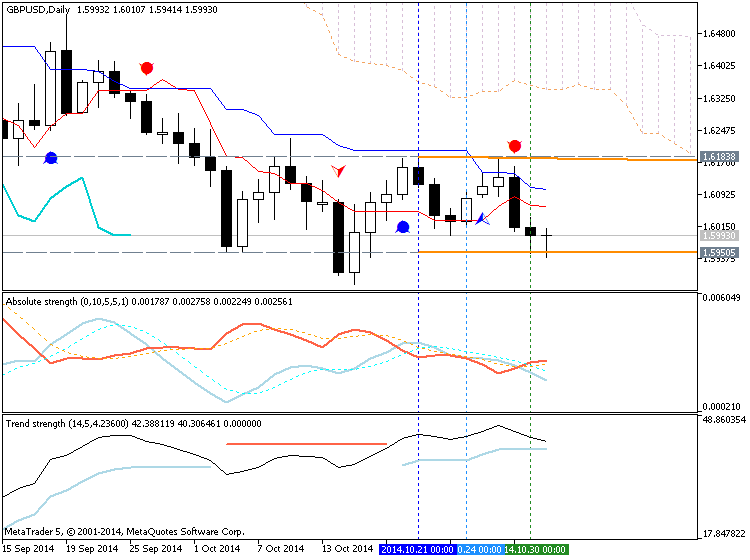

D1 price is on primary bearish with ranging between 1.6183 resistance and 1.5950 support levels.

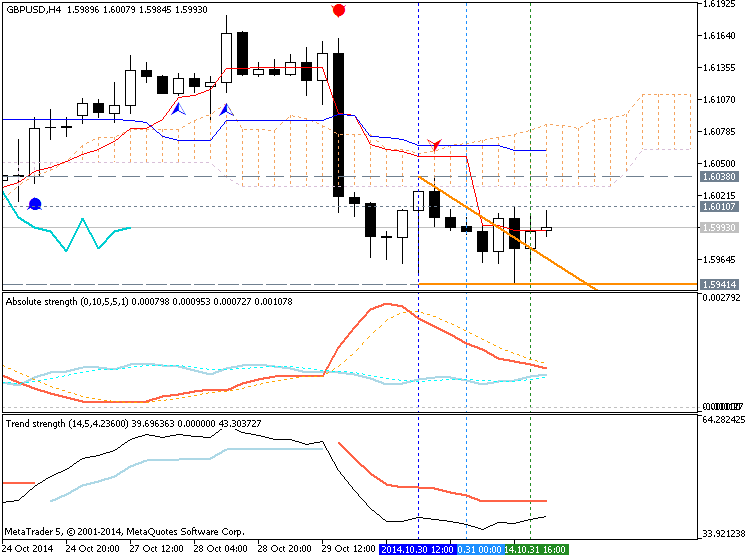

H4 price is on secondary flat within primary bearish.

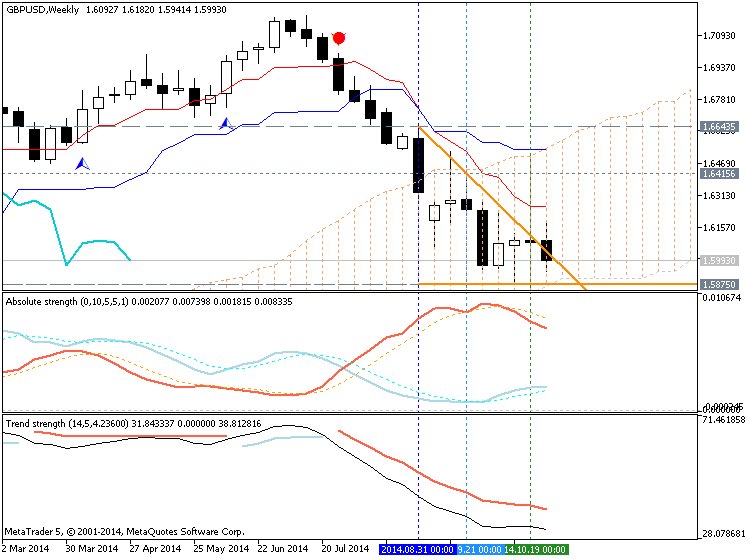

W1 price is located inside Ichimoku cloud/kumo with ranging market condition. The upper border of kumo is Senkou Span A line which is the virtual border between primary bullish and the primary bearish for high timeframes on the chart. Thus, W1 price is on ranging market condition within primary bearish.

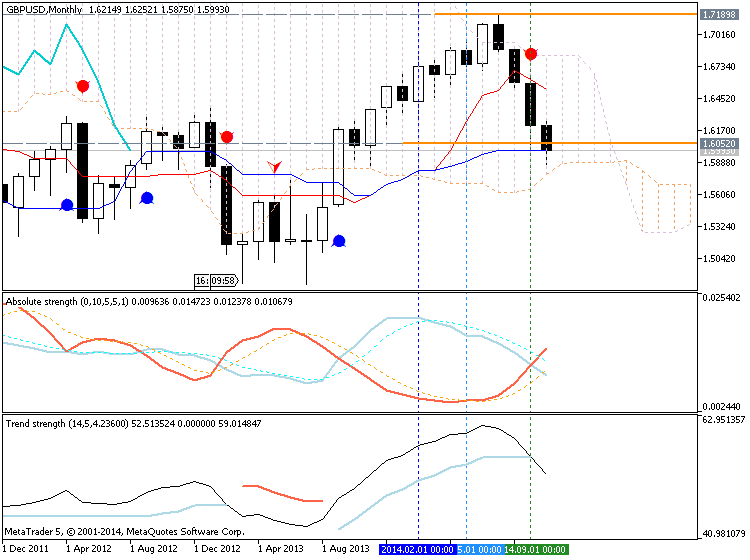

MN price is inside Ichimoku cloud/kumo and above Senkou Apan A line with 1.6052 support level crossed by price on open MN bar: this is indicating the secondary ranging within primary bullish. Besides, Chinkou Span line is ready to cross the price from above to below for good breakdown. If the price will break 1.6052 support together with Chinkou Span line crossing the price so we may see good breakdown with the reversal of the price movement from primary bullish to the primary bearish market condition.

If D1 price will break 1.5950 support level so the primary bearish will be continuing (good to open sell trade for example)If

D1 price will break 1.6183 resistance - we may see the secondary market

rally inside primary bearish with the good possibility to market

reversal to primary bullish on D1 timeframe (good to counter-trend

trading systems)

If not so we may see the ranging market condition within bearish.

- Recommendation for long: watch D1 price to break 1.6183 resistance for possible buy trade

- Recommendation

to go short: watch D1 close price to break 1.5950 support for possible sell trade

- Trading Summary: bearish

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2014-11-03 01:00 GMT (or 02:00 MQ MT5 time) | [CNY - Non-Manufacturing PMI]

2014-11-03 01:45 GMT (or 02:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-11-03 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing PMI]

2014-11-03 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

2014-11-04 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Construction PMI]

2014-11-04 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Trade Balance]

2014-11-05 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Services PMI]

2014-11-05 13:15 GMT (or 14:15 MQ MT5 time) | [USD - ADP Non-Farm Employment Change]

2014-11-05 14:15 GMT (or 15:15 MQ MT5 time) | [USD - FOMC Member Kocherlakota Speech]

2014-11-05 15:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Non-Manufacturing PMI]

2014-11-06 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Manufacturing Production]

2014-11-06 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Official Bank Rate]

2014-11-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-11-07 09:30 GMT (or 10:30 MQ MT5 time) | [GBP - Trade Balance]

2014-11-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on GBPUSD price movement| Resistance | Support |

|---|---|

| 1.6183 | 1.6052 |

| 1.6415 | 1.5950 |

| 1.6643 | 1.5875 |

SUMMARY : bearish

TREND : ranging

Intraday Chart