FOREX FIBONACCI RETRACEMENT TRADING STRATEGY FOR BEGINNERS

So you’re new to Forex trading and wondering how it all works? You’re not alone. Every day, thousands of traders open their first charts and ask the same questions: How do I make sense of the market? What trading strategy should I use? Where do I even begin?

This guide will walk you through the basics of Forex trading, and then I’ll share a simple, time-tested strategy that uses swing highs/lows and Fibonacci retracements and Fibonacci based strategy to help you catch powerful market moves — even if you're just starting out.

🧠 What Is Forex Trading?

Forex (foreign exchange) is the global market where currencies are traded. Think of it like buying and selling money. You might buy EUR/USD because you believe the euro will rise against the U.S. dollar, or sell GBP/JPY if you think the British pound is weakening.

Forex trading is decentralized, meaning it's not controlled by any single exchange. Trades happen electronically 24 hours a day, 5 days a week. The most popular platform for trading Forex is MetaTrader 4 (MT4), which allows you to analyze charts, run expert advisors (EAs), and place trades manually or automatically.

📈 Understanding Price Movement – The Foundation

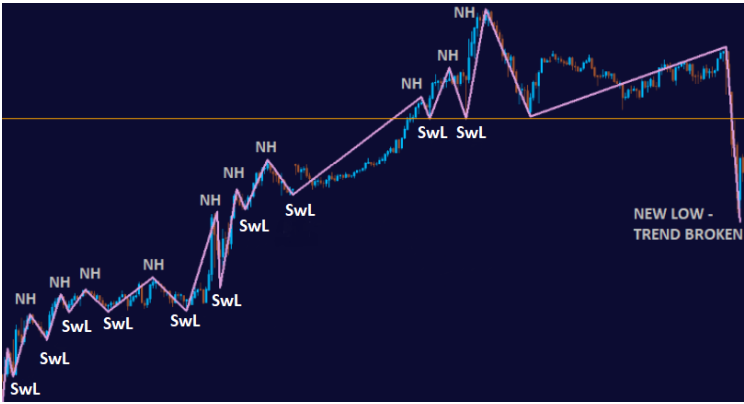

One of the most important things to understand is that price moves in **waves** — creating patterns like swing highs and swing lows. These “swings” represent the natural rhythm of the market as it trends and retraces.

Professional traders use these swings to identify entries and exits — and that’s where our Forex trading strategy begins.

The following image displays an uptrend example. An uptrend is where new highs are being made. The KEY concept to grasp is that these new Highs are made by swing lows. The swing low that makes the new high, is now what holds up the trend. You can see at the end of this uptrend that the swing low that made the new high was tested and then broke, ending the uptrend.

🔍 My Favorite Beginner Trading Strategy: Swing Highs, Swing Lows & Fibonacci Retracements

This trading strategy is based on a simple idea: after the market makes a new swing high (or low), it always pulls back before continuing in the same direction or breaking structure. That pullback is where we look for trades using Fibonacci retracement levels.

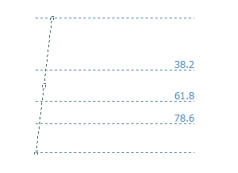

A Fibonacci Retracement tool is based on mathematical precision that is seen consistently in nature. The key zones we trade the most are the 38.2% Fibonacci retracement zone and the 61.8% Fibonacci retracement zone. This means that from the High to the Low, the price has retraced its steps 31.8% of the way back or 61.8% of the way back like in this image of a Fibonacci retracement tool from MT4:

Step-by-Step Fibonacci Retracement Strategy for Beginners in FOREX:

- Wait for a new swing high in an uptrend (or swing low in a downtrend)

- Use the Fibonacci retracement tool in MT4 to draw from the swing low to the high

- Look for the price to pull back to the 38.2%, 50%, or 61.8% level

- Wait for a confirmation candle or a chart pattern

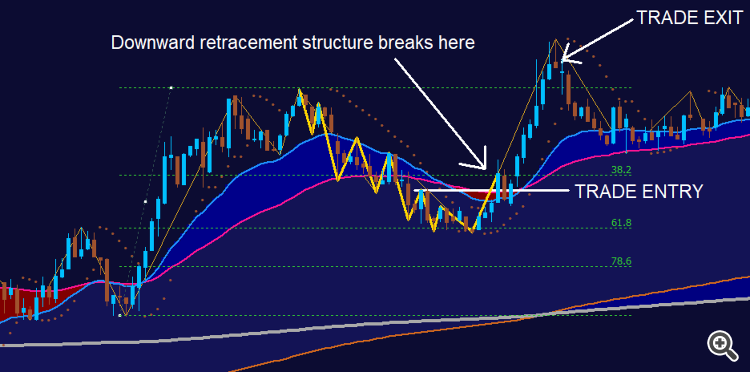

-In an uptrend, price will retrace downward making mini swing lows... it will then often strike one of these Fibonacci retracement zones and will then make a new swing high, breaking the retracement pattern of swing lows. This is our signal for Entry. (On a higher timeframe, this would look like an engulfing candle) - Enter the trade and target the previous high or higher like in the example below from USD/JPY:

This method gives structure and clarity to your trading — you’re not chasing price, you’re waiting for price to come to you.

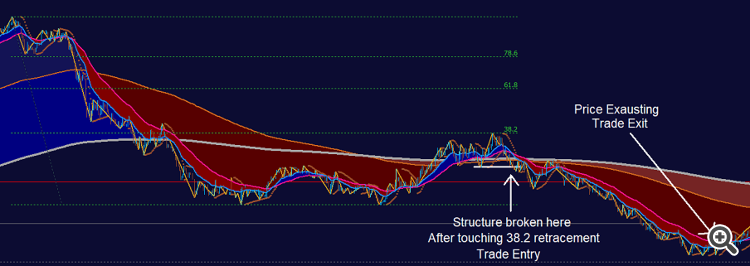

Let's look at a downtrending example. Price has just made a new swing low - and we are going to catch the pullback. This example is on a larger scale:

📲 Want to Automate This Fibonacci based Strategy?

If this approach makes sense to you, I’ve built an automated Fibonacci trading tool for MT4 that does everything above — it detects swing highs/lows, reacts to your Fibonacci retracement tool, and even monitors for entry signals based on your preferences. Works for Forex trading and every other instrument you can trade. Great for beginners or seasoned traders.

You can try it free for 14 days and get my complete step-by-step strategy guide (PDF), full of Fibonacci based trading strategy.

➡️ Click here to access the Ultimate Fibonacci EA Strategy Guide for beginners and Free EA trial

🎯 Final Thoughts

Trading strategies don’t have to be complicated. By starting with a simple Fibonacci based Trading Strategy, that follows the natural rhythm of the market — and by using tools that reduce stress and guesswork — you can build confidence quickly.

Start small. Focus on structure. Let the market come to you.

And if you’re ready to take that next step, grab the Ultimate Fibonacci Strategy guide and let’s get started.