📈 Stock Trader Pro — Long-Term Investment Trading Logic

Stock Trader Pro is not a classic Buy & Hold strategy and not unlimited averaging.

It is a long-term investment strategy with strict risk control, based on the Buy the Dip concept.

🔹 1. Buy the Dip, not Buy & Hold

The system opens trades only with mandatory Stop Loss protection.

Each position is a calculated entry during a market correction — not a blind “hold forever” approach.

📌 Unlike Buy & Hold:

-

risk is always limited,

-

losing positions are not held indefinitely,

-

the system can close, rebalance, and reallocate capital when market conditions change.

🔹 2. Long holding periods are normal

The stock market:

-

is less volatile than Forex or Crypto,

-

moves more slowly,

-

requires patience rather than high trading frequency.

That is why positions in Stock Trader Pro can be held for relatively long periods, while the market forms the next growth impulse.

🔹 3. The key feature of the stock market

The stock market is a spot market, not a derivative market.

📈 Stocks and indices are structurally biased to the upside:

-

companies grow and develop,

-

inflation supports asset prices,

-

major indices have been making new highs for decades.

Just look at the S&P 500 chart since 1871 — despite crises, wars, and recessions, the long-term trend has always remained upward.

👉 Every correction is an opportunity to accumulate, not a reason for panic.

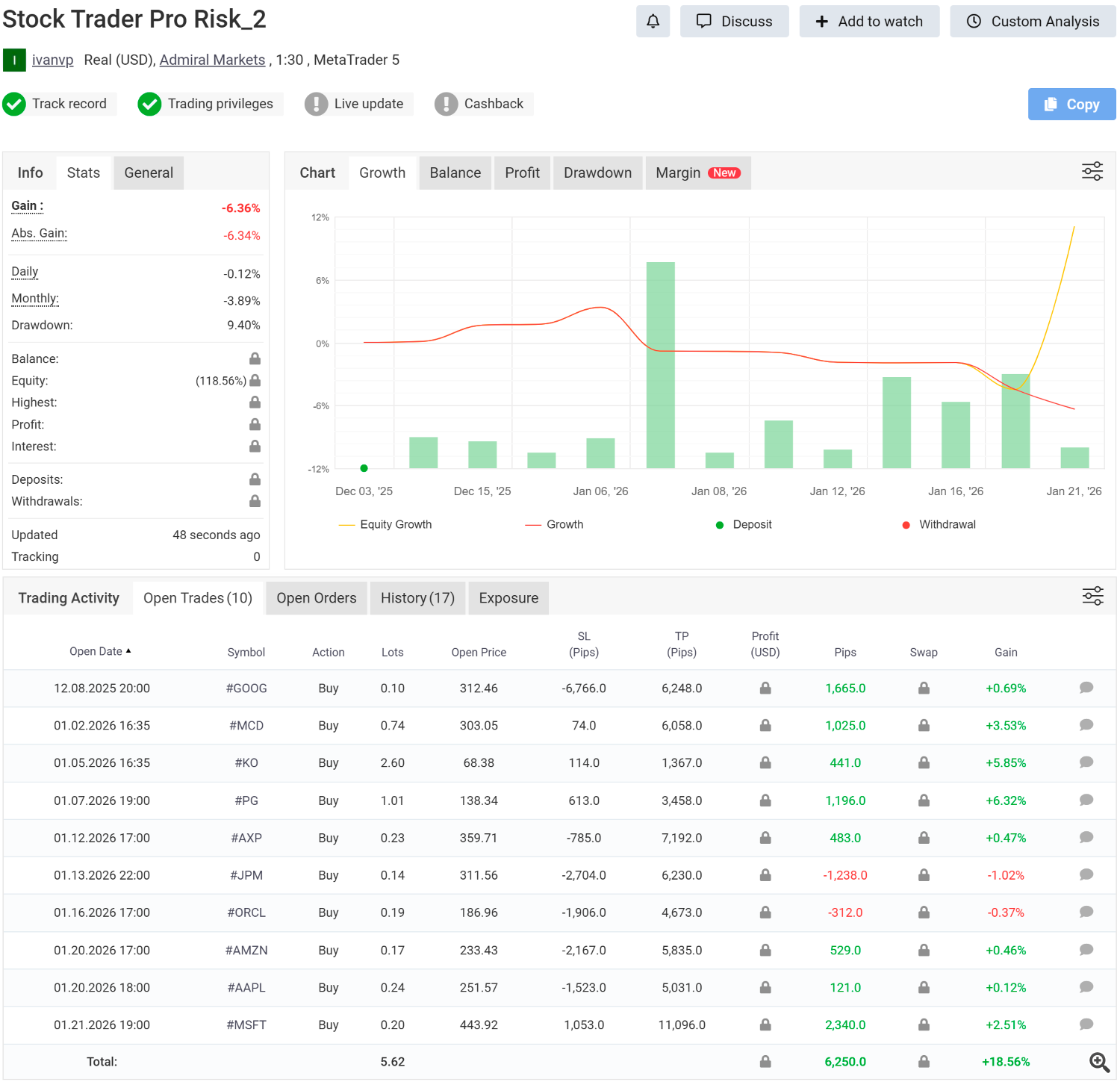

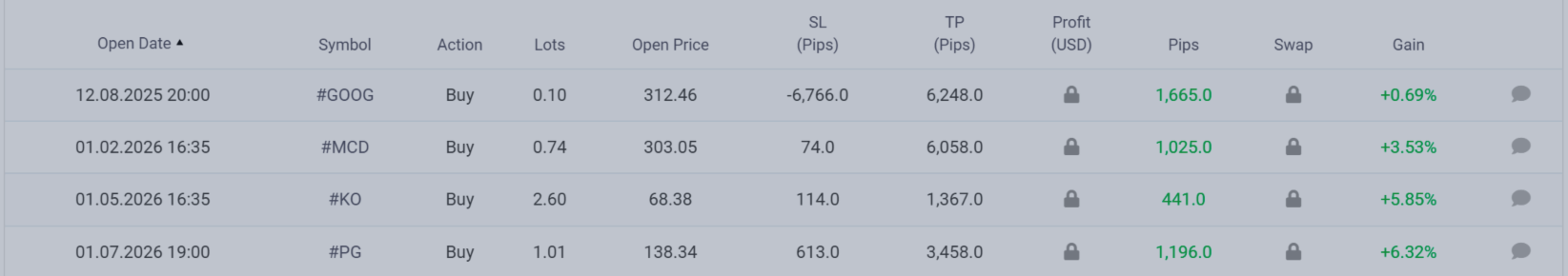

🔹 4. What we see on the current account

From the current account statistics, we can highlight two important characteristics of the system’s behavior:

▪️ A minor drawdown

It was caused by geopolitical factors, specifically statements by Trump regarding potential tariffs against the EU in the context of Greenland.

This is a typical external market factor and not a flaw in the strategy.

▪️ Active position management

The system:

-

partially closed existing positions,

-

opened new trades at more favorable prices,

-

started accumulating positions in anticipation of market growth.

📊 As a result:

-

floating profit is already significantly higher than the realized loss,

-

the portfolio structure has improved,

-

risk has been redistributed instead of being locked in a single asset.

🧠 Stock Trader Pro Philosophy

This strategy is designed for traders who:

-

understand the nature of the stock market,

-

do not expect quick miracles,

-

value risk control and a systematic approach.

Corrections are not a problem.

Corrections are the working environment.

📌 Stock Trader Pro product page: https://www.mql5.com/en/market/product/36161