Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.08 05:50

NZD/USD Technical Analysis: Clearing Path Below 0.76 Mark? (based on dailyfx article)

- NZD/USD Technical Strategy:Flat

- Support: 0.7659, 0.7525, 0.7386

- Resistance:0.7802, 0.7937, 0.8034

The New Zealand Dollar is attempting to accelerate downward in a bid to clear a path below the 0.76 figure against its US counterpart. Near-term support is in the 0.7659-96 area, marked by the November 7 low and the 23.6% Fibonacci expansion, with a break below that on a daily closing basis exposingthe 38.2% level at 0.7525.Alternatively, a reversal above the14.6% Fib at 0.7802clears the way for a challange of the 23.6% Fib retracement at 0.7937.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.05 16:29

Forex Weekly Outlook December 8-12Rate decision in New Zealand and in Switzerland, US Retail sales, Unemployment claims, Producer prices and Consumer sentiment are the major events for this week. Here is an outlook on the highlights coming our way.

Last week, Non-Farm Payrolls posted a superb job gain of 321,000 in November. The release also showed a 0.4% rise in wages. The unemployment rate remained unchanged at 5.8%. This was the biggest jobs gain since 2012, far above average of 224,000 a month over the past year. Economists expected an expansion of 231,000 positions. This excellent release demonstrating the ongoing improvement in the job market cannot go unnoticed. The Fed will have to reexamine its zero rates policy in the coming weeks.

- NZ Rate decision: Wednesday, 20:00. New Zealand’s central bank maintained its Cash rate in September at 3.50%, implying they will keep monetary policy on hold until the end of next year, contrasting the U.S. Federal Reserve plans of raising rates. Low inflation and slowing global growth were the reasons behind the decision to keep rates unchanged. Rates are expected to remain unchanged.

- Australian Employment data: Thursday, 0:30. Australia’s job market added 24,100 jobs in October. Full-time positions expanded by 33,400 while part-time roles declined by 9,400. The jobless rate remained unchanged at a 12-year high of 6.2%, suggesting a weaker labor market amid the economy’s transition from mining-driven growth. The participation rate edged up to a seasonally adjusted 64.6% compared to 64.5% in the previous month. These figures indicate a modest improvement and a positive trend. Australia is expected to gain 15,200 jobs in November, while the unemployment rate is predicted to reach 6.3%.

- Switzerland rate decision: Thursday, 8:30. The Swiss National Bank kept its Libor rate at the minimum low of 0.0% to 0.25%, in line with market prediction. SNB policymakers also issued updated forecasts for growth and inflation revealing a moderate pickup in the coming months. The Central Bank expects GDP growth to reach 2% in 2015. Inflation is expected to reach 2% in 2014 and only 0.6% in 2015. Libor rate is expected to stay unchanged this time.

- US retail sales: Thursday, 13:30. U.S. consumers increased their spending in October, reaching $444.5 billion, on a seasonally adjusted basis, rising 0.3% compared to September’s decline of 0.3%. Economists expected a smaller rise of 0.2%. Consumers were more optimistic and made more purchases. October’s core sales, excluding autos, edged up 0.3% from a 0.2% decline in September. Analysts predicted a 0.2% gain in October. Falling gasoline prices helped to increase domestic expenditures leading to stronger holiday sales. Retail sales are expected to gain 0.3% in November while core sales are predicted to rise 0.1 %.

- US Unemployment claims: Thursday, 13:30. The number of initial claims for unemployment benefits fell back below the 300,000 line last week, indicating continued growth in the labor market. He reading was broadly in line with market forecast. The four-week average increased by 4750 to 299,000 still near post-recession low. However, the sharp decline could be attributed to Thanksgiving holiday. The number of new unemployment claims is expected to be 299,000 this time.

- US PPI: Friday, 13:30. The producer price index gained 0.2% in October amid a pickup in inflation. Prices for many products increased despite a decline in wholesale gas costs. Automakers contributed to inflation by introducing 2015 car models. Beef prices jumped 6% and pork prices surged 8.1%. Meanwhile, core PPI excluding the volatile categories of food and energy, increased 0.4%. However, the rise in PPI does not reflect a trend, since the ongoing declines in fuel prices boost sales boosting inflation. The producer price index is predicted to fall 0.1% in November.

- US Prelim UoM Consumer Sentiment: Friday, 14:55. U.S. consumer sentiment edged up in November to a more than seven-year high of 89.4 points, compared to 86.4 posted in September. Economists predicted a reading of 87.3. The ongoing growth in the employment market and the sharp drop in gasoline prices, boosted sentiment. Current economic conditions increased to 103.0 from 98.3 beating forecast of 98.8. Consumer expectations increased to 80.6 from 79.6, exceeding the 80.2 forecast. However, expectations for income gains remained low despite rising and came in below inflation forecasts. One-year inflation expectation declined to 2.6% from 2.9%, while its five-year inflation outlook was also at 2.6%. U.S. consumer sentiment is expected to improve further to 89.6 this time.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video December 2014

newdigital, 2014.12.09 06:06

EUR/USD slumps, USD/JPY jumps, Crude slides as USD advances post NFPForum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.07 21:01

NZD/USD weekly outlook: December 8 - 12

The New Zealand dollar fell to a four-week low against its U.S.

counterpart on Friday, as stronger than forecast U.S. nonfarm payrolls

data bolstered bets that the Federal Reserve will begin to raise rates

sooner than previously thought.

NZD/USD hit 0.7700 on Friday, the pair's lowest since November 7, before

subsequently consolidating at 0.7715 by close of trade on Friday, down

0.86% for the day and 1.61% lower for the week.

The pair is likely to find support at 0.7659, the low from November 7, and resistance at 0.7821, the high from December 4.

The U.S. dollar rallied after the Department of Labor said that the U.S.

economy added 321,000 jobs in November, far more than the 225,000

forecast by economists and the largest monthly increase in almost three

years.

October’s figure was revised up to 243,000 from a previously reported

214,000, while the unemployment rate remained unchanged at a six-year

low of 5.8%.

The upbeat data added to the view that the strengthening economic

recovery may prompt the Federal Reserve to raise interest rates sooner

than markets are expecting.

The US dollar index, which measures the greenback against a basket of

six major currencies, hit a peak of 89.50, the strongest level since

March 2009 and ended the day up 0.82% to 89.39.

In the week ahead investors will be awaiting Thursday's U.S. data on

retail sales and jobless claims and Friday’s report on consumer

sentiment for further indications on the strength of the economic

recovery.

A policy decision by the Reserve Bank of New Zealand on Wednesday will also be in focus.

Meanwhile, China is to produce what will be closely watched reports on

trade, consumer prices and industrial production in the week ahead. The

Asian nation is New Zealand's second-largest trade partner.

Monday, December 8

- China is to publish data on the trade balance, the difference in value between imports and exports.

- China is to publish data on the consumer price index.

- Later in the day, the Reserve Bank of New Zealand is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision. The announcement is to be followed by a press conference.

- RBNZ Governor Graeme Wheeler is to testify before the Finance and Expenditure Select Committee in Wellington. His comments will be closely watched.

- The U.S. is to release data on retail sales, the government measure of consumer spending, as well as the weekly report on jobless claims.

- China is to release data on industrial production and fixed asset investment.

- The U.S. is to round up the week with data on producer prices and a preliminary report on consumer sentiment.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.10 13:35

NZD/USD higher but gains seen limited (based on nasdaq article)

The New Zealand dollar was higher against its U.S. counterpart on Wednesday, but gains were expected to remain limited by sustained support for the greenback and as markets eyed the Reserve Bank of New Zealand's upcoming policy statement.

NZD/USD hit 0.7728 during late Asian trade, the session high; the pair subsequently consolidated at 0.7697, rising 0.25%.

The pair was likely to find support at 0.7606, Tuesday's low and a two-and-a-half year low and resistance at 0.7788, the high of December 5.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.12.11 07:23

NZDUSD Technical Analysis (based on dailyfx article)

| Resistance | Support |

|---|---|

| 0.7930 | 0.7787 |

| 0.8076 | 0.7624 |

| 0.8221 | 0.7533 |

We will tactically opt against entering long. The markets appear enveloped by seasonal profit-taking on risk-geared positions, as expected. That may bode ill for the sentiment-sensitive Kiwi, meaning the up move might swiftly fizzle. As such, we will remain flat and look for the bounce to yield a selling opportunity in line with the larger trend.

Forum on trading, automated trading systems and testing trading strategies

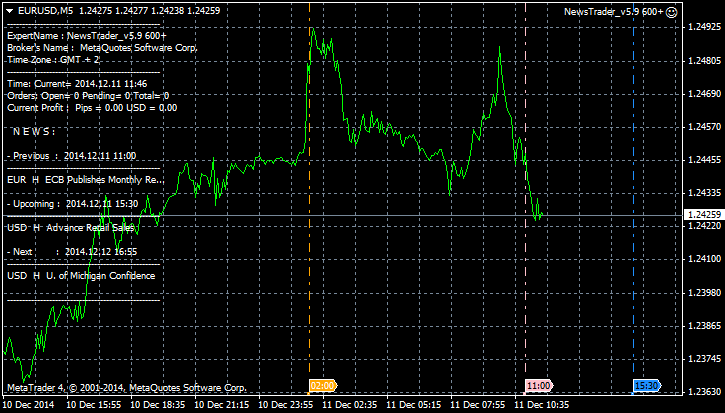

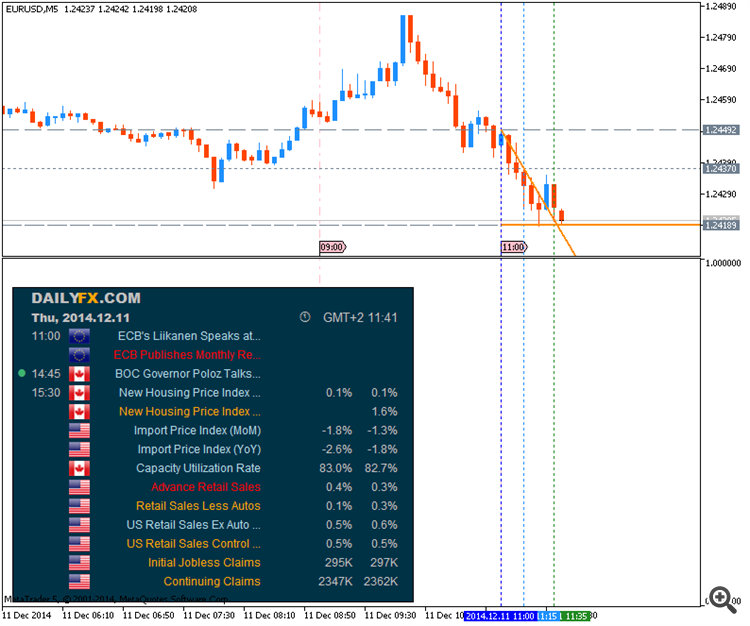

newdigital, 2014.12.11 11:17

Trading News Events: U.S. Advance Retail Sales (based on dailyfx article)

- U.S. Advance Retail Sales to Increase for Ninth-Time in 2014.

- Will Seasonal Factors Spur Better-Than-Expected Retail Sales Report?

Trading the News: U.S. Advance Retail Sales

A pickup in Advance U.S. Retail Sales may generate short-term decline in

EUR/USD as stronger consumption raises the growth and inflation outlook

for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Indeed, an expansion in household spending is likely to heighten the appeal of the greenback and boost interest rate expectations as a growing number of Fed officials show a greater willingness to normalize monetary policy in mid-2015.

However, sticky inflation along with the slowdown in private sector

credit may drag on household spending, and a dismal development may

foster a more meaningful rebound in EUR/USD as it raises the FOMC’s

scope to zero-interest rate policy (ZIRP) for an extended period of

time.

How To Trade This Event Risk

Bullish USD Trade: U.S. Retail Sales Climbs 0.4% or More

- Need red, five-minute candle following the release to consider a short trade on EUR/USD

- If market reaction favors a long dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

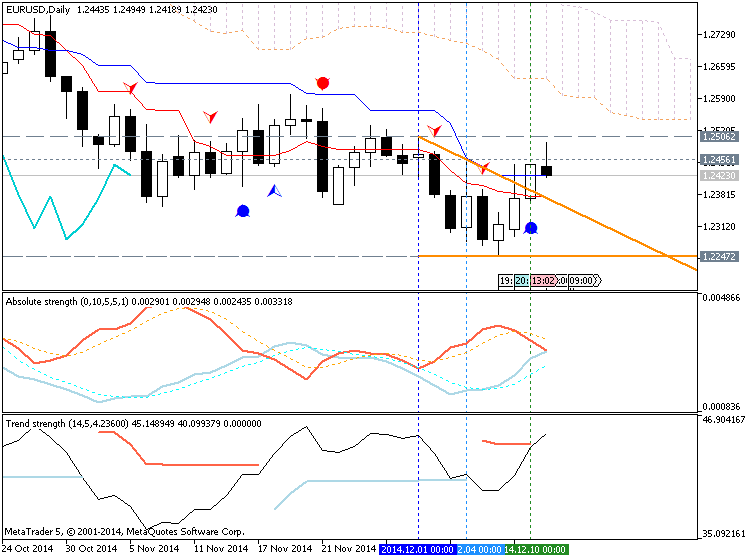

EUR/USD Daily Chart

- Despite the string of lower-highs, a bullish break in the Relative Strength Index (RSI) may highlight a larger for EUR/USD.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| OCT 2014 |

11/14/2014 13:30 GMT | 0.2% | 0.3% | -17 | +85 |

U.S. Retail Sales increased 0.3% from the month prior, with 10 of the 13 components showing an expansion in October. Despite stagnant wage growth, the resilience in private sector consumption may put increased pressure on the Fed to normalize monetary policy as it remains one of the leading drivers of growth. The initial reaction to the better-than-expected print was short-lived as EUR/USD climbed above the 1.2500 region during the North American trade to end the day at 1.2521.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5: 22 pips range price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

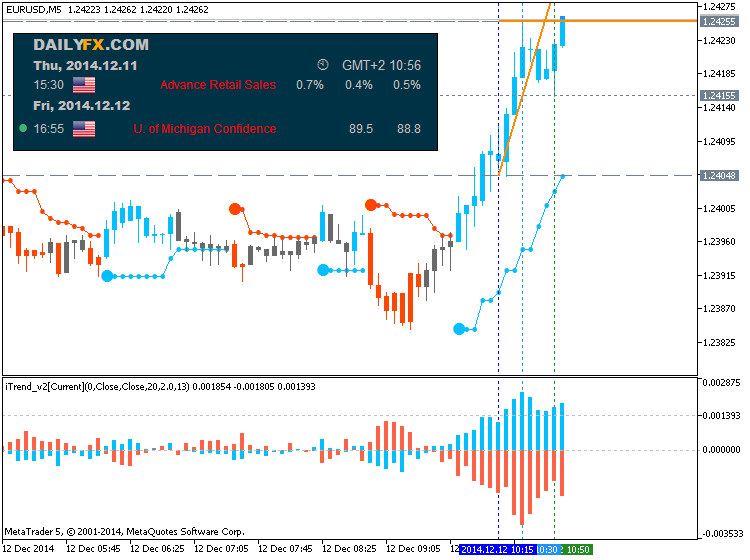

newdigital, 2014.12.12 10:03

Trading News Events: U. of Michigan Confidence (based on dailyfx article)

- U. of Michigan Confidence Survey to Increase for Fifth Consecutive Month.

- Print of 89.5 Would Mark Highest Print Since July 2007.

Trading the News: U. of Michigan Confidence

Another uptick in the U. of Michigan Confidence survey may spur a

further decline in the EUR/USD amid growing speculation for a Fed rate

hike in mid-2015.

What’s Expected:

Why Is This Event Important:

Positive data prints coming out of the U.S economy should continue to

fuel interest rate expectations and heighten the bullish sentiment

surrounding the greenback as a growing number of Fed officials scale

back their dovish tone for monetary policy.

However, we the survey may disappoint as U.S. households face sticky

price pressures paired with the ongoing slack in the real economy, and a

dismal print may spur a larger correction in the greenback as it drags

on expectations for higher borrowing-costs.

How To Trade This Event Risk

Bullish USD Trade: U. of Michigan Survey Climbs to 89.5 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

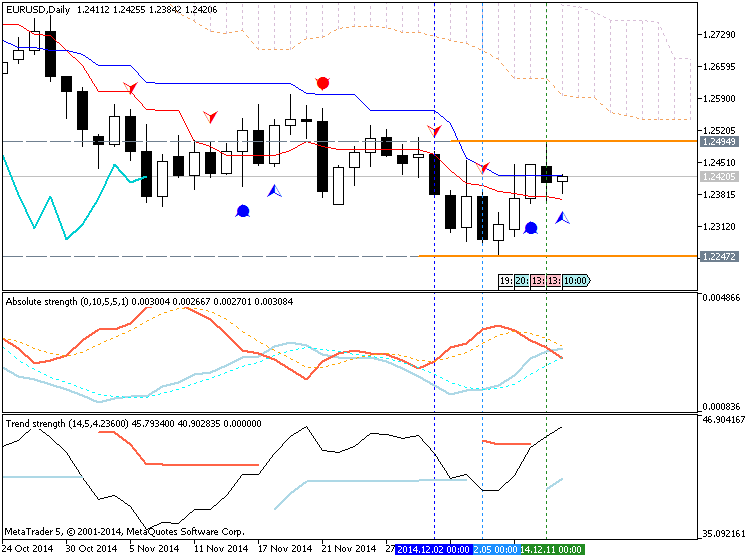

EUR/USD Daily Chart

- Failed attempts to close above 1.2450-70 may highlight near-term topping process for EUR/USD especially as the RSI largely retains a bearish momentum.

- Interim Resistance: 1.2600 pivot to 1.2610 (61.8% expansion)

- Interim Support: 1.2280 (100% expansion) to 1.2290 (38.2% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| NOV P 2014 |

11/14/2014 14:55 GMT | 87.5 | 89.4 | +52 | +100 |

The U. of Michigan Confidence survey unexpectedly surged to 89.4 in November from 86.9 the month prior to mark the fourth consecutive advance. Despite the uptick in sentiment, 12-month inflation expectations weakened further during the same period, with the figure slowing to an annualized 2.6% from 2.9% in October. Nevertheless, the ongoing improvement may highlight a stronger recovery for the U.S. economy as private-sector consumption remains one of the leading drivers of growth. The initial bullish dollar reaction was very short-lived as EUR/USD pushed back above the 1.2450 region following the data print, with the pair ending the day at 1.2521.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

NZDUSD M5: 20 pips price movement by USD - UoM Consumer Sentiment news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bearish market condition breakdown with trying to break 0.7728 support level:

W1 price is on primary bearish market condition with breaking 0.7659 support.

MN price is on bearish breakout by breaking 0.7659 support level with Chinkou Span line of Ichimoku indicator crossing the price from above to below.

If D1 price will break 0.7728 support level so the primary bearish will be continuing

If D1 price will break 0.7910 resistance level so the price will be reversed from the primary bearish to the primary bullish withs econdary ranging market condition

If not so we may see the ranging market condition.

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2014-12-07 21:45 GMT (or 23:45 MQ MT5 time) | [NZD - Manufacturing Sales]

2014-12-10 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2014-12-10 19:00 GMT (or 21:00 MQ MT5 time) | [USD - Federal Budget Balance]

2014-12-10 20:00 GMT (or 22:00 MQ MT5 time) | [NZD - Official Cash Rate]

2014-12-11 00:10 GMT (or 02:10 MQ MT5 time) | [NZD - RBNZ Gov Wheeler Speech]

2014-12-11 21:30 GMT (or 23:30 MQ MT5 time) | [NZD - Business NZ Manufacturing Index]

2014-12-12 05:30 GMT (or 07:30 MQ MT5 time) | [CNY - Industrial Production]

2014-12-12 13:30 GMT (or 15:30 MQ MT5 time) | [USD - PPI]

2014-12-12 14:55 GMT (or 16:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : bearish

TREND : breakdown