Poll: Europe is best place to invest in 2015; US unseated

A new poll conducted by Bloomberg has shown that Europe has become the best place to invest for the first time since 2009, throwing down the United States.

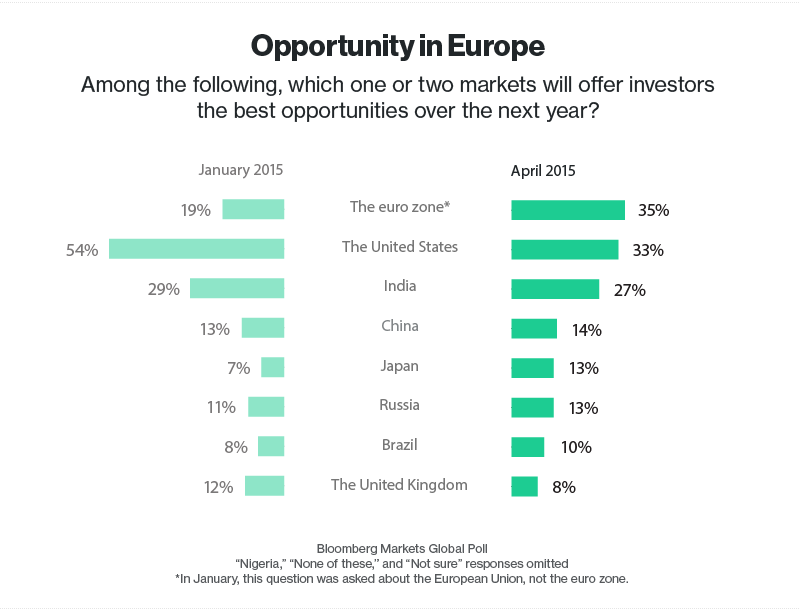

The euro area would be among the one or two markets offering investors the best opportunities over the next 12 months, thirty five percent of those surveyed in the Bloomberg Markets Global Poll responded.

The United States, with a

33 percent share, now sticks to the second - being unseated as the leader for the first time

since November 2010.

China, former top choice back in 2010, now is viewed as one of the worst markets to invest in.

About two in five polled described the euro region’s economy as improving, up from 14 percent in January. European investors were more optimistic than those in the U.S. and Asia, with almost half saying the area’s economy is getting better.

Europe had a top position in the poll despite the lingering standoff

between Greece and its creditors over payment of its debts, risk of defaulting and exiting the euro area.

However, this is how Charles

Brown, president of CB3 Financial Group in Geneva, Illinois, who took

part in the poll, commented on the Greek issue.

“It’s like Connecticut withdrawing from the U.S.,” he said. “Would we miss them? Yeah. Is it going to change the economy of the country? No.”

“Europe’s economy is improving, off an admittedly low base,” John Carlson, a poll participant and president of Epic Investment Management in Boulder, Colorado, said. “Also, Europe’s stock market has been strong, and that market probably has more predictive power than people recognize.”

A majority of financial experts

contacted by Bloomberg said the U.S. Treasury debt market is already a bubble or on

the verge of being one, while more than three-quarters said the same of

Internet and social networking stocks.

Participants were optimistic on the greenback: It was chosen as the asset of choice to go long now.

In the meantime, they were bearish on oil, with only 12 percent expecting crude prices to rise above $75 per barrel this year and 41 percent not anticipating that price will be exceeded until after 2016.

Lower oil prices and a weaker euro boosting output were the factors the International Monetary Fund took into account earlier this month when raising its forecast for the region’s growth in 2015 to 1.5 percent from 1.2 percent in January.

As the poll showed, the rebounding euro economy is helping to ease deflation fears there. The majority of specialists polled said deflation was a greater threat to the region than inflation over the next 12 months, down from 94 percent in January and the lowest level in a year.

Investors shifted their views on the euro region was mainly due to last month’s launch of a 1.1-trillion-euro ($1.2 trillion) quantitative easing program by the European Central Bank. The ECB and its president Mario Draghi have monetary policy about right - more than two of five investors believe, double those who said that in January. 68 percent of those who were polled gave a favorable rating to Mario Draghi.

This year the Euro Stoxx 50 Index has climbed 18 percent - a sign of the renewed optimism about the region.