Reverse MACD MT4

- Göstergeler

- Mario Jemic

- Sürüm: 1.1

- Güncellendi: 23 Aralık 2025

- Etkinleştirmeler: 5

Reversing MACD — Indicator Overview

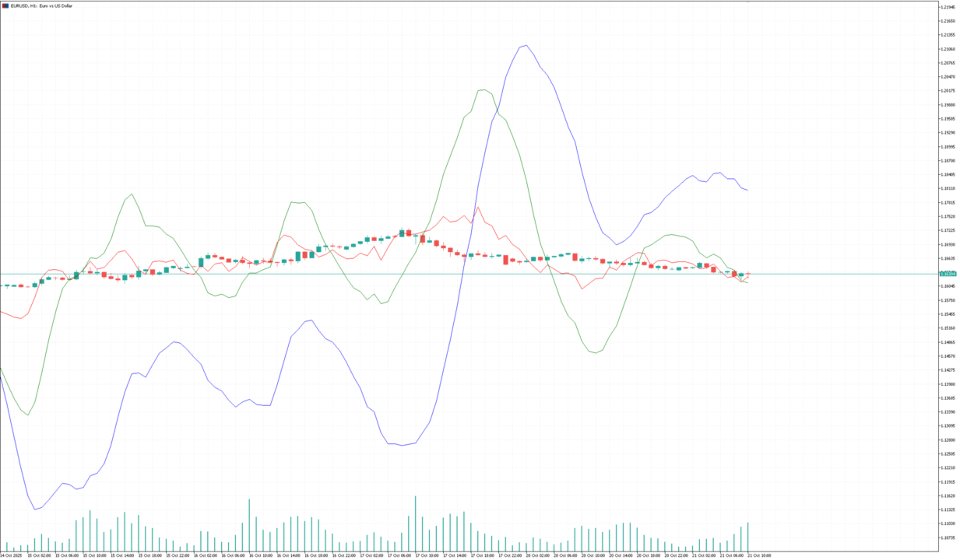

Reversing MACD is a forward-looking analytical tool that calculates the exact price the next bar would need to reach for the MACD line and the signal line to cross on the upcoming candle.

Instead of waiting for a crossover to occur after the fact, the indicator answers a more powerful question:

“At what price will the MACD cross on the very next bar?”

Core Idea Behind the Indicator

Traditional MACD reacts to price changes after they occur.

A trader only sees a confirmed bullish or bearish crossover after enough movement has already happened.

Johnny Doug’s “Reversing MACD” solves this lag by mathematically reversing the MACD formula.

Instead of feeding price into MACD, the indicator works backward:

It solves for the price level that creates the crossover.

This transforms MACD from a reactive indicator into a predictive threshold tool.

What the Indicator Actually Calculates

On every bar, it computes a single price level such that:

-

If the next bar closes above this level →

MACD line will cross above the signal line on the next candle (bullish crossover). -

If the next bar closes below this level →

MACD line will cross below the signal line on the next candle (bearish crossover).

This required price is plotted as a line (or a dynamic level) on the chart.

Why Traders Find It Useful

1. Anticipating Crossovers Before They Happen

Instead of waiting for the MACD to cross, traders can see the exact price that would trigger it.

This gives a major timing advantage.

2. Planning Entries More Intelligently

The threshold level becomes a natural decision point:

-

Break above the level → prepare for bullish momentum.

-

Fall below the level → prepare for bearish pressure.

3. Understanding Market Momentum Requirements

The indicator shows how strong the next bar must be for momentum to shift.

If the required price is unrealistically far away, traders know the crossover is unlikely.

4. Avoiding False Signals from Regular MACD

Because standard MACD signals are delayed, many traders enter late.

Reversing MACD eliminates guesswork by showing the upcoming threshold.

Practical Application

-

Used by swing traders, intraday traders, and algorithmic systems.

-

Helps set conditional orders:

“If price crosses X, momentum flips from bearish to bullish.” -

Works as a momentum pressure gauge — if the threshold converges toward the market, a crossover is imminent.

-

Particularly effective during trend exhaustion, early reversals, and consolidation breakouts.

In Short

Reversing MACD reveals the future price that creates the signal traders usually wait for.

It transforms MACD from reactive to proactive, giving traders a clear numerical threshold for upcoming momentum shifts.