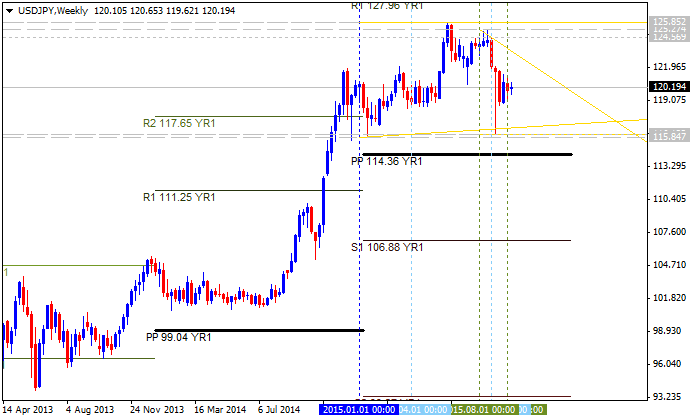

USDJPY Pivot Points Analysis - ranging above Yearly Pivot waiting for breakout

23 September 2015, 15:11

0

1 117

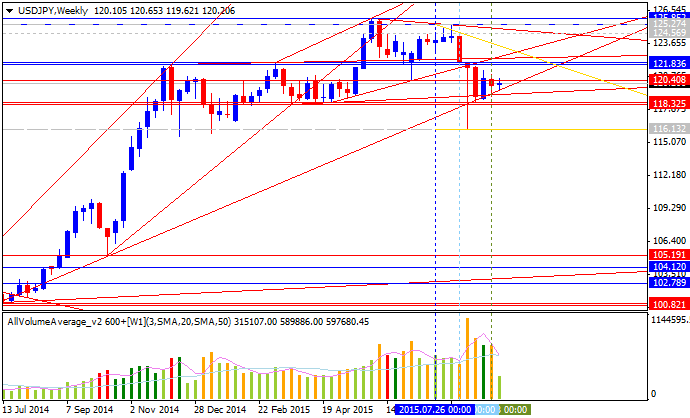

W1 price is located to be above yearly Central Pivot at 114.36 and below R1 Pivot at 127.96:

- The price is on bullish ranging between pivot level at 114.36 and R1 level at 127.96;

- If weekly price will break R1 Pivot at 127.96 together with 125.85 intermediate resistance level so the primary bullish market condition will be continuing up to R2 Pivot value as the next bullish target, otherwise the price will be ranging within yearly Central Pivot and yearly R1;

- If the price breaks 115.84 intermediate support level from above to below so the secondary correction will be started up to Central Pivot at 114.36 as a next bearish target.

| Instrument | S1 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|

| USD/JPY | 106.88 | 114.36 |

127.96 |

Trend:

- W1 - ranging bullish