Engineering Trading Discipline into Code (Part 1): Creating Structural Discipline in Live Trading with MQL5

Contents

- Introduction

- Why Rules Fail

- Why Psychology Isn’t Enough

- Discipline as a System Outcome

- From Rules to Constraints

- Scope and Audience

- Conclusion

Introduction

Making money in trading does not depend on strategy quality alone. A strategy can be logically sound, backtested, and statistically valid, yet still fail in live markets if discipline falters under pressure. Markets are dynamic, volatile, and emotionally demanding—but discipline must remain stable.

If any of the following patterns occur, this article is relevant:

- Clear rules are defined but often relaxed or bypassed under live market pressure.

- Profit targets are reached, yet trading continues, eroding gains.

- Daily trade or risk limits are set but overridden during the session.

- Attempts are made to recover losses instead of adhering to predefined stops.

- Rules exist on paper but fail to enforce themselves in real time.

Taken together, these behaviors inevitably lead to losses—rules broken in the moment will sometimes break you. These are not strategy failures—they are enforcement failures.

This article addresses the problem structurally. Using MQL5, we design governance layers that operate alongside your trading logic, monitoring execution in real time and blocking actions when limits are breached. The goal is not to redesign your strategy, but to close the enforcement gap—making discipline automatic rather than discretionary.

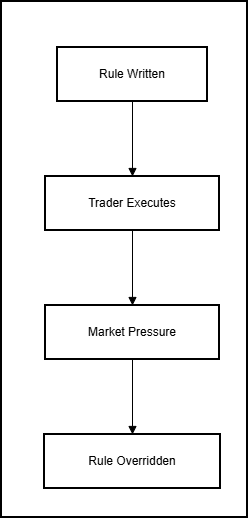

Why Rules Fail

After years of observing structured Forex systems in live markets, one pattern stands out: traders understand the rules, yet under live-market pressure, execution often shifts from disciplined planning to reactive decision-making. What starts as a well-defined strategy slowly becomes a sequence of actions driven by immediate price movement, confidence, or urgency, rather than deliberate structure.

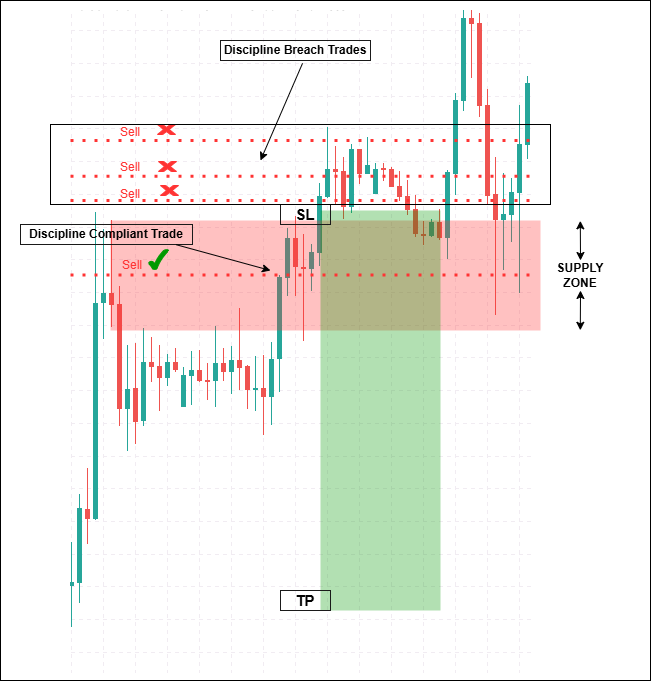

The chart below illustrates a familiar scenario. A valid supply zone is identified, risk is defined, and the initial trade follows the plan. As the price remains within the zone, additional trades are taken. Each entry may seem justified alone, but together they increase exposure, escalate risk, and erode profits. The setup hasn’t changed—behavior has. This shows how even disciplined strategies can fail under live-market pressure.

The issue rarely stems from poor preparation. Most traders have structured strategies, clearly defined entry and exit rules, daily trade limits, risk-per-trade caps, profit targets, and drawdown boundaries. The plan is coherent, measurable, and theoretically enforceable. Yet, once exposed to live market conditions, execution begins to drift: trade frequency rises, profit objectives expand mid-session, loss limits are ignored, and position sizing becomes flexible. The strategy remains in place, but its authority over decisions gradually weakens.

This behavioral drift is not new. Jesse Livermore, one of history's most legendary speculators, repeatedly attributed his heaviest setbacks not to flawed market analysis, but to lapses in discipline—failing to stick to his own rules when emotion, hope, or external influence took over.

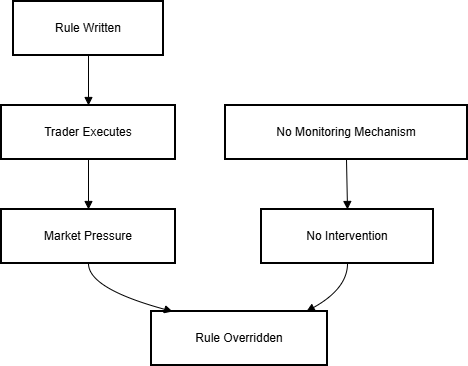

The root cause is an enforcement gap. Written rules describe intent but do not actively participate in decision-making. Traders may define limits yet exceed them, set profit targets yet continue trading, or plan to stop after losses but attempt recovery instead. Without real-time monitoring, counting, and constraint mechanisms, discipline depends entirely on moment-to-moment judgment—precisely when judgment is most vulnerable.

A trader begins the session with a simple and disciplined objective: earn $20 and stop trading. The target is modest, clearly measurable, and aligned with sound risk management principles. Early in the session, the market cooperates, and one or two trades quickly achieve the goal. At that moment, the plan has technically succeeded, yet trading continues. The shift feels gradual, almost imperceptible. Market activity appears favorable, confidence strengthens, and the original objective begins to feel unnecessarily conservative.

What started as a controlled and predefined goal quietly expands—first to $50, then $100, and eventually to amounts that were never part of the initial plan. As expectations rise, trade frequency increases, position size grows, and risk tolerance subtly adjusts upward. Engagement remains high, but execution is no longer anchored to the original rules. When a loss eventually occurs, the response is not to stop, but to recover. By the end of the session, the initial $20 gain has disappeared, and additional losses may have accumulated. The rules were not forgotten; they were consciously set aside in the moment.

Planned Discipline vs. Live Execution Reality

| Aspect | Planned Discipline | Live Execution Under Pressure |

|---|---|---|

| Daily Objective | Stop after +$20 | Objective expands mid-session |

| Trade Frequency | Limited and selective | Increased and impulsive |

| Risk Exposure | Fixed and predefined | Gradually escalated |

| Decision Basis | Pre-session plan | Real-time emotion and momentum |

| Response After Profit | Stop trading | Continue trading |

| Outcome | Small, controlled gain | Gains erased or reversed |

Both the chart example and the daily profit scenario expose the same structural weakness. The rules describe intent, but they do not participate in execution. There is no mechanism for counting trades, tracking cumulative outcomes, or recognizing that predefined objectives have already been met.

Without structural enforcement, discipline becomes optional the moment pressure, confidence, or opportunity increases. Rules that appear sufficient during planning often fail under live conditions because they rely on memory and judgment, which are most vulnerable when pressure peaks.

Why Psychology Isn’t Enough

Because discipline failures often involve emotion, trading education tends to emphasize psychology. Traders are encouraged to improve mindset, strengthen emotional resilience, and develop greater self-control. These efforts are valuable, and psychological awareness plays an important role in performance. However, experience repeatedly shows that psychological preparation alone is not sufficient.

Fear, confidence, urgency, and frustration are not defects in character. They are natural responses to uncertainty and financial risk. Expecting these reactions to disappear during live trading is unrealistic, regardless of experience level. Even traders with profound market understanding can behave differently when real capital is exposed to real-time volatility.

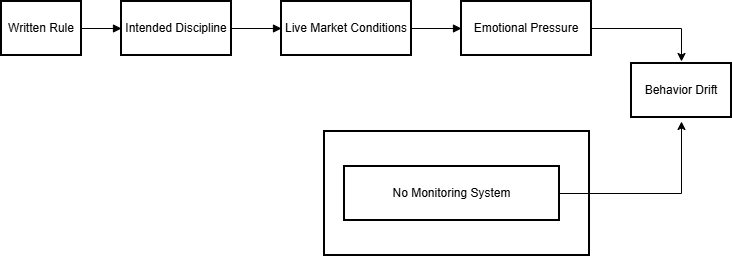

There is also a timing dimension to the problem. Most rule violations do not unfold after extended internal reflection. They occur quickly, sometimes within seconds, before deliberate reasoning has time to intervene. By the time conscious awareness intervenes, the decision has already been executed. Psychology can help explain why a mistake occurred, but it rarely prevents the action at the exact moment pressure peaks.

Without an external mechanism capable of slowing, blocking, or redirecting behavior, mental discipline has no structural reinforcement. It may encourage restraint, but it cannot enforce it.

Discipline as a System Outcome

At some point, it becomes clear that discipline cannot rely entirely on internal control. If behavior consistently changes under pressure, then the environment in which decisions are made needs to carry some of the responsibility. Discipline does not have to be treated as a personal struggle. It can be treated as a system outcome.

When boundaries are embedded into the trading environment itself, behavior changes automatically. Limits are no longer remembered—they are monitored. Violations are no longer debated—they are recognized immediately. Execution stays within predefined boundaries not because personal restraint holds, but because the structure does not allow deviation.

This shifts discipline away from moment-to-moment decision-making and into design. Pressure still exists, but it no longer dictates behavior. The structure contains it. Seen this way, discipline stops being something the trader must constantly fight to maintain. It becomes something the trading environment naturally produces through its constraints.

From Rules to Constraints

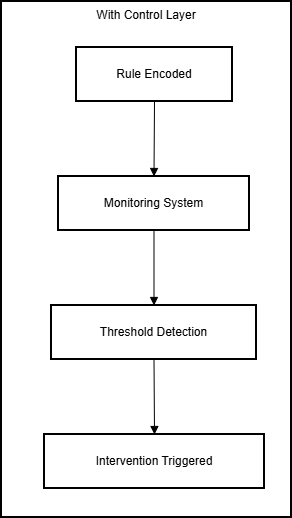

At this point, the distinction between knowing a rule and actively enforcing it becomes critical. Written guidelines describe intent—they outline what should happen—but they do not participate in the actual execution of trades. Under live market pressure, this gap between intention and enforcement is where discipline most often breaks down.

A rule that cannot observe behavior and intervene when violated is not a control mechanism.

A rule becomes an effective discipline tool only when embedded within the trading system, continuously monitoring activity and capable of taking immediate action.

Practical Illustration: Embedding Discipline in Code

To demonstrate how this translation from rule to constraint works in practice, consider the following examples. In most cases, the rules were clearly defined in advance. These snippets are intentionally minimal. They do not define trading strategies or manage positions. Their purpose is to illustrate how discipline-related rules can be embedded programmatically to remain active in real time. In practice, event functions (e.g., OnInit, OnTimer) must be merged appropriately in a production EA.

Example 1: Limiting Trade Frequency (Overtrading)

Discretionary Rule: Limit the number of trades taken in a single day. Traders often forget or ignore this limit after early wins or during extended market activity, leading to overtrading and increased risk.

The following snippet demonstrates trade-frequency enforcement. It counts trades per day and blocks any attempt beyond the limit.

Enforced as a constraint with actual blocking

#property strict input int MaxTradesPerDay = 5; int tradesToday = 0; datetime dayStartTime = 0; bool tradeBlocked = false; //------------------------------------------------------------------- // Reset daily counters //------------------------------------------------------------------- void ResetDailyCounters() { tradesToday = 0; dayStartTime = iTime(_Symbol, PERIOD_D1, 0); tradeBlocked = false; } //------------------------------------------------------------------- // Initialization //------------------------------------------------------------------- int OnInit() { ResetDailyCounters(); return(INIT_SUCCEEDED); } //------------------------------------------------------------------- // Track new trade transactions and enforce //------------------------------------------------------------------- void OnTradeTransaction(const MqlTradeTransaction &trans, const MqlTradeRequest &request, const MqlTradeResult &result) { if(trans.type != TRADE_TRANSACTION_DEAL_ADD) return; // Reset if new trading day datetime today = iTime(_Symbol, PERIOD_D1, 0); if(today != dayStartTime) ResetDailyCounters(); // Select deal if(HistoryDealSelect(trans.deal)) { long entryType = HistoryDealGetInteger(trans.deal, DEAL_ENTRY); if(entryType == DEAL_ENTRY_IN) tradesToday++; } if(tradesToday >= MaxTradesPerDay) { tradeBlocked = true; Alert("Daily trade limit reached — further trades blocked"); } } //------------------------------------------------------------------- // Centralized trade gateway with enforcement //------------------------------------------------------------------- bool TryOpenOrder(MqlTradeRequest &req, MqlTradeResult &res) { if(tradeBlocked) { Print("Trade blocked: Daily limit exceeded"); return false; // Actual blocking: trade not sent } if(!OrderSend(req, res)) { Print("OrderSend failed: ", res.comment); return false; } return true; // Trade executed if allowed }

Trade activity is counted objectively through transaction events. When the number of trades reaches the limit, further orders are blocked by returning false in TryOpenOrder(), preventing any new trades from being sent. To integrate this into an existing EA, replace all calls to OrderSend() with TryOpenOrder(). For example, in your EA's OnTick() or signal handler, wrap the trade request like this: if(TryOpenOrder(request, result)) { /* success */ } else { /* blocked */ }. This ensures enforcement without altering core strategy logic.

Example 2: Protecting Profits (Overtrading After Wins)

Discretionary Rule: Stop trading after reaching a daily profit target to lock in gains and prevent overexposure.

Enforced as a constraint with actual blocking

// ---------- User Input ---------- input double DailyProfitTarget = 2.0; // Target profit in percent // ---------- Internal State ---------- double dayStartEquity = 0.0; datetime dayStartTime = 0; bool profitLimitReached = false; // ---------- Initialization ---------- int OnInit() { ResetProfitTracking(); EventSetTimer(1); // Check every second return(INIT_SUCCEEDED); } // ---------- Reset Logic ---------- void ResetProfitTracking() { dayStartTime = iTime(_Symbol, PERIOD_D1, 0); dayStartEquity = AccountInfoDouble(ACCOUNT_EQUITY); profitLimitReached = false; } // ---------- Monitoring Logic ---------- void CheckDailyProfitLimit() { datetime today = iTime(_Symbol, PERIOD_D1, 0); // Reset if new trading day if(today != dayStartTime) ResetProfitTracking(); if(profitLimitReached) return; double currentEquity = AccountInfoDouble(ACCOUNT_EQUITY); double gainPercent = ((currentEquity - dayStartEquity) / dayStartEquity) * 100.0; if(gainPercent >= DailyProfitTarget) { profitLimitReached = true; Alert("Daily profit target reached — further trading restricted"); } } // ---------- Timer Event ---------- void OnTimer() { CheckDailyProfitLimit(); } //------------------------------------------------------------------- // Centralized trade gateway with enforcement (integrate with Example 1's TryOpenOrder) //------------------------------------------------------------------- bool TryOpenOrder(MqlTradeRequest &req, MqlTradeResult &res) { if(profitLimitReached) { Print("Trade blocked: Profit target reached"); return false; // Actual blocking } // ... (add OrderSend logic here or merge with full gateway) return true; } //+------------------------------------------------------------------+

The system continuously monitors equity gains relative to the start of the day. Once the profit target is hit, it sets the flag, and TryOpenOrder() blocks new trades. Integration: Add the profitLimitReached check to your central TryOpenOrder() function for unified enforcement.

Example 3: Containing Loss Escalation (Drawdown Control)

Discretionary Rule: Halt trading once a predefined loss limit for the day is exceeded to prevent emotional reactions from worsening losses.

Enforced as a constraint with actual blocking

// ---------- User Input ---------- input double MaxDailyLoss = 3.0; // Max daily loss in percent // ---------- Internal State ---------- double dayStartBalance = 0.0; datetime dayStartTimeLoss = 0; bool lossLimitBreached = false; // ---------- Initialization ---------- int OnInit() { ResetLossTracking(); EventSetTimer(1); // Check every second return(INIT_SUCCEEDED); } // ---------- Reset Logic ---------- void ResetLossTracking() { dayStartTimeLoss = iTime(_Symbol, PERIOD_D1, 0); dayStartBalance = AccountInfoDouble(ACCOUNT_BALANCE); lossLimitBreached = false; } // ---------- Monitoring Logic ---------- void CheckDailyLossLimit() { datetime today = iTime(_Symbol, PERIOD_D1, 0); // Reset if new trading day if(today != dayStartTimeLoss) ResetLossTracking(); if(lossLimitBreached) return; double currentEquity = AccountInfoDouble(ACCOUNT_EQUITY); double lossPercent = ((dayStartBalance - currentEquity) / dayStartBalance) * 100.0; if(lossPercent >= MaxDailyLoss) { lossLimitBreached = true; Alert("Daily loss limit breached — trading halted by constraint"); } } // ---------- Timer Event ---------- void OnTimer() { CheckDailyLossLimit(); } //------------------------------------------------------------------- // Centralized trade gateway with enforcement (integrate with Example 1's TryOpenOrder) //------------------------------------------------------------------- bool TryOpenOrder(MqlTradeRequest &req, MqlTradeResult &res) { if(lossLimitBreached) { Print("Trade blocked: Loss limit breached"); return false; // Actual blocking } // ... (add OrderSend logic here or merge with full gateway) return true; }

Loss boundaries are monitored in real time. When breached, the system recognizes it immediately, halting trading regardless of the trader's emotional state or momentary confidence.

Applied Examples

These snippets are not designed to be complete trading systems. Instead, they serve as illustrative building blocks emphasizing key principles:

- Rules are translated into measurable conditions: Instead of relying on memory or manual checks, constraints are encoded explicitly.

- Behavior is evaluated continuously: Monitoring is ongoing, not retrospective.

- Intervention occurs at the moment of violation: Actions are triggered immediately when limits are breached, preventing escalation.

This shift from intention-based discipline to structurally enforced discipline forms the foundation of the governance layers developed throughout this series.

With Control

Without control

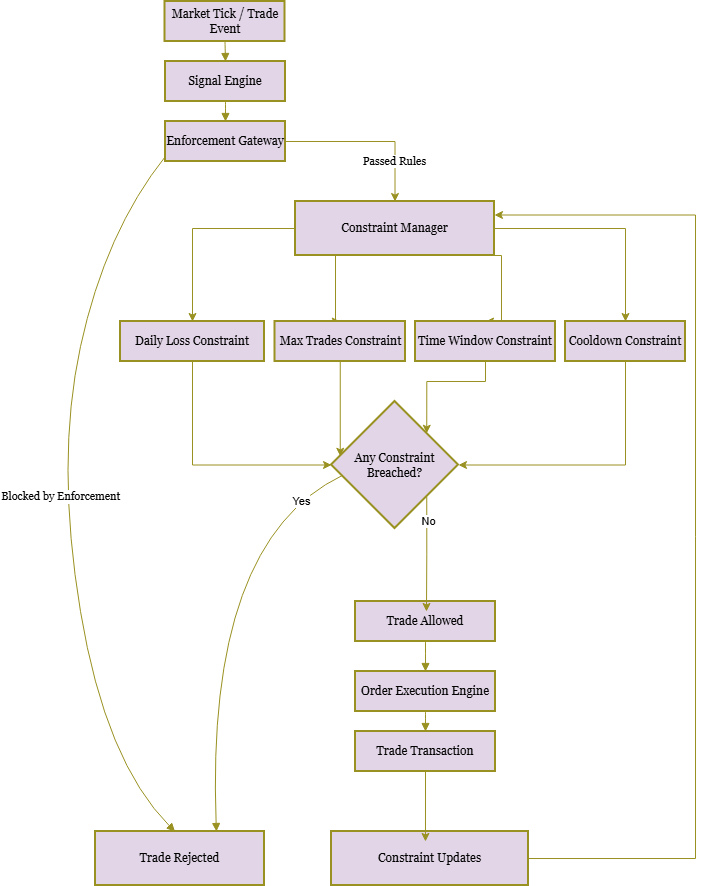

Enforcement Gateway & Modular Constraint Manager

While the procedural examples above demonstrate how discipline rules can be monitored, practical live trading requires a scalable, enforceable system. To achieve this, we introduce a centralized enforcement gateway combined with a modular constraint manager, ensuring that every trade is evaluated against all active discipline rules before execution.

The diagram above illustrates the full enforcement pipeline from signal generation to trade execution. All trade requests pass through a central enforcement gateway before being evaluated by the modular constraint manager. Each constraint operates independently and reports to a unified decision node, ensuring that any violation immediately blocks execution. Executed trades feed back into the system through real-time constraint updates, enabling continuous rule enforcement.

bool TryOpenOrder(MqlTradeRequest &request, MqlTradeResult &result, ConstraintManager &manager) { if(manager.AnyBreached()) { Alert("Trade blocked: ", manager.BreachReason()); return false; // Trade rejected } if(!OrderSend(request,result)) { Print("OrderSend failed: ", result.comment); return false; } return true; // Trade executed successfully }

class IConstraint { public: virtual void ResetIfNewDay() = 0; virtual void UpdateOnTransaction(const MqlTradeTransaction &trans) = 0; virtual bool IsBreached() = 0; virtual string Reason() = 0; };

This interface is a design contract pattern implemented using abstract base classes, which is fully supported in MQL5.

- ResetIfNewDay()—Resets counters at the start of a new trading day.

- UpdateOnTransaction()—Updates internal state whenever a trade occurs.

- IsBreached()—Returns true if the constraint has been violated.

- Reason()—Returns a human-readable message describing the breach.

class ConstraintManager { private: IConstraint* constraints[]; public: void AddConstraint(IConstraint* c) { ArrayAdd(constraints, c); } void ResetAll() { for(int i=0;i<ArraySize(constraints);i++) constraints[i].ResetIfNewDay(); } void UpdateAll(const MqlTradeTransaction &trans) { for(int i=0;i<ArraySize(constraints);i++) constraints[i].UpdateOnTransaction(trans); } bool AnyBreached() { for(int i=0;i<ArraySize(constraints);i++) if(constraints[i].IsBreached()) return true; return false; } string BreachReason() { for(int i=0;i<ArraySize(constraints);i++) if(constraints[i].IsBreached()) return constraints[i].Reason(); return ""; } };

In production systems, these objects should be properly destroyed or managed using static allocation or smart lifecycle handling. Time-based constraints can also be reset using a timer event if no trade transactions occur during a session.

- AddConstraint()—Adds a new discipline rule.

- ResetAll()—Resets all constraints for a new trading day.

- UpdateAll()—Updates all constraints after a trade.

- AnyBreached() / BreachReason()—Check if any rules are violated and report the reason.

class TradeFrequencyConstraint : public IConstraint { private: int tradesToday; datetime dayStart; int MaxTrades; public: TradeFrequencyConstraint(int maxTrades) { MaxTrades = maxTrades; ResetIfNewDay(); } void ResetIfNewDay() { tradesToday=0; dayStart=iTime(_Symbol,PERIOD_D1,0); } void UpdateOnTransaction(const MqlTradeTransaction &trans) { if(trans.type != TRADE_TRANSACTION_DEAL_ADD) return; if(iTime(_Symbol,PERIOD_D1,0)!=dayStart) ResetIfNewDay(); if(HistoryDealSelect(trans.deal)) if(HistoryDealGetInteger(trans.deal,DEAL_ENTRY)==DEAL_ENTRY_IN) tradesToday++; } bool IsBreached() { return tradesToday>MaxTrades; } string Reason() { return "Daily trade limit exceeded"; } };

2. Protecting Profits

class DailyProfitConstraint : public IConstraint { private: double startEquity; datetime dayStart; bool breached; double targetPercent; public: DailyProfitConstraint(double target) { targetPercent=target; ResetIfNewDay(); } void ResetIfNewDay() { startEquity=AccountInfoDouble(ACCOUNT_EQUITY); dayStart=iTime(_Symbol,PERIOD_D1,0); breached=false; } void UpdateOnTransaction(const MqlTradeTransaction &trans) { if(iTime(_Symbol,PERIOD_D1,0)!=dayStart) ResetIfNewDay(); } bool IsBreached() { if(breached) return true; double gain=((AccountInfoDouble(ACCOUNT_EQUITY)-startEquity)/startEquity)*100.0; if(gain>=targetPercent) breached=true; return breached; } string Reason() { return "Daily profit target reached"; } };

3. Containing Loss Escalation

class DailyLossConstraint : public IConstraint { private: double startBalance; datetime dayStart; bool breached; double maxLossPercent; public: DailyLossConstraint(double maxLoss) { maxLossPercent=maxLoss; ResetIfNewDay(); } void ResetIfNewDay() { startBalance=AccountInfoDouble(ACCOUNT_BALANCE); dayStart=iTime(_Symbol,PERIOD_D1,0); breached=false; } void UpdateOnTransaction(const MqlTradeTransaction &trans) { if(iTime(_Symbol,PERIOD_D1,0)!=dayStart) ResetIfNewDay(); } bool IsBreached() { if(breached) return true; double loss=((startBalance-AccountInfoDouble(ACCOUNT_EQUITY))/startBalance)*100.0; if(loss>=maxLossPercent) breached=true; return breached; } string Reason() { return "Daily loss limit breached"; } };

Integration in the EA

Once the constraints are defined, integrating them into a live EA is straightforward. During initialization, each constraint is registered with the ConstraintManager. Then, as trades occur, OnTradeTransaction() updates all constraints in real time, and every order passes through TryOpenOrder(). The system now enforces discipline automatically: violations are detected immediately, preventing overtrading, exceeding profit targets, or breaching loss limits—all without requiring conscious intervention.

ConstraintManager manager; manager.AddConstraint(new TradeFrequencyConstraint(5)); manager.AddConstraint(new DailyProfitConstraint(2.0)); manager.AddConstraint(new DailyLossConstraint(3.0));

OnTradeTransaction()—Update all constraints in real time:

void OnTradeTransaction(const MqlTradeTransaction &trans, const MqlTradeRequest &request, const MqlTradeResult &result) { manager.UpdateAll(trans); }

Trade Execution—All orders go through TryOpenOrder() to enforce rules automatically.

Scope, Filtering, and Trade Accounting

To make constraints practical in a live EA, it is important to define the scope of what is monitored and how trades are counted:

- Per symbol vs per account: In this implementation, each constraint tracks trades per symbol. Multi-symbol EAs would require separate constraint instances for each symbol or additional aggregation logic.

- Manual trades: By default, manual trades executed outside the EA can be included if HistoryDealSelect captures them. Otherwise, they are ignored. The framework allows choosing which trades contribute to counters.

- Magic number filtering: Constraints can be restricted to trades opened by a specific MagicNumber, preventing conflicts between multiple strategies running on the same account.

Trade counting rules:

- Only market entry trades are counted (`DEAL_ENTRY_IN`).

- Pending orders, partial fills, or exit trades are not counted unless explicitly included in the constraint logic.

//+------------------------------------------------------------------+ //| Minimal Enforcement EA (Testing Demo Only) | //+------------------------------------------------------------------+ #property strict input int MaxTradesPerDay = 2; int tradesToday = 0; datetime dayStartTime = 0; // Constraint Check Function bool TradeAllowed() { datetime today = iTime(_Symbol, PERIOD_D1, 0); if(today != dayStartTime) { tradesToday = 0; dayStartTime = today; } if(tradesToday >= MaxTradesPerDay) { Print("Trade blocked: Daily limit reached"); return false; } return true; } // Trade Gateway bool TryOpenOrder(MqlTradeRequest &request, MqlTradeResult &result) { if(!TradeAllowed()) return false; if(!OrderSend(request,result)) { Print("OrderSend failed: ", result.comment); return false; } tradesToday++; Print("Trade executed successfully"); return true; } // OnTick - test opening trades (demo only; in production, trigger on signals not every tick) void OnTick() { if(MathRand() % 1000 != 0) return; // Random throttle for safe testing; remove in real EA MqlTradeRequest req; MqlTradeResult res; ZeroMemory(req); ZeroMemory(res); // Example market buy request req.action = TRADE_ACTION_DEAL; req.symbol = _Symbol; req.volume = 0.1; req.type = ORDER_TYPE_BUY; req.price = SymbolInfoDouble(_Symbol,SYMBOL_ASK); req.magic = 123456; TryOpenOrder(req,res); } //+------------------------------------------------------------------+ //+------------------------------------------------------------------+

Scope and Audience

This series does not introduce a trading strategy, predict market direction, or refine entry and exit techniques. It is not intended to replace trader judgment or to automate discretionary decision-making. Its scope is intentionally focused on one objective: the structural enforcement of trading discipline.

The central aim is to design governance layers—implemented in MQL5—that operate alongside any trading approach, whether discretionary, automated, or hybrid. These layers monitor real-time behavior, enforce predefined risk limits, and intervene consistently when boundaries are breached. They are not trading engines. They do not generate signals, manage positions, or execute trades. Their sole purpose is to embed objective constraints into the trading environment, reinforcing structure precisely where human decision-making is most susceptible to pressure.

The series is written for two primary audiences:

- experienced traders who understand market structure and execution but seek greater consistency and stronger capital protection under live-market conditions.

- developers and technically oriented traders interested in integrating behavioral controls and risk governance mechanisms into their existing systems.

A foundational understanding of trading principles and basic familiarity with MQL5 programming is assumed. No advanced quantitative modeling or complex mathematical frameworks are required. The emphasis throughout is practical and architectural—demonstrating how disciplined execution can be strengthened through deliberate system design rather than relying solely on impulse control or psychological resilience.

Conclusion

This article demonstrated how discipline can be engineered directly into an MQL5 trading environment. Instead of relying on awareness or willpower, we translated discretionary rules into measurable constraints, real-time monitoring, and a centralized enforcement gateway that blocks execution when limits are breached.

Trade frequency caps, daily profit protection, and loss containment were transformed from written intentions into enforceable system logic. All trade operations are routed through TryOpenOrder(), ensuring that violations do not generate warnings—they prevent execution. The result is structural discipline.

After implementing this framework, you gain:

- Defined and enforceable trading constraints

- A centralized blocking gateway for order execution

- A modular constraint manager template for scalable governance

- Clear accounting logic for trade counting and daily resets

- An execution environment where discipline is embedded in design

This framework does not alter strategy logic. It strengthens it by closing the enforcement gap between planning and live execution. In the next part of this series, we will extend this architecture into more advanced governance layers, demonstrating how structural controls can evolve alongside trading systems without interfering with core strategy development.

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Features of Custom Indicators Creation

Features of Custom Indicators Creation

From Novice to Expert: Automating Intraday Strategies

From Novice to Expert: Automating Intraday Strategies

Features of Experts Advisors

Features of Experts Advisors

Market Simulation (Part 16): Sockets (X)

Market Simulation (Part 16): Sockets (X)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use