You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

AUDIO - Freaky Friday with John O'Donnell

Many market experts are calling for a MUCH higher dollar, and this could have significant impacts for the markets. John O’Donnell joins Merlin Rothfeld for a breakdown of how this might impact: Oil, Gold, bonds, global currencies and much more.

More hawkish than expected = Good for currency (for AUD in our case)

[AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

RBA Minutes: Modest Growth Likely To Continue For Economy

Members of Australia's monetary policy board believed that the rate of growth for Australia's economy is likely to hold steady for the time being, minutes from the central bank's November 4 meeting revealed on Tuesday.

At the meeting, the RBA left its benchmark cash rate unchanged at a record low 2.50 percent. The rate has been at the current level since August 2013.

"The forces underpinning the outlook for domestic activity were much as they had been for some time and the forecasts had not materially changed; GDP growth was still expected to be below trend over 2014/15, before gradually picking up to an above-trend pace towards the end of 2016," the minutes said.

Price & Time: USD Head Fake? (based on dailyfx article)

AUD/USD Fundamental Analysis November 20, 2014, Forecast (based on fxempire article)

The AUD/USD eased by 49 points give up weekly gains as the US dollar recovered in the morning session. The Aussie is trading at 0.8670. Problems from Japan weigh on the Aussie. Japan’s Abe confirmed widespread speculation by announcing he would delay plans for an unpopular second hike in the consumption tax scheduled for October next year by 18 months and would dissolve the lower house of parliament on Nov. 21 to seek a mandate at the polls next month for his set of economic policies, known as Abenomics, and includes economic reforms that have proven difficult to implement. The announcement came after data this week showed the Japanese economy has fallen into recession, with two quarters of negative growth. This in turn weakened the Australian dollar, as traders focused on the Japanese government getting a mandate to delay a planned sales tax rise.

The Australian dollar eased again as traders positioned themselves for today’s release of minutes from the Federal Reserve’s October meeting, and for possible clues on an American rate rise.

RBA governor Glenn Stevens told a business dinner in Melbourne that interest rates were likely to stay at a record low of 2.5 per cent for some time as mining investment and income growth fell and household debt and unemployment rose.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.05.11 15:39

Fundamental Analysis

Fundamental analysis is the study of statistical reports and economic indicators of countries to trade currencies more effectively. Changes in interest rates, employment reports, and the latest inflation figures, all fall under the purview of fundamental analysis, which forex traders must pay close attention to, because they can have a direct bearing on the value of a nation’s currency. Data used in forex fundamental analysis can be classified by the degree to which they affect the market:

Given the importance of these indicators, it is necessary to closely follow economic calendars, and know beforehand when they are scheduled for release. The most powerful indicators that move forex market include:

Generally, if a country increases its interest rates, its currency will increase in value because investors will shift their assets to that country to gain higher returns.

GDP is the primary indicator of the strength of economic activity in a country, and is generally reported quarterly. A high GDP figure leads to expectations of higher interest rates, which is mostly positive for the given currency.

A decreases in payroll employment is considered as a sign of weak economic activity, and could eventually lead to lower interest rates, which has a negative impact on the currency.

A country with a significant trade balance deficit is likely to have a weak currency as there will be continuous commercial sellings of its currency.

Traders, who rely on fundamental analysis to study markets, will typically create models to formulate a trading strategy. These models generally utilize a host of empirical data and try to forecast market behavior and estimate future currency levels. This information is then used to draw out specific trades that best exploit the situation. Forecasting models are as varied and numerous as the traders that create them. Two people can analyze the exact same data and come up with two completely different conclusions about how it will impact the market. Therefore is it important to understand what is more relevant to the current market and economic conditions, and not succumb to ‘paralysis by analysis.’

AUD/USD Daily Outlook (adapted from actionforex article)

AUD/USD's fall from 0.8795 picked up some momentum. But still, it's held above 0.8539 support. Intraday bias remains neutral and more consolidation could be seen in range of 0.8539/8910. As long as 0.8910 resistance holds, deeper decline is still expected. Break of 0.8539 should target 61.8% projection of 0.9401 to 0.8642 from 0.8910 at 0.8441. However, decisive break of 0.8910 will indicate near term reversal and turn outlook bullish.

In the bigger picture, price actions from 1.1079 are viewed as a medium term correction. The rejection from 55 weeks EMA and current downside acceleration suggests that it's still in progress. Sustained break of 50% retracement of 0.6008 to 1.1079 at 0.8544 will pave the way to 61.8% retracement at 0.7945 and below. On the upside, break of 0.9504 is needed to confirm medium term reversal. Otherwise, we won't turn bullish even in case of strong rebound.

if actual > forecast (or actual data) = good for currency (for EUR in our case)

[EUR - German PPI] = Change in the price of goods sold by manufacturers. It's a leading indicator of consumer inflation - when manufacturers charge more for goods the higher costs are usually passed on to the consumer.

==========

Producer prices in October 2014: –1.0% on October 2013

In October 2014 the index of producer prices for industrial products fell by 1.0% compared with the corresponding month of the preceding year. In September 2014 the annual rate of change all over had been –1.0%, too.

In October 2014 energy prices decreased by 3.6%, prices of consumer non-durable goods by 0.6% and prices of intermediate goods by 0.3%. In contrast prices of capital goods rose by 0.6% and prices of durable consumer goods by 1.2%.

The overall index disregarding energy decreased by 0.1% compared with October 2013.

Compared with the preceding month the overall index decreased by 0.2% in October 2014 (–0.1% in August 2014, unchanged in September 2014).

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

A downtick in the U.S. Consumer Price Index (CPI) may spark a more meaningful rebound in EUR/USD as it dampens the interest rate outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

It seems as though the Federal Open Market Committee (FOMC) is in no rush to normalize monetary policy as a growing number of central bank officials highlight the downside risk for inflation expectations, and a marked slowdown in price growth may undermine the bullish sentiment surrounding the greenback as central bank hawks Richard Fisher and Charles Plosser lose their vote in 2015.

Nevertheless, the ongoing improvement in household and business confidence may stoke faster price growth, and a strong inflation report should boost the appeal of the greenback as it raises the Fed’s scope to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bearish USD Trade: U.S. CPI Slows to Annualized 1.6% or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: Headline & Core Price Growth Exceed Market Expectations- Need green, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily Chart

- With the break of the monthly opening range, will watch former support on EUR/USD for new resistance.

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

Impact that the U.S. CPI report has had on EUR/USD during the last release(1 Hour post event )

(End of Day post event)

2014

September 2014 U.S. Consumer Price Index

EURUSD M5: 38 pips price movement by USD - CPI news event :

MetaTrader Trading Platform Screenshots

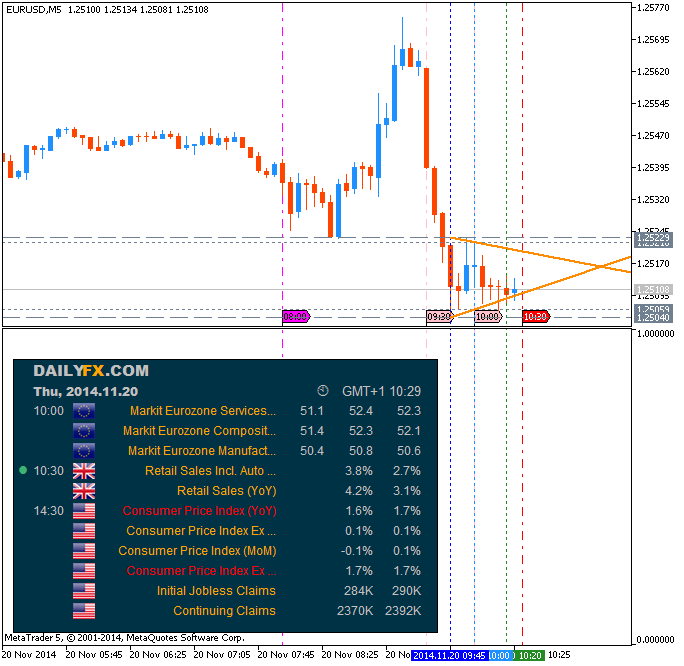

EURUSD, M5, 2014.11.20

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 52 pips ranging price movement by USD - CPI news event

Scalping the AUDUSD Correction- Longs Favored Above 8565 (based on dailyfx article)

US equity market closed on a positive note on Thursday, pushing the DOW and S&P 500 to fresh record closing highs, as data showed further strength in the US economy. The Dow Jones

industrial average rose 30.6 points or 0.17% to close at 17716.33, the S&P 500 gained 3.98 points or 0.19% to 2052.7 and the NASDAQ Composite added 26.16 points or 0.56% to close at 4701.87.

With no important data on Friday, market is expected to trade range bound with less volume.

BULLS OF THE STREET (NYSE)

Name

Close Price ( $ )

Change %

Nuverra Environmental Solutions

08.99

12.66

Midstates Petroleum

02.94

10.94

Arch Coal

02.54

10.43

Callon Petroleum

06.50

10.36

Ocwen Financial

23.46

10.16

BEARS OF THE STREET (NYSE)

Name

Close Price ( $ )

Change %

Jumei International Holding ADS

19.54

12.10

Enzo Biochem

04.18

07.11

CGG ADS

09.82

06.92

Donaldson

39.99

06.46

Mobileye

43.87

06.16