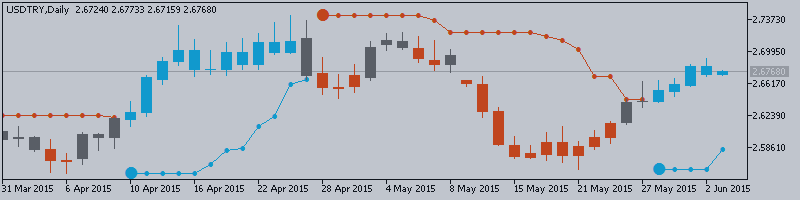

US Dollar/Turkish Lira (USD/TRY) Technical Analysis - good breakout with 2.6916 resistance

3 June 2015, 15:11

0

1 035

Daily price for this pair was on bear market rally since the beginning of last week: price crossed Senkou Span B line and came to the Ichimoku cloud for ranging. For now - D1 price crossed 'reversal' Senkou Span A line and came to the primary bullish zone on close daily bar with 2.6916 resistance level. Chinkou Span line is crossing the price from below to above for good possible breakout of resistance levels for the price to go to uptrend in the near future.

If

the price will cross 2.6916 resistance together with Chinkou Span

line to be crossing with the price so the bullish trend will be continuing. If not so we may see the ranging bearish market condition on this timeframe.

- Tenkan-sen line is crossing Kijun-sen line of Ichimoku

indicator from below to above on open bar for the bullish trend to be started.

- AbsoluteStrength indicator and TrendStrength indicators are in primary bullish condition estimated for the price.

- Chinkou Span line is crossing the price fron below to above for good possible bullish breakout in the near future.

- Nearest key resistance level is 2.6916.

- Nearest key support level is 2.5847.

Trend:

- H4 - ranging bullish

- D1 - bear market rally

- W1 - ranging bullish

- MN1 - bullish