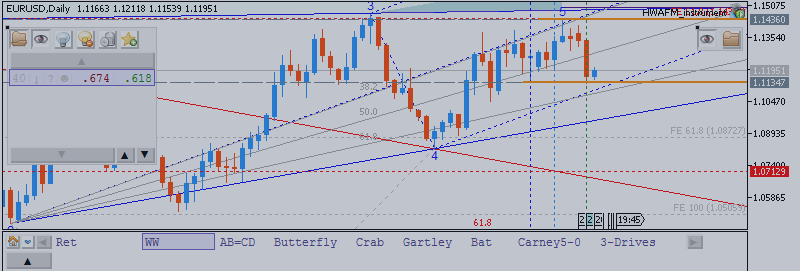

EURUSD Wave Points: Long opportunity near 1.09-1.10 with 1.0815 as risk level

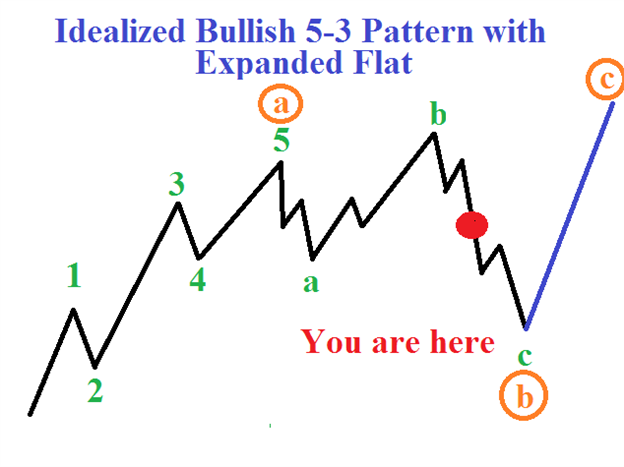

Higher probability scenario we are currently tracking is a smaller degree expanded flat correction that eventually works down towards 1.09-1.10. In this case, since it is a downward expanded flat correction, we can anticipate that once this flat is exhausted, we’ll see a continuation of the EURUSD trend higher.

Since the expanded flat is a corrective move, it will unfold in three bigger waves labeled on the chart below as (a)-(b)-(c). The sub-waves give a 3-3-5 appearance meaning wave (a) consists of three waves, wave (b) consists of three waves, and wave (c) consists of five waves. Therefore, it appears we are in the middle of wave the (c) wave lower. Since the (c) wave typically acts as a false break on the (a) wave, prices could dig into the 1.09 handle.

Expanded flats are challenging patterns that are designed to fool many

traders. It is essentially a dual false breakout pattern. We experienced

a false breakout higher above the June 4 high which means we’ll likely

see a false break below the June 5 low.

Once this expanded flat is exhausted, there will be an opportunity to

buy the EURUSD and target new highs above 1.15. Therefore, if a trader

enters near 1.10 with a 1.08 stop loss and a target of 1.15, that

provides a target 2.5 times the distance of the stop loss.