Market Condition Evaluation based on standard indicators in Metatrader 5 - page 97

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.20 12:06

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

A downtick in the U.S. Consumer Price Index (CPI) may spark a more meaningful rebound in EUR/USD as it dampens the interest rate outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

It seems as though the Federal Open Market Committee (FOMC) is in no rush to normalize monetary policy as a growing number of central bank officials highlight the downside risk for inflation expectations, and a marked slowdown in price growth may undermine the bullish sentiment surrounding the greenback as central bank hawks Richard Fisher and Charles Plosser lose their vote in 2015.

Nevertheless, the ongoing improvement in household and business confidence may stoke faster price growth, and a strong inflation report should boost the appeal of the greenback as it raises the Fed’s scope to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: U.S. CPI Slows to Annualized 1.6% or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: Headline & Core Price Growth Exceed Market Expectations- Need green, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- With the break of the monthly opening range, will watch former support on EUR/USD for new resistance.

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

Impact that the U.S. CPI report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

September 2014 U.S. Consumer Price Index

EURUSD M5: 38 pips price movement by USD - CPI news event :

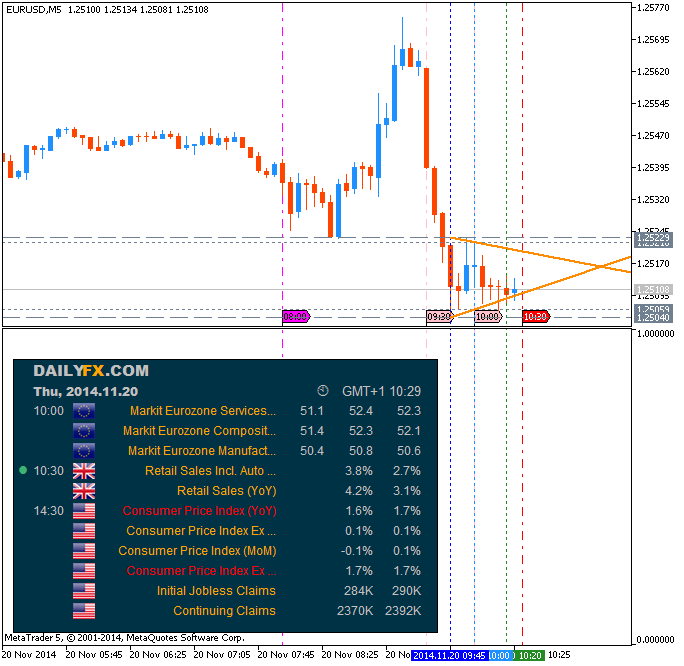

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.11.20

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 52 pips ranging price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.26 10:07

Trading News Events: U.S. Durable Goods Orders (adapted from dailyfx article)

Another 0.6% contract in orders for U.S. Durable Goods may generate a more meaningful rebound in EUR/USD as it dampens the growth and inflation outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

The threat of a slower recovery may further delay the Fed’s normalization cycle as Chair Janet Yellen remains in no rush to remove the zero-interest rate policy (ZIRP), and the dollar may face a larger correction over the near-term should interest rate expectations falter.

Nevertheless, the ongoing improvement in consumer confidence may generate a better-than-expected print, and a rebound in demand for U.S. Durable Goods may heighten the bullish sentiment surrounding the dollar as the Fed is widely expected to raise the benchmark interest rate in 2015.

How To Trade This Event Risk

Bearish USD Trade: Orders Contract 0.6% or Greater

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Demand for Large-Ticket Items Improve- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

USD/CAD Daily Chart

XAU/USD Daily Chart

- Will watch the November high (1.2599) as EUR/USD holds above the monthly low (1.2356).

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

Impact that the U.S. Durable Goods report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

September 2014 U.S. Durable Goods Orders

EURUSD M5: 56 pips price movement by USD - Durable Goods Orders news event:

Demand for U.S. Durable Goods slipped another 1.3% in September following the record 18.3% contraction the month prior. Orders for non-defense capital goods excluding aircraft, a proxy future business investments, also fell 1.7% during the same period. The persistent weakness in demand for large-ticket items may further dampen the outlook for global growthamid the weakening outlook for Europe and China. The greenback struggled to hold its ground following the worse-than-expected print, with EUR/USD climbing above the 1.2750 handle, but there was limited follow-through behind the market reaction as the pair closed at 1.2734.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.11.26

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 37 pips price movement by USD - Durable Goods Orders news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.11.28 08:48

Trading the News: Euro-Zone Consumer Price Index (CPI) (based on dailyfx article)

A further slowdown in the Euro-Zone’s Consumer Price Index (CPI) may heighten the bearish sentiment surrounding the EUR/USD as it puts increased pressure on the European Central Bank (ECB) to implement more non-standard measures.

What’s Expected:

Why Is This Event Important:

There’s growing bets that the Governing Council may have little choice but to implement quantitative easing across the monetary union amid the growing threat for deflation, and the single currency remains at risk of facing additional headwinds in 2015 as the economic recovery remains subdued.

However, the CPI report may show sticky price growth in Europe as the region returns the growth, and a stronger-than-expected inflation print may trigger a more meaningful correction in EUR/USD as it mitigates the risk for deflation.

How To Trade This Event Risk

Bearish EUR Trade: Euro-Zone CPI Slips to 0.3% or Lower

- Need red, five-minute candle following the release to consider a short EUR/USD trade

- If market reaction favors selling Euro, short EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish EUR Trade: Headline Reading for Inflation Tops Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bearish Euro trade, just in opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Will continue to look for lower highs & lows as the downward trending channel remains in play.

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the Euro-Zone CPI report has had on EUR during the last release(1 Hour post event )

(End of Day post event)

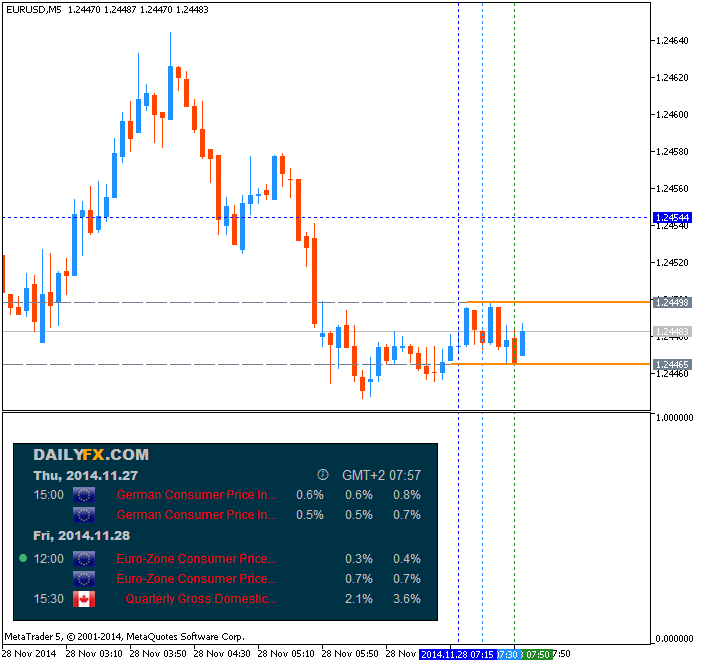

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2014.11.28

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 19 pips price movement by EUR - CPI Flash Estimate news event

Just an idea

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.12.03 06:46

2014-12-03 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - GDP]if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy. It's the broadest measure of economic activity and the primary gauge of the economy's health.

==========

Australia GDP Expands 0.3% In Q3Australia's gross domestic product gained a seasonally adjusted 0.3 percent on quarter in the third quarter of 2014, the Australian Bureau of Statistics said on Wednesday.

That was well shy of forecasts for an increase of 0.7 percent following the 0.5 percent gain in the second quarter.

On a yearly basis, GDP climbed 2.7 percent - also missing expectations for a gain of 3.1 percent, which would have been unchanged from the previous three months.

Terms of trade tumbled 3.5 percent on quarter and 8.9 percent on year, while real net disposable income sank 0.3 percent on quarter but gained 0.8 percent on year.

The main contributors to the increase in expenditure on GDP were net exports (0.8 percentage points) and final consumption expenditure (0.4 percentage points).

The main detractors were private gross fixed capital formation (-0.5 percentage points) and public gross fixed capital formation (-0.2 percentage points).

The main contributor to GDP growth was financial and insurance services (0.2 percentage points), with mining and information media and telecommunications each contributing 0.1 percentage points to the increase in GDP.

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.12.03

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5: 65 pips price movement by AUD - GDP news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.12.04 06:32

2014-12-04 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Trade Balance]if actual > forecast (or actual data) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers.

==========

Australia October Trade Deficit A$1.323 Billion

Australia posted a merchandise trade deficit of A$1.323 billion in October, the Australian Bureau of Statistics said on Thursday.

That beat expectations for a shortfall of A$1.80 billion following the revised A$2.235 billion deficit in September (originally A$2.261 billion).

It's also a decrease of A$912 million (41 percent) on the deficit in September 2014.

Exports were up 2.0 percent on year to A$26.904 billion. They were worth A$26.495 billion in September.

Non-rural goods climbed A$700 million (4 percent), while non-monetary gold fell A$204 million (13 percent), rural goods lost A$115 million (4 percent) and net exports of goods under merchanting fell A$7 million (70 percent). Services credits gained A$35 million (1 percent).

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.12.04

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5: 34 pips price movement by AUD - Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.12.05 10:25

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls (NFP) report may spark a bearish reaction in EUR/USD as market participants expected another 230K rise in employment paired with an uptick in wage growth.

What’s Expected:

Why Is This Event Important:

A batch of positive developments may spark another near-term rally in the greenback especially as a growing number of Fed officials show a greater willingness to normalize monetary policy in 2015.

However, the employment report may disappoint amid the ongoing slack in the labor market, and the greenback may face a larger correction over the near-term as a weaker-than-expected NFP print drags on interest rate expectations.

How To Trade This Event Risk

Bullish USD Trade: Strong Job/Wage Growth Boosts Interest Rate Expectations

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar position, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: NFP Report Falls Short of Market Forecasts- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the U.S. Non-Farm Payrolls report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

October 2014 U.S. Non-Farm Payrolls

EURUSD M5: 83 pips pips range price movement by USD - Non-Farm Employment Change news event

GBPUSD M5: 70 pips range price movement by USD - Non-Farm Employment Change news event

USDCAD M5: 99 pips price range movement by USD - Non-Farm Employment Change news event

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.12.05

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 53 pips price movement by USD - Non-Farm Employment Change news event

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.12.05

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5: 58 pips price movement by USD - Non-Farm Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.12.11 11:17

Trading News Events: U.S. Advance Retail Sales (based on dailyfx article)

Trading the News: U.S. Advance Retail Sales

A pickup in Advance U.S. Retail Sales may generate short-term decline in EUR/USD as stronger consumption raises the growth and inflation outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Indeed, an expansion in household spending is likely to heighten the appeal of the greenback and boost interest rate expectations as a growing number of Fed officials show a greater willingness to normalize monetary policy in mid-2015.

However, sticky inflation along with the slowdown in private sector credit may drag on household spending, and a dismal development may foster a more meaningful rebound in EUR/USD as it raises the FOMC’s scope to zero-interest rate policy (ZIRP) for an extended period of time.

How To Trade This Event Risk

Bullish USD Trade: U.S. Retail Sales Climbs 0.4% or More

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Private-Sector Consumption Falls Short of Market Forecast- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Despite the string of lower-highs, a bullish break in the Relative Strength Index (RSI) may highlight a larger for EUR/USD.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the U.S. Retail Sales report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

2014

U.S. Retail Sales increased 0.3% from the month prior, with 10 of the 13 components showing an expansion in October. Despite stagnant wage growth, the resilience in private sector consumption may put increased pressure on the Fed to normalize monetary policy as it remains one of the leading drivers of growth. The initial reaction to the better-than-expected print was short-lived as EUR/USD climbed above the 1.2500 region during the North American trade to end the day at 1.2521.

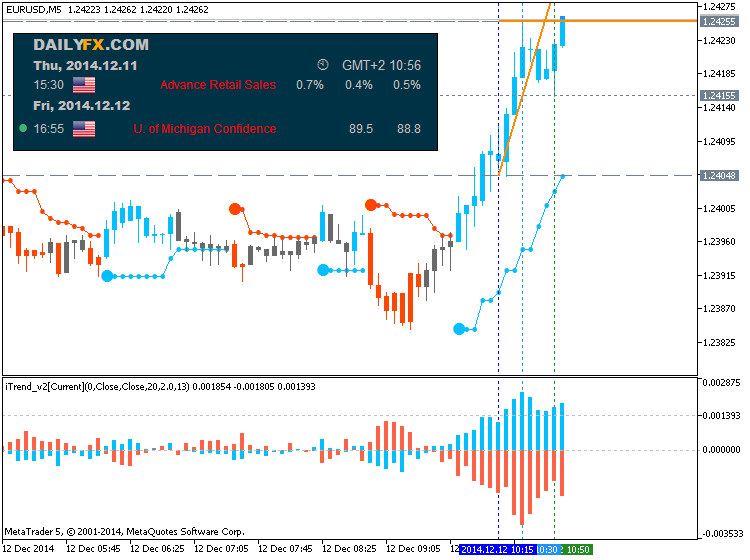

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.12.11

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5: 24 pips price movement by USD - Retail Sales news event

MetaTrader Trading Platform Screenshots

USDJPY, M5, 2014.12.11

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5: 31 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.12.12 10:03

Trading News Events: U. of Michigan Confidence (based on dailyfx article)

Trading the News: U. of Michigan Confidence

Another uptick in the U. of Michigan Confidence survey may spur a further decline in the EUR/USD amid growing speculation for a Fed rate hike in mid-2015.

What’s Expected:

Why Is This Event Important:

Positive data prints coming out of the U.S economy should continue to fuel interest rate expectations and heighten the bullish sentiment surrounding the greenback as a growing number of Fed officials scale back their dovish tone for monetary policy.

However, we the survey may disappoint as U.S. households face sticky price pressures paired with the ongoing slack in the real economy, and a dismal print may spur a larger correction in the greenback as it drags on expectations for higher borrowing-costs.

How To Trade This Event Risk

Bullish USD Trade: U. of Michigan Survey Climbs to 89.5 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Consumer Confidence Falls Short of Market Forecast- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- Failed attempts to close above 1.2450-70 may highlight near-term topping process for EUR/USD especially as the RSI largely retains a bearish momentum.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

Impact that the U. of Michigan Confidence has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

The U. of Michigan Confidence survey unexpectedly surged to 89.4 in November from 86.9 the month prior to mark the fourth consecutive advance. Despite the uptick in sentiment, 12-month inflation expectations weakened further during the same period, with the figure slowing to an annualized 2.6% from 2.9% in October. Nevertheless, the ongoing improvement may highlight a stronger recovery for the U.S. economy as private-sector consumption remains one of the leading drivers of growth. The initial bullish dollar reaction was very short-lived as EUR/USD pushed back above the 1.2450 region following the data print, with the pair ending the day at 1.2521.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.12.12

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 17 pips price movement by USD - UoM Consumer Sentiment news event

MetaTrader Trading Platform Screenshots

USDJPY, M5, 2014.12.12

MetaQuotes Software Corp., MetaTrader 5

USDJPY M5: 32 pips price movement by USD - UoM Consumer Sentiment news event

MetaTrader Trading Platform Screenshots

USDCHF, M5, 2014.12.12

MetaQuotes Software Corp., MetaTrader 5

USDCHF M5: 25 pips price movement by USD - UoM Consumer Sentiment news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.12.17 11:01

2014-12-17 09:30 GMT (or 11:30 MQ MT5 time) | [GBP - BoE Minutes]More hawkish than expected = Good for currency (for GBP in our case)

[GBP - BoE Minutes] = The BOE's MPC meeting minutes contain the interest rate vote for each MPC member during the most recent meeting. The breakdown of votes provides insight into which members are changing their stance on interest rates and how close the committee is to enacting a rate change in the future.

==========

The Governor invited the Committee to vote on the propositions that:

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.12.17

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 34 pips range price movement by GBP - BoE Minutes news event