Fundamental Weekly Forecasts for US Dollar, GBPUSD, USDJPY, AUDUSD, USDCAD and NZDUSD

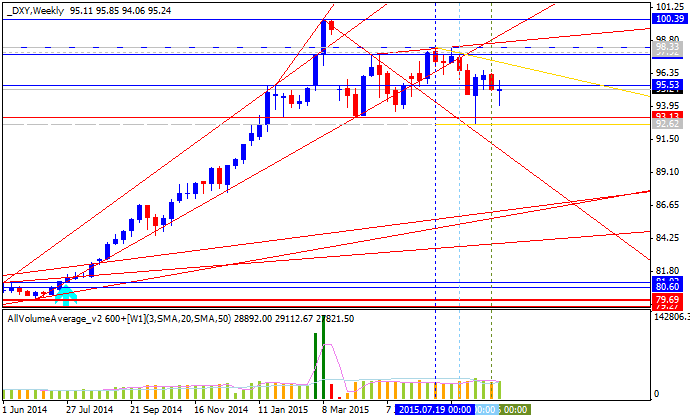

US Dollar - "Relative gains on monetary policy divergences is still the most active fundamental driver in the FX market. However, the greatest potential for volatility and momentum rests with the more elemental investor sentiment theme. If investors are no longer satisfied to participate in status quo bids for short-term gains, there is considerable thematic and notional leverage that will be at risk of deleverage. For conviction, if the S&P 500 extends its dive from four weeks ago, we will see a shift in focus and rolls. No longer will we look at the Dollar for a 25bp future yield advantage. Rather, we will see the Greenback as the market’s most prominent harbor from violent financial storms."

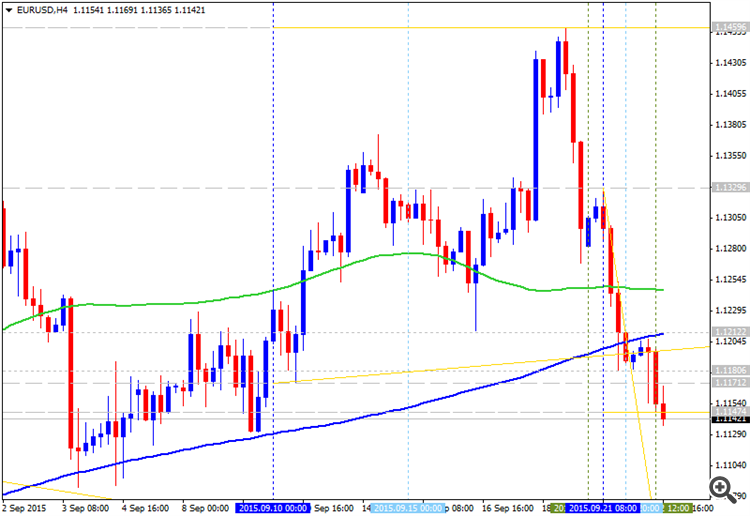

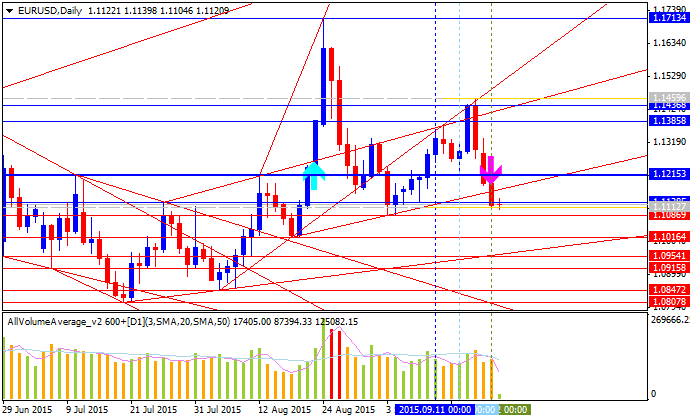

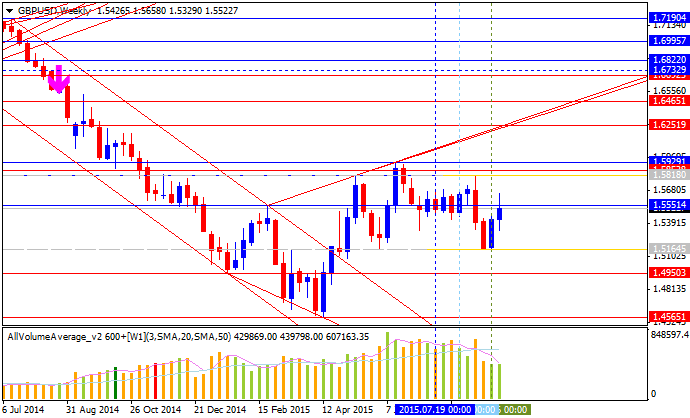

GBPUSD - "With that said, GBP/USD may continue to carve a series of higher highs & lows next week should BoE officials further boost interest rate expectations, while they key data prints coming out of the world’s largest economy may fuel bets for a Fed liftoff in 2016 as market participants look for a contraction in demand for U.S. Durable Goods Orders accompanied by a decline in Non-Defense Capital Goods Orders excluding Aircrafts, a proxy for future business investments."

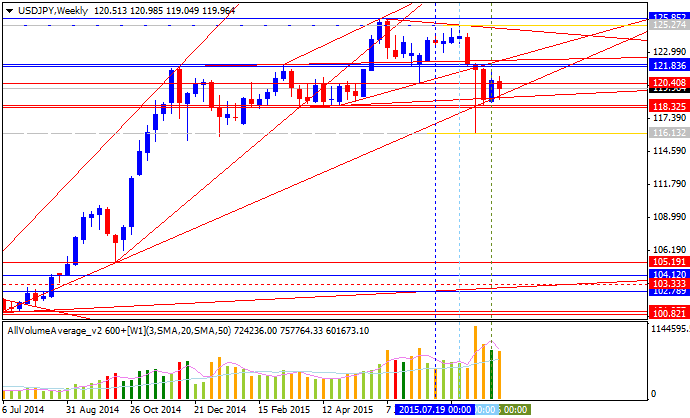

USDJPY - "A recent slowdown in financial market tensions has kept the USD/JPY above key support. Yet a recent build in USD/JPY-long positions suggests that a broader panic would force similarly outsized losses. Ultimately a break below ¥119 could help confirm that the US Dollar trend has turned and would likely coincide with a larger USD breakdown versus the Euro and other major FX counterparts."

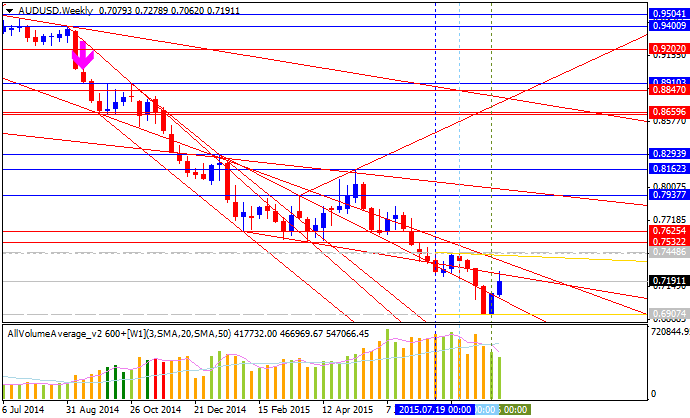

AUDUSD - "On balance, global economic news-flow has increasingly disappointed relative to consensus forecasts since late August out of the G10 and emerging-market economies alike. This suggests analysts’ models of global output trends have tended to be more optimistic than reality has warranted, opening the door for additional downside surprises ahead. Soft outcomes offering additional fodder for worldwide slowdown fears is likely to keep risk appetite under pressure, weighing on the Aussie."

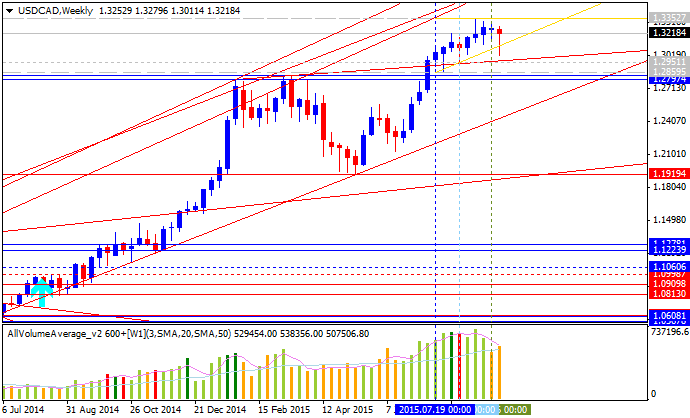

USDCAD - "While not overly affecting the Canadian dollar in the short term, Thursday also saw three candidates for can does Prime Minister Position discuss the economy. The candidates, incumbent Stephen Harper, Liberal leader Justin Trudeau and New Democratic Party lead Tom Mulcair took the stage but no one ended the night as a clear winner. However, Harper remaining as Prime Minister appears to be a most Friendly outcome for the October 19 elections."

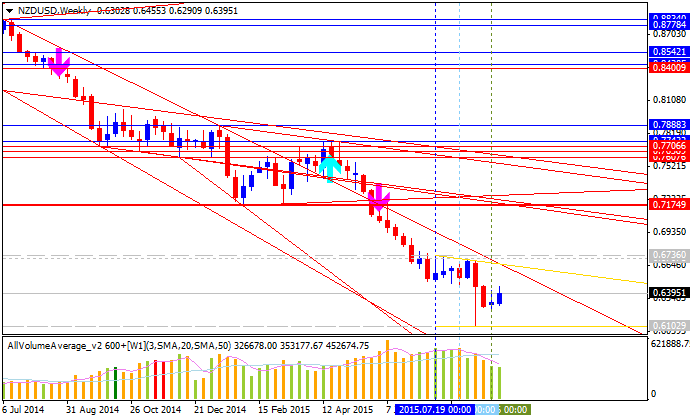

NZDUSD - "Next week is rather light on Kiwi data, the highlight of which is August trade data to be issued on Wednesday. Outside of that, US Durable goods on Tuesday morning could be market moving; but more likely the more prominent push points will be based on equity performance in Asia and the continued fall in commodity prices. But in New Zealand, the 16% pop in Dairy prices can provide hope for future increases, which may end up providing a long-lasting bottom in the NZD/USD market."