Imbalance Volume Trend MT4

- Indicateurs

- Denys Babiak

- Version: 1.0

- Activations: 5

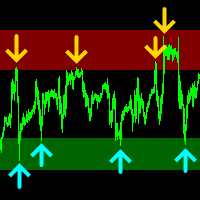

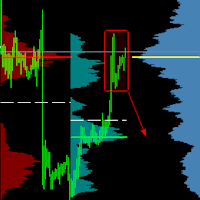

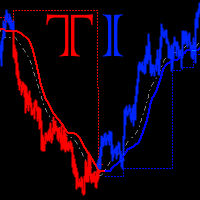

Imbalance Volume Trend is a professional indicator for MetaTrader that combines Fair Value Gap (FVG) / Imbalance zones with volume imbalance analysis and a trend engine based on imbalances.

The indicator automatically finds bullish and bearish Fair Value Gaps, paints them on the chart as colored rectangles and calculates the percentage of volume domination of buyers over sellers (or vice versa) inside the breakout candle that created the imbalance. On top of that, it builds a trend of imbalances and marks trend reversals with arrows, optionally sending alerts, push and email notifications.

Concept

Fair Value Gap (Imbalance) is a price gap that appears when the market moves aggressively in one direction and leaves unfilled space between three consecutive candles. This area is often considered an “unfair price”, and the market frequently returns to test it.

Imbalance Volume Trend:

-

Detects each such FVG / Imbalance automatically

-

Highlights it on the chart as a colored rectangle

-

Calculates how strong that move was in terms of volume imbalance in favor of buyers or sellers

-

Builds a trend based on the sequence of bullish and bearish imbalances and shows trend change signals

This turns standard FVG analysis into a complete volume-based trend and signal tool.

How imbalances are detected and drawn

For each three-candle sequence the indicator checks whether there is a price gap that was created by a strong directional move:

-

Bullish imbalance

-

Rectangle from the high of the first candle to the low of the third candle

-

The second (middle) candle is the breakout candle that “pierces” the space between the first and the third candles.

-

-

Bearish imbalance

-

Rectangle from the low of the first candle to the high of the third candle

-

The second candle is the breakout candle to the downside.

-

Only those imbalances that satisfy the minimum height filter (by points, percent or ATR value) are displayed if the corresponding option is enabled.

All zones are formed only after the third candle is closed and do not repaint.

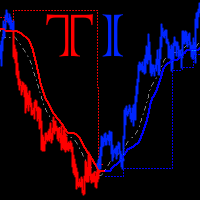

Volume imbalance calculation

The key unique feature of Imbalance Volume Trend is that for every breakout candle that creates an imbalance, the indicator calculates the percentage domination of buyers over sellers (or sellers over buyers).

-

Internal calculations use either lower-timeframe volumes or tick volumes as a proxy.

-

Next to each imbalance candle the indicator plots a text label with the percentage value, colored according to the direction of the imbalance (bullish / bearish).

Example:

-

73% near a bullish imbalance means buyers dominated the volume by 73% on that breakout move.

-

82% near a bearish imbalance shows strong selling pressure.

This allows you to filter and prioritize only those imbalances where the market was really driven by aggressive participants.

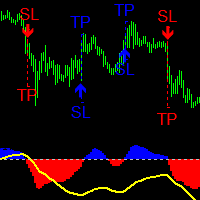

Imbalance Trend logic

The second unique module of the indicator is the Imbalance Trend Engine.

It works as follows:

-

As long as new imbalances appear in the same direction (bullish or bearish), the current imbalance trend continues.

-

A trend reversal occurs when:

-

A new imbalance appears in the opposite direction, and

-

The body of this new opposite imbalance breaks through a certain level of the last imbalance of the current trend.

-

-

The breakout level is set by the parameter Breakout Level [0.0…1.0]:

-

0.0 – near body extreme

-

1.0 – far body extreme

-

Intermediate values allow fine tuning of how strong a counter-imbalance must be to reverse the trend.

-

-

The breakout can be checked either by Close prices or by High/Low prices (parameter Breakout Price Type).

When a trend change is detected, the indicator draws an arrow of the corresponding color and direction at the moment of reversal.

Signals and practical use

You can use Imbalance Volume Trend in many ways, for example:

-

Trend following:

Trade only in the direction of the current imbalance trend, using arrows as trend-change confirmation. -

Pullback entries:

Wait for the price to return into a strong high-volume imbalance zone (e.g. >70–80%) in the direction of the trend. -

Reversal filtering:

React only to those opposite imbalances that break through deeper levels of the previous imbalance body (higher Breakout Level). -

Volume confirmation:

Ignore weak imbalances with low volume domination and focus on those where the percentage is high.

The indicator works on any timeframe and any symbol (Forex, indices, metals, crypto, stocks), as long as volume or tick volume data is available.