- Traders should find the trend to form a trading bias

- CCI can be used to identify market entries

- Traders should manage risk in the event of a trend shift

One of the hardest steps a trader must take before scalping their favorite Forex pair is creating a strategy. While strategies can range from the complex to the mundane, creating a plan for trading the market does not have to be needlessly complicated. Today, we are going to review a simple three step CCI (Commodity Channel Index) strategy that can be used for scalping trending Forex currency pairs.

So let’s get started!

Find the Trend

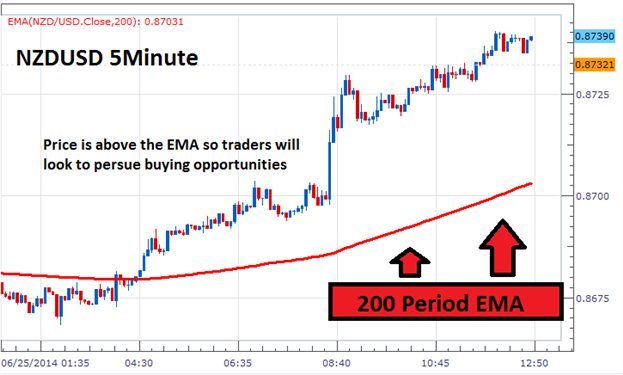

The first step to trading any successful trend based strategy is to find the direction of the market! The 200 period EMA (Exponential Moving Average) is an easy to read indicator for this purpose. Traders can add this indicator to any graph with the intent of finding if price is above or below the average. If price is above the EMA, traders can assume that the trend is up while looking to initiate new buy orders. Below, we can see a 5minute NZDUSD chart accompanied with the 200 period EMA.

Given the information above, traders should look to buy the NZDUSD, as long as it remains trending higher above the EMA. It should be noted in the event of a downtrend (price under the EMA), traders will look to sell as price decreases.

CCI Entry

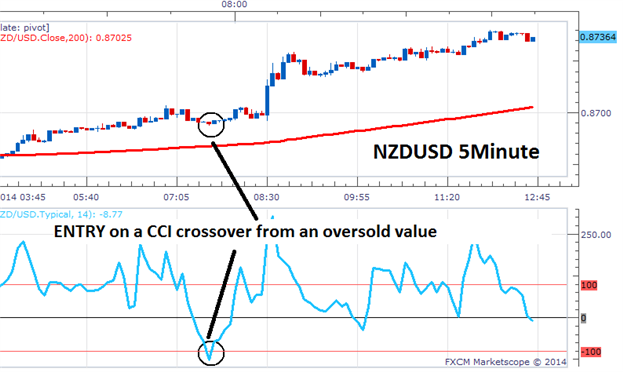

Once a trader has identified the trend and created a trading bias using the 200 period EMA, traders will begin looking for ways to time their market entries. Using a technical indicator is a favored choice for this task, and the CCI (Commodity Channel Index) oscillator can be added to your graph for this exact purpose. Below, we can again see the NZDUSD 5minute graph, this time with the CCI indicator added. With the NZDUSD trading in an uptrend, traders will look to buy a retracement when CCI signals momentum returning back in the direction of the trend. This occurs whenthe indicator crosses back above an oversold value of -100.

The CCI crossover from today’s trading shows exactly how traders can time their entry with the indicator. It should be noted again that only buy positions are being taken during this uptrend. This is just one of many ways you can use CCI in an active trading plan.

Manage Risk

As with any active market strategy, scalping Forex carries risk of loss. Because of this, traders should always consider their exits as well as their entries. Scalpers can use a swing low or even the 200 period MVA as places to set stop orders. In the event that the NZDUSD begins creating lower lows, traders will wish to exit any existing long positions and look for other opportunities.