Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD - not all market movement must have an academic, fundamental reasoning

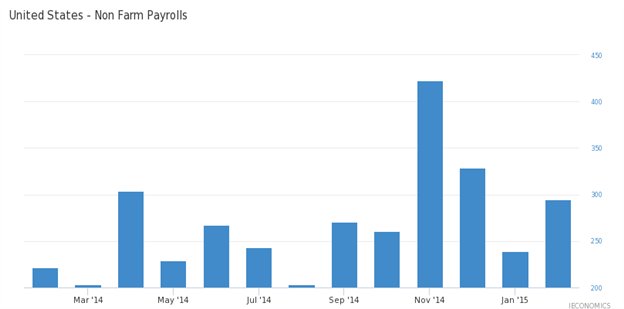

US Dollar - "After the FOMC rate decision two weeks ago and Yellen’s remarks this past week, it is clear that the first hike is increasingly data dependent. That will emphasize the importance of significant fundamental developments in the rates picture. In the register of event risk, few items will outshine the BLS labor conditions report for influence. That said, the March update is due on Friday (Good Friday). From this data though, the wage growth report should be paid specific attention. This is the connection between labor growth and inflation. And, on the topic of inflation, the Fed’s preferred reading – the PCE deflator – is due on Monday. And, between those two high profile book ends, we have no fewer than 10 Fed speeches scheduled. This should be an interesting, speculative week."

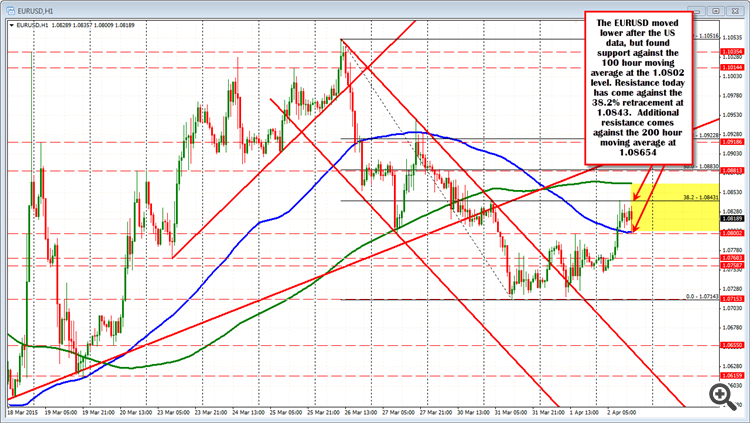

USDJPY - "The 118.20 (61.8% retracement) support zone will be closely watched going into the week ahead, and the pair remains vulnerable for a further decline as it continues to carve a series of lower-highs. In turn, a failure to preserve the March low (118.32) may open the door for a move back towards the 117.15 region (78.6% expansion) should the key event risks dampen bets for a mid-2015 Fed rate hike."

GBPUSD - "The British Pound remains at risk ahead of a key week for the US Dollar, and it may take a substantial shift in trader sentiment to force a meaningful GBP recovery."

AUDUSD - "US labor-market data has bucked the trend of otherwise lackluster news-flow relative to expectations over recent months. Another upside surprise may rekindle bets that the Fed may move to raise rates by mid-year. The prospect of relatively sooner stimulus withdrawal is likely to weigh on sentiment considering the formative role of QE-linked funding in supporting risky assets in the years since the 2008-9 crisis. That means an upbeat payrolls reading stands to hurt the Aussie, and vice versa."

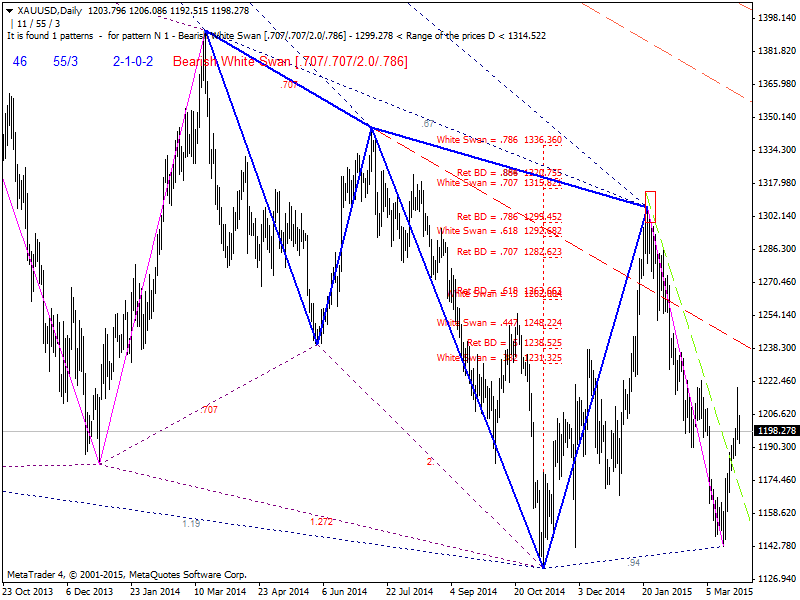

GOLD - "From a technical standpoint, gold spiked into a key median-line resistance dating back to September at 1219 before reversing sharply back into the former resistance noted last week, now support, at 1196/98. The trade is vulnerable for a pullback early next week but the bias remains constructive while above the 1167/72 barrier where the 61.8% retracement of the advance converges with a former resistance line off the 2015 high (bullish invalidation). That said, key near-term resistance remains with the March opening range high / ML resistance noted earlier at 1219/23- with a breach above targeting the 200-day moving average at 1238 backed by key resistance at 1245/48. Note that the daily momentum signature has not topped 60 since the January high and a hold below this RSI level puts the long-side at risk heading into to the start April trade. A breach through alongside a move surpassing 1225 reaffirms a broader correction here for the yellow metal."