You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBP/USD forecast for the week of March 2, 2015, Technical Analysis

The GBP/USD pair initially tried to break out during the course of the week, but found quite a bit of resistance above the 1.55 handle. This is the top of what we recognize as the potential consolidation area in this general vicinity, and as a result we believe that the market is getting ready to go lower. If we break down lower, and clear the bottom of the range from the week, we believe that this market should then head to the 1.53 level next, and then possibly the 1.50 handle. This isn’t much of a surprise though, because of the large, round, psychologically significant number such as this one is. There is a significant amount of resistance all the way to the 1.58 handle, so as a result even if we break above the top of the shooting star, we believe that this market still cannot be bought until we clear the 1.58 level.

We believe that this market will continue to bang around between the 1.55 handle and the 1.50 level. Because of this, we feel that the market is one that will be difficult to hang onto for the longer term, but if you are patient enough and can deal with the volatility, I believe that this market could offer quite a bit in the way of profit. Even if we break above the top of the shooting star, it’s only a matter time before we form another resistive candle as far as we can tell.

If we do break above the 1.58 handle, the more likely pattern will then be to the 1.60 level. At that level we would anticipate quite a bit of resistance as well, so really this point in time we don’t have any interest in buying this pair. The US dollar continues to be the favored currency by most traders, so of course it will be in this particular pair as well. Whether or not we can get down below the 1.50 level is a completely different question, so we aren’t even addressing that at this point.

EUR/USD forecast for the week of March 2, 2015, Technical Analysis

The EUR/USD pair fell hard during the course of the week, closing towards the bottom of the range. That being the case, looks as if the EUR/USD pair will probably fall from there, heading to the 1.11 handle next, and then the 1.10 level. Any rally this point time should be a nice selling opportunity and we believe that the 1.15 level is massively resistive. We like rallies the show signs of resistance, as it offers value in the US dollar. If we break down below the 1.10 level, this market could very well fall to the parity level next.

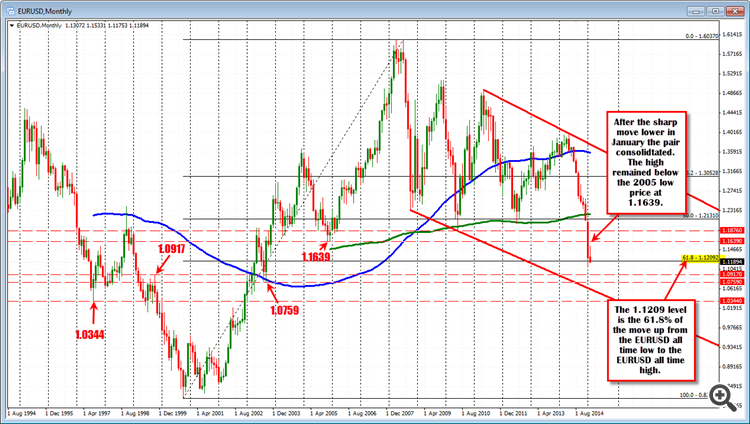

EUR/USD Monthly Technical Analysis for March 2015

The EUR/USD posted an inside move and lower close during February. The chart pattern indicates impending volatility and trader indecision, but with a bias to the downside. The close at 1.1193 indicates the consolidation around the major Fibonacci level at 1.1211 may be over, setting the stage for a possible breakdown under the January low at 1.1097.

During February, the market held up considerably well after Greece agreed to an extension of its bailout agreement with the Euro Zone. Some of the consolidation was a spillover from January when the European Central Bank finally announced the long-awaited stimulus plan.

With the Euro Zone still facing growth issues, traders are still heavily short, so any bottoming action will likely be fueled by short-covering rather than aggressive buying. The European Central Bank should leave interest rates unchanged while allowing its stimulus to do its work so the main focus this month will be on the U.S. Non-Farm Payrolls report on March 6.

A strong report will be bearish for the EUR/USD because it will bring the Fed closer to raising rates. Traders are currently pricing in a potential rate hike in June although Fed Chair Janet Yellen said late last month that the central bank was in no hurry to raise interest rates because of a struggling labor market and low inflation.

Weak jobs data won’t necessarily be bullish for the EUR/USD, but it will encourage position-squaring and short-covering, but any gains will be limited.

Technically, the main trend is down on the monthly chart. The close under the long-term Fibonacci level at 1.1211 indicates weakness. If a fresh round of selling pressure starts after the U.S. jobs report then sellers will go after the low for the year at 1.1097. Crossing to the bearish side of a steep downtrending angle at 1.10793 will put the market in an extremely weak position.

The tone of the market this month will be determined by trader reaction to 1.1211. If this area holds as support and momentum gets strong then look for the short-covering rally to extend into at least 1.1687.Forex technical analysis: EURUSD review for February 2015 and preview for March (based on forexlive article)

The month of February was a "take a breather" month for the EURUSD. That is not much of a surprise given the trend month in January, which saw the pair have an oversized 1003 pips trading range. In February the range was a more modest 357 pips.For most of the month, the pair was preoccupied with the headline news from Greece. That "can was kicked down the road" with a four month extension of the loan agreement. Although, there will likely need to be another bailout down the road, the EU (and the market) will deal with that later. For now there was no Greek exit (or Grexit) and although that bullet was dodged the EURUSD remained in a consolidative range for much of the month.

The uncertainty from the event (and countless headlines) gave traders the incentive to like the market not love it. Although the net shorts remained throughout the month (at least from the weekly commitment of traders reports), the action was more two way with a move higher followed by a move lower. Apart from a strong US employment report at the beginning of the month, the US data was more mixed/disappointing in the month. This too helped contribute to some of the up and down choppy action.

With Greece, settled, traders made a play to the downside on the next to last trading day of the month. The extension to the downside on February 26th, turned the technical bias to the downside going into the new trading month.

Some technical highlights:- The high for the month

extended up to 1.1533. The high was able to stay below the November

2005 low at the 1.1639 level. This remains a key level on the topside

that if the price can stay below, the bears are more comfortable and in

control

- The low could not extend below the January 2015 low (at

1.1097). As a result, there were "no new lows going back to 2003" in

the month.The 1.1097 level is a target level to get and stay below in

March for the trend down to resume.

- The price closed below the

1.12092 level. This is the 61.8% retracement of the move up from the

2000 year low to the 2008 year high. This will be a close resistance

level for traders into the new trading month.

- The price closed the month below the prior month close at 1.12785 area (more bearish).

Looking at the hourly chart (see below):- The

price moved below the month swing lows on the next to last trading day

of the month. Those lows came in between 1.12605 and 1.12790. Into

March, that is the risk for shorts. Stay below that ceiling area, and

the bears remain in control. Putting it another way, "The price should

not trade back above the 1.12605-79 area.". If it does, there should be

further upside momentum in March.

- The low in trading on Friday

found support against a low trend line. A break below that line is the

next downside target for the pair. That level comes in at 1.1173 area

(and moving lower as each hour passes).

Overall, the EURUSD stayed steady for most of February, but ended the month with a more bearish bias. If that bearish trend continues into March, the pair would next look toward the 1.0917 high from October 1999, or - on a stretch and trend month - the September 2003 low at 1.0759.Conversely, if the market does not find the follow through selling, and there is a move back above the 1.1209 then 1.1260-79 area, the pair would be back in the bellow the the February trading range and I would not be surprised to see the 1.1500 area again.

EUR/USD weekly outlook: March 2 - 6 (based on investing.com article)

The euro pared back gains against the dollar on Friday after data showed that the U.S. economy expanded modestly in the final three months of 2014, supporting expectations for higher interest rates.

The Commerce Department reported that U.S. gross domestic product grew at an annual rate of 2.2% in the last three months of 2014, down from an initial estimate of 2.6% but ahead of expectations for a downward revision to 2.1% growth.

Other reports showed that U.S. pending home sales rose to a one-and-a-half year high in January and consumer sentiment also remained strong.

The February reading of the University of Michigan's consumer sentiment index was revised up to 95.4 from the preliminary reading of 93.6. While this was down from the previous month final reading of 98.1, it was the second highest level since January 2007.

EUR/USD was at one-month lows of 1.1194 in late trade, off earlier highs of 1.1244.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, ended the day almost unchanged at 95.29, not far from Thursday’s one-month highs of 95.43.

The dollar rallied on Thursday after stronger-than-forecast data on U.S. durable goods orders added to indications that the economic recovery is on track.

Earlier in the week, Federal Reserve Chair Janet Yellen said that if the economy keeps improving as the bank expects it will modify its forward guidance, but emphasized that a modification of its language should not be read as indicating that a rate hike would automatically happen within a number of meetings.

EUR/JPY was up 0.15% to 133.9 late Friday, recovering from earlier one-month lows of 133.43.

In the week ahead, Friday’s U.S. employment report will be closely watched, while Thursday’s European Central Bank monetary policy meeting will also be in focus.

Monday, March 2

Tuesday, March 3

Wednesday, March 4

Thursday, March 5

Friday, March 6

EUR/USD Drops Below 1.12 (based on marketpulse article)

he dollar edged up on Monday, with an index that tracks the greenback against major currencies touching an 11-year peak even after soft economic data.

The euro, which is off nearly 10 percent in the last three months, had been up by as much as a third of a percent against the dollar on Monday but surrendered gains and last traded flat at $1.1192.

The yen went through 120 against the dollar for the first time since Feb. 12. The dollar was last up 0.50 percent to 120.09 yen, marking a three-week high for the dollar against the yen. The dollar index was last up 0.14 percent at 95.427 after earlier going as high as 95.514, its highest since September 2003.

Euro Exchange Rate: EURGBP and EURUSD Weakness Forecast to Resume

Eurozone inflation rebounded in February with the annual cost of living standing at -0.3%, up from -0.6% in January, the EU statistics agency Eurostat said in preliminary data.

Markets had expected a reading of -0.5%; the positive surprise got the shared currency off to a strong start.

Any upside surprises in Eurozone data will have notable impacts on the EUR owing to the massive amount of negative bets currently placed against the currency.

Contrast this to the pound sterling which hardly moved in response to March’s positive Manufacturing data. It will take blow-out positive data surprises to shift the GBP precisely because the market is so massively aligned behind the currency.

Dennis de Jong, managing director at UFX.com, comments on the EU deflation numbers:

“Mario Draghi would have had his fingers crossed before the consumer price index figures were released this morning, and though the results were better than expected, the outlook for Europe is still precarious.

“At least Draghi isn’t alone in fighting deflation. Of the 28 countries in the EU, 23 are officially in deflation and the UK looks likely to make it 24 in a few weeks’ time. Having already embarked on a massive bond buying programme, and with interest rates already at historic lows in many member countries, it’s difficult to see how Draghi and Co. will be able to escape deflation anytime soon.”

EUR/USD slips close to 11-1/2 year lows on Draghi remarks

On Thursday, Draghi confirmed that the ECB will begin purchasing euro zone government bonds on March 9 under its new quantitative easing program.

The combined asset purchases will amount to €60 billion per month and are expected to run until September 2016, or until the ECB sees that inflation is on a "sustained path" to its target of close to, but below, 2% in the medium term.

In addition, the ECB raised its growth forecast for this year to 1.5% from 1.0% previously, followed by faster growth in 2016 and 2017.

But it cut its inflation forecast for 2015, saying it now expects inflation to be flat, down from 0.7% previously. It then expects inflation to increase to 1.5% in 2016, up from 1.3% and 1.8% in 2017.

Meanwhile, sentiment on the dollar remained fragile after data on Thursday showed that the number of Americans who filed for unemployment assistance rose by 7,000 to 320,000 last week from the previous week's total of 313,000.

The euro was also lower against the pound, with EUR/GBP edging down 0.10% to 0.7229.

Later in the day, the U.S. was to release the closely watched government report on nonfarm payrolls, the unemployment rate and average earnings.

Forex Weekly Outlook Mar. 9-13 (based on forexcrunch aricle)

The US dollar had an excellent week, soaring across the board, most notably against the plunging euro. A rate decision in New Zealand, Employment figures from Australia and Canada, Retail sales, PPI, Unemployment claims and Consumer sentiment from the US are the top events on FX calendar. Let’s see, in detail, the main market movers for this week.

Yet another robust reading from the US job market. The all-important NFP release showed a strong gain of 295,000 positions in February while and the jobless rate fell to a 6.5 year low of 5.5%. The disappointment came from slow wage growth. This raises the chances of a rate hike in June. This boosted the dollar across the board. In the euro-zone, Draghi showed determination on implementing QE, and the euro plunged. The pound followed suit. Elsewhere, an upbeat BOC helped CAD, while no cut from the RBA kept AUD bid. All was lost when the NFP numbers came in.