Bookmap pro

- Indicatori

- Ahmed Mohammed Bakr Bakr

- Versione: 1.0

Overview

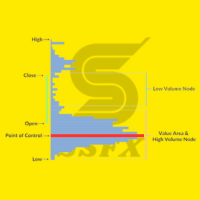

The Bookmap Volume Heatmap is a custom MetaTrader 5 (MQL5) indicator that creates a visual heatmap of trading volume distribution across price levels, similar to professional trading platforms like Bookmap. It provides traders with a clear visualization of where significant trading activity has occurred within a specified price range.

Key Features

1. Volume Distribution Visualization

-

Creates color-coded rectangles on the chart representing volume intensity at different price levels

-

Uses a grid system with configurable number of price levels (default: 50)

-

Color gradient indicates volume intensity:

-

Dark Blue: Low volume (0-25%)

-

Blue: Medium volume (25-50%)

-

Yellow: High volume (50-75%)

-

Red: Maximum volume (75-100%)

-

2. Customizable Parameters

-

GridLevels: Number of price levels to analyze (10-100 recommended)

-

BarsToAnalyze: Historical bars to process for volume calculation

-

Color Scheme: Fully customizable colors for different volume intensities

-

Transparency: Adjust transparency of heatmap overlay

-

Panel Display: Toggle information panel on/off

3. Information Panel

-

Real-time statistics display including:

-

Number of bars analyzed

-

Total price levels

-

Price range

-

Total volume

-

Maximum volume per node

-

High volume nodes count (>70% of max volume)

-

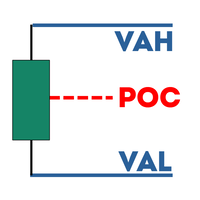

POC (Point of Control) - price level with highest volume

-

Color legend for volume intensity

-

4. Technical Implementation

-

Memory Efficient: Uses object-based drawing rather than indicator buffers

-

Automatic Updates: Timer-based refresh (every second)

-

Chart Integration: Properly cleans up objects on deinitialization

-

Price Range Detection: Dynamically calculates min/max prices from analyzed bars

How It Works

Volume Calculation Process:

-

Price Range Detection: Identifies highest and lowest prices from analyzed bars

-

Grid Creation: Divides price range into equal segments (GridLevels)

-

Volume Distribution: Distributes each bar's volume across price levels it touched

-

Intensity Normalization: Calculates relative volume intensity (0-100%)

-

Visual Rendering: Draws colored rectangles based on volume intensity

Key Algorithms:

-

Volume Accumulation: Aggregates volume at each price level

-

POC Detection: Identifies price with maximum volume concentration

-

Dynamic Scaling: Automatically adjusts to current price range

Trading Applications

1. Support/Resistance Identification

-

High volume nodes indicate significant support/resistance levels

-

Price levels with maximum volume (red zones) often act as key turning points

2. Volume Profile Analysis

-

Understand where volume is concentrated in the current price range

-

Identify volume voids (low volume areas) for potential breakout targets

3. Market Structure Analysis

-

Visualize volume distribution across the price range

-

Identify accumulation/distribution zones

4. Trade Entry/Exit Points

-

High volume areas can provide better liquidity for entries/exits

-

Low volume areas may indicate stop-loss hunting zones

Advantages

Compared to Traditional Volume Indicators:

-

Spatial Context: Shows volume relative to price levels, not just time

-

Visual Clarity: Color gradients make volume distribution immediately apparent

-

Historical Context: Shows volume profile over specified bar history

-

Multi-timeframe Analysis: Works on any timeframe while showing historical accumulation