Divergences not only signal a potential trend reversal; they can also be used as a possible sign for a trend continuation. Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you!

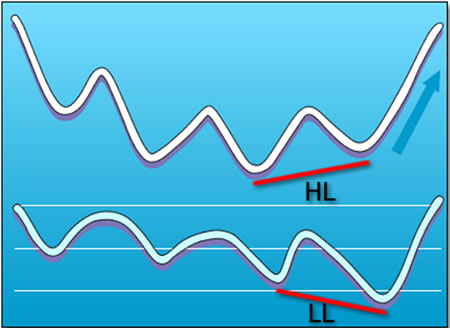

Hidden bullish divergence happens when price is making a higher low (HL), but the oscillator is showing a lower low (LL).

This can be seen when the pair is in an uptrend. Once price makes a higher low, look and see if the oscillator does the same. If it doesn’t and makes a lower low, then we’ve got some hidden divergence in our hands.

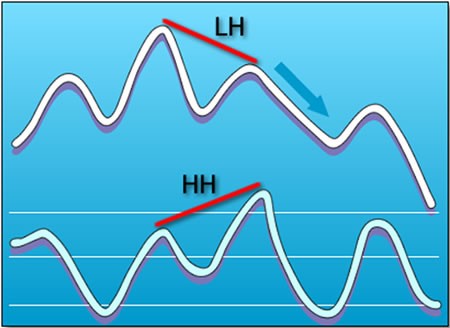

Lastly, we’ve got hidden bearish divergence. This occurs when price makes a lower high (LH), but the oscillator is making a higher high (HH). By now you’ve probably guessed that this occurs in a downtrend. When you see hidden bearish divergence, chances are that the pair will continue to shoot lower and continue the downtrend.