RBS Economics has reminded that cheaper oil played a key role pushing down U.K. inflation: