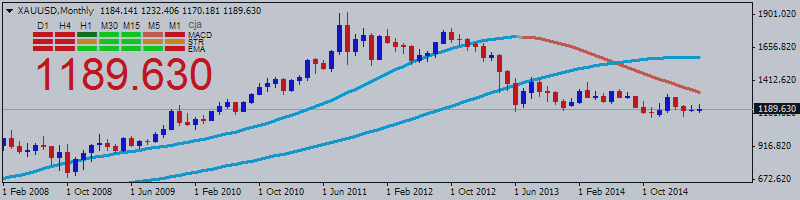

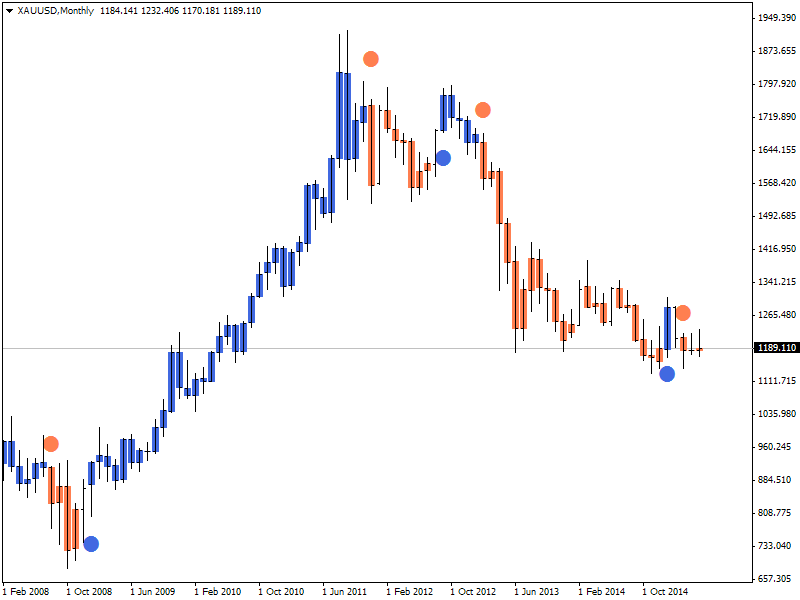

The strong U.S. dollar has pressured precious metals since last summer. Also, the talk of interest rate hikes by the Fed is said to have negatively influenced gold.

A standout feature this week, negatively impacting precious metals, is the latest COT report (Commitment of Traders), which reveals the positions of large traders in the gold and silver futures markets. This week’s COT report, for positions at the close of trade on Tuesday May 19th, shows a very strong accumulation of short positions by commercial traders, which indicates the capping power that can oppose this rally. It is no coincidence that gold’s recent rally was stopped this week. Do not expect a strong continuation of the rally in the very short term.

On the other hand, more gold-friendly factors include global monetary inflation and weakening currencies, which resulted in higher gold prices in those currencies. Moreover, we are seeing the first breakouts through long term declining trendlines in the precious metals complex.

From an intermarket perspective, gold appears to be preparing for a new trend. Our recent analysis shows that we should see new trends in the markets in the coming months.

The first half of 2015 was quite boring in most markets, but we expect a totally different picture in the second half of the year.

Gold could receive an assist from a very positive development this week. The CPI reading for April in the U.S. came in higher than expected. While the CPI stood at 0.0% in January of 2015, it increased to 0.2% in February and went up to 0.3 in April. That is the highest reading since the crash of the precious metals.

Gold is about to start trending. Investors should not anticipate a move, but should be preparing for an upcoming trend.