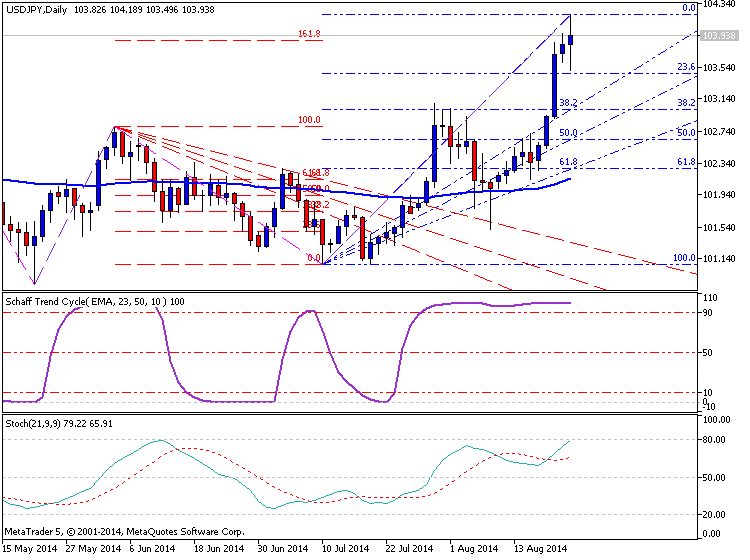

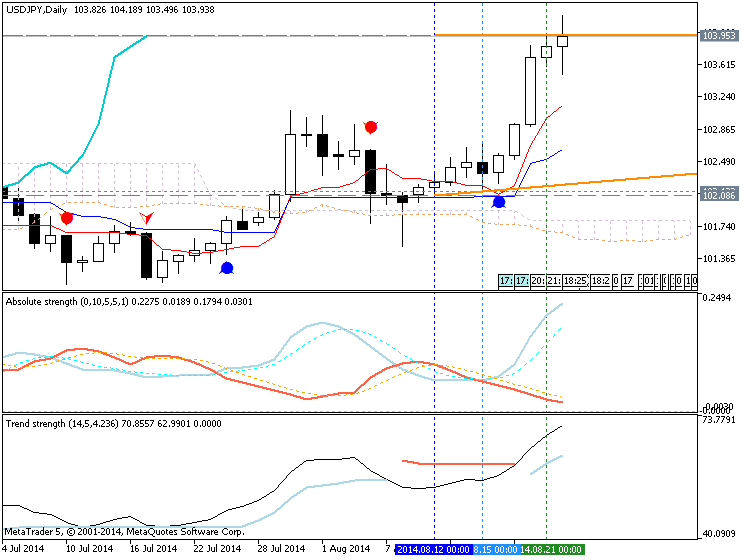

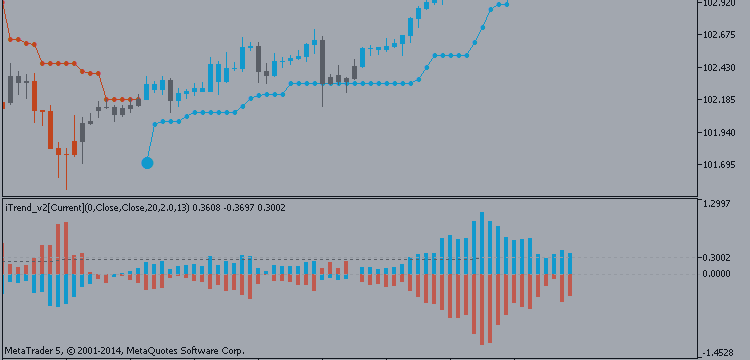

The USDJPY pair as you can see broke much higher during the course of the week as we clear the 103 level finally. This was an area that had been significant resistance over the last year, and as a result we feel that the market is in fact starting to break out. With that, the market could go as high as 105 in the short-term, and possibly even 110 over the course of the next several months. Remember, this market tends to follow not only the jobs market, but the interest-rate differential between the two ten year notes in these countries. With that, the interest-rate differential of course will be followed and we believe that the market in some going higher given enough time.

The 104 level of course will be a bit resistive, but at the end of the day we think that’s a minor resistance barrier to overcome. The 105 level of course is much more significant on a longer-term basis, but we did break above that area back in late 2013. With that being the case, there is precedent for us to break out above there, and we think that it’s only a matter of time before that happens.

Continue to watch the jobs numbers out of the United States, and as they improve this pair should as well. Pullbacks should offer buying opportunities, and as a result we believe that this is a “buy only” market at this point. Also, keep in mind that the Federal Reserve is looking to taper off of quantitative easing going forward, while the Bank of Japan continues to try to keep its monetary policy extraordinarily loose. That should continue to work against the value of the Japanese yen in general, and because of that we feel that the Japanese yen will depreciate against almost all currencies. The US dollar has an extra boost considering that the US economy is the closest one to being healthy as far as major currencies are concerned, and as a result this will be one of our favorite longs going forward.