After reaching the Friday "truce" between Athens and the creditors on the Greece loans issue for four months under the guarantee of performing reforms, the market focused its attention on the J. Yellen two-day speech , the Federal Reserve governor which will be held on February 24 and 25. Yellen will announce her position to the economy state and maybe she will give a hint about rate saving to normalize monetary policy, followed by the rates increase.

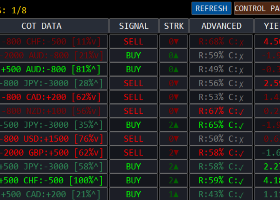

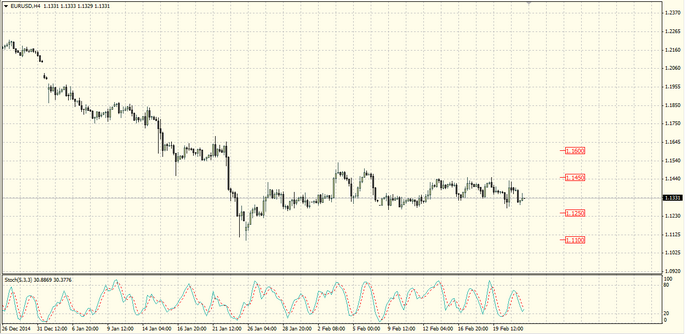

If the Yellen speech result will be the US economy upward trend acknowledgement and the number of pessimistic characteristics is not going to be large - it will be a good signal to the fact that the Fed remains on the way to raise interest rates in the middle of this year. If this happens, the single currency and the yen clearly come out of the corridors in which they have already been the significant period of time and will continue to fall against the US dollar.

Difference in opinions, concerning the Bank of Japan and the Federal Reserve monetary policy is a negative factor for the yen. It is also important for the yen, but other additional factor will be the ECB government bonds real foreclosure which will expand its balance sheet and reduce the single currency price.