Fundamental Weekly Forecasts for US Dollar, USDJPY, AUDUSD and GOLD - dollar pairs start off at high profile levels with a view to GDP

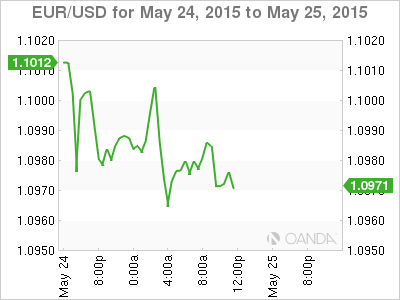

US Dollar - "In the week ahead, there are plenty of indicators and Fed speeches on the docket. Yet, few of them really hit the high-profile level that we would expect to single-handedly benchmark the timing for the first rate hike. One indicator in particular that should be kept on our radar is Friday’s 1Q GDP update. This is a revision, which most people would write off. However, given how fine the consideration for a data-dependent policy move is; a meaningful adjustment can trigger a sizeable response".

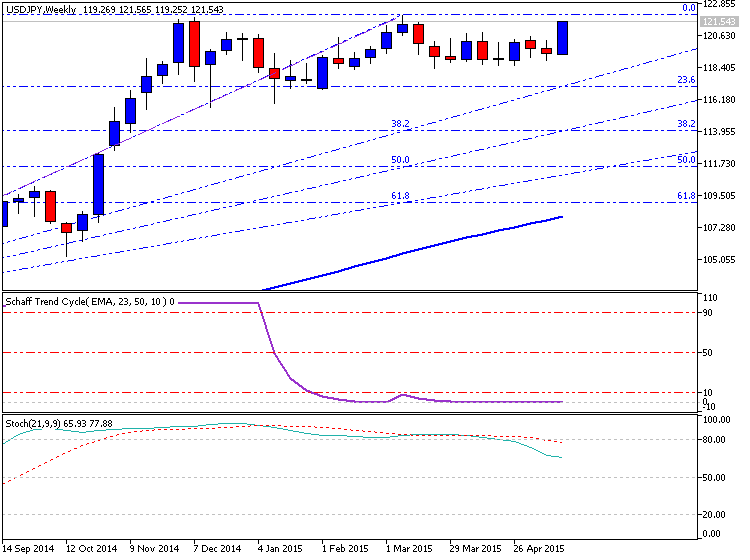

USDJPY - "A marked downward revision in 1Q GDP may encourage the Fed to retain the ZIRP for an extended period of time, and we may see a growing number of central bank officials adopt a more dovish tone should the weakness from the beginning of the year carry into coming quarters. With FOMC voting-members Stanley Fischer, Jeffrey Lacker and John Williams scheduled to speak next week, the fresh batch of rhetoric may ultimately spur a near-term pullback in USD/JPY should the policymakers talk down bets for a September rate hike".

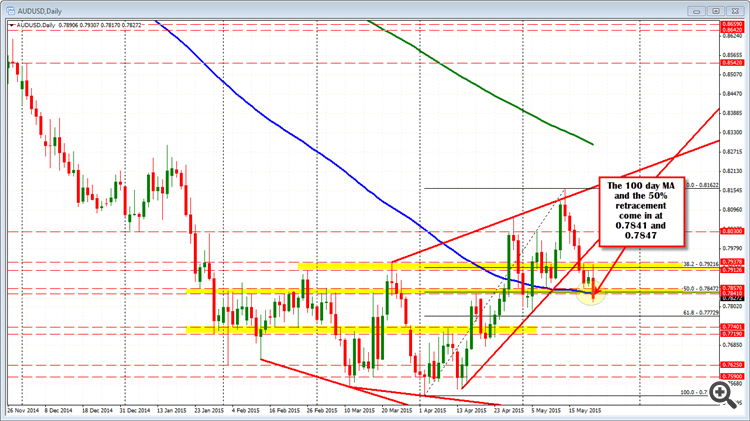

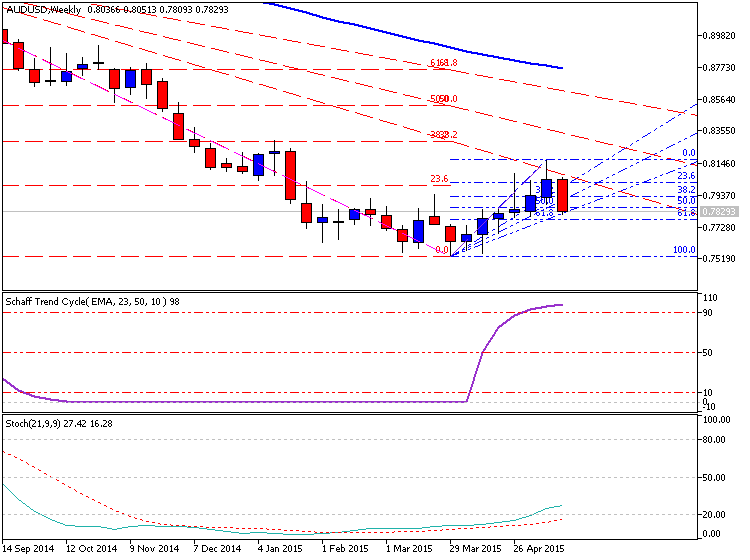

AUDUSD - "On balance, this seems to suggest that after last week’s respite, the broad-based counter trend reversal playing out across the G10 FX space in the second quarter may resume. The Aussie is set to resume its recovery in such a scenario as the range of anti-USD majors retrace, waiting for Janet Yellen and company to signal the onset of stimulus withdrawal so explicitly as to reboot the benchmark currency’s long-term advance. The mid-June meeting still seems like the time to do so, but there is ample time left in the interim".

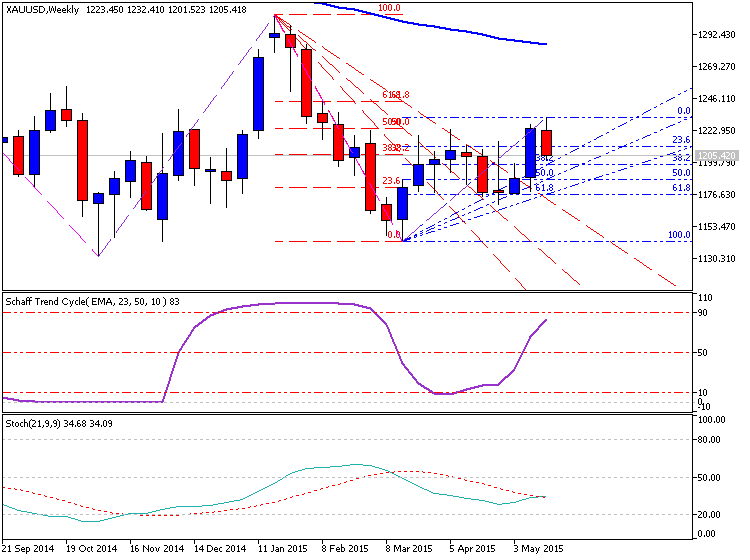

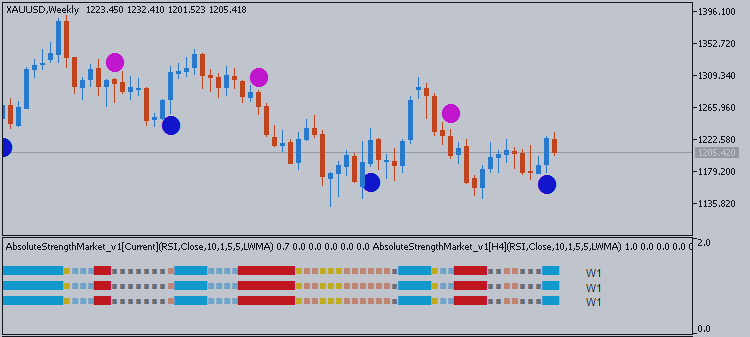

GOLD - "Fed speeches, Durable Goods Orders, Consumer Confidence & the second read on 1Q GDP will be in focus ahead into the end of May. Consensus estimates are calling for a downward revision to the initial forecast with expectations now projecting an annualized 0.9% contraction in the growth rate. The print would mark the first negative print since the 1Q of 2014, and a weaker-than-expected read could further kick out interest rate expectations as the FOMC Minutes revealed a June 17th interest rate hike is ‘unlikely'".