How to Build a Strategy - traders should look to match their strategy with the appropriate market condition

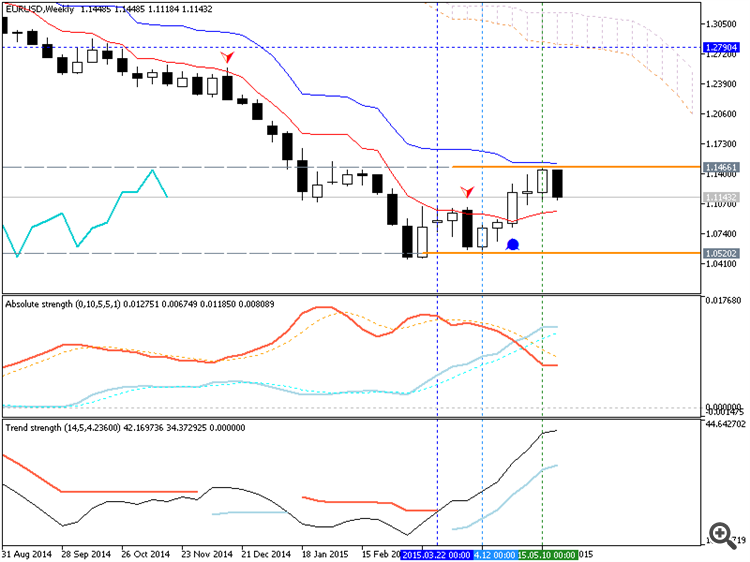

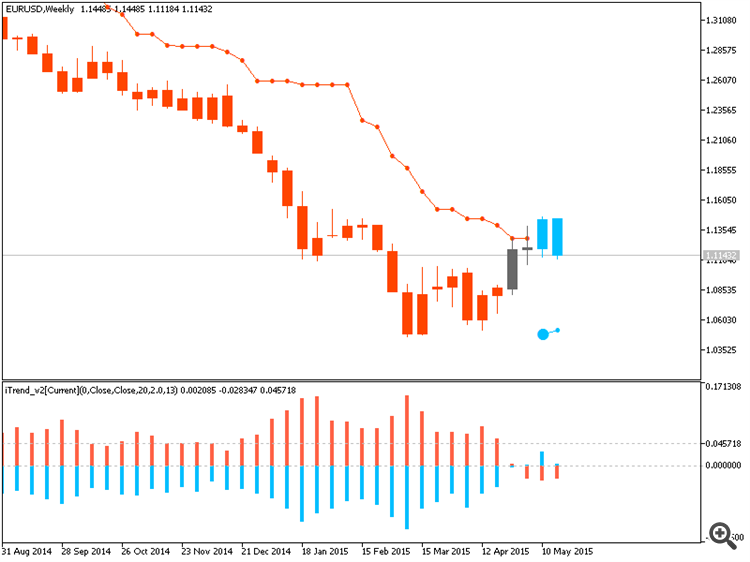

When utilizing multiple time frame analysis with a trend-trading

strategy, traders are often going to look to the longer time frame to

find and diagnose the strength of the trend. This can be done in a

multitude of ways. Some traders will prefer to do this without any

indicators at all, using price and price alone.

Other traders will look to one of the more common indicators, the moving average. There are a lot of different flavors and types of moving averages, but the goal is all the same – to show us a ‘line-in-the-sand’ as to whether price movements are ‘above-average’ or ‘below-average’ for a given period of time.

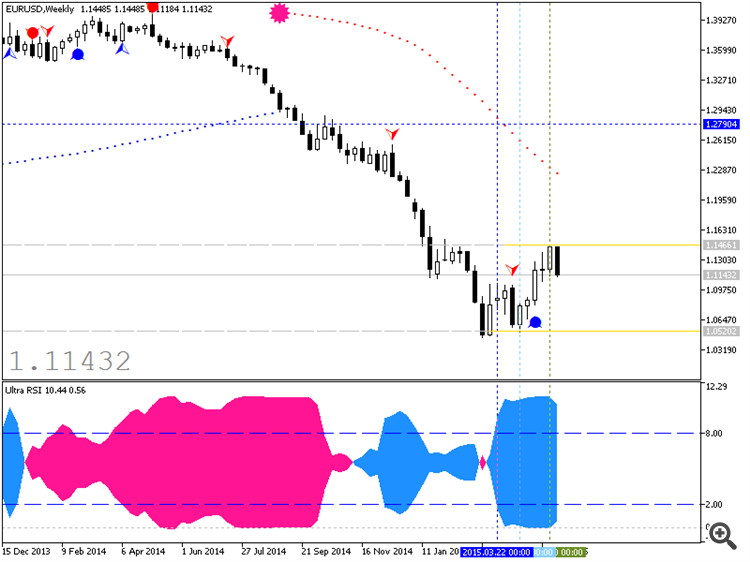

After the trend has been recognized so the trader can then plot the entry

into the position; and for that, there are a multitude of options

available.

Entering into the Trend

There is an old saying that goes: ‘The Trend is your friend until it ends.’

This one line pretty much sums up the quandary that traders are faced

with when trading trends. While a bias has been exhibited in the

marketplace, and may continue; there is no such thing as a ‘sure-fire

trend continuation setup.’ So, when the trend doesn’t continue, the trader is often advised to look

to mitigate the loss so that a reversal doesn’t damage their trading

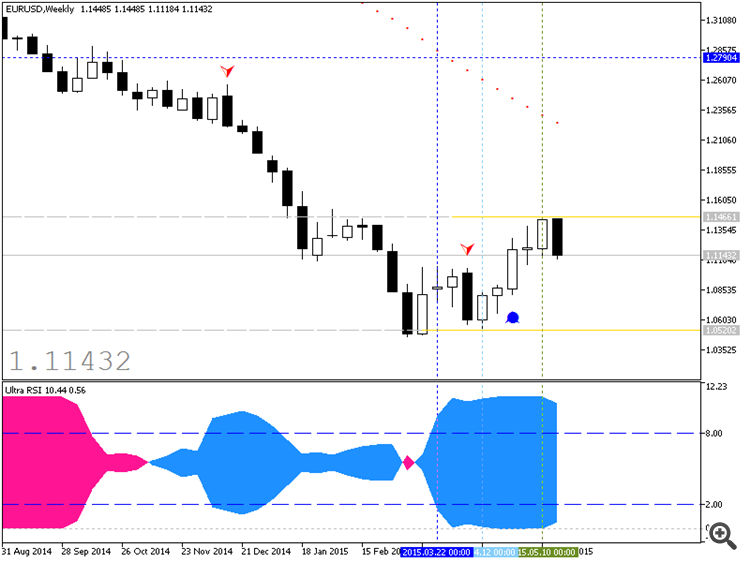

account too badly. In an effort to be as precise as possible, many traders will move down

to a lower time frame in an effort to get a more detailed look at the

move inside of the larger-term trend.