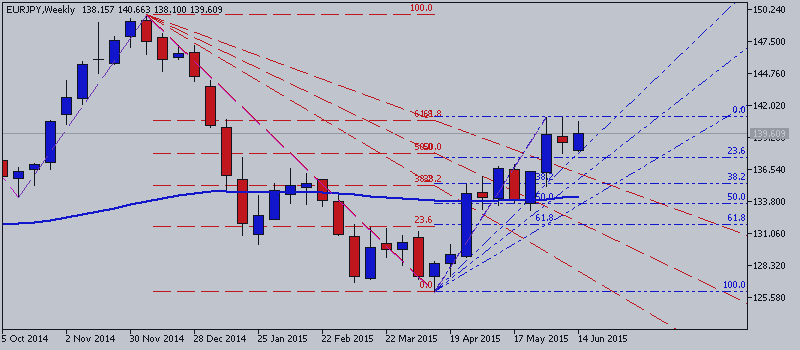

EURJPY Price Action Analysis - crossed 23.6% Fibo level at 137.47 together with 100 SMA from below to above for the primary bullish condition

W1 price was located between 200 period SMA

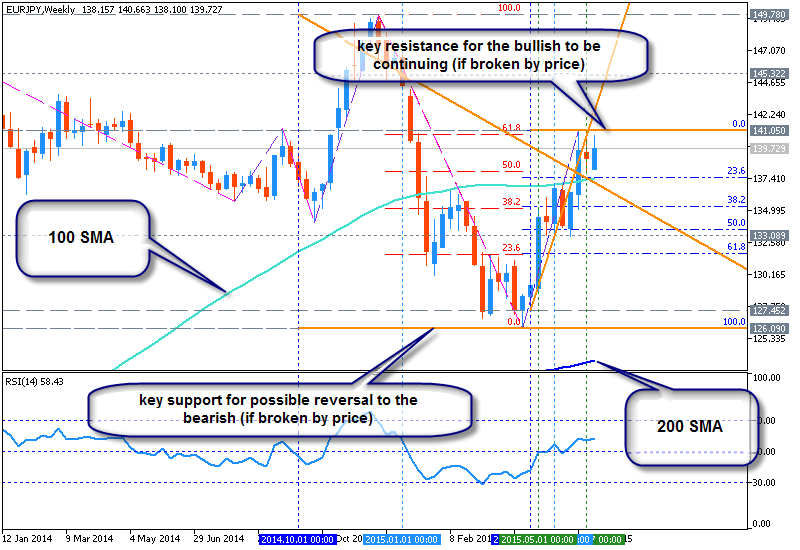

and 100 period SMA for the primary bullish with secondary ranging market condition. The price broke 100 SMA from below to above two weeks ago with 200 SMA located far below the price, and stopped near 141.05 resistance level for now for the bullish to be continuing:

- the price is trying to cross 141.05 resistance level from below to above;

- 23.6% Fibo level at 137.47 was broken by weekly price to be reversed to the bullish market condition;

- if weekly price will break 141.05 resistance so the primary bullish condition will be continuing with possible breakout, otherwise we may see the secondary ranging with the reversal back to the bearish market condition;

- “euro continues to wait for directional guidance against the Japanese Yen as prices tread water above the 137.00 figure. Near-term support is at 137.51, the 23.6% Fibonacci retracement, with a break below that on a daily closing basis exposing the 38.2% level at 135.33”;

- “the absence of a defined bearish reversal signal suggests taking up the short side is premature. We will remain flat for now, waiting for an actionable opportunity to present itself”.

Trend:

- H4 - ranging within the bullish

- D1 - ranging within the bullish

- W1 - bullish breakout

- MN1 - ranging within the bullish