Automated Optimization of a Trading Robot in Real Trading

Introduction

It is supposed that an Expert Advisor having inputs adjusted to the history will trade to a profit for the first (rather short) time. Indirect confirmations of this suggestion appeared after I had watched the Automated Trading Championship 2006. When the Championship started there were much more profitable Expert Advisors than later, when some of them turned to be noncompetitive. This is why I suppose the most of those Expert Advisors that had not come to the finish were adjusted to the history.

The idea to check this supposition in practice was born on the Russian forum of this website, in the section of Ideal Automated Trading System. The main idea is to start optimization of an EA automatically once a day and then analyze the obtained optimization results and record them in the EA's variables.

To implement this idea, we decided to take the ready-made Expert Advisor, MACD Sample, from the MetaTrader 4 Client Terminal and insert our own function of automated optimization into it. A bit later, the code of that automated optimizer was ready and uploaded in the same forum, in the section of Automated Optimizer. After some more time, the first confirmations of the idea appeared in the branch of Automated Optimizer. Later on, the optimizer was transformed into an mqh-library for better usability.

Installation of the Automated Optimizer

Below is what must be done for performing this task:

- copy MACD Sample_1.mq4 into the 'expert' folder of the MetaTrader 4 Client Terminal preliminarily installed and connected to the Internet; and

- copy the folder together with the installed MetaTrader 4 Client Terminal to a new location.

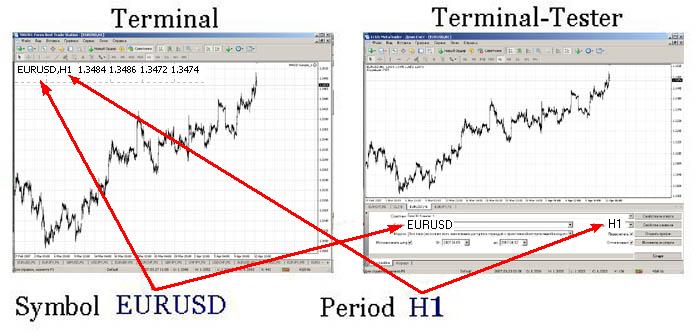

For better usability, we will hereinafter name the original terminal "Terminal", whereas the copy will be named "Terminal-Tester". We will perform a checking test on EURUSD at timeframe H1 using the Expert Advisor initially provided by the terminal, but slightly changed - MACD Sample_1.mq4.

Terminal-Tester Setup

Please don't forget to compile MACD Sample_1.mq4 in the Terminal-Tester. Let's start the client terminal first, then strategy tester, and set it up as shown in the screenshot below.

Optimization will be performed for three days. This is quite enough to check the automated optimizer. We will select the optimization date "From" according to the following formula - the current date minus three days. During optimization, the necessary history for the selected symbol (in our case, it is EURUSD) must be downloaded.

Those who perform optimization for the first time can find the description of necessary procedures in the Help menu of the MetaTrader 4 Client Terminal: <Help - Help Topics F1 - Auto Trading - Expert Optimization - Setup>. Or they can read the article named Testing of Expert Advisors in the MetaTrader 4 Client Terminal: An Outward Glance.

Then let's check variables to be optimized as shown in the screenshot below.

Automated optimization is limited to four variables, but it will be enough to have only three for our purposes and in order to save time. After the variables have been selected, let us store the optimization settings in the set-file named as MACD Sample_1.set. This file must be saved in the 'tester' folder of the Terminal-Tester. Then launch the pre-optimization and memorize the start time. This is necessary to calculate the time period needed for automated optimization with the preset parameters. After the optimization is finished, we will calculate the necessary waiting time. Then we have to close this terminal, since otherwise we won't be able to start it programmatically.

Setup of the Expert Advisor Located in the Terminal

For this, let's open the test Expert Advisor MACD Sample_1.mq4 in MetaEditor and perform the following:

- set the start time for auto optimization, for example, at 00:01 every day:

datetime SetHour = 0; // Optimization starting hour; datetime SetMinute = 1; // Optimization starting minute.

- set the amount of days for optimization (it must be the same as that for pre-optimization):

int TestDay = 3;

- set the optimization end waiting time, in minutes, that we have calculated before, for example, 4 minutes:

int TimeOut = 4;

- type in the Expert Advisor name:

string NameMTS = "MACD Sample_1"; // EA's name

- type in the set-file name with the settings:

// Set-file name with the settings string NameFileSet = "MACD Sample_1.set";

- type in the path to the folder containing the installed Terminal-Tester, for instance:

// Path to the tester string PuthTester = "D:\Program Files\Forex Best Trade Station";

- set the priority for filtering:

// Sorting by Maximal profit int Gross_Profit = 1; // Sorting by Maximal profit factor int Profit_Factor = 2; // Sorting by Maximal expected payoff int Expected_Payoff = 3;

- write variable names for optimization:

string Per1 = "FastEMA"; string Per2 = "SlowEMA"; string Per3 = "SignalSMA"; string Per4 = "";

- copy attached file auto_optimization.mqh to the 'include' folder';

- include the library file in the Expert Advisor:

//--- Including the auto optimizer's library #include <auto_optimization.mqh>

- it is only remains to copy the code below to the beginning of the start() function of your Expert Advisor. MACD Sample_1.mq4 contains it already.

// Not to be launched at testing and optimizing if(!IsTesting() && !IsOptimization()) { // Compare the current hour with that preset for launching if(TimeHour(TimeLocal()) == SetHour) { // Protection against restarting if(!StartTest) { // Compare the minute range to the minute // preset for launching if(TimeMinute(TimeLocal()) > SetMinute - 1) { // the range is necessary, in case that for some reasons // no new tick is available for a long time if(TimeMinute(TimeLocal()) < SetMinute + 1) { // Flag of tester launching StartTest = true; TimeStart = TimeLocal(); Tester(TestDay, NameMTS, NameFileSet, PuthTester, TimeOut, Gross_Profit, Profit_Factor, Expected_Payoff, Per1, Per2, Per3, Per4); } } } } } FastEMA = GlobalVariableGet(Per1); SlowEMA = GlobalVariableGet(Per2); SignalSMA = GlobalVariableGet(Per3); TrailingStop = GlobalVariableGet(Per4); // If the tester launching is flagged if(StartTest) { // If more time has elapsed the launching than it was set // to be the test waiting time if(TimeLocal() - TimeStart > TimeOut*60) { // Zeroize the flag StartTest = false; } }

That's all. After the automated optimizer has been recompiled, it can be launched, but it may be used for only the same symbol and timeframe, for which the pre-optimization was performed. In our case, it is EURUSD on H1. To check the auto optimizer, you can insert the code given below in the int init () function, then the auto optimizer will be launched at the Expert Advisor's start.

Tester(TestDay,NameMTS,NameFileSet,PuthTester,TimeOut, Gross_Profit,Profit_Factor, Expected_Payoff, Per1,Per2,Per3,Per4);

How Automated Optimizer Works

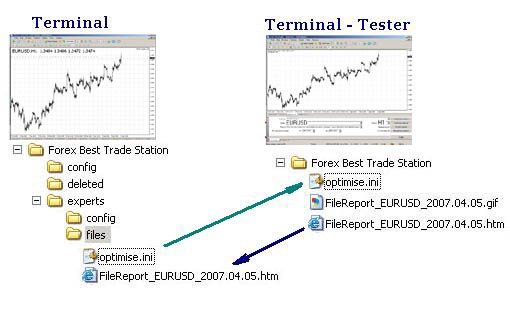

The automated optimizer works on the basis of using Terminal-Tester to optimize parameters of the Expert Advisor attached to the chart in Terminal. For this, the program sends to the Terminal-Tester a file containing optimization parameters (optimise.ini) and launches the Terminal Tester in the optimization mode. Then it copies the obtained results of "FileReport........htm" back to the Terminal and filters the best values from the obtained results.

More Details about How Auto Optimizer Works

At the preset time, for example, at 00.01, the automated optimizer should be launched. Variables should be filled out with values.

// Path to the terminal string PuthTerminal = TerminalPath() + "\experts\files"; // Name of the ini file for the tester string FileOptim = "optimise.ini"; string FileOptim1 = "\optimise.ini"; // Calculation of the starting date datetime DayStart = TimeLocal()-86400*TestDay; // Optimization starting date string DateStart = TimeToStr(DayStart,TIME_DATE); // Optimization ending date string DateStop = TimeToStr(TimeLocal(),TIME_DATE); // Tester report file name string FileReport = "FileReport_" + Symbol() + "_" + DateStop + ".htm"; string FileReport1 = "\FileReport_" + Symbol() + "_" + DateStop + ".htm"; // Limitation for the minimum amount of trades per day double MinTr = TestDay - 2; // Limitation for maximal amount of trades per day double MaxTr = (60 / Period()*TestDay) + 2; // The amount of attempts to copy the report file int KvoPptk = 10; // The amount of lines for sorting int StepRes = 12;

Then the parameters of the ini file are written in the string array:

// Prepare the ini file for optimization ArrayOpttim[0] = ";optimise strategy tester"; // Enable/Disable Expert Advisors ArrayOpttim[1] = "ExpertsEnable = false"; // Name of the EA file ArrayOpttim[2] = "TestExpert=" + NameMTS; // Name of the file containing parameters ArrayOpttim[3] = "TestExpertParameters=" + NameFileSet; // Symbol ArrayOpttim[4] = "TestSymbol=" + Symbol(); // Timeframe ArrayOpttim[5] = "TestPeriod=" + Period(); // Modeling mode ArrayOpttim[6] = "TestModel=" + 0; // Recalculate ArrayOpttim[7] = "TestRecalculate=false"; // Optimization ArrayOpttim[8] = "TestOptimization=true"; // Use date ArrayOpttim[9] = "TestDateEnable=true"; // From ArrayOpttim[10] = "TestFromDate=" + DateStart; // To ArrayOpttim[11] = "TestToDate=" + DateStop; // Report file name ArrayOpttim[12] = "TestReport=" + FileReport; // Rewrite the report file ArrayOpttim[13] = "TestReplaceReport=true"; // Shut down the terminal upon completion ArrayOpttim[14] = "TestShutdownTerminal=true";

The optimization parameters are recorded into the ini file from the array. You can also read about how to create an ini file in the MetaTrader 4 Client Terminal Help, see <Help - Help Topics F1 - Tools - Configuration at Startup>.

// Write data into the ini file // Find out about the array size OptimArraySize = ArraySize(ArrayOpttim); // Open a file to write opttim = FileOpen(FileOptim, FILE_CSV|FILE_WRITE, 0x7F); if(opttim > 0) { for(int i = 0; i < OptimArraySize; i++) { // from the array into the variable ini = ArrayOpttim[i]; // from the variable into the file FileWrite(opttim, ini); } // close the file FileClose(opttim); } else { Print("Failed writing data into the ini file. Error No ", GetLastError()); return(0); }

After the parameters have been recorded in the ini file, the shell32.dll included in the standard Windows delivery is connected and function ShellExecuteA is launched.

#import "shell32.dll" //Connect a dll (provided with Windows) int ShellExecuteA(int hwnd,string Operation,string File,string Parameters,string Directory,int ShowCmd); #import

File containing the parameters will be sent to the Terminal Tester folder.

// copy the ini file into the tester folder copyini = ShellExecuteA(0,"Open","xcopy", "\"" + PuthTerminal + FileOptim1 + "\" \"" + PuthTester + "\" /y", "", 3); // wait until the file is copied Sleep(1200); if(copyini < 0) { Print("Failed copying ini file"); return(0); }

Then the tester is launched and starts to optimize the predefined variables. The Expert Advisor is in the halted state during optimization.

// Start Tester start = ShellExecuteA(0, "Open", "terminal.exe", FileOptim, PuthTester, 3); if(start < 0) { Print("Failed starting Tester"); return(0); } Comment("Wait until optimization is complete"); // wait until optimization is complete Sleep(60000*TimeOut);

After optimization is complete, Tester will automatically record the results in the report file. That file is copied to the folder that contains the terminal.

for(Pptk = 0; Pptk < KvoPptk; Pptk++) { //Start a cycle attempting to compy the resport file Comment("Attempt # " + Pptk + " to copy the report file"); ShellExecuteA(0, "Open", "xcopy", "\"" + PuthTester + FileReport1 + "\" \"" + PuthTerminal + "\" /y", "", 3); // wait until the file is copied Sleep(1200); // Try to open the report file file = FileOpen(FileReport, FILE_READ, 0x7F); if(file < 0) { // if it fails to open, wait some more and try again Sleep(60000); } else break; } if(file < 0) { Print("Failed copying the report file"); return(0); }

Then the data from the report file will be placed in the string array for further processing.

// Read from file into the array // Cycle, until the file ends while(FileIsEnding(file) == false) { // Read a string from the report file FileLine = FileReadString(file); // Find the necessary string and set the reference point there index = StringFind(FileLine, "title", 20); if(index > 0) { // Increase the array in size ArrayResize(ArrayStrg, NumStr + 1); // Record the strings from the file in the array ArrayStrg[NumStr] = FileLine; NumStr++; } } // Close the file FileClose(file); // Delete the file in order not to produce too many copies FileDelete(FileReport); // Set the array size by the amount of data read from the file ArrayResize(ArrayData, NumStr);

Then the necessary values are selected in the array:

for(text = 0; text < NumStr; text++) { select = ArrayStrg[text]; //------------------------------------------------------------------------- // Reporting text processing (These are apples and oranges) | //------------------------------------------------------------------------- // Position Pass ClStep=StringFind(select, "; \">",20)+4; // Find the end of position ClStepRazm = StringFind(select, "td>", ClStep); // Read the value CycleStep = StringSubstr(select, ClStep, ClStepRazm - ClStep); // Position Profit // Find the beginning of the position GrProf = StringFind(select, "", ClStepRazm); // Find the end of position GrProfRazm = StringFind(select, "td>", GrProf); // Read value GrossProfit = StringSubstr(select, GrProf+4, GrProfRazm - (GrProf + 4)); // Position Total Trades // Find the beginning of position TotTrad = StringFind(select, "", GrProfRazm); // Find the end of position TotTradRazm = StringFind(select, "td>", TotTrad); // Read the value TotalTrades = StringSubstr(select, TotTrad+4, TotTradRazm - (TotTrad + 4)); // Position Profitability // Find the beginning of position ProfFact = StringFind(select, "", TotTradRazm); // Find the end of position ProfFactRazm = StringFind(select, "td>", ProfFact); // Read the value ProfitFactor = StringSubstr(select, ProfFact + 4, ProfFactRazm - (ProfFact + 4)); // Position Expected Payoff // Find the beginning of position ExpPay = StringFind(select, "", ProfFactRazm); // Find the dn of position ExpPayRazm=StringFind(select, "td>", ExpPay); // Read the value ExpectedPayoff = StringSubstr(select, ExpPay+4, ExpPayRazm - (ExpPay + 4)); // Variables' positions starting with the second one // Find the beginning of position P1 = StringFind(select, Per1, 20); // Find the end of position P1k = StringFind(select, ";", P1); // Read the Variable Perem1 = StringSubstr(select, P1 + StringLen(Per1) + 1, P1k - (P1 + 1 + StringLen(Per1))); // Find the beginning of position P2 = StringFind(select, Per2, 20); // Find the end of position P2k = StringFind(select, ";", P2); // Read the Variable Perem2 = StringSubstr(select, P2 + StringLen(Per2) + 1, P2k - (P2 + 1 + StringLen(Per2))); // Find the beginning of position P3 = StringFind(select, Per3, 20); // Find the end of position P3k = StringFind(select, ";", P3); // Read the Variable Perem3 = StringSubstr(select, P3 + StringLen(Per3) + 1, P3k - (P3 + 1 + StringLen(Per3))); // Find the beginning of position P4 = StringFind(select, Per4, 20); // Find the end of position P4k = StringFind(select, ";", P4); // Read the Variable Perem4 = StringSubstr(select, P4 + StringLen(Per4) + 1, P4k - (P4 + 1 + StringLen(Per4))); Comment("The obtained results are being analyzed");

After that, the obtained results, before they are transformed into number format, have been filtered by the minimal and the maximal amount of trades. Zero in the value of Profit_Factor is replaced with 1000 for correct sorting and subsequent sifting.

// Transform into number format TotalTradesTransit = StrToDouble(TotalTrades); GrossProfitTransit = StrToDouble(GrossProfit); ExpectedPayoffTran = StrToDouble(ExpectedPayoff); nodubl = true; if(MinTr < TotalTradesTransit && MaxTr > TotalTradesTransit) { // Filter by the amount of trades PrFactDouble = StrToDouble(ProfitFactor); // Replace 0 in the Profit_Factor for proper analysis if(PrFactDouble == 0) { PrFactDouble = 1000; }

Then the values are checked for duplicates and filtered out.

// Filter data having identical values for(Dubl = 0; Dubl <= ResizeArayNew; Dubl++) { // Start the loop searching for identical values if(GrossProfitTransit == ArrayData[Dubl][1]) { // check whether the results for maximal profit coincide if(TotalTradesTransit == ArrayData[Dubl][2]) { // check whether the results for the amount of trades coincide if(PrFactDouble == ArrayData[Dubl][3]) { // check whether the results for Profit Factor coincide if(ExpectedPayoffTran == ArrayData[Dubl][4]) { // check whether the results for expected payoff coincide nodubl=false; // If everything coincides, flag it as coincided } } } } }

Then the values prepared for sorting are written in the array.

// Write the filtered data in the array if(nodubl) { ArrayData[text][1] = GrossProfitTransit; ArrayData[text][2] = TotalTradesTransit; ArrayData[text][3] = PrFactDouble; ArrayData[text][4] = ExpectedPayoffTran; ArrayData[text][5] = StrToDouble(Perem1); ArrayData[text][6] = StrToDouble(Perem2); ArrayData[text][7] = StrToDouble(Perem3); ArrayData[text][8] = StrToDouble(Perem4); ResizeArayNew++; }

Then the data start to be analyzed in the preset priority order. The analysis is performed as follows:

- the loop is launched and, at the first pass, the values are sorted by the first parameter, for instance, by maximal profit; several best values are selected (12, by default), others are cut off;

- at the second pass, the values are sorted by the second parameter, for example, by Profit Factor; some best values are selected, a half after the first sorting, others are cut off;

- at the third pass, the last sorting is performed for the third parameter, for example, by expected payoff; a half of values is taken after the second sorting, others are cut off.

// Analyzer // Analyzing principle is the sequential checking of maximal // values according to the predefined filtering priority ArrayResize(ArrayTrans, ResizeArayNew - 1); for(int PrioStep = 1; PrioStep < 4; PrioStep++) { for(PrCycle = 0; PrCycle < ResizeArayNew; PrCycle++) { Sort = ArrayData[PrCycle][0]; Prior1 = ArrayData[PrCycle][1]; transit = ArrayData[PrCycle][2]; Prior2 = ArrayData[PrCycle][3]; Prior3 = ArrayData[PrCycle][4]; transit1 = ArrayData[PrCycle][5]; transit2 = ArrayData[PrCycle][6]; transit3 = ArrayData[PrCycle][7]; transit4 = ArrayData[PrCycle][8]; if(PrioStep == 1) { //Prepare for the 1st sorting if(Gross_Profit ==1) { SortTrans = Prior1; } if(Profit_Factor == 1) { SortTrans = Prior2; } if(Expected_Payoff == 1) { SortTrans = Prior3; } } if(PrioStep == 2) { // Restore if(Gross_Profit ==1) { Prior1 = Sort; } if(Profit_Factor == 1) { Prior2 = Sort; } if(Expected_Payoff == 1) { Prior3 = Sort; } //Prepare for the 2nd sorting if(Gross_Profit == 2) { SortTrans = Prior1; } if(Profit_Factor == 2) { SortTrans = Prior2; } if(Expected_Payoff == 2) { SortTrans = Prior3; } } if(PrioStep == 3) { // Restore if(Gross_Profit == 2) { Prior1 = Sort; } if(Profit_Factor == 2) { Prior2 = Sort; } if(Expected_Payoff == 2) { Prior3 = Sort; } //Prepare for the 3rd sorting if(Gross_Profit ==3) { SortTrans = Prior1; } if(Profit_Factor == 3) { SortTrans = Prior2; } if(Expected_Payoff == 3) { SortTrans = Prior3; } } ArrayTrans[PrCycle][0] = SortTrans; ArrayTrans[PrCycle][1] = Prior1; ArrayTrans[PrCycle][2] = transit; ArrayTrans[PrCycle][3] = Prior2; ArrayTrans[PrCycle][4] = Prior3; ArrayTrans[PrCycle][5] = transit1; ArrayTrans[PrCycle][6] = transit2; ArrayTrans[PrCycle][7] = transit3; ArrayTrans[PrCycle][8] = transit4; } ArraySort(ArrayTrans,StepRes, 0, MODE_DESCEND); // Sort the array ArrayResize(ArrayTrans, StepRes); // Cut off the unnecessary things for(int CopyAr = 0; CopyAr < StepRes; CopyAr++) { ArrayData[CopyAr][0] = ArrayTrans[CopyAr][0]; ArrayData[CopyAr][1] = ArrayTrans[CopyAr][1]; ArrayData[CopyAr][2] = ArrayTrans[CopyAr][2]; ArrayData[CopyAr][3] = ArrayTrans[CopyAr][3]; ArrayData[CopyAr][4] = ArrayTrans[CopyAr][4]; // Per1 Variable 1 ArrayData[CopyAr][5] = ArrayTrans[CopyAr][5]; // Per2 Variable 2 ArrayData[CopyAr][6] = ArrayTrans[CopyAr][6]; // Per3 Variable 3 ArrayData[CopyAr][7] = ArrayTrans[CopyAr][7]; // Per4 Variable 4 ArrayData[CopyAr][8] = ArrayTrans[CopyAr][8]; } StepRes = StepRes / 2; }

The values filtered in this manner are written in global variables. The values from global variables will be substituted in the EA.

// Write the obtained results in variables double Peremen1 = ArrayTrans[0][5]; double Peremen2 = ArrayTrans[0][6]; double Peremen3 = ArrayTrans[0][7]; double Peremen4 = ArrayTrans[0][8]; // If the variable name is specified, write the result in // global variables if(Per1 != "") { GlobalVariableSet(Per1, Peremen1); } if(Per2 != "") { GlobalVariableSet(Per2,Peremen2); } if(Per3 != "") { GlobalVariableSet(Per3,Peremen3); } if(Per4 != "") { GlobalVariableSet(Per4,Peremen4); } Comment(Per1, " ", Peremen1, " | ", Per2, " ", Peremen2, " | ", Per3, " ", Peremen3, " | ", Per4, " ", Peremen4); Print(Per1, " ", Peremen1, " | ", Per2, " ", Peremen2, " | ", Per3, " ", Peremen3," | ",Per4," ",Peremen4); } // Function ends. That's all, automated optimization is complete.

Auto Optimizer Operation Results

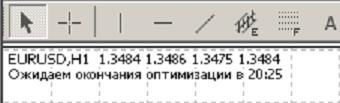

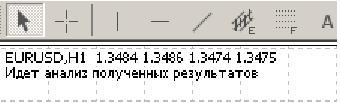

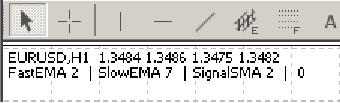

The operation results of the automated optimizer can be observed using messages that appear in the upper left corner of the chart as shown in the screenshot below:

Optimization Completeness Reference Time.

Analysis of Values Obtained after Optimization.

Resulting Values of Variables.

If the optimization results appear in the message, it means that optimization is complete and data have been received.

To estimate the automated optimizer's work independently, one may look through all files containing intermediate data and saved during the working process. Tester stores data in the file named "FileReport_EURUSD_2007.03. 12. htm" where the symbol and the date are substituted in the file name according to the selected symbol and the current date of optimization. This file can be found in the Terminal-Tester folder. These file with reports are not deleted automatically, so one may use them to check the changes of parameters.

The next file, FileTest1.csv, is saved after the values have been filtered by the amount of trades and the copies have been deleted. The file is saved in: D:\Program Files\terminal_folder_ame\experts\files

Then values obtained after each sifting step are saved to FileTest2.csv. The file is saved in this folder, too: D:\Program Files\terminal_folder_name\experts\files

The tables above show how the obtained values are filtered. The filtering order was set by default as: 1- Gross_Profit, 2- Profit_Factor, 3- Expected_Payoff.

The automated optimizer's code contains detailed comments and you can fit the most suitable variable parameters, if necessary. For example, you want to optimize your EA for a period of time other than the latest days, or you are planning to increase/decrease the amount of trades within the optimization period. For this, you just should change the corresponding variables directly in auto_optimization.mqh.

// Limitation of minimal amount of trades per day double MinTr = TestDay - 2; // Limitation on maximal amount of trades per day double MaxTr = (60 / Period()*TestDay) + 2; // The amount of attempts to copy the report file int KvoPptk = 10; // The amount of strings to be sorted int StepRes = 12;

Conclusion

This article is not aimed at teaching newbies elements of optimization, so it is highly recommended to learn normal optimization before setting up automated optimization of your Expert Advisor. It is better to use the automated optimizer after you have chosen the basic variables that will influence your Expert Advisor differently at different times. I.e., it is better to use this automated optimizer to fit parameters of the variables the changes in which influence the EA operation more than those in other variables, depending on the market volatility.

Besides, it is better not to set a very large automated optimization period. Suppose the Expert Advisor has been optimized for 6-12 hours every day. Then a question occurs: When will it trade? In other words, optimization is not necessary as itself. It is recommended to set optimization periodicity (the periodicity of optimizer launching is meant) considering the timeframe, on which the EA is supposed to trade. This means that it is necessary to consider that the historical data will be pumped when the Tester-Terminal is started and it is possible that the broker just does not possess the necessary historical data for the specified period of time. To verify the hypothesis described at the beginning of this article, you will need 24-hour and stable internet connection.

The automated optimization programs developed are located in the attached files: auto_optimization.mqh - the library itself, MACD Sample_1.mq4 - slightly changed Expert Advisor included in the MetaTrader 4 Client Terminal standard delivery set.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/1467

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

MT4TerminalSync - System for the Synchronization of MetaTrader 4 Terminals

MT4TerminalSync - System for the Synchronization of MetaTrader 4 Terminals

Can the Forex Market Be Forecasted? How to Create One's Own Trading Strategy?

Can the Forex Market Be Forecasted? How to Create One's Own Trading Strategy?

Automated Choice of Brokerage Company for an Efficient Operation of Expert Advisors

Automated Choice of Brokerage Company for an Efficient Operation of Expert Advisors

Transferring an Indicator Code into an Expert Advisor Code. Conclusion

Transferring an Indicator Code into an Expert Advisor Code. Conclusion

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Thanks for the EA, I also edit the address of the Terminal folder and and run the EA it can create the ini file and excel files but the files are empty ! I think we have the version confiliction problem here. Because the Terminal automatically export the result in (*.1) format but EA expected to see it on (*.htm) format, that's why it can not able to read the file and create the empty files.

Can any one solve this issue ? or do we have the new updated one of self optimizer ?

Hello,

No "optimise.ini" file gets ever created.

Can someone help me, and explain if I am doing something wrong ?

Thanks

Hello Igor,

Although the article dates back to 2007, it still seems valuable to me.

Having made the necessary adaptations of path names to make it fit with my installation, I succeded in creating and copying the optimise.ini in the tester terminal folder.

Whe trying to start the optimisation however, I get stuck:

The essence of the code looks like this:

Note that I am using ShellExecuteW.

Note that there are spaces in PathToTester.

The result is that the tester terminal starts, but it does not run the optimiser.What could possibly be wrong?

In addition: from the command line:

terminal.exe /config:optimise.ini

doesn't work either.

Thank you so much for the work in the past and possibly your response!

This excellent article is helpful to me.

I am not sure if there is a way to launch the test-terminal once and conduct the tests of various pairs and periods. The test terminal cannot be launched reliably everytime.

Best Wishes,