Market Condition Evaluation based on standard indicators in Metatrader 5 - page 102

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.12 08:59

Trading the News: U.S. Retail Sales (based on dailyfx article)

A rebound in U.S. Retail Sales may heighten the bullish sentiment surrounding the greenback and spur a further decline in EUR/USD as it fuels speculation for higher borrowing-costs in the world’s largest economy.What’s Expected:

Why Is This Event Important:

The Fed may stay on course to normalize monetary policy in mid-2015 as the central bank anticipates lower energy prices to boost private-sector consumption – one of the leading drivers of growth – and Chair Janet Yellen may adopt a more hawkish tone at the March 18 meeting as the board remains confident in achieving the 2% target for inflation.

Nevertheless, subdued wages along with the slowdown in private-sector credit may drag on retail spending, and another unexpected contraction may further delay the Fed’s normalization cycle as the ongoing weakness in household earnings undermines the central bank’s scope to achieve the inflation target.

How To Trade This Event Risk

Bullish USD Trade: U.S. Retail Sales Rebounds 0.3% or Greater

- Need red, five-minute candle following a positive print to consider a short EUR/USD trade.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Household Spending Disappoints- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

Potential Price Targets For The ReleaseEURUSD Daily Chart

- Despite the long-term bearish outlook for EUR/USD, will keep a close eye on the Relative Strength Index (RSI) as it approaches key support levels.

- Interim Resistance: 1.1185 (23.6% expansion) to 1.1210 (61.8% retracement)

- Interim Support: 1.0375 (78.6% expansion) to 1.0400 pivot

Impact that the U.S. Retail Sales report has had on EUR/USD during the previous month(1 Hour post event )

(End of Day post event)

2014

EURUSD M5: 44 pips price movement by USD - Retail Sales news event

U.S. Retail Sales declined another 0.8% in January following a 0.9% contraction the month prior. Despite lower energy costs, discretionary spending at department stores slipped for the second consecutive month, while demand for motor vehicles and parts slid another 0.5% during the same period. Following the worse-than-expected print, the greenback struggled to hold its ground, with EUR/USD climbing above the 1.1400 handle and closed the day at 1.1428.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.03.12

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 65 pips price movement by USD - Retail Sales news event

MetaTrader Trading Platform Screenshots

NZDUSD, M5, 2015.03.12

MetaQuotes Software Corp., MetaTrader 5

NZDUSD M5: 45 pips price movement by USD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.13 11:21

Trading News Events: Canada Employment Change (based on dailyfx article)

A 5.0K contraction in Canada Employment paired with an uptick in the jobless may drag on the loonie and produce fresh 2015-highs in USD/CAD as it fuels speculation for a further reduction in the Bank of Canada’s (BoC) benchmark interest rate.

What’s Expected:

Why Is This Event Important:

Even though BoC Governor Stephen Poloz endorses a wait-and-see approach, a dismal labor report may encourage the central bank to adopt a more dovish tone at the April 15 policy meeting in order to encourage a stronger recovery.

Nevertheless, lower input costs accompanied by the pickup in private sector activity may encourage Canadian firms to boost their labor force, and a positive development may keep the USD/CAD range intact as the BoC looks to retain its current policy over the near-term.

How To Trade This Event Risk

Bearish CAD Trade: Canada Sheds 5.0K Jobs or Greater

- Need green, five-minute candle following the report for a potential long USD/CAD trade

- If market reaction favors a bearish loonie trade, buy USD/CAD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit

Bullish CAD Trade: Employment Report Exceeds Market Expectations- Need red, five-minute candle to consider a short USD/CAD position

- Carry out the same setup as the bearish Canadian dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseUSDCAD Daily Chart

- Favor the approach to ‘buy-dips’ in USD/CAD following the bullish RSI break, but seems as though the dollar-loonie needs a fundamental catalyst for a break/close above the February high (1.2797)

- Interim Resistance: 1.2797 (Feb. high) to 1.2800 (38.2% expansion)

- Interim Support: 1.2390 (161.8% expansion) to 1.2420 (161.8% expansion)

Impact that Canada Employment Change has had on CAD during the last release(1 Hour post event )

(End of Day post event)

How it was traded:

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2015.03.13

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_39640.png

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2015.03.13

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_34334.png

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2015.03.13

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_29690.png

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2015.03.13

MetaQuotes Software Corp., MetaTrader 5

USDCAD M5: 41 pips price movement by CAD - Employment Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.16 11:53

2015-03-16 08:15 GMT (or 10:15 MQ MT5 time) | [CHF - Retail Sales]if actual > forecast (or previous data) = good for currency (for CHF in our case)

[CHF - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level, excluding automobiles and gas stations. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

==========Swiss Retail Sales Fall In January

Swiss retail sales declined in January after recovering in the prior month, provisional results from the Federal Statistical Office showed Monday.

Excluding fuel, retail sales dropped 0.3 percent from last year, reversing a 1.9 percent rise in December.

Sales of food, drinks and tobacco registered an annual increase of 1.4 percent, while non-food sector sales declined 1.4 percent.

Retail sales fell by real 2.1 percent month-on-month in January, reversing the 1 percent rise in the prior month. This was the first fall in four months.

MetaTrader Trading Platform Screenshots

USDCHF, M5, 2015.03.16

MetaQuotes Software Corp., MetaTrader 5

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.17 06:30

2015-03-17 00:30 GMT (or 02:30 MQ MT5 time) | [AUD - Monetary Policy Meeting Minutes][AUD - Monetary Policy Meeting Minutes] = It's a detailed record of the RBA Reserve Bank Board's most recent meeting, providing in-depth insights into the economic conditions that influenced their decision on where to set interest rates.

==========

RBA considered cutting interest rates, decided to wait for more data

The Reserve Bank of Australia’s minutes from its policy meeting earlier this month showed us that members considered loosening monetary further this month, but it was decided that more data was needed and it would take some time for the economy to respond to an earlier cut in the OCR. It’s also clear that the RBA is nervously watching the housing market; it is acutely aware that softer monetary policy is helping to fuel the red-hot residential housing market in Sydney and, to a lesser extent, Melbourne.

The key lines from the minutes are:

On interest rates

On the housing market

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2015.03.17

MetaQuotes Software Corp., MetaTrader 5

AUDUSD M5: 24 pips price movement by AUD - Monetary Policy Meeting Minutes news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.18 08:05

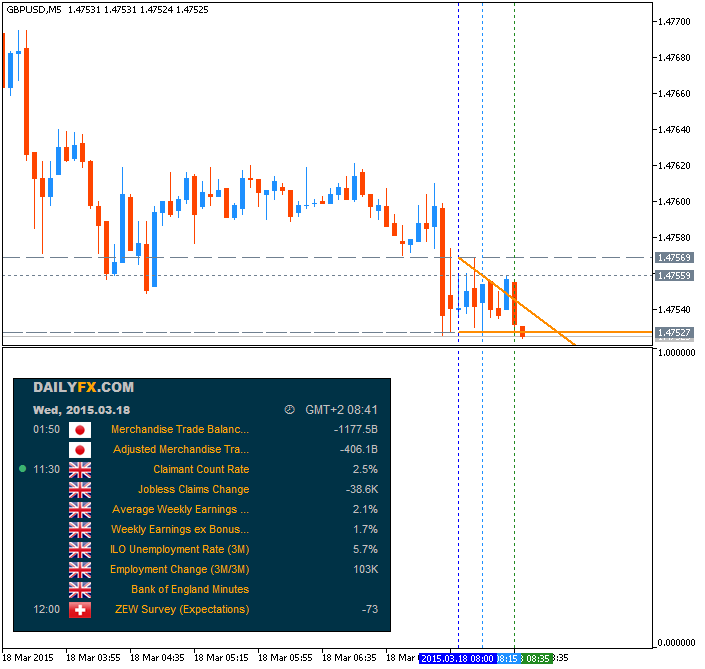

Trading the News: GBP Jobless Claims Change (based on dailyfx article)

Another 30.0K decline in U.K. Jobless Claims paired with a hawkish Bank of England (BoE) Minutes may spark a near-term rebound in GBP/USD should the fundamental developments boost interest rate expectations.

What’s Expected:

Why Is This Event Important:

At the same time, Average Weekly Earnings are projected to increase an annualized 2.2% after climbing 2.1% in January, and a marked expansion in household earnings may encourage BoE Governor Mark Carney to normalize monetary policy sooner rather than later as the central bank anticipates a more sustainable recovery in the U.K economy.

However, the slowdown in building activity along with the pullback in business outputs may drag on hiring, and a dismal labor report may push Governor Carney to further delay the normalization cycle in an effort to encourage a stronger recovery.

How To Trade This Event Risk

Bullish GBP Trade: Claims Slip 30.0K or More Accompanied by Stronger Wages

- Need green, five-minute candle following the print to consider a long GBP/USD trade

- If market reaction favors buying sterling, long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Labor Report Fails to Meet Market Expectations- Need red, five-minute candle to favor a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in opposite direction

Potential Price Targets For The ReleaseGBPUSD Daily Chart

- The near-term rebound in the RSI may pave the way for a larger rebound in GBP/USD as the oscillator comes off of oversold territory.

- Interim Resistance: 1.5000 pivot to 1.5020 (50% expansion)

- Interim Support: 1.4700 pivot to 1.4710 (78.6% expansion)

Impact that the U.K. Jobless Claims Change has had on GBP during the last release(1 Hour post event )

(End of Day post event)

2015

U.K. Jobless Claims decline another 38.6K in January following the revised 35.8K contraction the month prior. The unemployment rate subsequently fell to 5.7% in three-months through November, reaching the lowest level since September 2008. In addition, private wages grew more-than-expected over the last quarter at an annualized rate of 2.1% amid forecasts for a 1.7% print. The ongoing improvement in the U.K. labor market may encourage the Bank of England (BoE) to retain a hawkish tone for monetary policy as the central bank anticipates stronger wage growth in 2015. The sterling gained ground following slew of positive prints, with GBP/USD breaking above the 1.5400 handle to end the day at 1.5444.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2015.03.18

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 93 pips price movement by GBP - Jobless Claims Change news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.18 16:49

EURUSD Pre-FOMC Pivot Values - Breakouts Occur Above R4, and Below S4 Pivots (based on dailyfx article)

The EURUSD has opened Wednesdays trading range bound, trading between pivot support and resistance. Current range bound conditions are not surprising as many traders are waiting on today’s FOMC even prior to taking positions on markets. Currently price has traded off pivot resistance at 1.0624, but has yet to test range support found at 1.0569. These values complete the current range valued at 55 pips.

During the FOMC event, any surprises may cause the EURUSD to breakout. Traders should watch the S4 pivot at 1.0541. This would signal a potential return to USD strength and a resumption of the pair’s current long term trend. Conversely if price breaks above the R4 pivot at 1.0651, it would suggest price is beginning a larger counter trend move, creating a new higher high.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.18 19:10

2015-03-18 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future

==========Press Release

“Information received since the Federal Open Market Committee met in January suggests that economic growth has moderated somewhat. Labor market conditions have improved further, with strong job gains and a lower unemployment rate. A range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; declines in energy prices have boosted household purchasing power. Business fixed investment is advancing, while the recovery in the housing sector remains slow and export growth has weakened. Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of energy price declines and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress–both realized and expected–toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. Consistent with its previous statement, the Committee judges that an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. This change in the forward guidance does not indicate that the Committee has decided on the timing of the initial increase in the target range.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

MetaTrader Trading Platform Screenshots

USDCHF, M5, 2015.03.18

MetaQuotes Software Corp., MetaTrader 5

USDCHF M5: 60 pips price movement by USD - Federal Funds Rate news event

Forum on trading, automated trading systems and testing trading strategies

BRAINWASHING SYSTEM

newdigital, 2013.12.25 19:20

For MA Channel - look at those links :

================================

3 Stoch MaFibo trading system for M5 and M1 timeframe================================

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.03.20 14:35

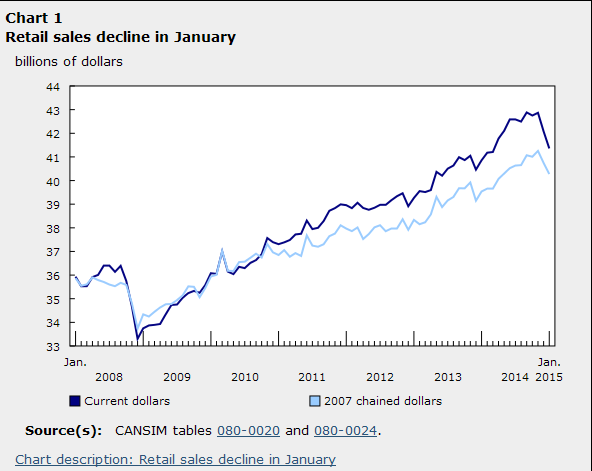

2015-03-20 12:30 GMT (or 14:30 MQ MT5 time) | [CAD - Retail Sales]if actual > forecast (or previous data) = good for currency (for CAD in our case)

[CAD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

==========

Canada Retail Sales Decline 1.7% in JanuaryCanadian retail sales dropped at a steeper-than-anticipated pace in January, reaching the lowest level in 10 months, on a decline in receipts from gasonline stations.

Retail sales decreased 1.7% to a seasonally adjusted 41.36 billion Canadian dollars ($32.50 billion) in January, Statistics Canada said Friday, whereas market expectations were for a 0.8% decline, according to economists at Royal Bank of Canada.

MetaTrader Trading Platform Screenshots

USDCAD, M5, 2015.03.20

MetaQuotes Software Corp., MetaTrader 5

USDCAD M5: 48 pips price movement by CAD - Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.01.06 18:38

What is the Pip Cost for Gold and Silver?The pip cost for 1 ounce of Gold (minimum trade size) is $0.01 per pip.

The pip cost for 50 ounces of Silver (minimum trade size) is $0.50 per pip