Fundamental Weekly Forecasts for US Dollar, USDJPY, GBPUSD, AUDUSD and GOLD

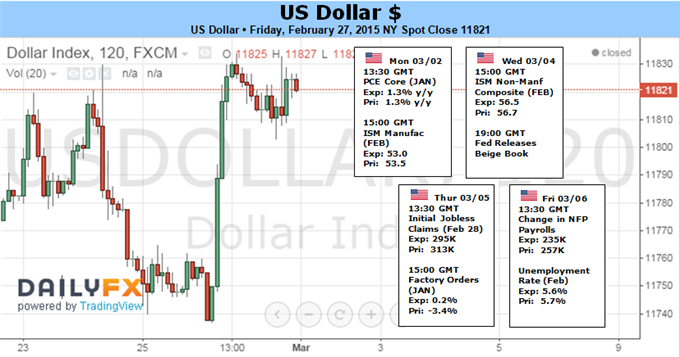

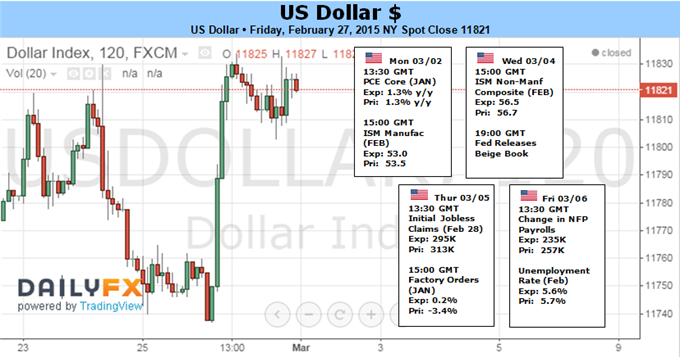

US Dollar - "The view of US monetary policy compared to its

conterparts is a node, but how collective monetary policy influences

global investor sentiment is a central pillar. ‘Risk appetite’ has not

contributed much to the Dollar’s cause – bullish or bearish – recently

as it has not moved with conviction (regardless of what it seems the S&P 500

is doing). It is difficult to instill confidence of a robust extension

of already mature risk accumulation trends. In contrast, the correct spark can ignite an explosive value gap to risk aversion and deleveraging. When this reallocation hits, the Dollar will gain at the extremes."

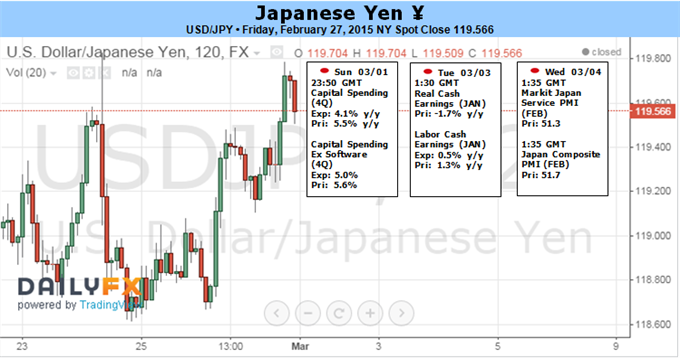

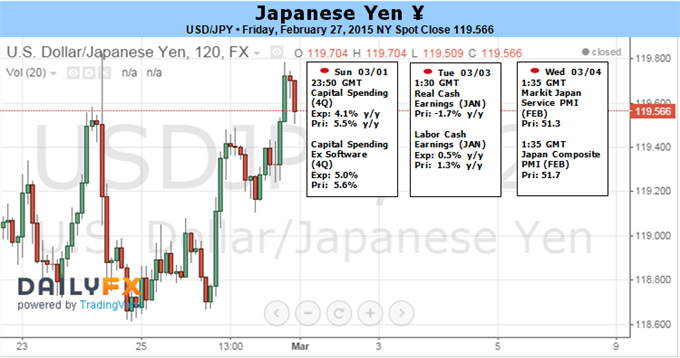

USDJPY - "It’s certainly possible that strong US economic data could force a larger break higher in the USDJPY. As far as probabilities go, however, we put relatively low odds on a sustained US Dollar move higher in the week ahead."

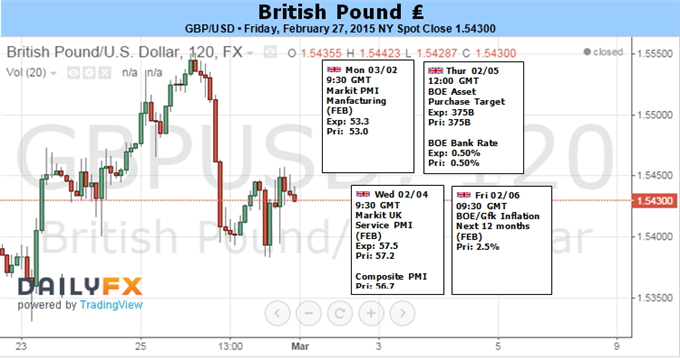

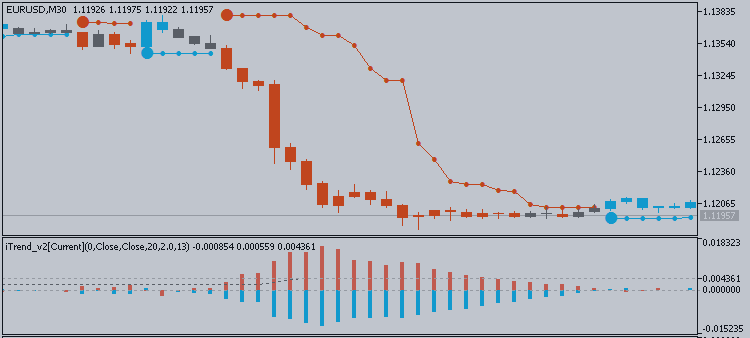

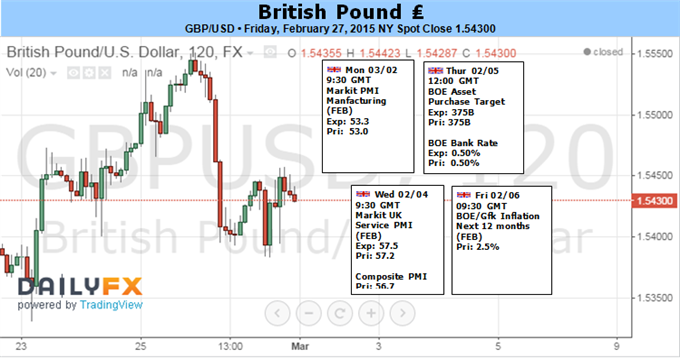

GBPUSD - "Nevertheless, the lack of momentum to push and close above the former support zones around 1.5510-55 may produce range-bound prices in GBP/USD ahead of the key event risks, but the pair may make a more meaningful effort to retrace the decline from the previous year should the fundamental developments sway the interest rate outlook for the U.S. and U.K. As we open up the March trade, the opening monthly range may dictate the short-term outlook for the pound-dollar as the Fed is scheduled to deliver its next interest rate decision on March 18."

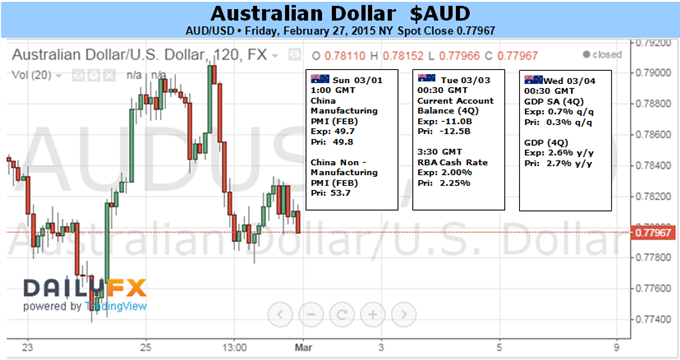

AUDUSD - "US news-flow has tended to underperform relative to forecasts in recent months, hinting economists continue to overestimate the vigor of the world’s largest economy and opening the door for a disappointing jobs figure. Such a result may pour cold water on bets calling for the onset of FOMC policy normalization by mid-year. That is likely to weigh on the US Dollar, offering a lift to the Australian unit that either cuts short weakness or amplifies strength seen after the RBA announcement, depending how Glenn Stevens and company ultimately decide to proceed."

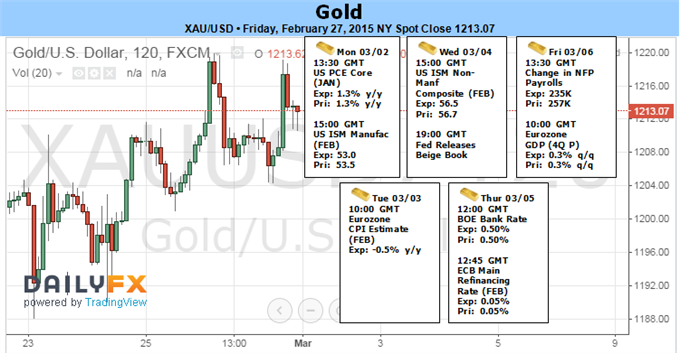

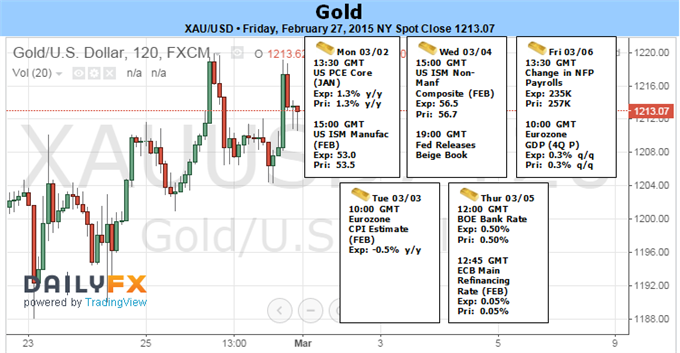

Gold - "Bottom line: looking for a low early next week with a general topside bias in play near-term while above $1196/98.” - Indeed the market fell to a fresh low on Monday before rebounding to test the $1218/24 resistance range. Our outlook remains unchanged heading into March with the 1196-1224 range in focus to start the week. A topside breach keeps the long-bias in play targeting resistance objectives at 1234 & 1248/50 with a break sub 1195 (close basis) risking substantial declines into subsequent support targets at $1171 & $1155."