Limit Levels AM

- Indicatori

- Andrii Matviievskyi

- Versione: 10.0

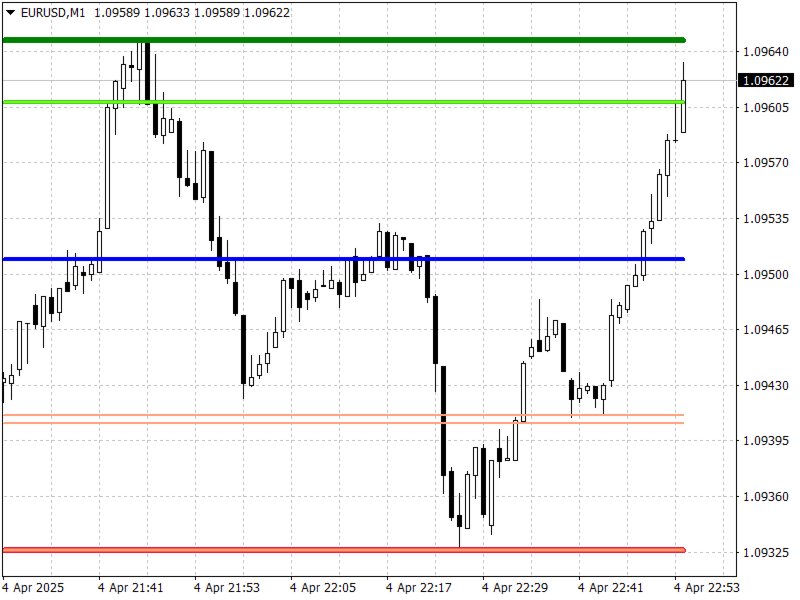

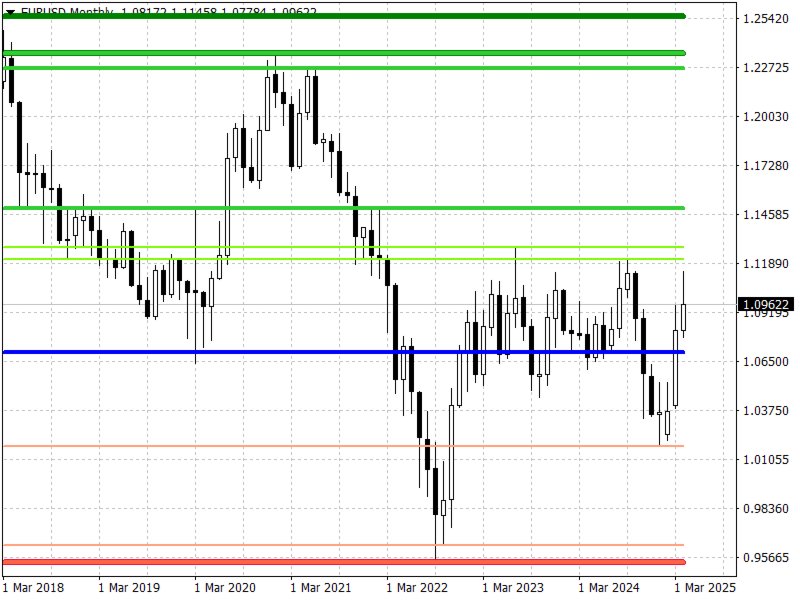

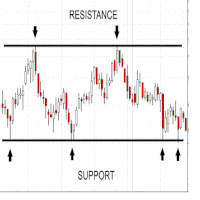

The presented indicator sets dynamic support/resistance levels on the price chart.

The indicator is easy to use and can be useful for both beginners and professional traders.

The middle line of the indicator (Central level) helps to identify the current trend:

- If the closing price is above the central line - the trend is ascending.

- If the closing price is below the central line - the trend is descending.

The presented indicator allows implementing another version of the trading strategy, which we will discuss below.

Let's consider a strategy for trading on a false breakout of the support/resistance level by the price.

A false breakout is considered:

If the minimum/maximum price of the bar has broken the support/resistance level, but the closing price of the bar was higher/lower than the support/resistance level.

This situation usually occurs on the market in cases where the momentum of the price movement in a certain direction has been lost.

The consequence of a false breakout is usually a price correction in the direction from the support/resistance level.

Thus:

- A false breakout of the support level is a signal for a short-term deal to buy an asset.

- A false breakout of the resistance level is a signal for a short-term deal to sell an asset.

Let's consider a strategy for trading on a true breakout of the support/resistance level by the price.

A true breakout is considered to be:

If the minimum/maximum price of the bar has broken through the support/resistance level, and the closing price of the bar is below/above the support/resistance level.

This situation usually occurs on the market in cases where the momentum of the price movement in a certain direction is strong enough.

A true breakout usually results in the price moving in the direction of the support/resistance level.

Thus:

- A true breakout of the support level is a signal for a medium-term deal to sell the asset.

- A true breakout of the resistance level is a signal for a medium-term deal to buy the asset.

Let's consider the third version of the trading strategy that the presented indicator allows you to implement.

The middle line of the indicator (Central level) helps to identify the current trend:

- If the closing price is above the central line, the trend is upward.

- If the closing price is below the central line, the trend is downward.

Thus:

- A bar closing above the central line of the indicator (if the closing price of the previous bar was below the central line of the indicator) is a signal to buy the asset.

- Closing a bar below the central line of the indicator (if the closing price of the previous bar was above the central line of the indicator) is a signal to sell the asset.

The support/resistance levels in this strategy are reasonable values for placing orders to fix potential profit/loss.

Configurable parameters of the indicator:

- Sensitivity - the period of data minimums/maximums of which are taken to determine the dynamic support/resistance levels;

- Depth - the depth of drawing levels.

Attention:

Please note that any market is constantly changing and there is no guarantee that methods that have been effective in the past will show the same results in the future.

To minimize potential losses, you should regularly optimize the product parameters, study the results of its work and withdraw part of the profit received.

It is recommended that before using the product on a real account, you test its work on a demo account in the same market and with the same broker where you plan to trade.

With respect and best wishes,

Andriy Matviyevs'kyy

P.S.

If you liked this product, I would be grateful for a fair assessment - positive user reviews motivate the author, and reasonable criticism allows us to make products better.

I suggest visiting my page where you will find many unique author's works that are the result of many years of studying exchange trading and FOREX trading.

Muy útil en conjunto con otros indicadores de Support-N-Resistance.