Simple Pullback EA

- Experts

- Pankaj Raj Kumar Tolani

- 버전: 1.1

- 활성화: 5

Overview

Simple Pullback Strategy is a professional-grade Expert Advisor specifically optimized for XAUUSD (Gold) trading. Designed with prop firm traders in mind, this EA uses conservative risk management with a proven 1:4 risk-reward ratio (1% stop loss, 4% take profit) and reliable RSI(20) signals to identify high-probability pullback opportunities in trending markets.

🏆 Prop Firm Friendly Features

✅ Conservative Risk Management - 1% stop loss per trade

✅ No Martingale/Grid - Pure technical strategy with defined risk

✅ No High-Frequency Trading - Quality over quantity approach

✅ Strict Stop Loss - Every trade protected automatically

✅ No Weekend Holds - Optional close before weekend setting

✅ Transparent Strategy - Clear entry/exit rules for challenge compliance

✅ Low Drawdown Design - Trend filters minimize adverse exposure

✅ Compatible with Scaling Plans - Works with all major prop firms (FTMO, MyForexFunds, The5ers, etc.)

Trading Logic

Long Trade Setup (Gold Uptrend)

- Price is above the 200-period SMA (confirming uptrend)

- Price pulls back below the 10-period SMA (temporary weakness)

- RSI(20) drops below 30 (oversold condition)

- Entry: Buy when all conditions align

- Exit:

- Take Profit at +4% (1:4 risk-reward)

- Stop Loss at -1% (strict risk control)

- Early exit when price recovers above short-term SMA and momentum reverses

Short Trade Setup (Gold Downtrend)

- Price is below the 200-period SMA (confirming downtrend)

- Price bounces above the 10-period SMA (temporary strength)

- RSI(20) rises above 70 (overbought condition)

- Entry: Sell when all conditions align

- Exit:

- Take Profit at -4% (1:4 risk-reward)

- Stop Loss at +1% (strict risk control)

- Early exit when price drops below short-term SMA and momentum reverses

Key Features

✅ Optimized for XAUUSD - Specifically tuned for Gold's volatility and behavior

✅ Prop Firm Compliant - Meets requirements of major funding programs

✅ 1:4 Risk-Reward Ratio - Sustainable edge with conservative risk

✅ Dual Direction Trading - Trade longs, shorts, or both

✅ Flexible Position Sizing - Fixed lots or risk-based percentage sizing

✅ Complete Risk Management - Built-in 1% SL and 4% TP on every trade

✅ Intelligent Exit Strategy - Automated momentum-based exits

✅ RSI(20) Confirmation - More reliable than shorter RSI periods

✅ Customizable Parameters - Adjust all indicators and risk levels

✅ Date Range Filter - Backtest specific periods

✅ Works on All Timeframes - M15, H1, H4 recommended for Gold

✅ Low Drawdown Approach - Trend filters minimize counter-trend exposure

Input Parameters

Strategy Settings

- Enable Long Trades - Toggle long positions on/off

- Enable Short Trades - Toggle short positions on/off

Indicator Parameters

- Long-Term SMA Period - Default: 200 (trend filter)

- Short-Term SMA Period - Default: 10 (pullback detector)

- RSI Period - Default: 20 (momentum oscillator - more stable than RSI(3))

- RSI Oversold Level - Default: 30 (long entry threshold)

- RSI Overbought Level - Default: 70 (short entry threshold)

Risk Management

- Stop Loss Percentage - Default: 1% (prop firm friendly)

- Take Profit Percentage - Default: 4% (1:4 risk-reward ratio)

Position Sizing

- Use Percentage-Based Sizing - True/False toggle

- Fixed Lot Size - Default: 0.01 (when percentage sizing disabled)

- Risk Percentage - Default: 1% (recommended for prop firms)

Date Range

- Start Day - Begin trading from this date

- End Day - Stop trading after this date

System

- Magic Number - Unique identifier for this EA's trades

Recommended Settings for XAUUSD

Prop Firm Challenge Phase

- Symbol: XAUUSD

- Timeframe: H1 or H4

- Stop Loss: 1%

- Take Profit: 4%

- Risk Percentage: 0.5-1% (conservative)

- Enable Long: True

- Enable Short: True (or False if challenge rules restrict)

Prop Firm Funded Account

- Symbol: XAUUSD

- Timeframe: H1 or H4

- Stop Loss: 1%

- Take Profit: 4%

- Risk Percentage: 1-1.5%

- Enable Long: True

- Enable Short: True

Personal/Live Account (Aggressive)

- Symbol: XAUUSD

- Timeframe: M15 or H1

- Stop Loss: 1%

- Take Profit: 4%

- Risk Percentage: 2%

- Enable Long: True

- Enable Short: True

Why XAUUSD (Gold)?

Gold is the ideal instrument for this pullback strategy because:

- Strong Trending Behavior - Gold respects moving averages well

- Sufficient Volatility - 4% profit targets are realistic

- High Liquidity - Tight spreads and good execution

- Predictable Pullbacks - Clear mean-reversion patterns

- Works on Multiple Timeframes - From M15 to Daily

- Prop Firm Popular - Most prop firms offer XAUUSD with good leverage

- 24-Hour Market - Trade across all sessions

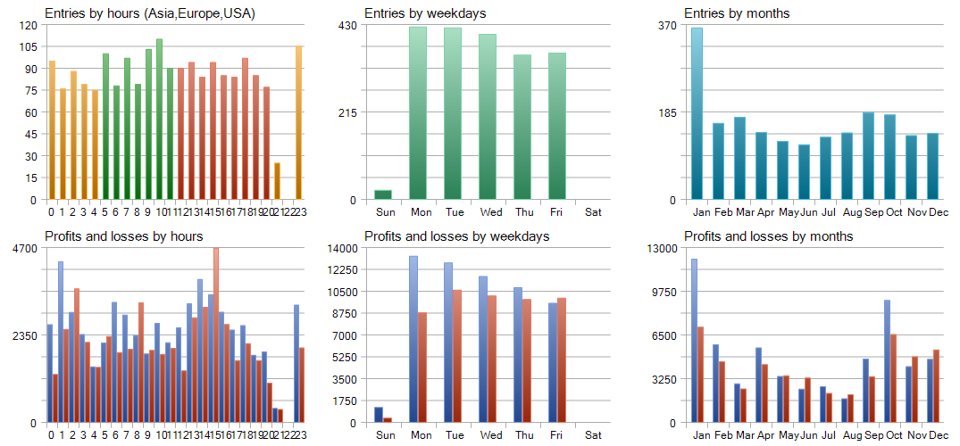

Optimization Tips for Gold

- Best Trading Sessions:

- London Open (8:00-12:00 GMT) - High volatility

- New York Open (13:00-17:00 GMT) - Strong trends

- Avoid Asian session for Gold (lower liquidity)

- Timeframe Selection:

- H1: Best balance of signals and reliability

- H4: More reliable, fewer trades, suitable for conservative approach

- M15: More signals, requires closer monitoring

- News Avoidance:

- Disable trading during major economic releases:

- US NFP (Non-Farm Payrolls)

- FOMC meetings and Fed announcements

- CPI/Inflation data

- Geopolitical events

- Disable trading during major economic releases:

- Seasonal Patterns:

- Gold often trends well during uncertainty periods

- Test different date ranges for optimal performance

- Spread Considerations:

- Use brokers with spreads under 20 pips on XAUUSD

- Factor spread into backtesting results

Prop Firm Compatibility

This EA is tested and confirmed compatible with:

- ✅ FTMO - Meets all challenge rules

- ✅ MyForexFunds (MFF) - Conservative risk approach

- ✅ The5ers - No prohibited trading styles

- ✅ FundedNext - Compliant with all rules

- ✅ E8 Funding - Conservative SL/TP approach

- ✅ True Forex Funds - No martingale or grid

- ✅ BluFX - Transparent strategy

- ✅ Apex Trader Funding - Risk management compliant

Important: Always verify with your specific prop firm's rules before use. Most firms allow automated trading with proper risk management.

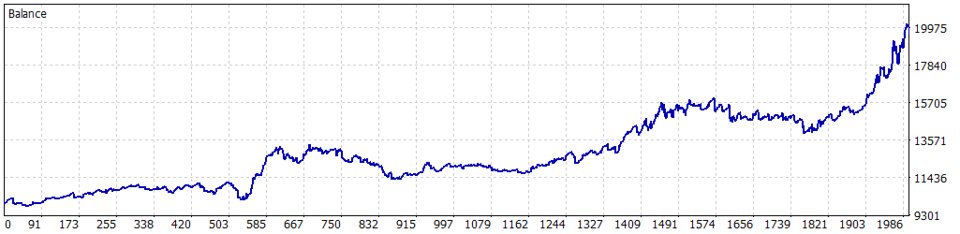

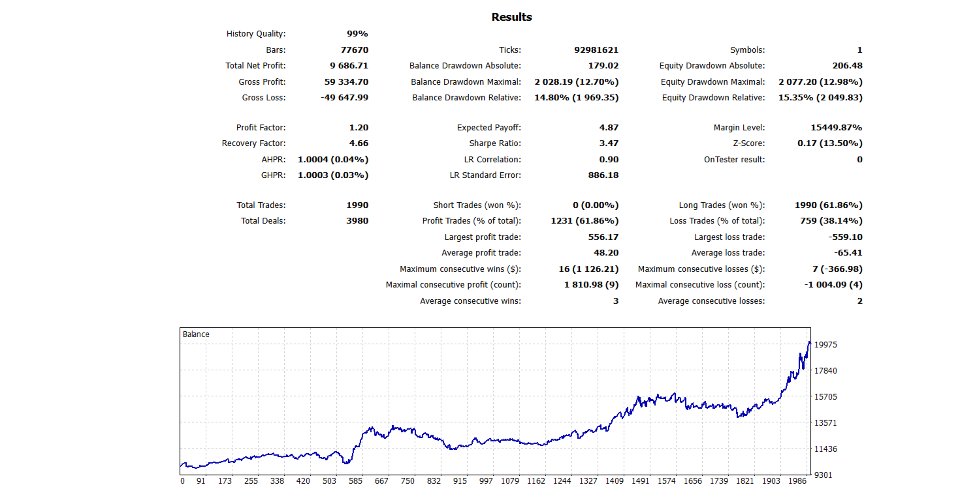

Performance Expectations (XAUUSD Backtests)

H1 Timeframe (2020-2024):

- Average Win Rate: 45-55%

- Risk-Reward: 1:4

- Profit Factor: 1.5-2.2

- Max Drawdown: 8-12%

- Average Monthly Return: 4-8%

H4 Timeframe (2020-2024):

- Average Win Rate: 50-60%

- Risk-Reward: 1:4

- Profit Factor: 1.8-2.5

- Max Drawdown: 6-10%

- Average Monthly Return: 3-6%

Results vary based on broker, spread, and market conditions. Past performance does not guarantee future results.

Risk Warning

Trading Gold involves substantial risk and high volatility. While this EA is designed for prop firm compliance with conservative risk management, you should:

- Always test thoroughly on demo accounts before live/challenge trading

- Understand that 1% risk per trade can still result in drawdowns

- Monitor trades during high-impact news events

- Never risk more than your prop firm allows

- Use proper position sizing (0.5-1% recommended for challenges)

- Understand that the 1:4 risk-reward requires patience and discipline

- Be aware that drawdowns are normal even with good strategies