NZD/USD: Trading Recommendations and Forecast for the week 19-23 October

Trading recommendations -> HERE

Overview and Dynamics

Past

almost 2 decades since the beginning of the month were marked by almost nonstop

growth of the pair NZD / USD.

The current month the pair based on 3 pillars, so to speak. It is - to reduce

almost to zero the expectations of market participants that the Federal Reserve

on the background of the incoming negative data will not raise rates in the

United States in October, expectations that the RBNZ, in turn, will reduce the

interest rate in New Zealand, who grew up world prices for dairy products ,

whose exports account for 25% of all New Zealand's exports, directly affecting

the budget of the country.

The head of the RBNZ, Graeme Wheeler, speaking last week, said the increased

concerns about the situation in the housing market of the country, and said the

central bank has room to lower interest rates in the event of a significant

slowdown in the global economy.

He also said he did not rule out the possibility of returning to the country's

budget deficit in 2016. The growing trade deficit on the background of a

slowing economy the largest trading partner of China, reduce China's imports

from New Zealand, the slowdown in GDP growth in Q2 may cause the RBNZ to go for

another interest rate cut in New Zealand, probably towards the end of the year.

In the context of the global economic slowdown the Fed can keep its key

interest rate in the US at the same level over the next few months.

New Zealand economy, export-oriented, more needs cheap New Zealand dollar, as

pointed out in September, Wheeler stating that the RBNZ is ready to go for

another interest rate cut in New Zealand.

Technical Analysis

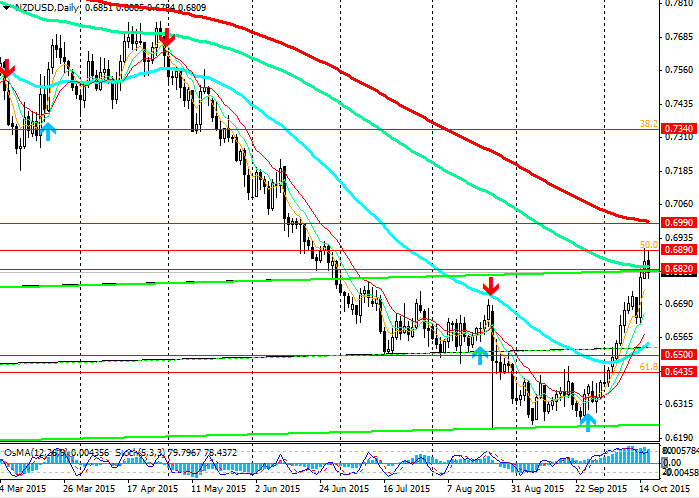

From a technical point of view, the pair NZD / USD, which is located to

open short positions, rising to corrective gains from the lows of the year to a

level of 0.6230 Fibonacci 23.6% at 0.6860. Just below the 0.6835 mark is

located on another level of resistance (EMA144 on the daily chart). Here, the

upper limit of the downward channel on the weekly chart.

Since the beginning of the month the pair was able to consolidate 500 points,

2.5 times blocked the volatility of the previous month and returning to the

June prices.

The next meeting of the RBNZ rate, as well as the Fed will take place on 28

October.

And, most likely, until that time the pair NZD / USD is unlikely to rise above

the levels achieved, while having considerable space to reduce the current

downtrend.

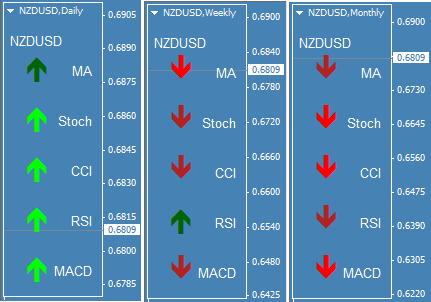

While the weekly chart indicators OsMA and Stochastic recommend buying on the monthly chart - short positions. On the daily chart, there were also signals the opening of short positions. The main trend of the current pair NZD / USD, while it is below the level 0.6835 (EMA144), 0.7000 (EMA200 on the daily chart) remains downward.