Gold Impulse Scalper M15

- Эксперты

- Christian Villen Fajardo

- Версия: 1.4

- Активации: 10

Impulse-driven execution engine for Gold on M15 🤖🟨

What it does

This EA waits for a true momentum burst—a candle where price moves decisively in one direction. When that candle closes, the system deploys a 3-step plan: a market entry at close and two smart retrace orders. It’s built to be transparent, disciplined, and quick, without martingale or grid.

🚀 How it trades (story of a signal)

-

Spot the impulse

The engine evaluates the finished candle: strong body, clean structure, close near the extreme, and orderly wicks. Optional volatility/flow checks can keep out low-energy moves. -

Deploy the entry array

-

E1: instant market order at the close of the signal bar.

-

E2 & E3: limit orders placed at shallow pullbacks (about a third and a half of the candle). These give you better prices if the trend breathes before continuing. Orders auto-expire if price never returns.

-

-

Manage the exit

-

Stop anchors at the opposite end of the impulse candle (with a protective buffer).

-

Take-profit can be a fixed distance or a clear risk-to-reward objective.

The result: a simple, mechanical path from signal → entries → exit.

-

🧠 Why this approach works for Gold

-

Gold moves in bursts. Clear impulse bars often lead to quick follow-through or neat pullbacks.

-

One bar = one decision. You see exactly why a trade happened—no hidden rules.

-

Stacked entries, not stacked risk. The retrace orders are designed to improve average price, not to chase losses.

-

Tight discipline. Bad candles are filtered; good ones are handled consistently.

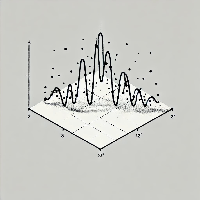

📊 What you’ll see on the chart

-

A clean signal mark on the impulse candle.

-

E1 labeled at bar close; E2/E3 as pending levels on the same candle range.

-

A neat stop line at the far end of the impulse.

-

A simple dashboard readout with status and last bar analysis (pass/fail reasons are logged so tuning is fast).

🧭 Using it day-to-day

-

Attach to XAUUSD, M15 before the session you plan to trade.

-

Keep Algo Trading on and allow live trading in the EA.

-

If you want the market-at-close execution (E1), the EA must be attached before the candle closes.

-

If big candles rarely pull back, extend the pending lifetime so E2/E3 have time to fill.

-

Watch the Experts tab: logs explain each pass/fail so you can refine thresholds with confidence.

🧩 Trade flow example

-

A strong bullish candle prints on M15.

-

At close, E1 Buy executes.

-

Price dips slightly—E2 Buy Limit fills at ~⅓ retrace; if it dips more, E3 fills at ~½ retrace.

-

Price rotates up; partials reach their TP, or the global target completes the cycle.

-

If the impulse fails, the anchored SL at the opposite end limits the risk cleanly.

🔍 What this EA is (and is not)

-

Is: rule-based, transparent, and focused on impulse-and-retrace behavior specific to Gold on M15.

-

Is not: martingale, grid, or a “set and forget forever” black box. It’s a tool you can understand and tune.

📝 Good practice

-

Backtest on your broker’s data with realistic spread/commission.

-

Forward-test on demo before going live.

-

Keep notes on which sessions (e.g., London/NY overlap) your broker executes best.

⚠️ Disclaimer

Trading involves risk. This tool provides a disciplined process, not guarantees. Use responsible position sizing and test thoroughly.