基于预测的统计套利

概述

统计套利是一种复杂的金融策略,它通过数学模型,利用相关金融工具之间的价格低效性交易获利。该策略通常应用于股票、债券或衍生品,要求深刻理解相关性、协整性以及皮尔逊系数,这些是识别和利用市场机会的关键工具。

在金融领域,相关性用于衡量两种证券之间价格变动的紧密程度,即量化它们之间的关联程度。正相关表明证券的价格通常朝同一方向变动,而负相关则意味着它们的价格朝相反方向变动。交易者会分析这些关系来预测未来的价格走势。

协整是一个更为精细的统计特性,它超越了相关性,通过检验两个或多个时间序列变量的线性组合是否随时间保持稳定来进行分析。简而言之,虽然单个证券可能遵循不同的路径,但它们的相对变动受到某种均衡关系的制约,这种均衡关系使它们倾向于回归。这个概念在成对交易中至关重要,成对交易的目标是识别出历史上价格一起变动,且预期会继续这种趋势的一对股票。

皮尔逊相关系数是一个统计指标,用于计算两个变量之间线性关系的强度和方向。皮尔逊相关系数的值域为-1到1,其中1表示完全正相关,-1表示完全负相关,0表示没有线性关系。在统计套利中,如果两个资产之间的皮尔逊相关系数绝对值较高,这可能意味着存在一个潜在的交易机会,前提是这两个资产的价格关系将回归到长期平均水平。

实施统计套利策略的交易者依赖于算法和高频交易系统来监控和执行交易。这些系统能够处理大量数据,迅速检测出资产价格关系中的异常。该策略假设相关资产的价格将收敛到其历史均值,从而使交易者能够在价格调整中获利。

然而,统计套利的成功不仅取决于复杂的数学模型,还取决于交易者根据不断变化的市场条件解读数据和调整策略的能力。确实,诸如突发经济变动、市场情绪或政治事件等因素,都可能对最稳定的关系造成干扰,从而引发更高层次的风险。

下面用简单的例子来做解释说明

相关性衡量两件事之间的关系。想象一下,你和你最好的朋友总是在星期六一起去看电影。这是一个相关性的例子:当你去电影院时,你的朋友也在那里。如果相关性为正,则意味着当一个增加时,另一个也会增加。如果为负,则一个增加,但另一个减少。如果相关性为0,则意味着两者之间没有联系。

协整是一个统计概念,用于描述两个或多个变量之间虽然短期内可能独立波动,但长期内却存在某种稳定关系的现象。想象一下两个用绳子绑在一起的游泳者:他们可以在泳池中自由游动,但彼此间的距离不会相隔太远。协整表明,尽管这些变量之间会存在暂时的差异,但它们最终总是会回归到共同的长期均衡状态或趋势上。

皮尔逊相关系数用于衡量两个变量之间的线性相关程度。如果相关系数接近+1,则表示一个变量增加时,另一个变量也随之增加,呈现出直接依赖关系。相关系数接近-1时,意味着一个变量增加时,另一个变量减少,呈现出反向关系。相关系数为0时,表示两个变量之间没有线性联系。例如,通过测量温度和冷饮销售量,我们可以使用皮尔逊相关系数来了解这些因素之间的相关性。

总结来说,统计套利是一种复杂但可能带来丰厚回报的交易策略,它融合了经济学、金融学和数学等多个领域的元素。这种策略不仅要求深入理解高级统计概念,还需要具备部署高速算法进行市场分析和执行交易的能力。

计算

要知道哪些交易品种是协整及相关的,可以使用以下.py代码。

import MetaTrader5 as mt5 import pandas as pd from scipy.stats import pearsonr from statsmodels.tsa.stattools import coint import numpy as np # Connect with MetaTrader 5 if not mt5.initialize(): print("Failed to initialize MT5") mt5.shutdown() # Get the list of symbols symbols = mt5.symbols_get() symbols = [s.name for s in symbols if s.name.startswith('EUR') or s.name.startswith('USD') or s.name.endswith('USD')] # Filtrar símbolos por ejemplo # Download historical data and save in dictionary data = {} for symbol in symbols: rates = mt5.copy_rates_from_pos(symbol, mt5.TIMEFRAME_D1, 0, 365) # Último año, diario if rates is not None: df = pd.DataFrame(rates) df['time'] = pd.to_datetime(df['time'], unit='s') data[symbol] = df.set_index('time')['close'] # Close connection with MT5 mt5.shutdown() # Calculate the Pearson coefficient and test for cointegration for each pair of symbols cointegrated_pairs = [] for i in range(len(symbols)): for j in range(i + 1, len(symbols)): if symbols[i] in data and symbols[j] in data: common_index = data[symbols[i]].index.intersection(data[symbols[j]].index) if len(common_index) > 30: # Asegurarse de que hay suficientes puntos de datos corr, _ = pearsonr(data[symbols[i]][common_index], data[symbols[j]][common_index]) if abs(corr) > 0.8: # Correlación fuerte score, p_value, _ = coint(data[symbols[i]][common_index], data[symbols[j]][common_index]) if p_value < 0.05: # P-valor menor que 0.05 cointegrated_pairs.append((symbols[i], symbols[j], corr, p_value)) # Filter and show only cointegrated pairs with p-value less than 0.05 print(f'Total pairs with strong correlation and cointegration: {len(cointegrated_pairs)}') for sym1, sym2, corr, p_val in cointegrated_pairs: print(f'{sym1} - {sym2}: Correlación={corr:.4f}, P-valor de Cointegración={p_val:.4f}')

结果如下:

Total pairs with strong correlation and coitegration: 54 EURUSD - USDBGN: Correlación=-0.9957, P-valor de Cointegración=0.0000 EURUSD - USDHRK: Correlación=-0.9972, P-valor de Cointegración=0.0000 GBPUSD - USDPLN: Correlación=-0.8633, P-valor de Cointegración=0.0406 GBPUSD - GBXUSD: Correlación=0.9998, P-valor de Cointegración=0.0000 GBPUSD - EURSGD: Correlación=0.8061, P-valor de Cointegración=0.0191 USDCHF - EURCHF: Correlación=0.8324, P-valor de Cointegración=0.0356 USDJPY - EURDKK: Correlación=0.8338, P-valor de Cointegración=0.0200 USDJPY - USDTHB: Correlación=0.9012, P-valor de Cointegración=0.0330 AUDUSD - USDCNH: Correlación=-0.8074, P-valor de Cointegración=0.0390 EURCHF - USDKES: Correlación=-0.9104, P-valor de Cointegración=0.0048 EURJPY - EURRON: Correlación=0.8177, P-valor de Cointegración=0.0333 EURJPY - USDCOP: Correlación=-0.9361, P-valor de Cointegración=0.0125 EURJPY - USDLAK: Correlación=0.9508, P-valor de Cointegración=0.0410 EURJPY - EURDKK: Correlación=0.8525, P-valor de Cointegración=0.0136 EURJPY - EURMXN: Correlación=-0.8785, P-valor de Cointegración=0.0172 EURJPY - USDTRY: Correlación=0.9564, P-valor de Cointegración=0.0102 EURNZD - NZDUSD: Correlación=-0.8505, P-valor de Cointegración=0.0455 EURNZD - EURDKK: Correlación=0.8242, P-valor de Cointegración=0.0017 EURCZK - USDCLP: Correlación=0.9655, P-valor de Cointegración=0.0001 USDCLP - USDCZK: Correlación=0.8972, P-valor de Cointegración=0.0147 USDCLP - USDARS: Correlación=0.8077, P-valor de Cointegración=0.0231 USDCLP - USDIDR: Correlación=0.8569, P-valor de Cointegración=0.0423 USDCLP - USDNGN: Correlación=0.8468, P-valor de Cointegración=0.0436 USDCLP - USDVND: Correlación=0.9021, P-valor de Cointegración=0.0194 USDCZK - USDIDR: Correlación=0.9005, P-valor de Cointegración=0.0086 USDCZK - USDVND: Correlación=0.8306, P-valor de Cointegración=0.0195 USDMXN - USDCOP: Correlación=0.8686, P-valor de Cointegración=0.0286 USDMXN - EURMXN: Correlación=0.9522, P-valor de Cointegración=0.0328 NZDUSD - USDSGD: Correlación=-0.8145, P-valor de Cointegración=0.0097 NZDUSD - USDTHB: Correlación=-0.8094, P-valor de Cointegración=0.0255 ADAUSD - KSMUSD: Correlación=0.9429, P-valor de Cointegración=0.0071 ALGUSD - LNKUSD: Correlación=0.8038, P-valor de Cointegración=0.0454 ATMUSD - MTCUSD: Correlación=0.9423, P-valor de Cointegración=0.0146 BTCUSD - SOLUSD: Correlación=0.9736, P-valor de Cointegración=0.0112 DGEUSD - GLDUSD: Correlación=0.8933, P-valor de Cointegración=0.0136 DGEUSD - USDGHS: Correlación=0.8562, P-valor de Cointegración=0.0101 EOSUSD - UNIUSD: Correlación=0.8176, P-valor de Cointegración=0.0051 ETCUSD - ETHUSD: Correlación=0.9745, P-valor de Cointegración=0.0009 ETCUSD - SOLUSD: Correlación=0.9206, P-valor de Cointegración=0.0093 ETCUSD - UNIUSD: Correlación=0.9236, P-valor de Cointegración=0.0249 ETHUSD - SOLUSD: Correlación=0.9430, P-valor de Cointegración=0.0074 UNIUSD - USDNGN: Correlación=0.8074, P-valor de Cointegración=0.0195 EURNOK - USDNOK: Correlación=0.9065, P-valor de Cointegración=0.0430 EURRON - USDCOP: Correlación=-0.8010, P-valor de Cointegración=0.0097 EURRON - USDCRC: Correlación=-0.8015, P-valor de Cointegración=0.0159 EURRON - USDLAK: Correlación=0.8364, P-valor de Cointegración=0.0349 GBXUSD - EURSGD: Correlación=0.8067, P-valor de Cointegración=0.0180 USDARS - USDVND: Correlación=0.8093, P-valor de Cointegración=0.0268 USDBGN - USDHRK: Correlación=0.9944, P-valor de Cointegración=0.0000 USDCOP - USDTRY: Correlación=-0.9548, P-valor de Cointegración=0.0160 USDCRC - EURDKK: Correlación=-0.8519, P-valor de Cointegración=0.0153 USDHRK - USDDKK: Correlación=0.9954, P-valor de Cointegración=0.0000 USDIDR - USDVND: Correlación=0.8196, P-valor de Cointegración=0.0417 USDSEK - USDSGD: Correlación=0.8346, P-valor de Cointegración=0.0264

因此,这些货币对已被过滤掉。

为了用MetaTrader 5检查这些值,我们有了这个指标(Pearson.mq5):

//+------------------------------------------------------------------+ //| PearsonIndicator.mq5 | //| Copyright Javier S. Gastón de Iriarte Cabrera | //| https://www.mql5.com/en/users/jsgaston/news | //+------------------------------------------------------------------+ #property copyright "Javier S. Gastón de Iriarte Cabrera" #property link "https://www.mql5.com/en/users/jsgaston/news/" #property version "1.00" #property indicator_separate_window #property indicator_buffers 1 #property indicator_color1 Red input string Symbol2 = "GBPUSD"; // Second financial instrument input int BarsBack = 100; // Number of bars to include in correlation calculation double CorrelationBuffer[]; //+------------------------------------------------------------------+ //| Custom indicator initialization function | //+------------------------------------------------------------------+ int OnInit() { SetIndexBuffer(0, CorrelationBuffer, INDICATOR_DATA); PlotIndexSetInteger(0, PLOT_DRAW_TYPE, DRAW_LINE); PlotIndexSetString(0, PLOT_LABEL, "Pearson Correlation"); IndicatorSetString(INDICATOR_SHORTNAME, "Pearson Correlation (" + Symbol() + " & " + Symbol2 + ")"); return INIT_SUCCEEDED; } //+------------------------------------------------------------------+ //| Custom indicator iteration function | //+------------------------------------------------------------------+ int OnCalculate(const int rates_total, const int prev_calculated, const datetime &time[], const double &open[], const double &high[], const double &low[], const double &close[], const long &tick_volume[], const long &volume[], const int &spread[]) { if (rates_total < BarsBack) return 0; // Ensure enough bars are present double prices1[], prices2[]; ArrayResize(prices1, BarsBack); ArrayResize(prices2, BarsBack); // Copy historical data for primary symbol if (CopyClose(Symbol(), PERIOD_CURRENT, 0, BarsBack, prices1) <= 0) { Print("Error copying prices for ", Symbol()); return 0; } // Copy historical data for secondary symbol if (CopyClose(Symbol2, PERIOD_CURRENT, 0, BarsBack, prices2) <= 0) { Print("Error copying prices for ", Symbol2); return 0; } // Calculate Pearson correlation for the entire buffer double correlation = CalculatePearsonCorrelation(prices1, prices2); Print("Pearson correlation: ", correlation); // Fill the buffer for the indicator for (int i = BarsBack; i < rates_total; i++) { CorrelationBuffer[i] = correlation; // Update the buffer correctly } return(rates_total); } //+------------------------------------------------------------------+ //| Calculate Pearson correlation coefficient | //+------------------------------------------------------------------+ double CalculatePearsonCorrelation(double &prices1[], double &prices2[]) { int length = BarsBack; double mean1 = 0, mean2 = 0; double sum1 = 0, sum2 = 0, sumProd = 0, stdev1 = 0, stdev2 = 0; for (int i = 0; i < length; i++) { mean1 += prices1[i]; mean2 += prices2[i]; } mean1 /= length; mean2 /= length; for (int i = 0; i < length; i++) { double dev1 = prices1[i] - mean1; double dev2 = prices2[i] - mean2; sum1 += dev1 * dev1; sum2 += dev2 * dev2; sumProd += dev1 * dev2; } stdev1 = sqrt(sum1); stdev2 = sqrt(sum2); if (stdev1 == 0 || stdev2 == 0) return 0; // Avoid division by zero return sumProd / (stdev1 * stdev2); } //+------------------------------------------------------------------+

结果显示:

建立ONNX模型

一旦我们知道了哪些货币对是相互关联且协整的,并且在mql5中检查了皮尔逊相关系数之后,我们就可以构建一个ONNX模型来研究这两对货币对过去的表现。

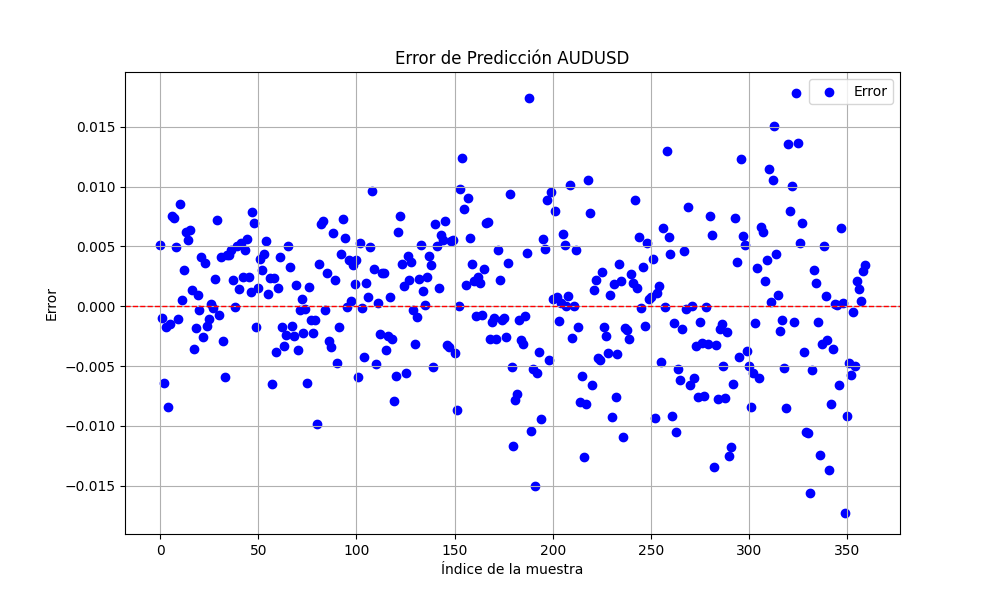

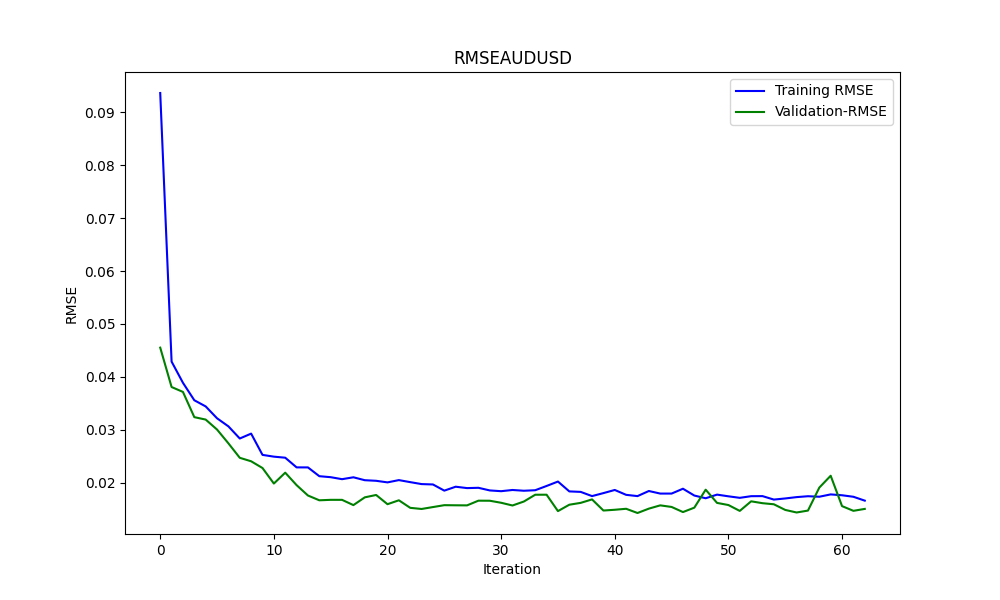

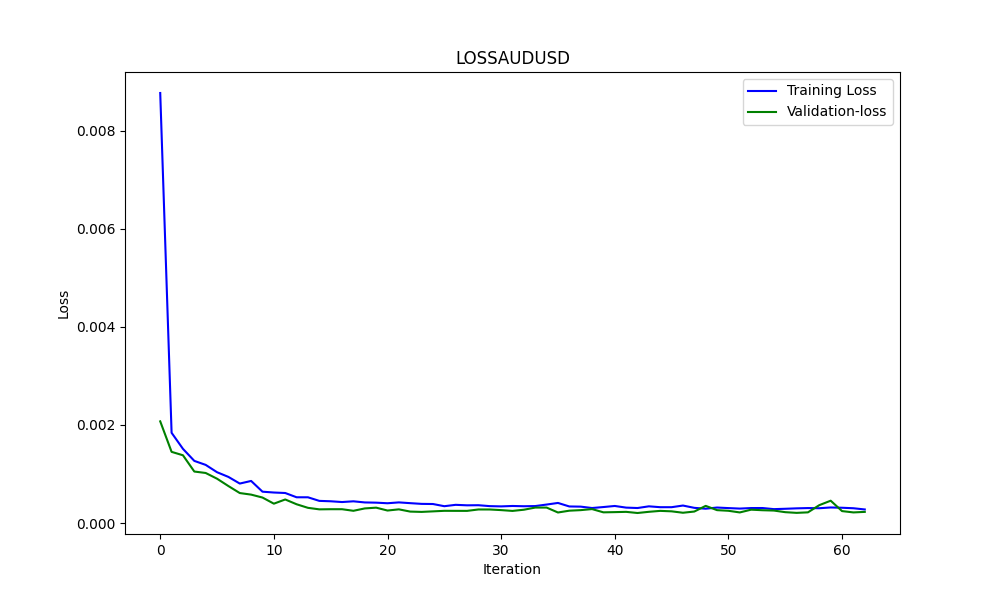

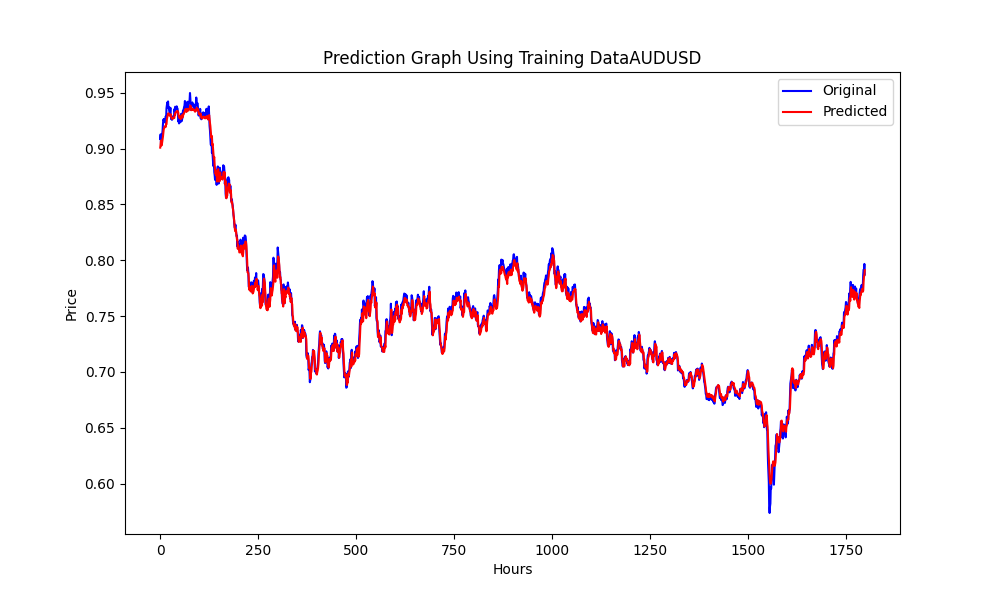

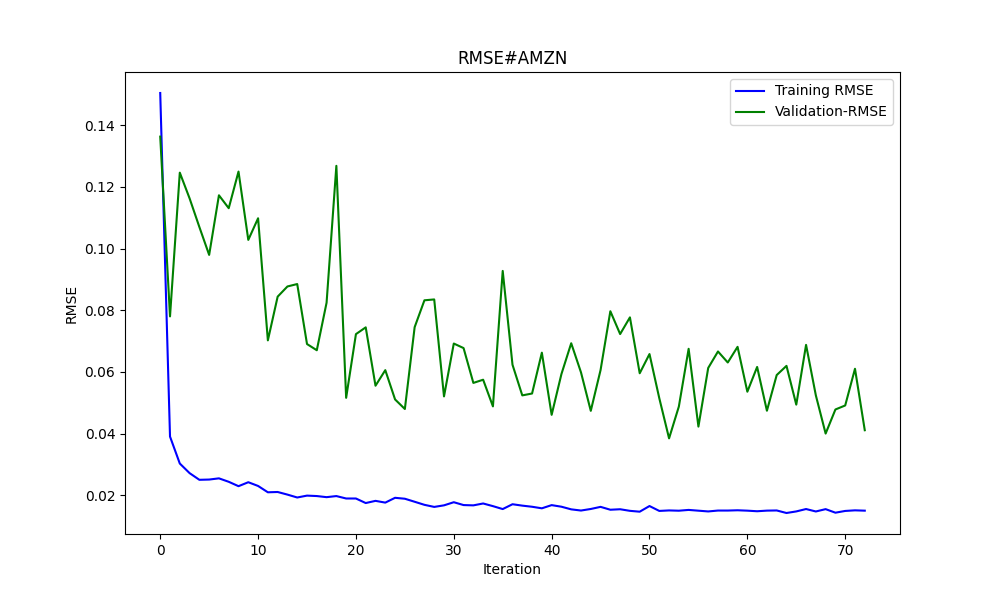

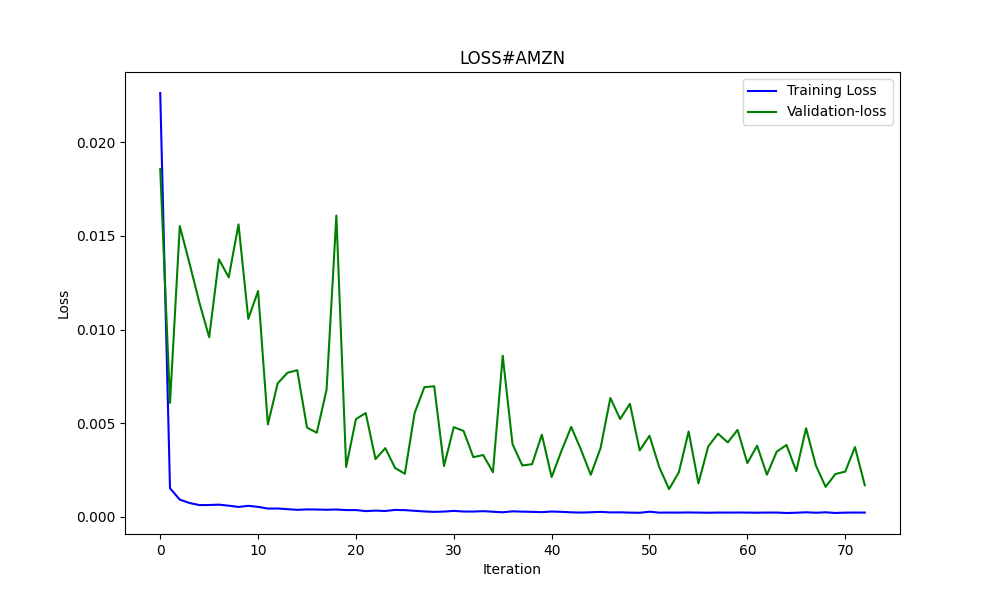

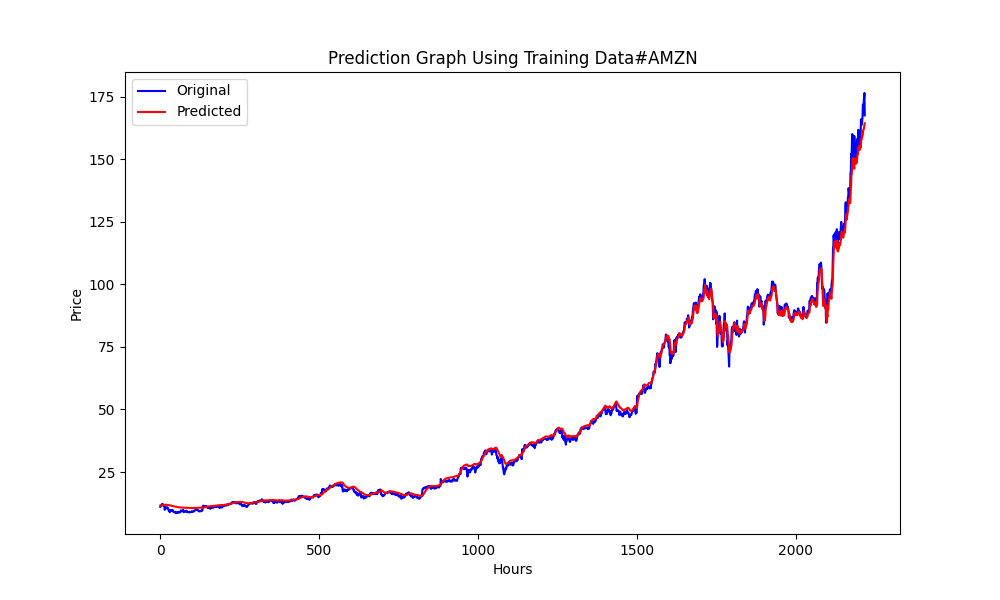

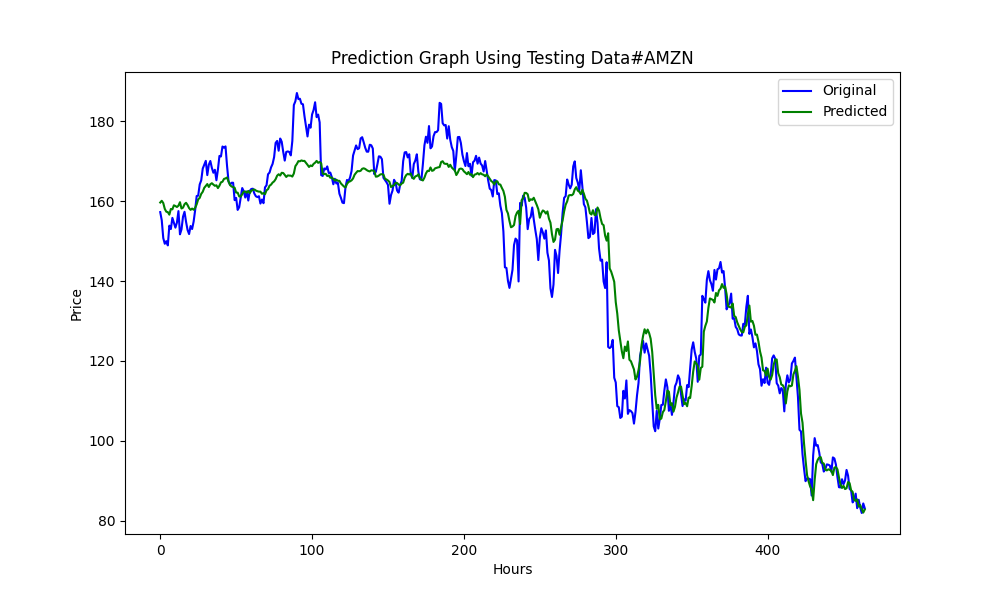

# python libraries import MetaTrader5 as mt5 import tensorflow as tf import numpy as np import pandas as pd import tf2onnx # input parameters inp_history_size = 120 sample_size = 120*20 symbol = "AUDUSD" optional = "D1" inp_model_name = str(symbol)+"_"+str(optional)+".onnx" if not mt5.initialize(): print("initialize() failed, error code =",mt5.last_error()) quit() # we will save generated onnx-file near the our script to use as resource from sys import argv data_path=argv[0] last_index=data_path.rfind("\\")+1 data_path=data_path[0:last_index] print("data path to save onnx model",data_path) # and save to MQL5\Files folder to use as file terminal_info=mt5.terminal_info() file_path=terminal_info.data_path+"\\MQL5\\Files\\" print("file path to save onnx model",file_path) # set start and end dates for history data from datetime import timedelta, datetime #end_date = datetime.now() end_date = datetime(2023, 1, 1, 0) start_date = end_date - timedelta(days=inp_history_size*20) # print start and end dates print("data start date =",start_date) print("data end date =",end_date) # get rates eurusd_rates = mt5.copy_rates_from(symbol, mt5.TIMEFRAME_D1, end_date, sample_size) # create dataframe df = pd.DataFrame(eurusd_rates) # get close prices only data = df.filter(['close']).values # scale data from sklearn.preprocessing import MinMaxScaler scaler=MinMaxScaler(feature_range=(0,1)) scaled_data = scaler.fit_transform(data) # training size is 80% of the data training_size = int(len(scaled_data)*0.80) print("Training_size:",training_size) train_data_initial = scaled_data[0:training_size,:] test_data_initial = scaled_data[training_size:,:1] # split a univariate sequence into samples def split_sequence(sequence, n_steps): X, y = list(), list() for i in range(len(sequence)): # find the end of this pattern end_ix = i + n_steps # check if we are beyond the sequence if end_ix > len(sequence)-1: break # gather input and output parts of the pattern seq_x, seq_y = sequence[i:end_ix], sequence[end_ix] X.append(seq_x) y.append(seq_y) return np.array(X), np.array(y) # split into samples time_step = inp_history_size x_train, y_train = split_sequence(train_data_initial, time_step) x_test, y_test = split_sequence(test_data_initial, time_step) # reshape input to be [samples, time steps, features] which is required for LSTM x_train =x_train.reshape(x_train.shape[0],x_train.shape[1],1) x_test = x_test.reshape(x_test.shape[0],x_test.shape[1],1) # define model from keras.models import Sequential from keras.layers import Dense, Activation, Conv1D, MaxPooling1D, Dropout, Flatten, LSTM from keras.metrics import RootMeanSquaredError as rmse from tensorflow.keras import callbacks model = Sequential() model.add(Conv1D(filters=256, kernel_size=2, activation='relu',padding = 'same',input_shape=(inp_history_size,1))) model.add(MaxPooling1D(pool_size=2)) model.add(LSTM(100, return_sequences = True)) model.add(Dropout(0.3)) model.add(LSTM(100, return_sequences = False)) model.add(Dropout(0.3)) model.add(Dense(units=1, activation = 'sigmoid')) model.compile(optimizer='adam', loss= 'mse' , metrics = [rmse()]) # Set up early stopping early_stopping = callbacks.EarlyStopping( monitor='val_loss', patience=20, restore_best_weights=True, ) # model training for 300 epochs history = model.fit(x_train, y_train, epochs = 300 , validation_data = (x_test,y_test), batch_size=32, callbacks=[early_stopping], verbose=2) # evaluate training data train_loss, train_rmse = model.evaluate(x_train,y_train, batch_size = 32) print(f"train_loss={train_loss:.3f}") print(f"train_rmse={train_rmse:.3f}") # evaluate testing data test_loss, test_rmse = model.evaluate(x_test,y_test, batch_size = 32) print(f"test_loss={test_loss:.3f}") print(f"test_rmse={test_rmse:.3f}") # save model to ONNX output_path = data_path+inp_model_name onnx_model = tf2onnx.convert.from_keras(model, output_path=output_path) print(f"saved model to {output_path}") output_path = file_path+inp_model_name onnx_model = tf2onnx.convert.from_keras(model, output_path=output_path) print(f"saved model to {output_path}") # finish mt5.shutdown() #prediction using testing data #prediction using testing data test_predict = model.predict(x_test) print(test_predict) print("longitud total de la prediccion: ", len(test_predict)) print("longitud total del sample: ", sample_size) plot_y_test = np.array(y_test).reshape(-1, 1) # Selecciona solo el último elemento de cada muestra de prueba plot_y_train = y_train.reshape(-1,1) train_predict = model.predict(x_train) #print(plot_y_test) #calculate metrics from sklearn import metrics from sklearn.metrics import r2_score #transform data to real values value1=scaler.inverse_transform(plot_y_test) #print(value1) # Escala las predicciones inversas al transformarlas a la escala original value2 = scaler.inverse_transform(test_predict.reshape(-1, 1)) #print(value2) #calc score score = np.sqrt(metrics.mean_squared_error(value1,value2)) print("RMSE : {}".format(score)) print("MSE :", metrics.mean_squared_error(value1,value2)) print("R2 score :",metrics.r2_score(value1,value2)) #sumarize model model.summary() #Print error value11=pd.DataFrame(value1) value22=pd.DataFrame(value2) #print(value11) #print(value22) value111=value11.iloc[:,:] value222=value22.iloc[:,:] print("longitud salida (tandas de 1 hora): ",len(value111) ) print("en horas son " + str((len(value111))*60*24)+ " minutos") print("en horas son " + str(((len(value111)))*60*24/60)+ " horas") print("en horas son " + str(((len(value111)))*60*24/60/24)+ " dias") # Calculate error error = value111 - value222 import matplotlib.pyplot as plt # Plot error plt.figure(figsize=(10, 6)) plt.scatter(range(len(error)), error, color='blue', label='Error') plt.axhline(y=0, color='red', linestyle='--', linewidth=1) # Línea horizontal en y=0 plt.title('Error de Predicción ' + str(symbol)) plt.xlabel('Índice de la muestra') plt.ylabel('Error') plt.legend() plt.grid(True) plt.savefig(str(symbol)+str(optional)+'.png') rmse_ = format(score) mse_ = metrics.mean_squared_error(value1,value2) r2_ = metrics.r2_score(value1,value2) resultados= [rmse_,mse_,r2_] # Abre un archivo en modo escritura with open(str(symbol)+str(optional)+"results.txt", "w") as archivo: # Escribe cada resultado en una línea separada for resultado in resultados: archivo.write(str(resultado) + "\n") # finish mt5.shutdown() #show iteration-rmse graph for training and validation plt.figure(figsize = (18,10)) plt.plot(history.history['root_mean_squared_error'],label='Training RMSE',color='b') plt.plot(history.history['val_root_mean_squared_error'],label='Validation-RMSE',color='g') plt.xlabel("Iteration") plt.ylabel("RMSE") plt.title("RMSE" + str(symbol)) plt.legend() plt.savefig(str(symbol)+str(optional)+'1.png') #show iteration-loss graph for training and validation plt.figure(figsize = (18,10)) plt.plot(history.history['loss'],label='Training Loss',color='b') plt.plot(history.history['val_loss'],label='Validation-loss',color='g') plt.xlabel("Iteration") plt.ylabel("Loss") plt.title("LOSS" + str(symbol)) plt.legend() plt.savefig(str(symbol)+str(optional)+'2.png') #show actual vs predicted (training) graph plt.figure(figsize=(18,10)) plt.plot(scaler.inverse_transform(plot_y_train),color = 'b', label = 'Original') plt.plot(scaler.inverse_transform(train_predict),color='red', label = 'Predicted') plt.title("Prediction Graph Using Training Data" + str(symbol)) plt.xlabel("Hours") plt.ylabel("Price") plt.legend() plt.savefig(str(symbol)+str(optional)+'3.png') #show actual vs predicted (testing) graph plt.figure(figsize=(18,10)) plt.plot(scaler.inverse_transform(plot_y_test),color = 'b', label = 'Original') plt.plot(scaler.inverse_transform(test_predict),color='g', label = 'Predicted') plt.title("Prediction Graph Using Testing Data" + str(symbol)) plt.xlabel("Hours") plt.ylabel("Price") plt.legend() plt.savefig(str(symbol)+str(optional)+'4.png')

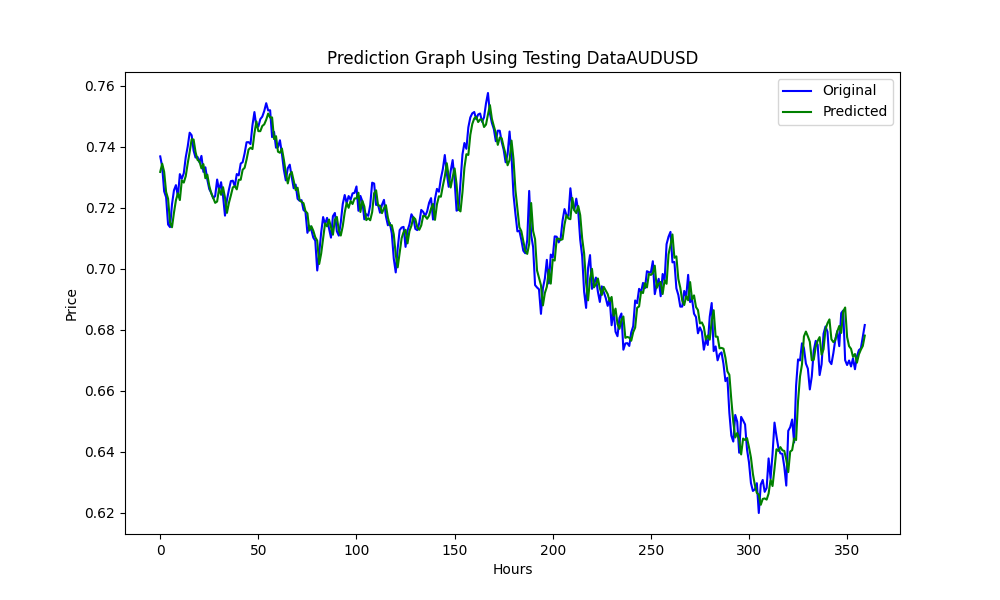

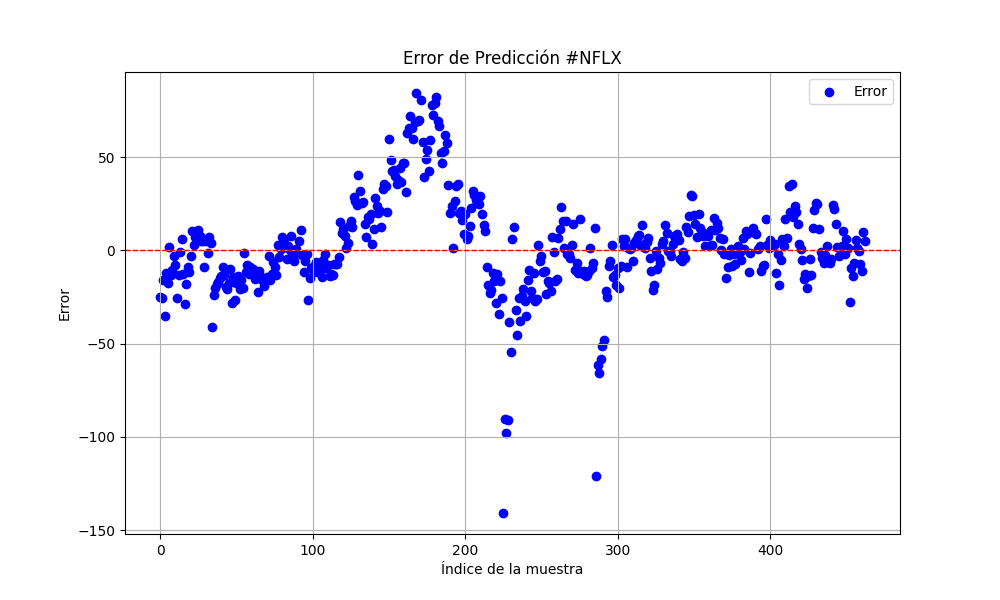

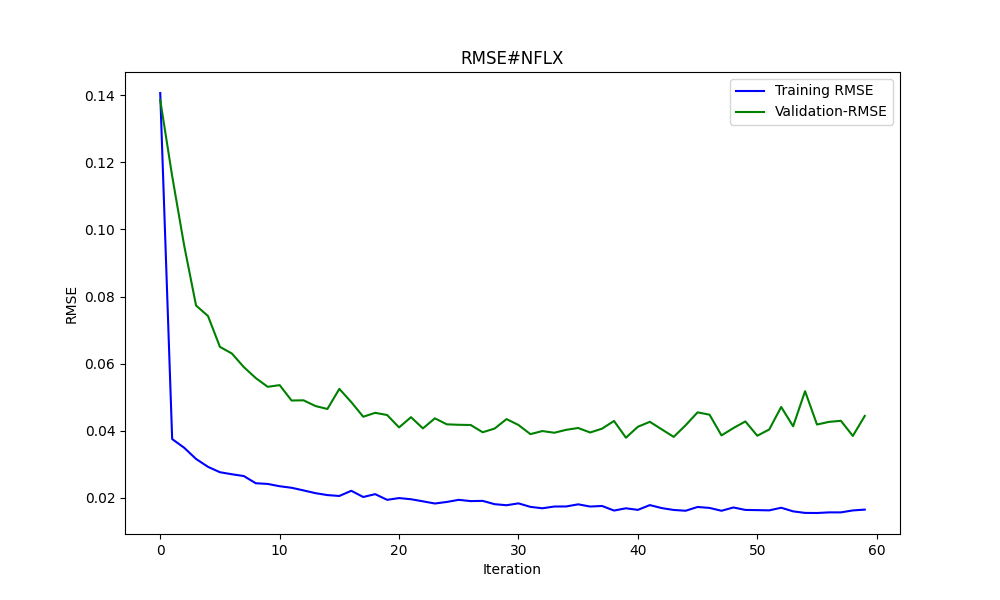

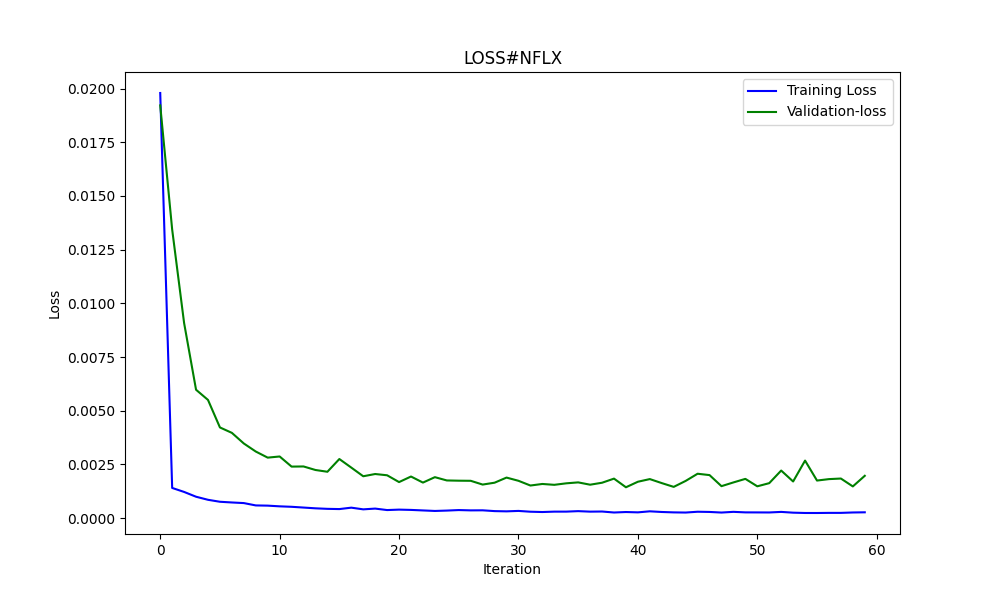

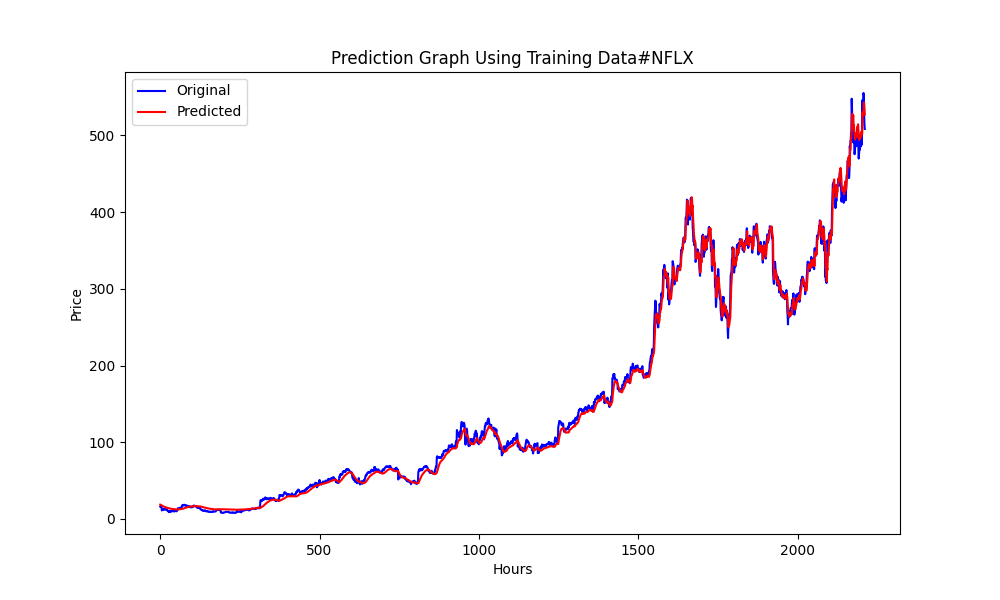

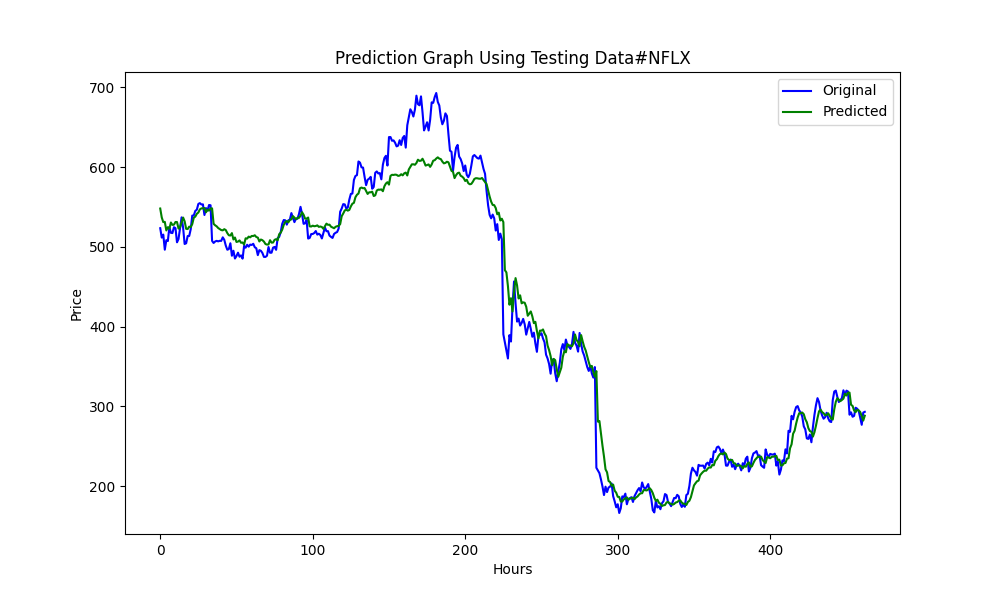

此.py生成ONNX模型和一些图表以及数值,如下所示。我们需要从我们选择的相关性和协整对中选择两个模型:

结果如下

0.005679790676089899 3.226002212419775e-05 0.9670613229880559

这些分别是RMSE、MSE和R2。

使用Python进行反向测试

您可以使用以下.py代码。只需更改策略并检查回溯测试的结果:

import MetaTrader5 as mt5 import pandas as pd from scipy.stats import pearsonr from statsmodels.tsa.stattools import coint import numpy as np # Función para la estrategia de Pairs Trading def pairs_trading_strategy(data0, data1): spread = data0 - data1 short_entry = np.mean(spread) - 2 * np.std(spread) short_exit = np.mean(spread) long_entry = np.mean(spread) + 2 * np.std(spread) long_exit = np.mean(spread) positions = [] for i in range(len(spread)): if spread[i] > long_entry and (not positions or positions[-1][1] != 1): positions.append((spread[i], 1)) elif spread[i] < short_entry and (not positions or positions[-1][1] != -1): positions.append((spread[i], -1)) elif spread[i] < long_exit and positions and positions[-1][1] == 1: positions.append((spread[i], 0)) elif spread[i] > short_exit and positions and positions[-1][1] == -1: positions.append((spread[i], 0)) return positions # Conectar con MetaTrader 5 if not mt5.initialize(): print("No se pudo inicializar MT5") mt5.shutdown() # Obtener la lista de símbolos symbols = mt5.symbols_get() symbols = [s.name for s in symbols if 'EUR' in s.name or 'USD' in s.name] # Filtrar símbolos data = {} for symbol in symbols: rates = mt5.copy_rates_from_pos(symbol, mt5.TIMEFRAME_D1, 0, 365) if rates is not None: df = pd.DataFrame(rates) df['time'] = pd.to_datetime(df['time'], unit='s') # Convertir a datetime df.set_index('time', inplace=True) data[symbol] = df['close'] mt5.shutdown() # Identificar pares cointegrados cointegrated_pairs = [] for i in range(len(symbols)): for j in range(i + 1, len(symbols)): if symbols[i] in data and symbols[j] in data: common_index = data[symbols[i]].index.intersection(data[symbols[j]].index) if len(common_index) > 30: corr, _ = pearsonr(data[symbols[i]][common_index], data[symbols[j]][common_index]) if abs(corr) > 0.8: score, p_value, _ = coint(data[symbols[i]][common_index], data[symbols[j]][common_index]) if p_value < 0.05: cointegrated_pairs.append((symbols[i], symbols[j], corr, p_value)) print(cointegrated_pairs) # Ejecutar estrategia de Pairs Trading para pares cointegrados for sym1, sym2, _, _ in cointegrated_pairs: positions = [] df0 = data[sym1] df1 = data[sym2] positions = pairs_trading_strategy(df0.values, df1.values) print(f'Backtesting completed for pair: {sym1} - {sym2}') print('Positions:', positions)

使用MT5策略测试器进行反向测试

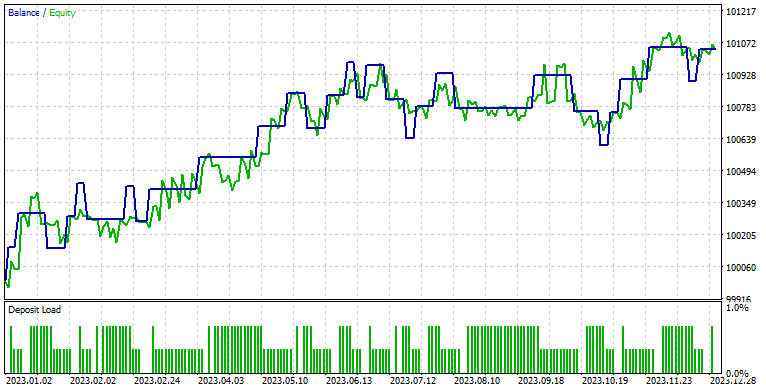

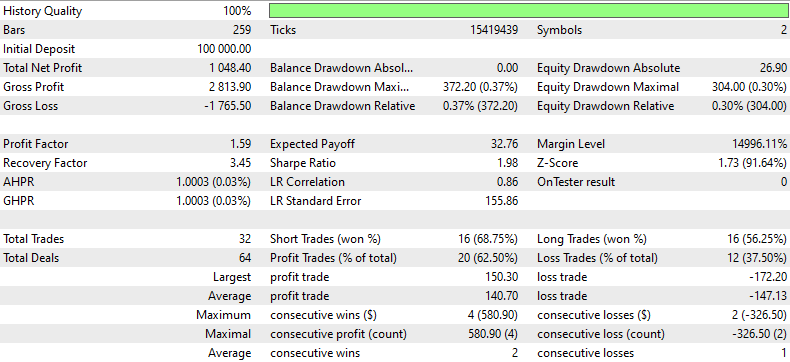

一旦我们有了ONNX模型,就可以运行EA了。我选择了一个简单的策略,但你可以选择任何你想要的或需要的策略。如果你愿意展示你的策略及其结果,我也很欢迎。

当我第一次自行操作时,NZDUSD和AUDUSD是协整且相关的,但此刻它们没有通过筛选(协整度小于0.05)。为了教学目的,也为了避免再次创建ONNX模型,我将继续使用这两个交易品类。

//+------------------------------------------------------------------+ //| Hybrid Arbitrage_Statistic ONNX.mq5| //| Copyright 2024, Javier S. Gastón de Iriarte Cabrera. | //| https://www.mql5.com/en/users/jsgaston/news | //+------------------------------------------------------------------+ #property copyright "Copyright 2024, Javier S. Gastón de Iriarte Cabrera." #property link "https://www.mql5.com/en/users/jsgaston/news" #property version "1.00" #property strict #include <Trade\Trade.mqh> input double lotSize = 0.1; //input double slippage = 3; input double stopLoss = 1500; input double takeProfit = 1500; //input double maxSpreadPoints = 10.0; #resource "/Files/art/hybrid/NZDUSD_D1.onnx" as uchar ExtModel[] #resource "/Files/art/hybrid/AUDUSD_D1.onnx" as uchar ExtModel2[] #define SAMPLE_SIZE 120 string symbol1 = _Symbol; input string symbol2 = "AUDUSD"; ulong ticket1 = 0; ulong ticket2 = 0; input bool isArbitrageActive = true; CTrade ExtTrade; double spreads[1000]; // Array para almacenar hasta 1000 spreads int spreadIndex = 0; // Índice para el próximo spread a almacenar long ExtHandle=INVALID_HANDLE; //int ExtPredictedClass=-1; datetime ExtNextBar=0; datetime ExtNextDay=0; float ExtMin=0.0; float ExtMax=0.0; long ExtHandle2=INVALID_HANDLE; //int ExtPredictedClass=-1; datetime ExtNextBar2=0; datetime ExtNextDay2=0; float ExtMin2=0.0; float ExtMax2=0.0; float predicted=0.0; float predicted2=0.0; float lastPredicted1=0.0; float lastPredicted2=0.0; int Order=0; //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { Print("EA de arbitraje ONNX iniciado"); //--- create a model from static buffer ExtHandle=OnnxCreateFromBuffer(ExtModel,ONNX_DEFAULT); if(ExtHandle==INVALID_HANDLE) { Print("OnnxCreateFromBuffer error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the input tensor we must set them explicitly //--- first index - batch size, second index - series size, third index - number of series (only Close) const long input_shape[] = {1,SAMPLE_SIZE,1}; if(!OnnxSetInputShape(ExtHandle,ONNX_DEFAULT,input_shape)) { Print("OnnxSetInputShape error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the output tensor we must set them explicitly //--- first index - batch size, must match the batch size of the input tensor //--- second index - number of predicted prices (we only predict Close) const long output_shape[] = {1,1}; if(!OnnxSetOutputShape(ExtHandle,0,output_shape)) { Print("OnnxSetOutputShape error ",GetLastError()); return(INIT_FAILED); } //--- create a model from static buffer ExtHandle2=OnnxCreateFromBuffer(ExtModel2,ONNX_DEFAULT); if(ExtHandle2==INVALID_HANDLE) { Print("OnnxCreateFromBuffer error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the input tensor we must set them explicitly //--- first index - batch size, second index - series size, third index - number of series (only Close) const long input_shape2[] = {1,SAMPLE_SIZE,1}; if(!OnnxSetInputShape(ExtHandle2,ONNX_DEFAULT,input_shape2)) { Print("OnnxSetInputShape error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the output tensor we must set them explicitly //--- first index - batch size, must match the batch size of the input tensor //--- second index - number of predicted prices (we only predict Close) const long output_shape2[] = {1,1}; if(!OnnxSetOutputShape(ExtHandle2,0,output_shape2)) { Print("OnnxSetOutputShape error ",GetLastError()); return(INIT_FAILED); } return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { if(ExtHandle!=INVALID_HANDLE) { OnnxRelease(ExtHandle); ExtHandle=INVALID_HANDLE; } if(ExtHandle2!=INVALID_HANDLE) { OnnxRelease(ExtHandle2); ExtHandle2=INVALID_HANDLE; } } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- check new day if(TimeCurrent()>=ExtNextDay) { GetMinMax(); GetMinMax2(); //--- set next day time ExtNextDay=TimeCurrent(); ExtNextDay-=ExtNextDay%PeriodSeconds(PERIOD_D1); ExtNextDay+=PeriodSeconds(PERIOD_D1); /*ExtTrade.PositionClose(symbol1); ExtTrade.PositionClose(symbol2); ticket1 = 0; ticket2 = 0;*/ } //--- check new bar if(TimeCurrent()<ExtNextBar) { return; } //--- set next bar time ExtNextBar=TimeCurrent(); ExtNextBar-=ExtNextBar%PeriodSeconds(); ExtNextBar+=PeriodSeconds(); //--- check min and max float close=(float)iClose(symbol1,PERIOD_D1,0); if(ExtMin>close) ExtMin=close; if(ExtMax<close) ExtMax=close; float close2=(float)iClose(symbol2,PERIOD_D1,0); if(ExtMin2>close2) ExtMin2=close2; if(ExtMax2<close2) ExtMax2=close2; lastPredicted1=predicted; lastPredicted2=predicted2; //--- predict next price PredictPrice(); PredictPrice2(); if(!isArbitrageActive || ArePositionsOpen()) { Print("Arbitraje inactivo o ya hay posiciones abiertas."); return; } double price1 = SymbolInfoDouble(symbol1, SYMBOL_BID); double price2 = SymbolInfoDouble(symbol2, SYMBOL_ASK); double currentSpread = MathAbs(price1 - price2); Print("current spread ", currentSpread); Print("Price1 ",price1); Print("Price2 ",price2); Print("PricePredicted1 ",predicted); Print("PricePredicted2 ",predicted2); Print("Last PricePredicted1 ",lastPredicted1); Print("Last PricePredicted2 ",lastPredicted2); double predictedSpread = MathAbs(predicted - predicted2); Print("Predicted spread ", predictedSpread); double LastpredictedSpread = MathAbs(lastPredicted1 - lastPredicted2); Print("Last Predicted spread ", LastpredictedSpread); // Almacenar el spread actual en el array y actualizar el índice spreads[spreadIndex % 1000] = currentSpread; spreadIndex++; // Verifica si hay suficientes datos para calcular la desviación estándar int count = MathMin(spreadIndex, 1000); // Utiliza todos los datos disponibles hasta 1000 double stdDevSpread = CalculateStdDev(spreads, 0, count); //Print("StdDevSpread ", stdDevSpread); // Verifica si el spread es lo suficientemente bajo para el arbitraje if(LastpredictedSpread< currentSpread) { // Inicia el arbitraje si aún no está activo if(isArbitrageActive) { //Print("max spread : ",maxSpreadPoints * _Point); double meanSpread = (lastPredicted1 + lastPredicted2) / 2.0; Print("mean spread: ",meanSpread); double stdDevSpread = CalculateStdDev(spreads, 0, ArraySize(spreads)); Print("StdDevSpread ", stdDevSpread); double shortEntry = meanSpread - 2 * stdDevSpread ; double shortExit = meanSpread; double longEntry = meanSpread + 2 * stdDevSpread ; double longExit = meanSpread; Print("Long Entry: ", longEntry, " Short Entry: ", shortEntry); // Comprueba si la condición de entrada corta se cumple para el arbitraje if(price1 < shortEntry && (ticket1 == 0 || ticket2 == 0)) { Print("Preparando para abrir órdenes"); Order = 1; Print("Error al abrir posiciones de arbitraje: ", GetLastError()); ticket1 = ExtTrade.PositionOpen(symbol1, ORDER_TYPE_BUY, lotSize, price1, price1 - stopLoss * _Point, price1 + takeProfit * _Point, "Arbitraje"); ticket2 = ExtTrade.PositionOpen(symbol2, ORDER_TYPE_SELL, lotSize, price2, price2 + stopLoss * _Point, price2 - takeProfit * _Point, "Arbitraje"); ticket1=0; ticket2=0; } else if(price2 < shortEntry && (ticket1 == 0 || ticket2 == 0)) { Print("Preparando para abrir órdenes"); Order = 2; Print("Error al abrir posiciones de arbitraje: ", GetLastError()); ticket1 = ExtTrade.PositionOpen(symbol1, ORDER_TYPE_SELL, lotSize, price1, price1 + stopLoss * _Point, price1 - takeProfit * _Point, "Arbitraje"); ticket2 = ExtTrade.PositionOpen(symbol2, ORDER_TYPE_BUY, lotSize, price2, price2 - stopLoss * _Point, price2 + takeProfit * _Point, "Arbitraje"); ticket1=0; ticket2=0; } else if(price1 > longEntry && (ticket1 == 0 || ticket2 == 0)) { Print("Preparando para abrir órdenes"); Order = 3; Print("Error al abrir posiciones de arbitraje: ", GetLastError()); ticket1 = ExtTrade.PositionOpen(symbol1, ORDER_TYPE_SELL, lotSize, price1, price1 + stopLoss * _Point, price1 - takeProfit * _Point, "Arbitraje"); ticket2 = ExtTrade.PositionOpen(symbol2, ORDER_TYPE_BUY, lotSize, price2, price2 - stopLoss * _Point, price2 + takeProfit * _Point, "Arbitraje"); ticket1=0; ticket2=0; } else if(price2 > longEntry && (ticket1 == 0 || ticket2 == 0)) { Print("Preparando para abrir órdenes"); Order = 4; Print("Error al abrir posiciones de arbitraje: ", GetLastError()); ticket1 = ExtTrade.PositionOpen(symbol1, ORDER_TYPE_BUY, lotSize, price1, price1 - stopLoss * _Point, price1 + takeProfit * _Point, "Arbitraje"); ticket2 = ExtTrade.PositionOpen(symbol2, ORDER_TYPE_SELL, lotSize, price2, price2 + stopLoss * _Point, price2 - takeProfit * _Point, "Arbitraje"); ticket1=0; ticket2=0; } } } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ double meanSpread = (lastPredicted1 + lastPredicted2) / 2.0; //Print("mean spread: ",meanSpread); double stdDevSpread2 = CalculateStdDev(spreads, 0, ArraySize(spreads)); //Print("StdDevSpread ", stdDevSpread); double shortEntry = meanSpread - 2 * stdDevSpread2 ; double shortExit = meanSpread; double longEntry = meanSpread + 2 * stdDevSpread2 ; double longExit = meanSpread; if((price2 < longExit && ticket2 != 0 && Order==4) || (price1 > shortExit && ticket1 != 0 && Order==1) || (price2 > shortExit && ticket1 != 0 && Order==2) || (price1 < longExit && ticket2 != 0 && Order==3)) { ExtTrade.PositionClose(ticket1); ExtTrade.PositionClose(ticket2); ticket1 = 0; ticket2 = 0; Print("Arbitraje detenido - Cerrando órdenes"); } } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ double CalculateStdDev(double &data[], int start, int count) { double sum = 0; double sumSq = 0; for(int i = start; i < start + count; i++) { sum += data[i]; sumSq += data[i] * data[i]; } double mean = sum / count; double variance = (sumSq / count) - (mean * mean); return MathSqrt(variance); } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ bool ArePositionsOpen() { // Check for positions on symbol1 if(PositionSelect(symbol1) && PositionGetDouble(POSITION_VOLUME) > 0) return true; // Check for positions on symbol2 if(PositionSelect(symbol2) && PositionGetDouble(POSITION_VOLUME) > 0) return true; return false; } //+------------------------------------------------------------------+ void PredictPrice(void) { static vectorf output_data(1); // vector to get result static vectorf x_norm(SAMPLE_SIZE); // vector for prices normalize //--- check for normalization possibility if(ExtMin>=ExtMax) { Print("ExtMin>=ExtMax"); //ExtPredictedClass=-1; return; } //--- request last bars if(!x_norm.CopyRates(_Symbol,PERIOD_D1,COPY_RATES_CLOSE,1,SAMPLE_SIZE)) { Print("CopyRates ",x_norm.Size()); //ExtPredictedClass=-1; return; } float last_close=x_norm[SAMPLE_SIZE-1]; //--- normalize prices x_norm-=ExtMin; x_norm/=(ExtMax-ExtMin); //--- run the inference if(!OnnxRun(ExtHandle,ONNX_NO_CONVERSION,x_norm,output_data)) { Print("OnnxRun"); //ExtPredictedClass=-1; return; } //--- denormalize the price from the output value predicted=output_data[0]*(ExtMax-ExtMin)+ExtMin; //return predicted; } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ void PredictPrice2(void) { static vectorf output_data2(1); // vector to get result static vectorf x_norm2(SAMPLE_SIZE); // vector for prices normalize //--- check for normalization possibility if(ExtMin2>=ExtMax2) { Print("ExtMin2>=ExtMax2"); //ExtPredictedClass=-1; return; } //--- request last bars if(!x_norm2.CopyRates(symbol2,PERIOD_D1,COPY_RATES_CLOSE,1,SAMPLE_SIZE)) { Print("CopyRates ",x_norm2.Size()); //ExtPredictedClass=-1; return; } float last_close2=x_norm2[SAMPLE_SIZE-1]; //--- normalize prices x_norm2-=ExtMin2; x_norm2/=(ExtMax2-ExtMin2); //--- run the inference if(!OnnxRun(ExtHandle2,ONNX_NO_CONVERSION,x_norm2,output_data2)) { Print("OnnxRun"); //ExtPredictedClass=-1; return; } //--- denormalize the price from the output value predicted2=output_data2[0]*(ExtMax2-ExtMin2)+ExtMin2; //--- classify predicted price movement //return predicted2; } //+------------------------------------------------------------------+ //| Get minimal and maximal Close for last 120 days | //+------------------------------------------------------------------+ void GetMinMax(void) { vectorf close; close.CopyRates(_Symbol,PERIOD_D1,COPY_RATES_CLOSE,0,SAMPLE_SIZE); ExtMin=close.Min(); ExtMax=close.Max(); } //+------------------------------------------------------------------+ //| Get minimal and maximal Close for last 120 days | //+------------------------------------------------------------------+ void GetMinMax2(void) { vectorf close2; close2.CopyRates(symbol2,PERIOD_D1,COPY_RATES_CLOSE,0,SAMPLE_SIZE); ExtMin2=close2.Min(); ExtMax2=close2.Max(); }

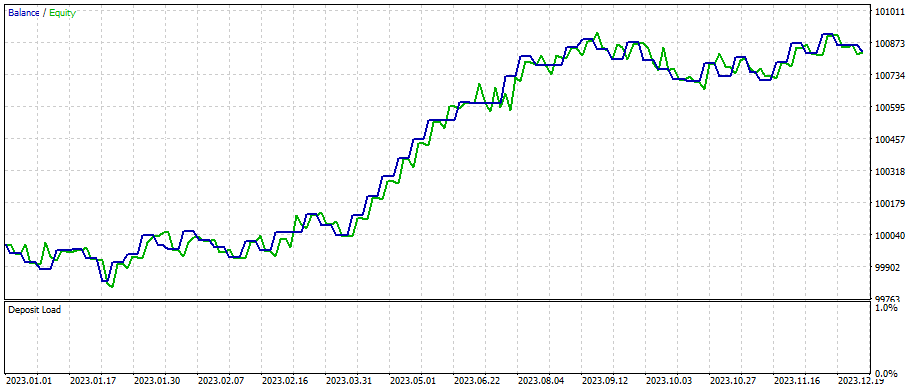

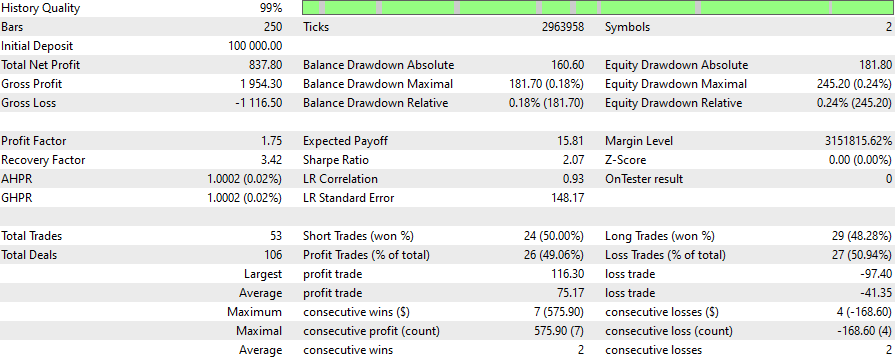

这些是NZDUSD与AUDUSD在1分钟时段内的结果,而ONNX模型为1天时段,SL为1500点,TP为1500点,模型预测时间为2023年1月1日至2024年1月初:

如需重新选择其它对,请更改此行:

symbols = [s.name for s in symbols if s.name.startswith('EUR') or s.name.startswith('USD') or s.name.endswith('USD')]

案例研究2

套利在股票交易领域很常用,这就是为什么我觉得用纳斯达克的对冲组合来做另一个例子会很有意思。

对我而言,我修改了这一行:

symbols = [s.name for s in symbols if s.name.startswith('EUR') or s.name.startswith('USD') or s.name.endswith('USD')]

对此:

# Crea un DataFrame con la información completa de los símbolos

symbols_df = pd.DataFrame([{'Symbol': symbol.name, 'Path': symbol.path} for symbol in all_symbols])

# Filtra adicionalmente para obtener solo los CFDs de NASDAQ

# Asumiendo que los CFDs tienen un identificador único en el 'Path'

nasdaq_group4_df = symbols_df[symbols_df['Path'].str.contains('NASDAQ')]

# Filtra aún más para obtener solo los símbolos que NO contienen '.'

nasdaq_group4_df3 = nasdaq_group4_df[nasdaq_group4_df['Symbol'].str.contains('#')]

nasdaq_group4_df2 = nasdaq_group4_df3[~nasdaq_group4_df3['Symbol'].str.contains('\.')]

# Ahora, obtenemos la lista de símbolos filtrados

filtered_symbols = nasdaq_group4_df2['Symbol'].tolist()

# Descargar datos históricos y almacenar en un diccionario

symbols = filtered_symbols 这就是配对过滤之处:

(在那里,有太多的配对是协整和相关的,我不得不改变剧本。我修改了.py脚本,以csv格式打印出来。)

更改:

# Filtrar y guardar solo los pares cointegrados con p-valor menor de 0.05 en un archivo CSV

result_df = pd.DataFrame(cointegrated_pairs, columns=['Symbol1', 'Symbol2', 'Correlation', 'Cointegration P-value'])

result_df.to_csv('cointegrated_pairs.csv', index=False)

# Imprimir el total de pares cointegrados

print(f'Total de pares con fuerte correlación y cointegrados: {len(cointegrated_pairs)}') 您已经从纳斯达克中筛选出了这些股票对(附上了包含结果的Excel文件)。

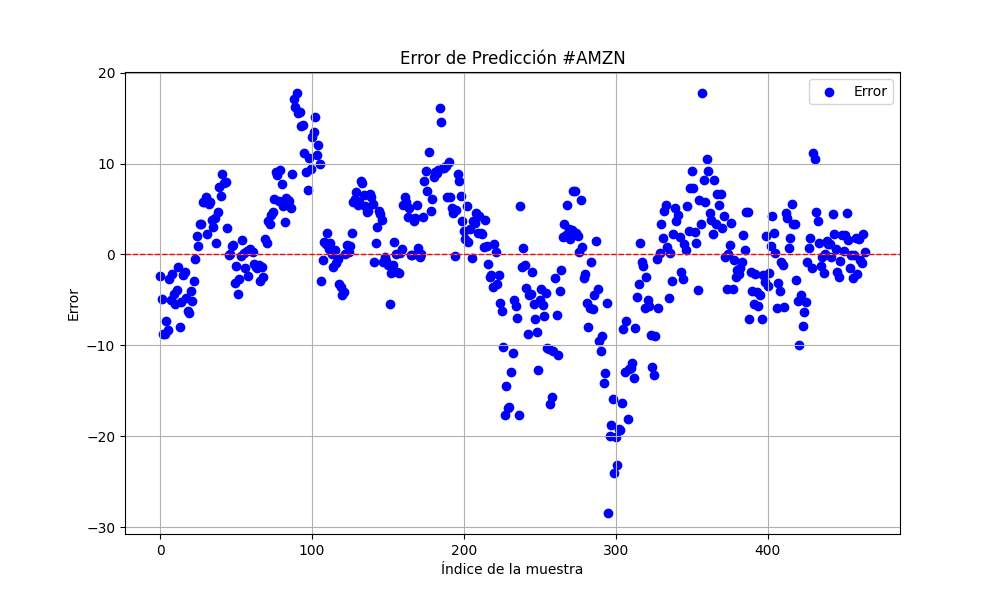

从现在开始,我将继续使用Amazon和Netflix这两个股票对,同时使用预测从2023年1月1日至2024年1月1日的模型。

#AMZN #NFLX 0.966605859 0.021683012

为了获得更好的结果,将样本量扩大了三倍。

sample_size = 120*25*3

结果如下:

6.856399020501732 47.010207528337105 0.9395402850007741

25.975755379462548 674.7398675336775 0.9735838717570285

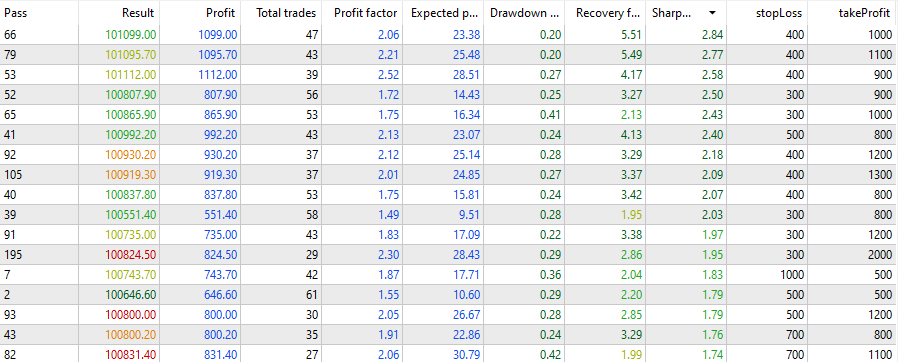

止损400止盈800

之后我对止损和止盈做出了微调。这就是我们通过快速优化得到的结果:

所有脚本、ONNX模型以及与EA相关的内容都已附在本文中。您可以根据需要下载,系统且科学地运用它们来获得您的分析结果。您需要根据自己需要的日期来创建新的ONNX模型(记得在训练用的.py文件中更改日期),并同时在策略测试器中更改日期。例如:针对D1时间段的ONNX模型,以及最多使用120*3*25条数据,这些数据可以覆盖一年多的时间(但如果我是您,我会选择每周或每月创建一次模型)。

请记住,这只是一个策略及示例,并不是一个即插即用的交易EA,而且您可能永远无法通过互联网免费找到一个像这样的EA。

结论

我们已经掌握了如何使用相关性和协整性,并创建了皮尔逊系数指标和基于预测进行套利交易的EA。当使用来自.py筛选器的正确配对时,可以获得更好的结果。您可以通过微调止损(SL)和止盈(TP)来获得更好的结果,并使策略更加复杂以提高收益。

请记住将ONNX模型保存在MQL5/Files文件夹中,将mq5指标保存在Indicator文件夹中,将EA保存在Experts文件夹中。

本文由MetaQuotes Ltd译自英文

原文地址: https://www.mql5.com/en/articles/14846

注意: MetaQuotes Ltd.将保留所有关于这些材料的权利。全部或部分复制或者转载这些材料将被禁止。

本文由网站的一位用户撰写,反映了他们的个人观点。MetaQuotes Ltd 不对所提供信息的准确性负责,也不对因使用所述解决方案、策略或建议而产生的任何后果负责。

Python中的虚假回归(伪回归)

Python中的虚假回归(伪回归)

一步步学习如何利用公允价值缺口(FVG)或市场不平衡性来交易的策略:一种“聪明资金”的交易方法

一步步学习如何利用公允价值缺口(FVG)或市场不平衡性来交易的策略:一种“聪明资金”的交易方法

开发多币种 EA 交易(第 6 部分):自动选择实例组

开发多币种 EA 交易(第 6 部分):自动选择实例组